Today we are going to talk about one of the most volatile – and often very rewarding — sectors of the market, the small cap biotech/biopharma space.

Today we are going to talk about one of the most volatile – and often very rewarding — sectors of the market, the small cap biotech/biopharma space.

The wide divergence of outcomes in this space is why I take much smaller positions in a bigger pool of attractive plays when investing in the biotech/biopharma sectors.

It is something I call “Shotgun Investing”.

This area produces many home runs as well as frequent strikeouts.

The upside is that the occasional five or ten bagger will more than make up for the frequent implosions over time if one’s portfolio is managed in a prudent and disciplined manner.

[ad#Google Adsense 336×280-IA]A perfect example of major returns that can be had in this sector is Avanir Pharmaceuticals (Nasdaq: AVNR) which was one of two inaugural picks in the July edition of Small Cap Gems when the stock was going for $5.20 a share.

Over the past six months the company had positive Phase II trial results for its compound to treat agitation in Alzheimer’s patients and then soon thereafter accepted a buyout offer that valued the company at $17.00 a share.

A return of more than 200% in just over four months.

Avanir is demonstrative of the returns that can be had when things go right at one of these speculative small cap concerns. More importantly Avanir is a good example of what I look for when making small investments in this speculative and volatile space.

Among the traits I look (and you should, too!) for within this area include:

- compounds in development that could bring lucrative returns if they make it through the challenging approval process,

- numerous drugs in development or additional “shots on goal”

- partnerships with major biotech and/or pharma players

- a balance sheet that can fund development

- insider buying

This is not an exhaustive list but it is a good start. Let’s look at two attractive plays in the space that have many of these core traits and could have substantial upside.

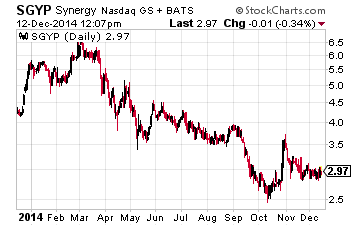

Let’s start with Synergy Pharmaceuticals (Nasdaq: SGYP), a small biopharma that currently goes for just $3 a share and has less than a $300 million market capitalization. The company has two key products in development currently.

Let’s start with Synergy Pharmaceuticals (Nasdaq: SGYP), a small biopharma that currently goes for just $3 a share and has less than a $300 million market capitalization. The company has two key products in development currently.

This first is SP-304 also known as Plecantide. This compound just completed an over 400 patient Phase II trial assessing the safety and efficacy of the compound to treat irritable bowel syndrome with constipation. The study successfully achieved its endpoint and showed statistically significant improvement in the overall responder rate.

Plecantide has good potential in a fairly lucrative market. Plecanatide is targeted to function like Linaclotide from Ironwood Pharmaceuticals (Nasdaq: IRWD) with less incidence of diarrhea. Sales of Linaclotide, which is marketed as LINZESS©, reached almost $80 million last quarter and sales are increasing at better than a 25% clip.

The company’s other key product is SP-33 targeted to treat opioid-induced constipation (OIC) and possibly ulcerative colitis. SP-33 just successfully completed a Phase II trial targeted at OIC and the company just started a small Phase I B trial for treatment of ulcerative colitis.

The median price target on the shares by analysts that follow the company is $6 a share, double the current price of the stock. Cantor Fitzgerald raised its price target to $8.50 a share on SGYP in late November. At the end of the last completed quarter the company had over $30 million in cash on the balance sheet which was boosted by a $200 convertible debt offering. This should ensure the company has funding into 2017. Insiders have also been net buyers making frequent but small purchases of new shares over the past two years.

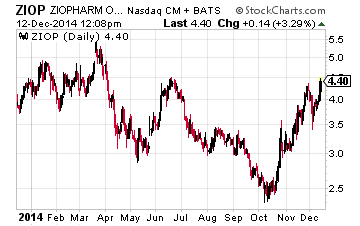

I continue to be positive on the prospects of ZioPharma Oncology (Nasdaq: ZIOP). The stock has been on the move recently and is up substantially since the last time I covered here on Investors Alley. That rise has accelerated after a presentation at the American Association for Cancer Research in Orlando early in December. I am assuming the audience like what it heard on ZioPharma’s prospects.

I continue to be positive on the prospects of ZioPharma Oncology (Nasdaq: ZIOP). The stock has been on the move recently and is up substantially since the last time I covered here on Investors Alley. That rise has accelerated after a presentation at the American Association for Cancer Research in Orlando early in December. I am assuming the audience like what it heard on ZioPharma’s prospects.

Just to recap, ZioPharma is developing novel gene expression and control technology to deliver DNA for the treatment of cancer. The company’s technology platform helps to turn on and off and precisely modulate gene expression at the cancer site. Its key product is IL-12 which is in early stage trials for use in breast cancer and melanoma treatments which it is developing with Intrexon (NYSE: ION) and it has several other indications in pre-clinical testing.

Even with the recent rally in the stock to around $4.25 share, the stock is still far below the $7.00 a share level it achieved prior to the big biotech sell-off that occurred in March crushing most of the small cap biotech sector. The company has some $45 million on hand and a market capitalization of just over $400 million. Obviously, the stock trajectory will be determined by the success or failure of IL-12 but the company is an attractive addition to a well-diversified biotech portfolio.

Both of these speculative drug development plays go for under $5 a share and make good candidates in an aggressive growth portfolio. My hope is that one or both of them turn out to be the next Avanir for investors.

— Bret Jensen

Positions: Long AVNR, SGYP & ZIOP

[ad#ia-bret]

Source: Investors Alley