What’s the best path to great investment results over the long run?

Well, many roads lead to Rome.

I’m not saying there’s only one way.

But I do think there’s a path that’s so easy and intuitive, it’s silly to not take it.

That path is this: Invest in great businesses.

That’s it?

It can’t be that easy!

Yet it can be.

If you wanted to build a great sports team, you’d fill the team with great athletes in the given sport.

And if you want to build a great portfolio, you should aim to fill it with great businesses.

Okay, but how does one find these great businesses?

That can also be quite easy.

The Dividend Champions, Contenders, and Challengers list has already compiled many of them for you.

This list contains invaluable information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

These are all dividend growth stocks.

A high-quality dividend growth stock represents equity in a world-class business that pays reliable, rising dividends to its shareholders.

And it’s able to afford such payments because it’s producing reliable, rising profits.

Reliable, rising profits come about when you’re running a great business and selling more products and/or services.

I’ve been buying high-quality dividend growth stocks with my hard-earned savings for years now.

I built the FIRE Fund in the process of doing so.

This is my real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

In fact, I’ve been able to live off of dividends for years now.

I actually quit my job and retired in my early 30s.

My Early Retirement Blueprint explains how I did that.

Now, I’ve achieved some measure of financial success in my life because of following the path I just laid out.

But there is more to it than just finding and investing in great businesses.

But there is more to it than just finding and investing in great businesses.

There’s also the matter of valuation.

Whereas price simply describes what you pay, it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Buying high-quality dividend growth stocks when they’re undervalued is an easy, yet highly effective, path toward great investment results over the long run.

Of course, the valuation bit does require one to first have a basic understanding of how to go about valuing a business.

Fear not.

Fellow dividend growth investor Dave Van Knapp put together Lesson 11: Valuation in order to make the process of valuing a business simple to approach, understand, and repeat.

You can use it to estimate the fair value of just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Essex Property Trust Inc. (ESS)

Essex Property Trust Inc. (ESS)

Essex Property Trust Inc. (ESS) is a real estate investment trust that owns and operates a portfolio of US West Coast multifamily properties.

Founded in 1971, the company is now a $14 billion (by market cap) real estate giant that employs more than 1,700 people.

Essex Property Trust focuses on three different supply-constrained markets: Southern California, 42% of NOI; Northern California, 40%; and Seattle, 18%.

The company’s property portfolio consists of approximately 62,000 apartment homes across 252 apartment communities.

Many forms of commercial real estate are rather discretionary in nature.

Think shopping centers, for example.

However, Essex Property Trust focuses completely on shelter – a non-discretionary basic need.

Everlasting demand is built right in.

Outside of malfeasance, it’s pretty difficult for Essex Property Trust to go out of business.

There is almost no risk of obsolescence, as shelter is timeless.

Technology is powerful, but it’s hard to imagine it changing shelter.

People will always need somewhere to live.

All that said, the company’s concentration on the US West Coast could be both the company’s greatest strength and greatest weakness.

On one hand, a combination of unique geography and heavy-handed regulation conspire to limit supply.

This is a big advantage: Existing supply is that much more valuable when it’s so difficult to bring new supply to market.

These same supply issues plague single-family houses in these markets, which only serves to make apartments more affordable by comparison.

Moreover, because of an intoxicating mixture of high-paying jobs, comfortable climates, and beautiful nature, the West Coast is highly desirable.

On the other hand, very high costs, a homelessness crisis, and rising crime along the I-5 corridor all collude to temper demand.

In addition, the work-from-home trend, which has shown staying power, makes it easier for some workers to move to cheaper locations inland without losing their high-paying jobs.

But not all jobs are remote, and climate isn’t mobile.

Many of the problems facing the West Coast are fixable and most likely temporary.

But the appeal of the West Coast is not temporary, nor is the need for shelter.

And that’s why Essex Property Trust should continue to grow its revenue, profit, and dividend in a fairly perpetual manner over the coming decades.

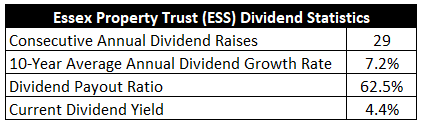

Dividend Growth, Growth Rate, Payout Ratio and Yield

To date, the company has increased its dividend for 29 consecutive years.

