This is the fifth and final article in our series covering investors of different ages. We already published videos talking about stocks to buy for investors in their 20’s, 30’s, 40’s, and 50’s.

And now we’re covering investors in their 60’s. One of the most important considerations for an investor is their time horizon.

Simply put, compounding requires time. The more time you have, the more powerful compounding can be. But if you’re in your 60s, time isn’t the luxury it once was when you were younger. And so a more immediate return on capital becomes appealing.

Moreover, you’re likely in retirement and focusing on investments that provide a large amount of sustainable income. As such, when you’re in your 60s and buying stocks, high-yielding stocks are right in your wheelhouse.

Now, this usually means sacrificing growth to a degree. But that’s okay.

If you’re able to buy stocks with yields upwards of 7% and comfortably cover your bills in retirement, you don’t need a lot of growth.

You just want enough growth to keep up with inflation so that you don’t lose ground to the rising costs of life. And that’s exactly what I’m here to help you with.

I’m going to tell you about three high-quality dividend growths stocks that offer all of this. They give you yields that are more than 4 times higher than the broader market. And these big dividends are safe and growing.

This could make them perfect for investors in their 60s that are income-oriented. Want to know which stocks I’m talking about?

Let’s dig in.

DGI Stock for Your 60’s #1: Enbridge (ENB)

The first stock I want to bring to your attention is Enbridge (ENB). Enbridge is the largest energy infrastructure company in North America.

While humanity has aspirations toward a green energy future, the truth is that we still need oil and gas. And that oil and gas has to be moved from one place to another, which is where pipelines often come in. Enbridge owns thousands of miles of crude and natural gas pipelines.

This company is pipelining more than just energy products, though. It’s also pipelining a massive dividend.

