Introduction to SPG

According to the company’s investor relations page on this REIT, Simon Property Trust (SPG) is

… a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company. [Its] properties across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales.

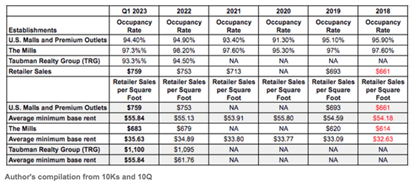

The founder-led company was incorporated as a REIT in 1986 and has been in business for 37 years. SPG’s portfolio as of December 2022 includes direct ownership of 196 income-producing properties in the United States: 94 traditional malls, 69 premium outlets, 14 Mills centers, 6 lifestyle centers, and 13 other retail properties in 37 states and Puerto Rico. 12 months prior to the pandemic, Simon’s portfolio averaged $693 in sales per square foot; it is now $759.

The company has international business ventures too. SPG has a 21% stake in Klepierre, a European retail company with investments in shopping centers in 16 countries, and joint venture interests in 33 premium outlets across 11 countries including Australia, Canada, France, Germany, Mexico, Japan, Korea, Thailand, and Malaysia.

FAST Graphs Analyze Out Loud Video On Simon Property Trust

Matters Have Improved But Is That Enough?

The pandemic did a number on SPG in 2020, causing it to cut its dividend and close its doors. Headlines such as the one below give pause to anyone considering investing in mall-related businesses like SPG.

Fast forward to 2023.

Fast forward to 2023.

With the pandemic firmly in the rearview mirror, more shoppers are returning to in-person shopping experiences rather than simply shopping online.

CEO David Simon said in the 2022 annual letter,

We have fully bounced back from the toll of the COVID-19 pandemic. Retailer demand is strong. Our properties are getting better, excess supply is leaving the landscape, and e-commerce growth has decelerated as retailers acknowledge that it is simply not as profitable as physical stores (omnichannel is a must for retailers with a major emphasis on stores assuming profitability is a priority). This is leading to growth in our property cash flow.

The positives continued into 2023. According to the CEO in the Q1 2023 earnings call,

Retail sales momentum continued. Reported retail sales per square foot reached another record in the first quarter at $759 per square foot for malls and premium outlets combined, an increase of 3.3%. All platforms achieved record sales level, including the mills at $683 a foot, a 2.2%, and TRG was $1,100 per square foot, a 6% increase. Good news is, tourism is returning with our tourist-oriented centers outperforming the portfolio average in terms of sales. Our occupancy cost at the end of the first quarter was 12%.

Indeed, the numbers are looking up.

Compared to the terrible year of the pandemic, and even when compared to the pre-pandemic years of 2019 and 2018, SPG has seen occupancy rates, retailer sales per square foot, average base rent for the U.S. malls and premium outlets, and The Mills improved.

Compared to the terrible year of the pandemic, and even when compared to the pre-pandemic years of 2019 and 2018, SPG has seen occupancy rates, retailer sales per square foot, average base rent for the U.S. malls and premium outlets, and The Mills improved.

The fact remains that despite the inflationary environment and the incessant talks about an impending recession, SPG has been able to raise rents, and retailers have been able to sell more, all good signs pointing to a recovering and healthy business environment for malls.

The results from the latest quarter gave the conservative management sufficient confidence to increase its full year 2023 FFO growth guidance range from the previously stated $11.70 to $11.95 per share to $11.80 to $11.95 per.

Do Risks Remain?