That stretches all the way back to the company’s original IPO, showing just how consistent and determined Essex Property Trust has been since the start.

There are only three Dividend Aristocrats that are REITs.

There are only three Dividend Aristocrats that are REITs.

Essex Property Trust is one of them.

The 10-year dividend growth rate is 7.2%.

That’s actually fairly high for a REIT, as REITs tend to be slow-growth income vehicles.

Notably, though, there has been some mild deceleration in dividend growth over the last few years.

But it’s not a massive divergence, and it’s still a healthy growth rate for a REIT.

Furthermore, while the dividend growth has come down a bit, the yield has risen in kind.

The stock’s 4.4% yield blows away what the broader market offers.

It’s also 130 basis points higher than its own five-year average.

Smartly, the market has already adjusted for the lower growth rate, compensating new investors with a higher yield.

And this high yield is protected by a payout ratio of 62.5%, which is relatively modest for a REIT.

For income-oriented dividend growth investors, Essex Property Trust offers a compelling yield backed by a great legacy of reliable growth.

Revenue and Earnings Growth

As compelling as the numbers may be, many of them are looking backward.

However, investors must look forward and acknowledge the fact that today’s capital is being risked for tomorrow’s rewards.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be of aid when later estimating fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then unveil a professional prognostication for near-term profit growth.

Blending the proven past with a future forecast in this manner should allow us to come to a reasonable judgement about where the business might be going from here.

Essex Property Trust advanced its revenue from $611 million in FY 2013 to $1.6 billion in FY 2022.

That’s a compound annual growth rate of 11.3%.

This is really good top-line growth, but it’s important to remember that a REIT typically funds growth by issuing equity and debt.

That’s why it’s especially important to look at profit growth on a per-share basis when dealing with a REIT.

It moves past absolute growth and drills down into the more insightful relative growth.

Moreover, instead of looking at earnings, you want to look at funds from operations.

FFO is a measure of cash generated by a REIT, which adds depreciation and amortization expenses back to earnings.

The company grew its FFO/share from $7.59 to $13.70 over this period, which is a CAGR of 6.8%.

This is the more accurate representation of the company’s true growth profile.

It’s obviously not as good as the top-line growth was, but it’s still quite good.

We can also see a tight relationship between FFO/share growth and the growth of the dividend over the last decade.

That shows excellent control from management.

Looking forward, CFRA currently has no three-year growth projection for the REIT’s FFO/share.

That’s unfortunate.

I generally like to compare the proven past up against a future forecast, which helps with extrapolating out results.

Since this is absent, I’ll instead shift over to the most recent guidance provided right from Essex Property Trust itself.

Per the company’s Q1 report, released in April, guidance calls for $14.74 to $15.12 in FFO/share for FY 2023.

That’s $14.93 at the midpoint.

What’s especially noteworthy here is that this was a guidance raise from Essex Property Trust.

This new midpoint is an $0.18 improvement over the previous midpoint.

Impressively, this would represent 9% YOY growth in FFO/share.

That’s actually an acceleration in FFO/share growth compared to the prior decade’s trend.

I think this illustrates a great case of narrative versus reality.

There’s a popular narrative that California (the major market for Essex Property Trust) is somehow “dying”, yet Essex Property Trust is growing faster than usual.

Here’s the reality: If California were a sovereign nation, it would rank as the world’s fifth largest economy in terms of nominal GDP.

California is, by far, the most populated (i.e., popular) state in the USA.

Yogi Berra would have probably put it something like this: California is too crowded; nobody goes there anymore.

Yes, California did recently lose a minor percentage of its population, but its overall population is up significantly over the last decade.

I see nothing to indicate that Essex Property Trust can’t grow over the next decade at least as fast as it did over the last decade.

And that’s coming off of a base where scheduled rents are higher than ever.

Putting it all together, I see Essex Property Trust more or less doing what they’ve been doing – growing the business and dividend at a mid-single-digit annual rate (or better).

Meantime, you’re getting a near-4.5% yield to start off with.

