It’s a question I’m hearing from a lot of investors these days, and it just came up again a few days ago:

How should I prepare for the next market crash?

So today I’m going to dive into 3 simple strategies I use to protect and grow my own money, starting with…

“Crash Insurance” Tip No. 1: The Best Defense …

When I’m looking for stocks that hold their own in a crash or snap back for big gains when the dust settles, I zero in on three things: hefty discounts, share buybacks and quick dividend growth.

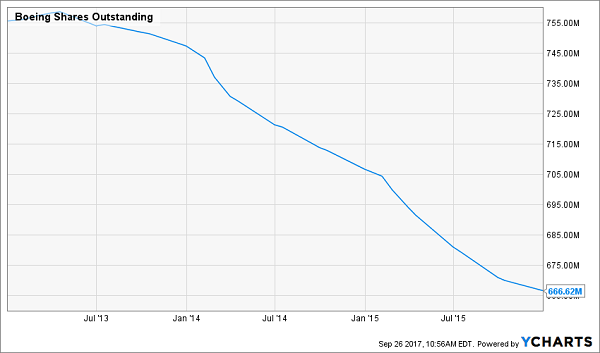

And a little over a year and a half ago, Boeing (BA) certainly qualified: it was a bargain at less than 12 times free cash flow, and management knew it: they’d been ramping up BA’s buybacks for nearly two years!

Buybacks Rise …

That was enough for me: I urged members of my Hidden Yields dividend growth service to buy Boeing on December 18, 2015. As if on cue, worries about Chinese stocks sent the S&P 500 into an 11% tailspin from January 1 to February 11.

That was enough for me: I urged members of my Hidden Yields dividend growth service to buy Boeing on December 18, 2015. As if on cue, worries about Chinese stocks sent the S&P 500 into an 11% tailspin from January 1 to February 11.

How did we do?

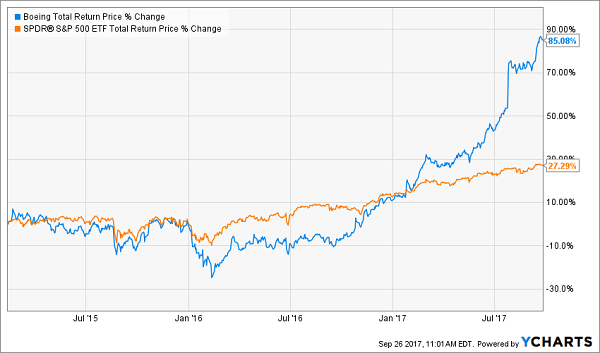

Boeing did fall further than the market, but it wasn’t long before its share price caught up with its rising earnings per share, which got a nice assist from management’s timely buybacks. Today, shareholders are sitting on an 85% total return since the trough of the selloff, tripling the market’s gain in that time!

… and Boeing Ignites

As you can see above, BA really hit the afterburners starting in late 2016. That’s when it hiked its dividend by a monster 30%, yanking in new investors and setting us up for a nice 4.1% dividend yield on our original buy today—nearly double the 2.2% you’d get if you bought Boeing now.

As you can see above, BA really hit the afterburners starting in late 2016. That’s when it hiked its dividend by a monster 30%, yanking in new investors and setting us up for a nice 4.1% dividend yield on our original buy today—nearly double the 2.2% you’d get if you bought Boeing now.

“Crash Insurance” Tip No. 2: Buy Cheap in Your Sleep

My next strategy is as boring as its name suggests: dollar-cost averaging.

But that masks its power, because this savvy move not only lets you survive the next wipeout but use it to snap up great stocks at terrific prices.

It couldn’t be easier: all you have to do is buy a fixed-dollar amount of a particular stock on a set schedule. That way, you’ll be locked in to buy more shares when they’re cheap and fewer when they’re pricey.

Here’s how it works: let’s rewind to 2007 and say you decided to “gradually” invest in Pfizer (PFE), one of the 3 buy-and-hold “forever stocks” I just recommended. And let’s say you invested $7,000 annually in PFE on the last trading day of the year for the following decade.