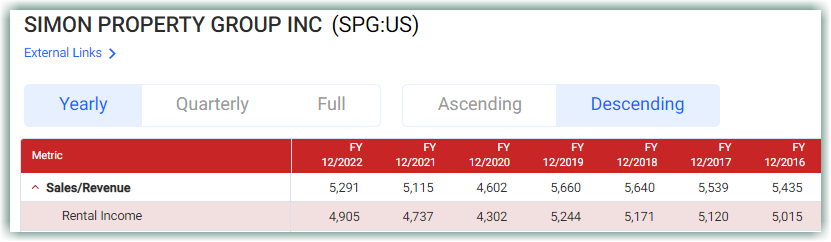

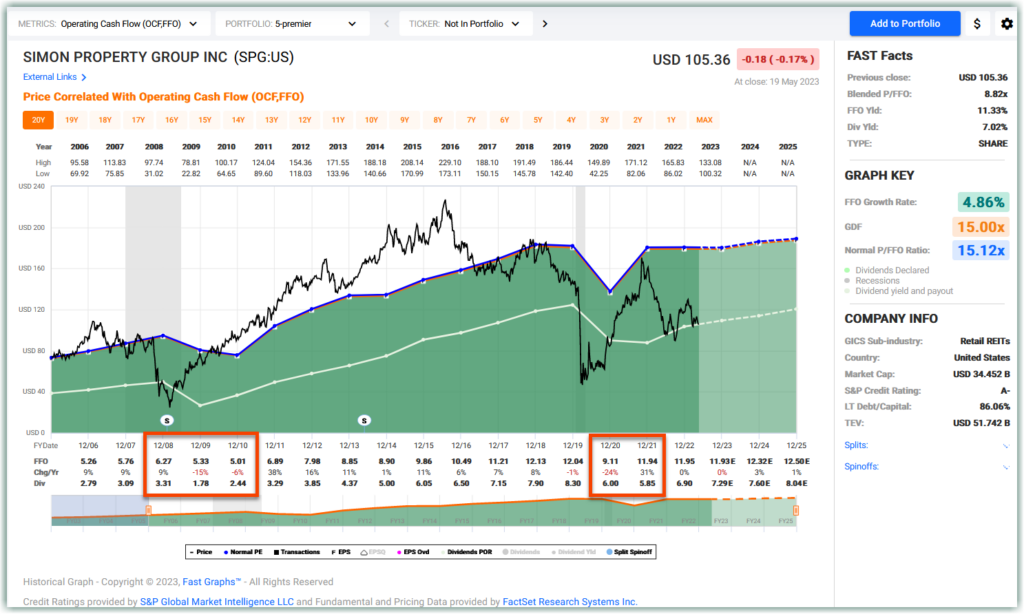

While the situation has certainly improved from the depths of 2020, the rental income collection in FY 2022 still trailed the pre-pandemic figures. Just based on the lower rental revenue alone, one may make the argument that this could be a potential red-flag.

No matter how well-run SPG is, traditional brick-and-mortar retail malls have already been struggling in a world even before the pandemic. Malls were facing a different existential threat then: the rise of e-commerce. Even SPG is not immune to that. The pandemic just hastened the end. A headline such as the one below is a stark reminder of this reality.

No matter how well-run SPG is, traditional brick-and-mortar retail malls have already been struggling in a world even before the pandemic. Malls were facing a different existential threat then: the rise of e-commerce. Even SPG is not immune to that. The pandemic just hastened the end. A headline such as the one below is a stark reminder of this reality.

Is The End of Malls Really SPG’s New Reality?

Is The End of Malls Really SPG’s New Reality?

It will be a mistake to think that SPG was selling the properties because (1) mall business was bad and (2) it was so cash-strapped that it had to sell properties to raise cash.

It will be a mistake to think that the lower than pre-pandemic rental income is a red flag.

Like all things, context matters.

Firstly, it is clear from the 2022 10k and the 2018 10K that selling off properties (as well as acquiring new ones) is a common practice at SPG, as in all REITs. The key measure of success is whether SPG profits from these sales. The results speak for themselves: in the period from 2018 to 2022, other than two small losses, the rest were gains.

Secondly, the lower rental income is attributed to the decline in the total available leasable space, down from 181.1 million square feet of gross leasable area, or GLA, in 2018, to 172.6 million square feet of gross leasable area by December 2022. The number of income-producing properties fell from 206 in 2018 to just 196 in 2022. SPG is closing the gap in the rental income collection by raising rents on existing properties, and the fact that rent can continue to rise without affecting the occupancy rate means business that SPG’s malls could not be better.