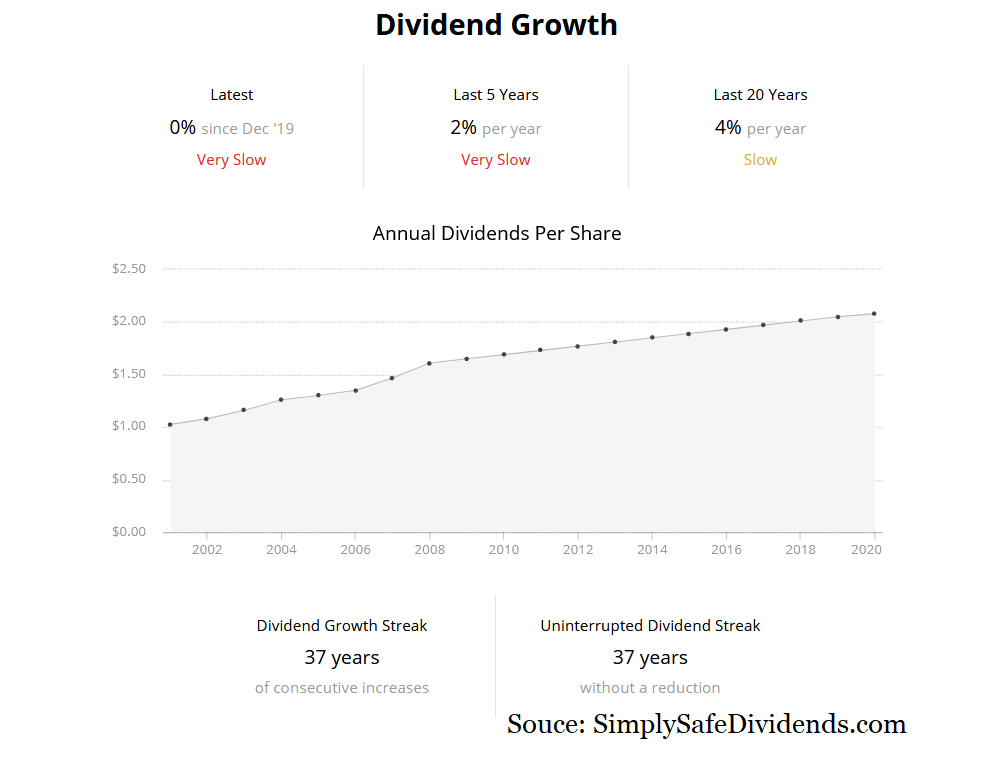

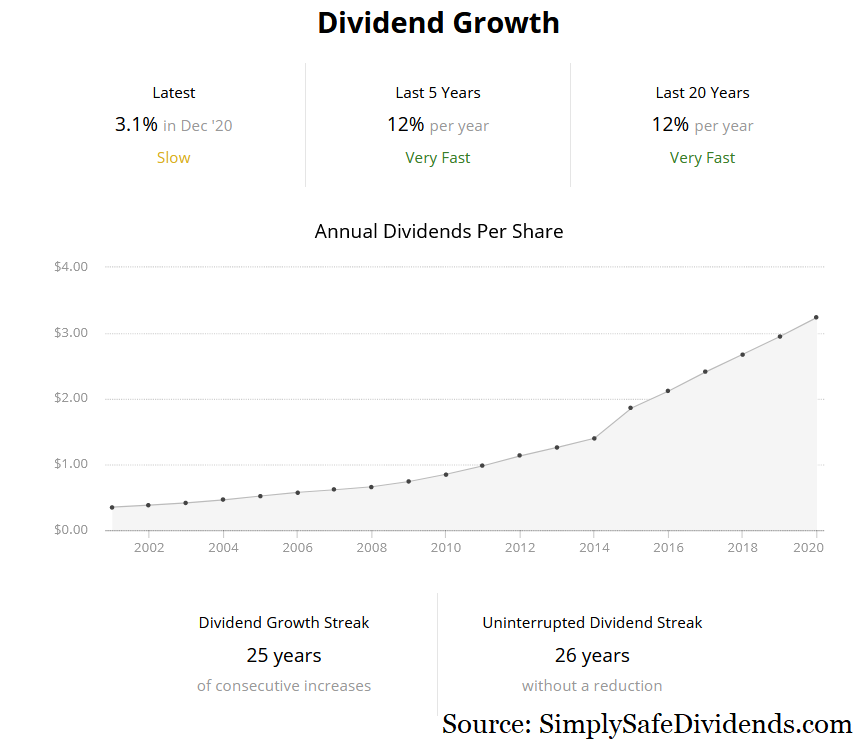

The stock yields 7.1% right now. That’s more than 4 times higher than the S&P 500’s yield. This is a golden goose laying one of the fattest golden eggs you’ll find. And they’re laying more of these golden eggs every year. They’ve increased their dividend every year for 25 consecutive years. And they’re killing inflation with the dividend raises.

Their 10-year dividend growth rate is a jaw-dropping 11.3%.

If you’re in your 20s, you might be concerned about the long-term future of oil and gas. But if you’re in your 60s? I don’t think so. The odds of these pipelines becoming obsolescent over the next 10-20 years is a very small risk. This is an example of where a limited time horizon is advantageous – it opens you up to investments that have business model risks over periods of time that exceed your time horizon.

Best of all, the stock looks undervalued right now.

We put out a video a few months ago analyzing and valuing Enbridge stock, estimating its intrinsic value at almost $44/share. We also showed in that video how the dividend is quite safe, ensuring your income stream in retirement.

DGI Stock for Your 60’s #2: Altria Group (MO)

DGI Stock for Your 60’s #2: Altria Group (MO)

The second stock I want to tell you about is Altria Group (MO). Altria is a dividend magician.

This stock gives it all to you. Big dividend? Check. The stock is yielding 6.6%. Safe dividend? Check. Free cash flow easily covers the dividend. Growth? Check.

