Uber Technologies, Inc. (UBER) shares have soared 80% in 2023. The ride-hailing firm in early August reported GAAP operating profit for the first time in its history.

Wall Street has celebrated Uber’s ability to expand its ride-hailing and delivery businesses while simultaneously focusing on the bottom line. Uber crushed our Q2 earnings estimate on August 1 and boosted its guidance as ridership booms and delivery grows. Uber is also experimenting with new revenue streams.

Plus, Uber stock slipped recently on some post-release profit-taking and its valuation levels look enticing.

Recent Quarter

Uber posted adjusted quarterly earnings of +$0.18 a share in Q2 to crush the Zacks consensus that called for a loss of -$0.01 per share. The company also crucially posted GAAP operating profit for the first time in Uber’s history.

Uber reported $394 million in profit in Q2 vs. a loss of $2.60 billion in the year-ago period and an operating income of $326 million vs. a $713 million loss in the second quarter of 2022. The “power of the Uber platform and the team’s relentless focus on profitable growth was on full display in Q2, with record profitability and over $1 billion of quarterly free cash flow,” CFO Nelson Chai said in prepared remarks.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

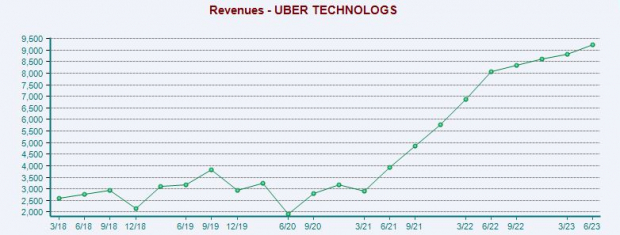

Revenue climbed 14% YoY to $9.23 billion, with Uber’s gross bookings up 16% to $33.60 billion. Riding-hailing (mobility) gross bookings climbed 25% to $16.73 billion, with delivery up 12% to $15.60 billion.

Total trips jumped 22% to 2.28 billion. These gains helped offset continued weakness in its freight segment that saw its gross bookings fall 30% YoY to $1.28 billion—only 4% of the business.

Uber’s recent results highlight that people are living their pre-pandemic lives in full force. Crucially, the resurgence of its ride-hailing segment hasn’t come at the expense of delivery, which highlights the strength of its two core business models that are especially popular with higher-income consumers that are less impacted by lingering inflation.

Monthly Active Platform Consumers climbed 12% YoY and 5% QoQ to 137 million, “driven by continued improvement in consumer activity” for its mobility offerings.

What’s Around the Corner?

Looking ahead, Uber’s revenue is projected to jump over 17% in 2023 and another 18% in FY24 to $44.27 billion vs. $31.88 billion in FY22. Its mobility segment’s gross bookings are projected to surge 25% in 2023, with delivery set to jump 13%.

Zacks data also projects Uber’s Monthly Active Platform Consumers will climb 11% to 146 million in 2023, with trips expected to grow by 21%.

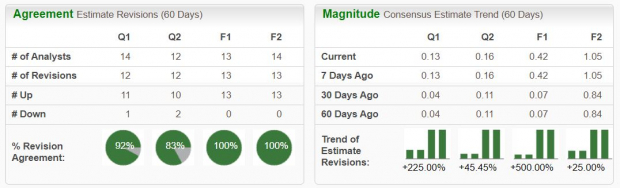

On top of that, Uber is projected to swing from an adjusted loss of -$4.65 a share last year to +$0.42 in FY23 and then soar to +$1.05 a share in FY24. These current Zacks consensus estimates have surged since its Q2 release, with its FY23 figure up 500% and 25% higher for FY24.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Uber’s near-term EPS outlooks are also up big since its August 1 report to help it grab a Zacks Rank #1 (Strong Buy) right now. And Uber has crushed our EPS estimates in the trailing three quarters.

Focused on Now, Preparing for the Future

Uber bought delivery peers Drizly in October 2021 and Postmates in December 2020 to expand in a growing area of the economy. On top of that, Uber is rolling out more advertisements across its core Uber app, Uber Eats, and beyond to help monetize its growing customer base for both ride-hailing and delivery.

Uber, under CEO Dara Khosrowshahi has focused heavily on disciplined spending and cost-cutting measures. Uber offers far fewer discounts to consumers and incentives to drivers these days. Uber is also reducing delivery errors and becoming more efficient while boosting its market share vs. rival Lyft (LYFT) and others.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Uber remains focused on a possible future where fleets of autonomous vehicles drive people around cities, deliver food, and transport goods. In fact, Uber in late May announced a new multi-year strategic partnership with Waymo for autonomous driving, bringing together its “world-leading autonomous driving technology with the massive scale of Uber’s ridesharing and delivery networks.”

Uber’s CEO said at the time that: “Fully autonomous driving is quickly becoming part of everyday life, and we’re excited to bring Waymo’s incredible technology to the Uber platform.” Uber will be competing against or possibly with the likes of Tesla (TSLA) and others in this space down the road.

Price and Valuation

Uber is up around 7% since its May 2019 IPO vs. the Zacks tech sector’s 77% gain and the S&P 500’s 60% climb.

Uber shares have climbed by roughly 36% during the past 12 months to crush the benchmark’s 5% and Lyft’s -37% drop. More recently, Uber stock has jumped 80% in 2023 vs. the S&P 500’s 18% and Lyft’s 10%.

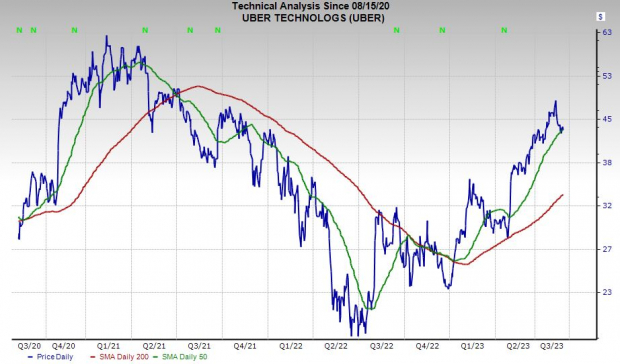

Uber hit fresh 52-week highs of $49.49 per share the day before it reported its Q2 results.

Uber is currently down 30% from its 2021 records and 10% below its recent highs at roughly $44 a share. Uber is holding the line around its 50-day moving average and it trades about 28% below its average Zacks price target.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Uber trades at a 65% discount to its own highs at 2.2X forward sales and 43% below the Zacks tech sector. And its PEG ratio, which factors in its bottom-line growth outlook, sits at 1.2 vs. tech’s 2.0.

Bottom Line

Long-term investors might want to consider Uber as it proves it can thrive and grow market share in multiple key segments of the economy and become profitable at the same time.

Wall Street is very high on the stock, with 27 of the 33 brokerage recommendations Zacks has at “Strong Buys,” alongside four “Buys,” and two “Holds.” And Uber’s recent fall has taken it from overbought RSI levels to below neutral.

— Benjamin Rains

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks