As someone who practices minimalism and frugality, separating wants from needs has been incredibly helpful.

Needs don’t add up to much.

Wants, on the other hand, can be unlimited.

That said, needs have a stable place in one’s life in a way that wants do not.

This separation is also helpful when it comes to finding businesses to invest in, as businesses that cater to needs often feature extremely stable operations.

Indeed, some of the world’s best businesses cater to nothing but needs.

You can find many of them on the Dividend Champions, Contenders, and Challengers list.

This list has compiled data on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

They are all dividend growth stocks.

These stocks represent equity in businesses that pay reliable, rising dividends to shareholders.

Reliable, rising dividends are able to be funded when reliable, rising profits are produced.

And reliable, rising profits are produced when a business is selling the great products and/or services that are in demand.

What could have more durable demand than needs?

What could have more durable demand than needs?

It’s a very intuitive approach to investing that tends to naturally filter you right into some of the world’s best businesses.

It’s an approach I’ve used in my own life, using it to build the FIRE Fund.

That’s my real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

I’ve actually been able to live off of dividends for years now.

I quit my job and retired in my early 30s.

How?

My Early Retirement Blueprint explains.

Key to my success has been consistently investing in wonderful businesses.

It’s also about investing at the right valuations.

Price only describes what you pay, but it’s value that you get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Investing in wonderful businesses that can consistently generate higher profits and dividends by catering to needs, and doing this investing when undervaluation is present, sets you up to build extraordinary wealth and passive income over the long run.

Of course, being able to spot undervaluation first requires one to understand valuation.

But this isn’t as difficult as you might think.

Fellow contributor Dave Van Knapp put together Lesson 11: Valuation in order to help.

One of his “lessons” on dividend growth investing, it lays out a valuation template that you can use to estimate fair value and identify undervaluation.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Dollar General Corp. (DG)

Dollar General Corp. (DG)

Dollar General Corp. (DG) is an American chain of neighborhood general stores that focus on low-cost merchandise.

Founded in 1939, Dollar General is now a $37 billion (by market cap) retail monster that employs 170,000 people.

The company groups its merchandise into four categories: Consumables, 80% of FY 2022 sales; Seasonal, 11%; Home products, 6%; and Apparel, 3%.

There are nearly 20,000 Dollar General stores spread out across 48 different US states.

Dollar General has a unique retailing strategy that aims to serve thinly populated rural areas across the US.

This provides Dollar General with two distinct advantages.

First, these communities have few, if any, competing retail choices.

This means limited competition to pressure Dollar General.

It also creates a situation where the local populace is captive to the convenience that Dollar General provides.

Second, and because of limited competition, Dollar General can offer suitable low-cost merchandise without sacrificing too much on margins.

See, these rural communities tend to feature lower-income households (roughly $40,000 annually).

As such, affordability is a prime concern for these households.

As you might gather by its name, Dollar General’s specialty is affordability – approximately 20% of a store’s product assortment is priced at $1 or less.

Furthermore, since most of its merchandise is focused on everyday consumables, the repeatability and predictability of business is very high.

It’s a recipe that Dollar General has followed to great success thus far.

And I don’t see anything on the horizon that threatens that success, which bodes well for the company’s ability to continue growing its revenue, profit, and dividend.

Dividend Growth, Growth Rate, Payout Ratio and Yield

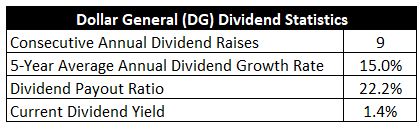

To date, the company has increased its dividend for nine consecutive years.

It’s a young track record, sure.

But Dollar General is off to a fast start.

But Dollar General is off to a fast start.

The five-year dividend growth rate is 15%.

That’s quite impressive.

What might be even more impressive is the fact that the payout ratio is only 22.2%, even after all of that dividend growth.

However, it’s tough to have it all.

The stock’s yield is only 1.4%.

So investors are giving up a bit of yield in order to access the double-digit dividend growth rate.

That said, this yield is 60 basis points higher than its own five-year average.

For dividend growth investors who gravitate toward compounders, these metrics are pretty compelling.

As compelling as these numbers may be, though, most of them are looking backward.

Revenue and Earnings Growth

However, investors must look forward, as today’s capital is being risked for tomorrow’s rewards.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be of use later when the time comes to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Blending the proven past with a future forecast like this should allow us to roughly gauge where the business could be going from here.

Dollar General moved its revenue from $17.5 billion in FY 2013 to $37.8 billion in FY 2022.

That’s a compound annual growth rate of 8.9%.

Very, very strong.

I usually like to see a mid-single-digit top-line growth rate from a mature business.

Seeing as how Dollar General has more retail locations than any other retailer in the entire US, I’d say that Dollar General is fairly mature.

Yet the company delivered excellent revenue growth.

Earnings per share grew from $3.17 to $10.68 over this period, which is a CAGR of 14.5%.

That’s outstanding.

We can see how tight the relationship is between EPS and dividend growth, which also helps to explain the low payout ratio.

Instead of blowing up the payout ratio, Dollar General has been fueling high dividend growth with high EPS growth.

Excess bottom-line growth can be mostly explained by a prolific share buyback program that saw the outstanding share count get reduced by 30% over the last decade.

Looking forward, CFRA believes that Dollar General will grow its EPS at a CAGR of 6% over the next three years.

While I don’t think a 6% CAGR is bad at all, relative to the recent past, it’s not all that great.

If this forecast is materialized, it would represent a material slowdown in EPS growth for Dollar General.