On December 31, 2008, in the depths of the meltdown, Pfizer closed at $17.71, so your $7,000 would have gotten you 395 shares (excluding commissions). But on your priciest “buy” day (December 30, 2016, when PFE traded at $32.48), you would have automatically tempered your purchase, adding just 215 shares to your holding.

This is hands-down my favorite way to “time” the market—and you can do it with no extra legwork at all!

Which brings me to…

“Crash Insurance” Tip No. 3: No Withdrawals

Of course, the best crash-survival strategy is to be able to ignore the crash completely!

That’s where my “No-Withdrawal” plan comes in—especially if you’re retired or leaning on your portfolio for income. All you have to do is buy stocks (or funds, as I’ll show you in a moment) paying high, safe dividends … and hold for the long haul.

How high are the dividends we’re talking about here?

How does a 7.5% yield sound? That will send a nice $37,500 our way on a modest $500,000 nest egg. It’s also where my plan gets its name, as an income stream like that lets you live on dividends alone—without being forced to sell into a downturn.

And you might be surprised to hear that there are plenty of “unicorns” out there throwing off safe 7.5%+ payouts. We just have to go where other investors aren’t.

A great example is the Nuveen Tax-Advantaged Dividend Growth Fund (JTD), a closed-end fund my colleague Michael Foster analyzed on May 1.

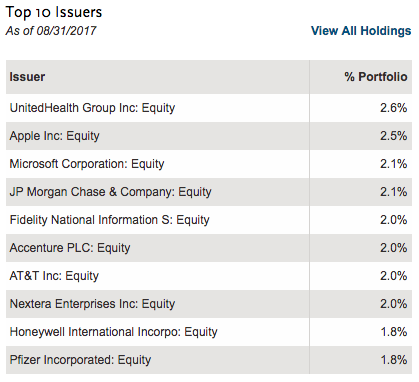

Funny thing is, despite its gaudy yield, JTD’s top 10 holdings don’t look much different than those of any other equity mutual fund.

Source: Nuveen

Source: Nuveen

However, it throws in three smart twists to squeeze that 7.5% payout out of household names like Apple (AAPL), owner of a 1.6% yield, and JPMorgan Chase & Co. (JPM), at 2.4%.

First, it devotes about 19% of the portfolio to preferred shares, many of which boast higher yields than common stocks.

Management then adds its own secret sauce: a modest amount of leverage (currently 29.9% of the portfolio) borrowed cheaply to reinvest in higher-yielding common stocks and preferreds. JTD also uses a savvy call-option strategy to smooth out volatility and protect its portfolio from a downturn.

As an extra bonus, it minimizes your tax bill by focusing on long-term capital gains and qualified dividend income, both of which are taxed at lower rates than short-term capital gains.

And this stealth income play is just the start. Because now I’m going to show you 6 other “unicorns” that combine to hand you a payout that’s even safer than JTD’s—and higher, too!

— Brett Owens

Your Own Personal 8% “No-Withdrawal” Plan [sponsor]

What I’m about to reveal is a 6-stock portfolio I spent months crafting for one purpose: to hand you a solid 8% income stream no matter what the market does.

That’s enough to generate a $40,000 a year on your $500,000 nest egg (with plenty of room for more payout hikes, to boot).

And with just one click, you can get all the details on these 6 income wonders now.

This 8% “No-Withdrawal” portfolio is far safer than making an all-in bet on a fund like JTD because it spreads your cash out across 6 investments—CEFs, real estate investment trusts (REITs) and preferred shares.

Here are just a few of the retirement lifesavers you’ll discover:

A CEF that’s the brainchild of one of the top fund managers on the planet and pays 8.6% every year in cash.

This REIT is a dividend machine! It pays 8% now and has boosted its dividend for 20 quarters in a row!

A preferred fund that gives you an extra layer of protection because it doesn’t move in tune with the stock market. It pays a reliable 7.3% and can easily keep that up no matter what the market does.

Don’t miss your chance to kickstart your own 8% income stream today. Simply CLICK HERE and I’ll reveal the names, ticker symbols and my complete research on this one-of-a-kind 6-stock portfolio now.

Source: Contrarian Outlook