Walter Mischel, a psychologist, performed a simple, but enlightening experiment. The experiment has serious implications for you – the dividend-stock investor.

Mischel’s experiment involved a child, a marshmallow, and a slice of time. Mischel would seat a child at a table. He would then offer the child a choice of an immediate reward – a marshmallow – or two marshmallows after Mischel left the room and returned. If the child waited 15 minutes, two marshmallows were the reward.

The choice appears obvious to an adult, but is it?

A research paper published in the National Bureau of Economic Research found what’s true for the child is true for the adult.

Adults able to delay financial gratification were wealthier than their impatient counterparts.

The paper’s authors surveyed nearly 600 older individuals (70 and over).

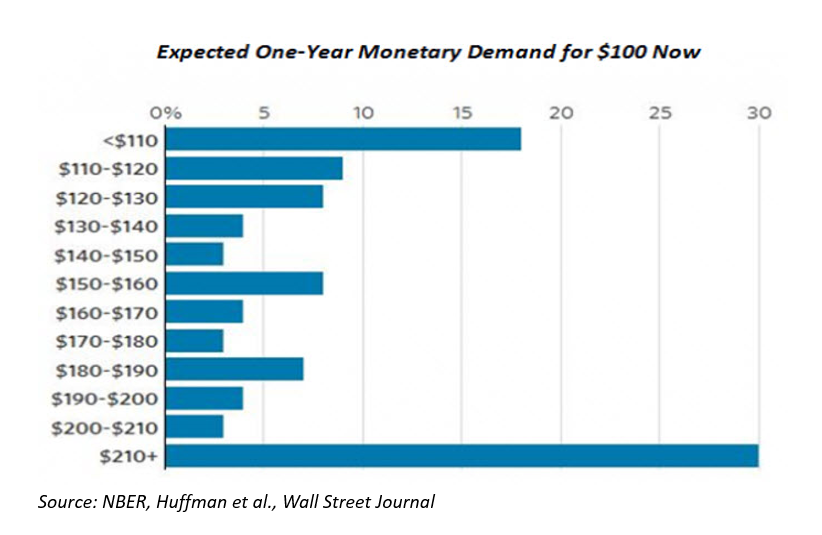

They asked each how much money they would want in a year in lieu of $100 now. The graph below shows the amount those surveyed demanded in order to delay gratification.

The results were revealing, particularly for investors.

The results were revealing, particularly for investors.

With age comes wisdom, so we’ve been told. The survey results suggest otherwise.

The survey found that only 18% of those surveyed would take $110-or-less instead of $100 today. Thirty percent demanded more than $210. (That’s a 110%-plus annual return on $100). Fifty-two percent demanded a return of 60% or more.

The 19th-century Austrian economist Eugen Böhm Bawerk observed that a willingness to accept a lower rate of interest in a free market was correlated with intelligence and patience. If investors were willing to accept a lower rate of return on their investments, they had more patience.

To demand a 110% annual return on $100 exemplifies impatience (and childish expectations). The investor is saying that he prefers the $100 today over anything within reason. A $110-to-$120 return would be within reason. To say that you would invest $100 only if you were to receive $210 in a year is to say you prefer one marshmallow now over two in 15 minutes.

What holds for the young and for the old holds for everyone else.

To achieve success, you need to delay gratification. If you can delay gratification, you’ll significantly raise your odds of accumulating wealth.

No example better illustrates my point than a quality dividend-growth stock. Altria Group (NYSE: MO) serves my purpose.

Altria Group has been a High Yield Wealth recommendation since September 2011. I first recommended Altria shares when they were trading around $27. Altria paid a $1.64-per-share annual dividend back then.

Less than a year later, Altria shares had risen to $35, but then they plateaued. For the next 18 months, they hovered around $35. In mid-2014, Altria shares finally began to ascend again. They trade around $56 today.

Altria increased the dividend annually without fail. Altria pays a $2.80-per-share dividend, which yields 10.3% on my initial recommended cost basis. Altria shares have more than doubled since September 2011.

But it wasn’t a linear shot, and it’s rarely a linear shot. Had an investor lost patience 30 months after my initial recommendation, he would have forfeited most of Altria’s price appreciation. He would also have forfeited a meaningful chunk of dividend income.

The investor would have forfeited wealth.

Patience, as the English poets and biblical scholars tell us, is a virtue. It’s also a necessity to achieving success investing in dividend-paying stocks. Always take the two marshmallows over the one.

— Steve Mauzy

Source: Wyatt Investment Research