Secondly, the lower rental income is attributed to the decline in the total available leasable space, down from 181.1 million square feet of gross leasable area, or GLA, in 2018, to 172.6 million square feet of gross leasable area by December 2022. The number of income-producing properties fell from 206 in 2018 to just 196 in 2022. SPG is closing the gap in the rental income collection by raising rents on existing properties, and the fact that rent can continue to rise without affecting the occupancy rate means business that SPG’s malls could not be better.

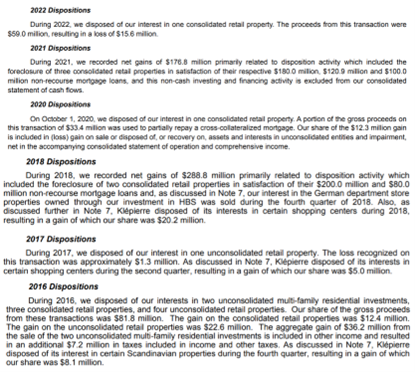

Another matter investors need to be cognizant of it how SPG’s FFO performed in past recessions.

In FY 2009, the FFO fell by 15%, and it continued to fall in 2010 before recovering in 2011. Similarly in FY 2020 FFO fell sharply by 24%. Of course, 2020 was special. Looking ahead, analysts are forecasting that the imminent recession will blunt any FFO growth to at best in the low single-digits.

In FY 2009, the FFO fell by 15%, and it continued to fall in 2010 before recovering in 2011. Similarly in FY 2020 FFO fell sharply by 24%. Of course, 2020 was special. Looking ahead, analysts are forecasting that the imminent recession will blunt any FFO growth to at best in the low single-digits.

With this backdrop in mind, investors will do well to temper expectations that SPG would grow FFO at high-single-digits to double digit rates like it did from 2011 to 2018. An investment into SPG should be for other reasons but FFO growth should not be one of them.

Is SPG Priced Well?

Analysts’ 1-year and 2-year forecasts for SPG has been right 83% so we are inclined to give more credence to their figures.

