Nearly one year ago, I issued an important warning to Daily Profit readers.energy stocks

That’s when I told you to sell energy stocks. It was the same advice that I shared with my dad.

Oil prices had recently plunged 50%. A barrel of crude oil was selling for $49. At the time, that seemed cheap. And many value investors were rushing into oil trades.

Fast-forward to today, and oil is selling near multi-year lows at $33. Most folks in the energy patch would be thrilled if oil prices rebounded to $50.

So why did I recommend selling oil stocks last year? Here’s what I wrote back then:

I don’t have a clue about where crude oil prices are heading. … Oil could continue trading at $45 – $60 per barrel. It could fall to the $30s, or rise to the $70s. Your guess is as good as mine…but it’s nothing more than a guess.

With lots of uncertainty, you might expect big oil stocks to be cheap. But based on the most conventional valuation metric – the price-to-earnings ratio (P/E) – these stocks are expensive.

In early 2015, crude prices had already dropped dramatically. Earnings for big energy stocks were falling too. Yet the shares of these blue chip energy stocks had posted only small losses. I didn’t want to own these stocks until there was a big sell-off. Again, this is from my article a year ago:

As a value investor, I’m often tempted to buy out-of-favor sectors. Today, the energy sector is out of favor. Some energy stocks have crashed along with the price of oil. But that hasn’t been the case for the huge fully integrated oil stocks.

I’ll be ready to jump into big oil stocks when their valuations are attractive. But buying Exxon at a huge premium to the S&P 500 doesn’t make a ton of sense to me.

Today, I’d love to jump into oil stocks. But the numbers still don’t make any sense.

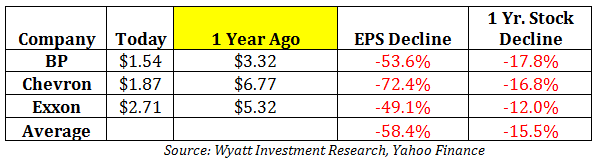

Just take a look at the following data for BP (NYSE: BP), Chevron (NYSE: CVX) and Exxon Mobil (NYSE: XOM). It shows what’s happened to 2016 earnings estimates for these companies over the last year. It also displays the corresponding drop in the stock price.

There’s clearly a shocking divergence between the drop in estimated 2016 EPS and the corresponding drop in the stock price. On average, the EPS estimate for 2016 has plunged 58%. Yet these stocks have dropped just 15% during the same time.

There’s clearly a shocking divergence between the drop in estimated 2016 EPS and the corresponding drop in the stock price. On average, the EPS estimate for 2016 has plunged 58%. Yet these stocks have dropped just 15% during the same time.

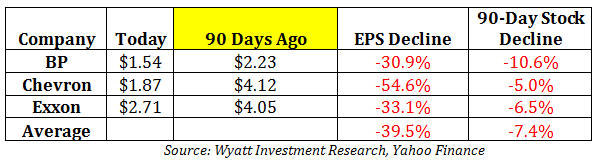

Even in the last 90 days, the same trend is happening.

That’s right. In the last three months, analysts have turned much more bearish on 2016 earnings for these fully integrated oil stocks. They’ve slashed EPS estimates by nearly 40%. Yet the stocks are down just 7%.

That’s right. In the last three months, analysts have turned much more bearish on 2016 earnings for these fully integrated oil stocks. They’ve slashed EPS estimates by nearly 40%. Yet the stocks are down just 7%.

[ad#Google Adsense 336×280-IA]How is that possible?

Can you think of another group of companies that have performed similarly?

How can earnings fall 50% in the last year, without a corresponding decline in the stock price?

The result of this move is that energy stocks have now become very expensive.

On average, BP, Chevron and Exxon Mobil trade at a P/E multiple of more than 31.

That’s right. You’ll pay a premium valuation of 31 times earnings for an oil company that’s experiencing a 50% drop in earnings. To put this in context, these energy stocks are trading at a 100% premium valuation to the S&P 500 index.

Typically, such premium valuations are reserved for companies that are experiencing healthy growth in a prosperous sector. Yet that’s clearly not the case with energy stocks. For some reason, investors are giving them a pass. And there are two reasons for this.

First, investors think oil will bounce back quickly. They think cheap oil is temporary. This view is largely unchanged in the last year. The only difference is that oil has dropped another 40%.

Investors who think oil will quickly rebound are hopelessly optimistic. Oil supplies continue to rise, with Iran starting to sell its oil on the global markets and OPEC committed to continue pumping at current levels. Meanwhile, demand for oil is slowing thanks to the global economic picture.

Second, investors love these dividend stocks and view them as “safe.” This view is supported by years of dividend increases. And with share prices down from their highs, these big oil stocks now offer attractive yields ranging from 4%-8%.

From a high-yield standpoint, these dividend yields certainly look healthy. Yet BP and Chevron froze their dividends last year. Meanwhile, Exxon increased its dividend payment at the slowest pace in several years.

At these valuations, it just doesn’t make sense to buy the big oil stocks. As I said one year ago, “Perhaps crude prices will bounce back in 2016. But the market shows that a rebound for oil prices is already baked in to their future earnings. And that will limit the upside for these stocks.”

Not much has changed in the last 11 months. Beware of the big oil stocks.

— Ian Wyatt

[ad#wyatt-income]

Source: Wyatt Investment Research