A recent article on mortgage-backed securities (MBS) had me going, “huh?” The story covers MBSs being very popular when mortgage rates were less than 3%, but now with rates over 7%, large, institutional buyers are staying away.

That’s one reason why mortgage rates are so high, despite MBSs in theory being more profitable today.

That’s created a profit opportunity for one of my favorite 10%+-yielding stocks…

The Wall Street Journal article titled “Mortgage Rates Are High Because Nobody is Buying Mortgages” lays out the story with Bank of America as the centerpiece.

In 2021, Bank of America Corp. (BAC) found itself with $1.9 trillion of deposits and only $900 million of outstanding loans. To earn interest on the deposits (for itself), the bank bought mortgage-backed securities (MBS). By the end of 2021, Bank of America owned $622 billion of MBSs.

Also, last year, the ten banks that own the most MBSs bought $219 of these home loan-backed bonds. The Federal Reserve also bought MBSs as part of its Qualitative Easing (QE) program.

These MBS were acquired when mortgage rates were less than 3%, meaning these MBS probably yield less than 2.5%.

Now that mortgage rates are much higher, the buyers of 2021 don’t have the capital to invest. The WSJ article notes this:

“Higher rates arrived this year and scrambled the economics of buying. Banks’ deposits have leveled off and in some cases declined. Loans are growing again. Some banks are also opting to hold mortgages, instead of mortgage bonds, on their books.”

Rising rates hammered the value of the low-coupon bonds purchased last year. If Bank of America sold those bonds, the losses would top $100 billion.

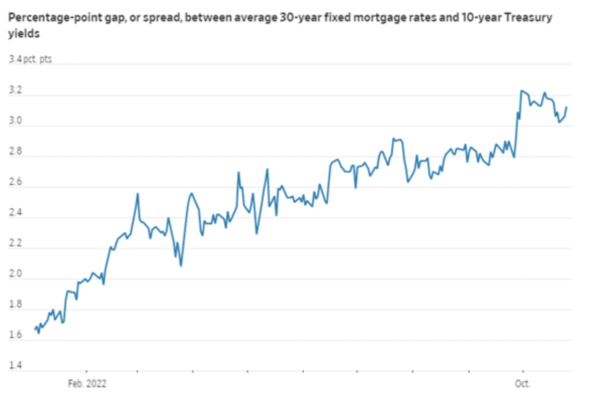

Mortgage rates have risen much faster than Treasury bond yields. Consider this chart:

Somewhere in my memory is the idea that 30-year mortgages typically cost about 2% more than the 10-year Treasury note yield. You can see the current spreads are well above that threshold.

Somewhere in my memory is the idea that 30-year mortgages typically cost about 2% more than the 10-year Treasury note yield. You can see the current spreads are well above that threshold.

The combination of high mortgage rates and a large spread compared to Treasury yields brings two thoughts to mind.

First, anyone needing to finance a home now will likely be able to refinance to a lower rate reasonably quickly. At some point, investors (especially institutional investors) will see the attractiveness of MBS yields and start to buy. The buying will shrink the spread, even if Treasury yields stay flat.

Second, an opportunistic operator in the mortgage space will find price dislocation that will lead to great returns. Finance REIT Rithm Capital Corp. (RITM) has proven especially astute at finding high-profit opportunities. RITM already sports an 11% yield, and 2023 may be their most profitable year yet.

— Tim Plaehn

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

Source: Investors Alley