What really causes the most powerful changes in the financial markets?

Trust me, it’s not about lines on a chart or earnings announcements in the media.

[ad#Google Adsense 336×280-IA]What I’m going to teach you today is just common sense dressed up in a lot of financial jargon. After reading this, I bet that for the first time ever, you won’t feel anxious about what might happen to your savings.

Instead, you’ll be excited about what’s going to happen next… because you’ll know why it’s going to happen.

What are we talking about? What is the big underlying force that moves the market forward or causes it to collapse? The answer won’t surprise you…

A very old school of economic thought – known as the Austrian School of Economics – teaches these concepts.

Many of its theories have proven to be extremely powerful. For example, the Austrian School led to the discovery of “game theory,” an understanding of human decision-making that guided policy during the Cold War. One Austrian School thinker, Friedrich Hayek, won the Nobel Prize in Economics for his idea that money serves as the primary means of communication in an economy.

You don’t need to become an Austrian economist to understand two of the most important foundations of their theories…

One: The economy can’t be understood (or predicted) by the study of groups. It is individuals, making individual decisions to maximize their own utility, that will guide the collective… not the other way around.

Now, I know that sounds pretty obvious… But it isn’t obvious to government economists, Marxists, or Socialists. Many people around the world continue to believe in policies that try to control or exploit groups without considering the obvious negative implications for the individual.

A classic example: when states like Maryland try to increase the rate of income taxes on the rich, only to discover that the amount they collect decreases because individuals simply move rather than let themselves be targeted and treated unfairly.

Two: Inflation can’t be accurately measured by price indexes. It can only be measured at its root – because all inflation is caused by creating money and credit in excess of savings.

This is simple common sense dressed up with math and theory…

An individual doesn’t enrich himself by borrowing capital. He can only enrich himself by carefully increasing his utility (his skills), saving his excess production, and investing that capital wisely to further increase his production. Nothing could be true of a national economy that isn’t also true for the individual.

But consider our policies over the past decade… or four decades. Has the United States of America worked diligently to increase its national production? Have we carefully saved our excess capital and invested wisely in further increases to production?

No.

Instead, every downturn in our economy has been met with more printing and borrowing… until finally the numbers are downright insane.

This, the Austrians would teach us, is a recipe for a massive inflationary boom. And we’ve seen it. The trouble is, the Austrians also teach us that either the inflation must recede to the economy’s natural level of savings, or even greater amounts of inflation will be required to sustain the boom. In other words, the boom will eventually peter out, as demand cannot be sustained enough to keep it going.

Therefore, it was always only a matter of time before production began to wane… before profits began to recede… and before loans began to sour. And now, it is only a matter of time before a new panic emerges… as every individual tries to salvage whatever remains of the unsustainable boom.

OK, enough theory… Let me show you a case study of exactly how this Austrian theory plays out in a real industry.

The U.S. auto industry has been a primary beneficiary of the current inflation. As you’ll remember, the government spent more than $80 billion to bail out one of the automakers alone – General Motors (GM). It also made guarantees to major banks and finance companies that allowed lending in the sector to grow massively.

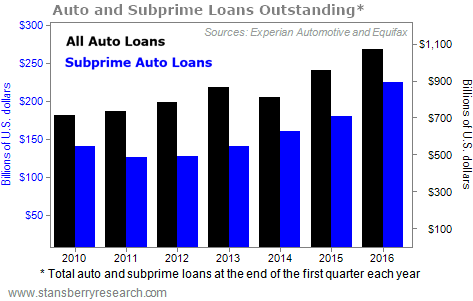

The result was predictable. We’ve seen an unprecedented boom in auto sales. And as the cycle aged, auto sellers had to find more and more buyers. That meant loaning to folks who can’t actually afford a car. Subprime lending soared in 2013 and 2014. Those loans have started to go bad at a shocking rate. (At least, it’s shocking to most people. It seemed inevitable to us, as we warned in 2014.)

Most investors don’t realize that the entire car-rental business is basically a giant leveraged bet on the value of used cars. That bet is failing. As we explained last month in my flagship newsletter, Stansberry’s Investment Advisory…

Since 2010, Avis and Hertz have spent more than $110 billion on new-car purchases. Meanwhile, their used-car sales generated $85 billion. That’s a net cash shortfall of $25 billion…

Where did all of that capital come from? Debt, of course. And as the Austrian economists will tell you… the big problem with debt-led expansions is that nobody ever wants to pay the money back…

Of the $30 billion in debt these companies owe, more than 40% of it – $12.6 billion – is due before the end of 2018. That’s a mountain of debt for these companies. But it gets even worse when you study their company filings.

Avis and Hertz have committed to purchase another $13 billion next year from the major auto manufacturers. So that’s an additional $13 billion that has to be raised next year… and paid for by approximately 2020.

As long as the amount of money and credit being pumped into the auto industry is growing, car-rental companies can grow their fleets and keep buying new cars. But the moment the credit spigot gets turned off, they have a big problem. In the first place, when lenders start repossessing cars, used-car prices will collapse.

And man oh man, have car loans started to go bad.

Last month, credit-ratings agency Fitch shocked the market by reporting that losses on securitized car loans soared 27% over the last year.

Fitch now expects capital losses on these loans to exceed 10% of loan values by the end of this year. That will exceed the losses seen during the crisis of 2009. And this is just the beginning. Keep in mind, we predicted this would happen in 2014. We first traded on it in 2015. And we’ve traded on it successfully again this year – we recommended shorting both Hertz Global (HTZ) and Avis Budget (CAR), a move which led to huge profits in only a month.

We didn’t get “lucky”… We didn’t find a needle in the haystack. We followed a well-known principle of economics. We followed the debt and inflation cycle in the auto industry. We simply connected the obvious dots, and we profitably shorted the weakest and most vulnerable businesses.

The principles driving the market today are not new. And these credit trends are by far the most powerful force in the stock market. Ironically, however, they’re largely invisible to virtually all investors – even the most sophisticated.

Instead of getting hurt by changes you never saw coming in the credit markets… use this knowledge. When you understand what’s really driving these market movements, and what comes next… you’ll find yourself with the confidence to protect your wealth, and even profit, in the months and years to come.

Regards,

Porter Stansberry

[ad#stansberry-ps]

Source: Daily Wealth