There’s a clear path to a 10% annual rate of total return over the long run, and it could be achieved on a low-risk basic need.

I think that’s pretty appealing.

Keep in mind, through January 31, 2023, Essex Property Trust has provided a 4,102% total return since its June 1994 IPO – far ahead of the 1,445% provided by the S&P 500 over the same time frame.

Financial Position

Moving over to the balance sheet, Essex Property Trust has a solid financial position.

Essex Property Trust has $12.4 billion in total assets against $6.5 billion in total liabilities.

The company’s investment-grade credit ratings are as follows: BBB+, Fitch; Baa1, Moody’s; and BBB+, Standard & Poor’s.

Essex Property Trust has been a fantastic investment for nearly 30 years.

I don’t see why the next 30 years won’t also be fantastic.

And with economies of scale, luxury properties, regulatory know-how in difficult markets, and an entrenched footprint in supply-constrained and desirable locations, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

California’s infamous red tape is a double-edged sword – constraints on bringing new inventory to market assist existing properties, but it’s also difficult to grow the portfolio.

Real estate is generally cyclical, although the basic need of shelter does mitigate some of that cyclicality.

Essex Property Trust has indirect exposure to the technology industry, as a lot of tech companies are based on the West Coast.

The capital structure of a REIT relies on external funding for growth, and rising interest rates can create harm in two ways – debt becomes more expensive when rates are higher, and competitive yields elsewhere reduces demand for equity.

Essex Property Trust lacks geographic diversification.

The West Coast exposure introduces risks of natural disasters, such as earthquakes.

As work becomes more flexible, more remote workers could choose to leave the West Coast for cheaper locations inland.

I think the risks are definitely worth considering, but the quality of the business can’t be forgotten or denied.

Also not worth considering and not forgetting is the valuation of the business, which looks very appealing after a 30% slide in the stock’s price from its 52-week high…

Stock Price Valuation

The P/FFO ratio is 14.3.

That’s decently analogous to a P/E ratio on a normal stock, and it depicts a very undemanding multiple.

It’s not far off from the P/CF ratio, which is 14.6.

For perspective on just how undemanding this is, the stock’s own five-year average P/CF ratio is 20.6.

And the yield, as noted earlier, is substantially higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 6.5%.

That growth rate is on the lower end of the spectrum I’m usually looking at.

I find it appropriate to be cautious when extrapolating out growth for REITs, largely due to the fact that these are income vehicles that rely on external funding.

However, let’s be clear.

This number is well below what Essex Property Trust has delivered over the last decade in terms of both bottom-line and dividend growth.

In addition, current guidance is calling for YOY FFO/share growth that’s higher than this number.

Overall, I think it’s a very reasonable, if cautious, assumption of the long-term dividend growth path.

The DDM analysis gives me a fair value of $281.16.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I fail to see anything irresponsible in my valuation, yet the stock still looks worth much more than its current price.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates ESS as a 5-star stock, with a fair value estimate of $317.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates ESS as a 2-star “SELL”, with a 12-month target price of $214.00.

An interesting range, which is made to be even more interesting when you see that CFRA was much more sanguine on the stock back in 2022 when it was in the $300s. Averaging the three numbers out gives us a final valuation of $270.72, which would indicate the stock is possibly 22% undervalued.

Bottom line: Essex Property Trust Inc. (ESS) is a high-quality REIT providing a basic need for people and profiting handsomely from it. With a market-smashing yield, a moderate payout ratio, a healthy dividend growth rate, nearly 30 consecutive years of dividend increases, and the potential that shares are 22% undervalued, long-term dividend growth investors would be wise to consider buying this Dividend Aristocrat after its massive drop in price.

Bottom line: Essex Property Trust Inc. (ESS) is a high-quality REIT providing a basic need for people and profiting handsomely from it. With a market-smashing yield, a moderate payout ratio, a healthy dividend growth rate, nearly 30 consecutive years of dividend increases, and the potential that shares are 22% undervalued, long-term dividend growth investors would be wise to consider buying this Dividend Aristocrat after its massive drop in price.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is ESS’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 93. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, ESS’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income