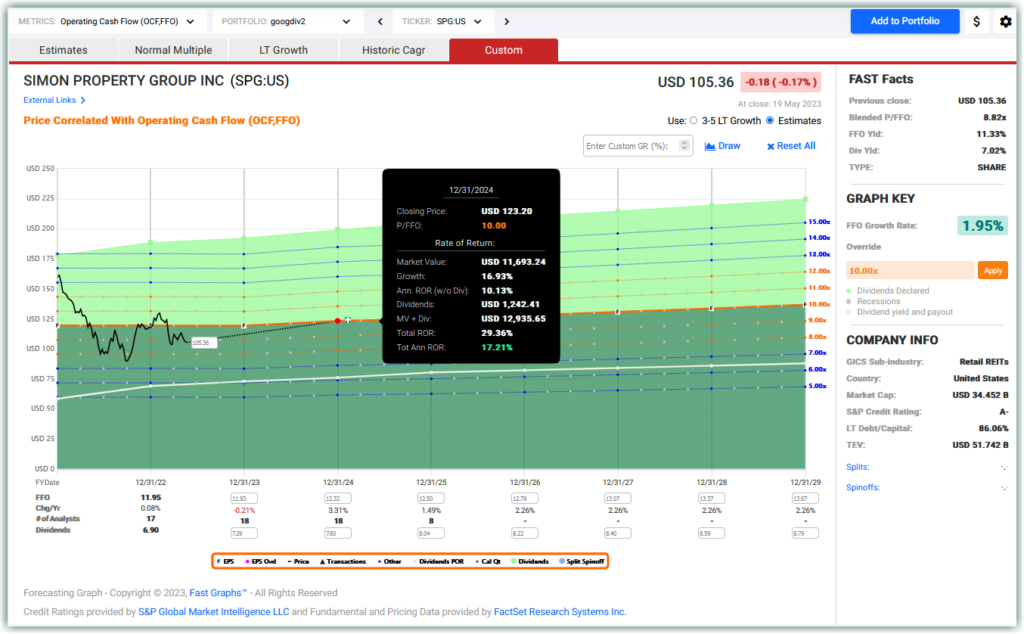

SPG’s normal P/FFO between 2009 and 2019 is 16.77. After factoring the two recessions, normal P/FFO between January 2008 and December 2020 dropped to 15.54. Factoring the high probability of a recession coming (if it is not already here) in the next 6-12 months that result in low-single digit growth in FFO of just 1.95%, and applying a much lower-than-normal P/FFO multiple of 10, SPG could still provide a double-digit rate of return by 2024.

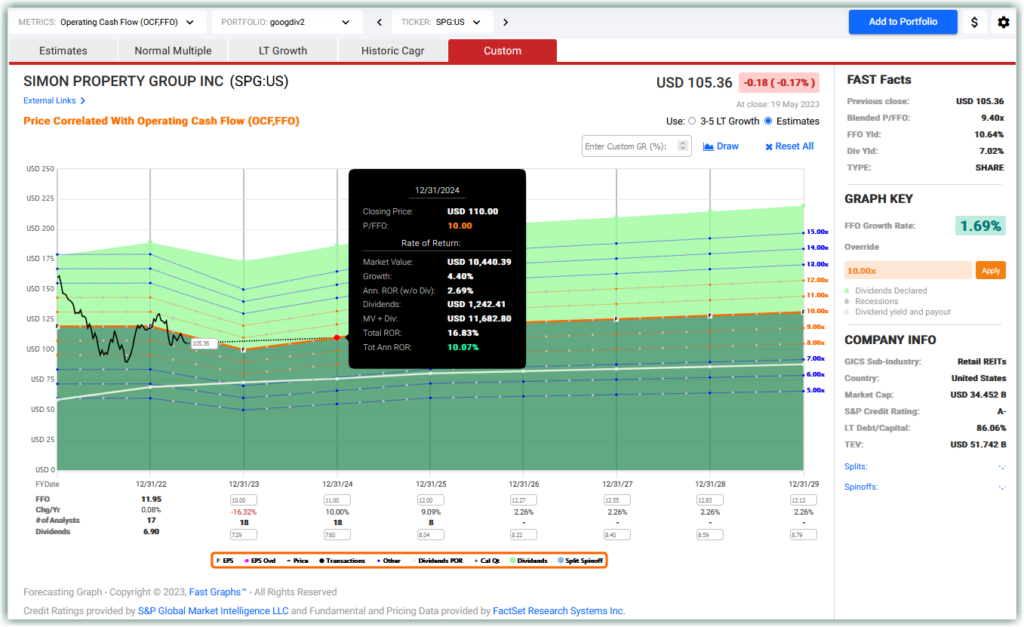

And in a really bearish scenario where we modelled in a severe recession that drops FFO by 16.32% in FY 2023 before recovering slowing in 2024 and 2025, and at the lower-than-normal P/FFO multiple of 10, SPG could, unbelievably, still provide a double-digit rate of return by 2024.

And in a really bearish scenario where we modelled in a severe recession that drops FFO by 16.32% in FY 2023 before recovering slowing in 2024 and 2025, and at the lower-than-normal P/FFO multiple of 10, SPG could, unbelievably, still provide a double-digit rate of return by 2024.

This really shows how cheap SPG is right now, and the wide margin of safety it offers investors.

This really shows how cheap SPG is right now, and the wide margin of safety it offers investors.

Summary

Simon Property Group (NYSE: SPG) is one of the rare, high-quality, founder-led REIT that has a A- credit rating a high quality REIT that is selling at a discount to its fair value. It is selling at just a blended P/FFO of 8.82 versus its 20-year normal P/FFO of 14.46. It is so cheap that even if it just grow FFO at 1.95% it can still provide a double-digit rate of return in under two years.

