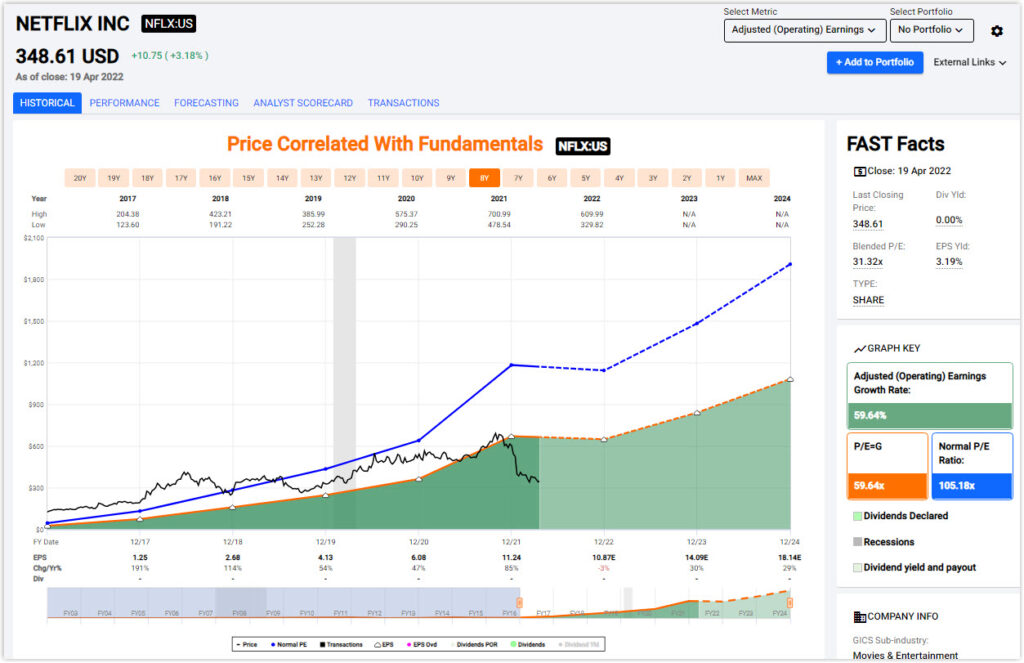

Even though Netflix (NFLX) stock is down approximately 35% today, I contend the company is still too expensive to invest in. With this video I go through a by-the-numbers look at Netflix utilizing the powerful FAST Graphs fundamentals analyzer software tool. When I run the numbers out to their logical conclusion you will discover that Netflix is still too expensive to invest in.

There is never a substitute for comprehensive research and due diligence. Moreover, although you can learn a great deal from the past you can only invest in the future. What is changing the valuation of Netflix is subdued guidance from management and analyst expectations regarding the intermediate future. Consequently, I would argue that the final shoe has yet to drop.

There is never a substitute for comprehensive research and due diligence. Moreover, although you can learn a great deal from the past you can only invest in the future. What is changing the valuation of Netflix is subdued guidance from management and analyst expectations regarding the intermediate future. Consequently, I would argue that the final shoe has yet to drop.

In addition to covering the current valuation of Netflix in this video, I also provide some insights to current FAST Graph subscribers on how to take advantage of this powerful fundamental tool. With the custom forecast calculator subscribers can apply their own estimates or estimates gathered from other sources. Therefore, comprehensive what-if scenarios can be run in order to make better informed investing decisions.

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: FAST Graphs