CFRA seems to believe that it’s more of a temporary bump in the road than a structural problem with the business model, which I agree with.

CFRA cites near-term pressure on operating margins “largely due to negative sales mix, increased shrink (e.g., theft) and investments in store labor hours and repairs and maintenance.”

However, CFRA then follows that up with this statement: “Longer term, however, we’re positive on [Dollar General] growing operating margins to above 10%.”

I should note that a mild recession has been supposedly on the horizon for the US for the greater part of a year now.

While a recession hasn’t really shown up yet, and while it may not show up at all, it’s a possible issue for Dollar General.

CFRA notes this chink in the armor: “[Dollar General] stores primarily serve rural areas, catering to consumers with an average annual income of less than $40,000. As a result, [Dollar General’s] core customer is particularly susceptible to weak economic conditions.”

Dollar General offsets this with low-cost merchandise, which should help to cushion the business against a major drop in business during any widespread economic weakness.

On the other hand, another chink in the armor might be the store count.

In some ways, Dollar General is a victim of its own success.

With nearly 20,000 stores across the US, Dollar General operates more physical retail locations than any other retailer in the US.

The company does plan to open almost 1,000 new stores in the current fiscal year, so market saturation is apparently not yet at a critical level.

I see CFRA’s projection as reasonable, if slightly pessimistic.

Either way, with the payout ratio being so low, Dollar General could easily grow its dividend at a high-single-digit rate under this framework.

From there, an acceleration back into the low-double-digit area would be quite feasible.

It’s a compounding machine that doesn’t seem to be broken or out of fuel.

Financial Position

Moving over to the balance sheet, Dollar General has a rock-solid financial position.

The long-term debt/equity ratio is 1.3, while the interest coverage ratio is 13.

There has been some balance sheet weakening in recent years, and the low common equity makes it look worse than it is, but this balance sheet is still quite strong.

Profitability is quite robust.

Over the last five years, the firm has averaged annual net margin of 6.8% and annual return on equity of 33.5%.

By the standards of a retailer, Dollar General’s returns on capital are extraordinary.

And with economies of scale, brand recognition, a built-out footprint in underserved communities, and a focus on low-cost merchandise, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

Retail is notoriously competitive, although Dollar General circumvents much of this by operating in areas with limited competition.

There are effectively no switching costs present, but a dearth of alternatives in local markets creates sticky customers.

A recession would likely impact Dollar General, and its customer base could be especially vulnerable to an economic ebb, but a sizable portion of Dollar General’s merchandise is consumable, non-discretionary, and affordable.

The balance sheet remains a strength, but further weakening here is something to watch for.

Dollar General has no real exposure to e-commerce, instead relying on its merchandising strategy, which could be key issue.

There are no barriers to entry, and future competitors could easily enter Dollar General’s markets.

Dollar General staffs stores at the bare minimum, which may be part of the shrinkage problem for the company, and hiring more staff would come at a time in which wages have been on the rise.

Saturation may be the biggest challenge of all, as the company’s physical store count is by far the most out of any retailer in the US.

There are definitely some risks to consider here, but the growth and quality of the business are also considerations.

And with the stock down more than 30% YTD, its valuation has become one of the biggest considerations of all…

Stock Price Valuation

The stock’s P/E ratio is 15.7.

To put that in perspective, its own five-year average P/E ratio is 21.6.

This is a stock that has often been expensive, but the mighty has fallen.

The sales multiple of 1 is also well off of its own five-year average of 1.5.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a two-stage dividend discount model analysis.

I factored in a 10% discount rate, a 12% dividend growth rate for the next 10 years, and a long-term dividend growth rate of 8%.

This is a unique dividend growth stock in some ways, which makes it difficult to confidently value.

On one hand, a case could be made that these growth rates are somewhat aggressive – markets are fairly saturated, the last dividend increase was less than 8%, and the near-term forecast for EPS growth is middling.

On the other hand, Dollar General has a great track record for revenue, EPS, and dividend growth over the long run.

Plus, it has one of the lowest payout ratios I’ve come across, which provides a lot of flexibility with the dividend.

The next year or two is iffy, to be honest, but it’s hard to imagine Dollar General coming woefully short of these projections over the next decade or so.

The DDM analysis gives me a fair value of $178.70.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

The stock looks decently cheap in pricing when compared to my number.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates DG as a 4-star stock, with a fair value estimate of $191.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates DG as a 4-star “BUY”, with a 12-month target price of $197.00.

I came out the lowest, but we’re all below the $200 mark – a mark this stock has been above for a number of years now – and that just goes to show you why I’ve long thought it was just too expensive. Averaging the three numbers out gives us a final valuation of $188.90, which would indicate the stock is possibly 12% undervalued.

Bottom line: Dollar General Corp. (DG) is a great retailer that has thrived by pursuing a unique strategy that limits competition. With a market-like yield, a double-digit dividend growth rate, a very low payout ratio, nearly 10 consecutive years of dividend increases, and the potential that shares are 12% undervalued, the stock’s recent drop in pricing may have finally created a long-term investment opportunity for dividend growth investors.

Bottom line: Dollar General Corp. (DG) is a great retailer that has thrived by pursuing a unique strategy that limits competition. With a market-like yield, a double-digit dividend growth rate, a very low payout ratio, nearly 10 consecutive years of dividend increases, and the potential that shares are 12% undervalued, the stock’s recent drop in pricing may have finally created a long-term investment opportunity for dividend growth investors.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is DG’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 64. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, DG’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income