I like it that the management is not increasingly assets under management for the sake of it, or making joint venture deals just for the sake of “growth”. Prudence is what we look for in the managers of investors’ money. A comparison of the number of JVs between 2018 (81 properties) and 2022 (82 properties, just one more JV after 4 years) will make this clear. Management has been very selective when it comes to choosing who it wants to work with and what to work on. The same prudence is also seen on the acquisition front. When asked if SPG is looking to buy any new properties, the CEO responded well. David Simon said:

Nothing here that would really like we’re not jumping up and down to do external transaction. So it’s mostly the same stuff that we’ve been doing and just keep plugging away on that. And look, I do think we have to respect the capital markets. The capital markets are telling all companies to be more prudent, to do more accretive investments, and we are listening very closely to that.

Finally, SPG is not the stuck-in-the-mud kind of company. It is still learning new tricks and evolving. In December 2022, Simon Property acquired a 50% stake in Jamestown, a global real estate investment and management with a 39-year track record and had more than $13 billion of assets under management as of Jun 30, 2022. This partnership has both a near-term positive impact on the bottom line as well as long-term growth potential.

In the near-term, SPG is confident that its stake in Jamestown will be accretive to earnings. In the long-term, SPG will be able to drive its future densification projects with the help of Jamestown’s platform. To be clear, SPG is no newcomer in carrying out redevelopment and expansion projects. However, those have been usually more localized, leaning towards the addition of anchors, big box tenants, and restaurants to existing malls.

Jamestown has a much more diverse portfolio and broader range of expertise. Jamestown not only has redevelopment projects in the same geographical regions as SPG (U.S. and Europe), it is also in the Latin America residential and mixed-use urban markets in Colombia, Peru, and Chile. Jamestown, through its Timberland Fund, can help to burnish SPG’s ESG (environment, social and governance) credentials. Finally, through its involvement with Jamestown, SPG can learn from and connect with institutional investors. CEO David Simon said this about the deal with Jamestown:

And they have excellent institutional relationships. And we think with our partnership, we can grow that business… Eventually, I see us partnering with institutional money that will be managed by Jamestown that will partner with us to build XYZ or buy XYZ or build a big community in Charleston — North Charleston.

All the above gives us confidence in the management and in the business. The business model is not complicated – buy great properties at great prices, partner with tenants, support them so they will do well and are happy to pay increasing rents, and when properties are not doing so well, redevelop/repurpose them to become more valuable, and sometimes sell properties for a profit and recycle the proceeds to new properties. What sets Simon Property Group apart is how well it has done this for close to 40 years.

Yes, a recession may come or may even be upon us as we speak but SPG has survived previous recessions. It survived the pandemic, and it will survive the next recession.

Conclusion

Simon Property Group is one of the highest quality real estate investment trusts in the REIT universe. However, like most REITs, the recent Fed action regarding raising interest rates have caused valuations to fall. Nevertheless, we believe this is not only temporary but overdone in many cases, but specifically in the case of Simon Property Group.

As a result, we believe the company offers a great margin of safety and a very attractive dividend yield that was recently increased. Therefore, even though fixed income is becoming more competitive, it still will not provide the inflation hedging, income growth, and long-term total return that we believe Simon Property group currently provides.

Consequently, if you are an income-oriented investor looking to grow both your income and your overall wealth, then we believe Simon Property Group offers a great opportunity at current levels. As always, no one can pick the perfect bottom, but we believe valuation indicates a strong long-term entry point at these levels. Additionally, there is talk that the Federal Reserve may abstain from further interest rate increases, which if true, could provide a stimulus for capital appreciation in the near term.

— James Long and Chuck Carnevale

After researching income stocks for over 30 years, I've come up with a one of a kind dividend portfolio. With the right 20-30 stocks, you can collect a dividend check every single day the market is open. That's over 260 dividend checks per year. Click here for the names of these 20+ stocks.

Source: FAST Graphs