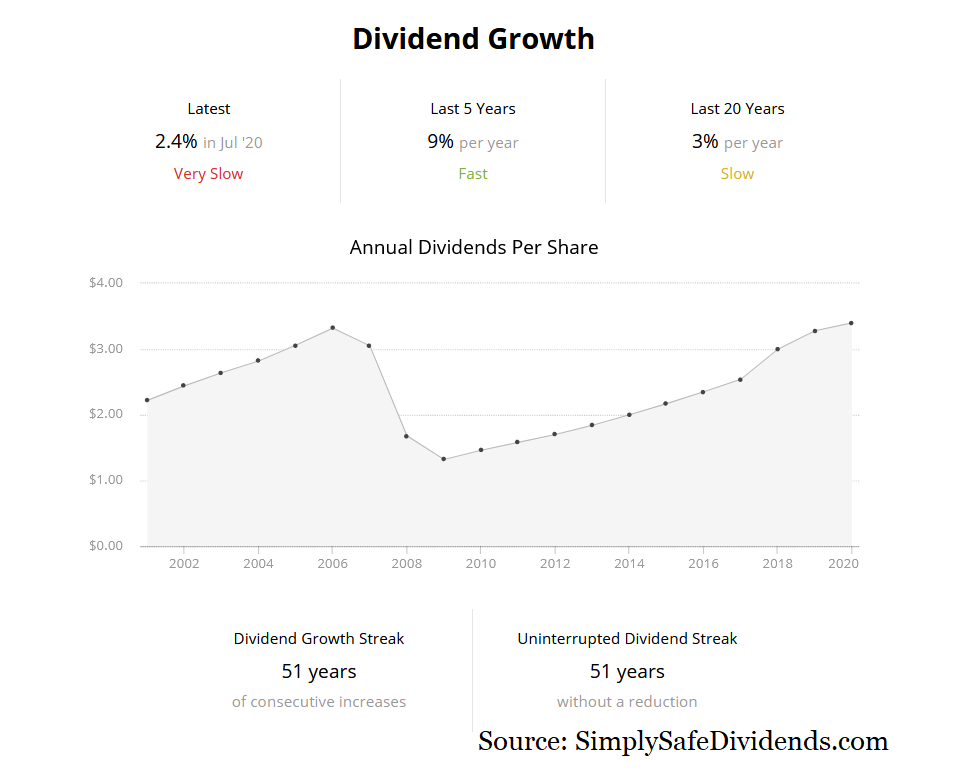

Altria has increased its dividend for a very impressive 51 consecutive years.

With a 10-year dividend growth rate of 9.1%, we once again have a very compelling combination of yield and growth. Now, Altria’s recent dividend raises have been small. But with a yield of well over 6%, you just don’t need much growth in order to rationalize the investment.

This is a rare case where you don’t really have to sacrifice anything at all.

The only potential issue here is one of morality. As Altria is a tobacco company, some investors avoid it on moral ground. That’s up to you. The other issue could be one of a questionable long-term future since smoking is in secular decline. However, again, I see that as a risk that would exceed a 20-year time horizon, making this high-yielding stock a very appealing idea for investors in their 60s.

Another thing you don’t have to sacrifice with this stock? Valuation.

We highlighted this stock as undervalued back in November, when it was below $40/share. It’s now over $50/share. But I see the stock as still very buyable for dividend growth investors in their 60s, as the yield makes the juice very much worth the squeeze.

DGI Stock for Your 60’s #3: AT&T (T)

DGI Stock for Your 60’s #3: AT&T (T)

Last but not least, let’s talk about AT&T (T). AT&T Inc. is a telecommunications and media conglomerate.

Operating one of the largest telecom businesses in the world and one of the largest media businesses in the world, AT&T is a giant. You know what else is a giant? Their dividend.

This stock yields a mouth-watering 6.9%.

It’s more than four times higher than the broader market’s yield. And that’ll definitely get some bills paid, which is very important if you’re in retirement. Plus, this stock allows you to keep pace with inflation with dividend growth.

AT&T has increased its dividend for 36 consecutive years.

Their 10-year dividend growth rate of 2.2% won’t knock you dead, but if a near-7% yield is covering a nice chunk of your bills and your passive dividend income is slowly increasing so that you don’t lose ground to inflation, that’s a pretty nice deal. And with prodigious free cash flow of nearly $30 billion/year covering the dividend almost twice over, the dividend is safe enough to rely on in retirement.

Surprisingly, even with all of the positive attributes, the stock remains what looks like a rare deal in today’s expensive stock market.

We put out a video only weeks ago highlighting the stock’s income appeal and undervaluation, noting that the stock might actually be worth over $35/share.

If you’re not in your 60s, no worries. We recently published videos for investors in their 20s. 30s, 40s, and 50s. Make sure to take a look at the whole series so that you can keep some ideas in mind as you age.

If you’re not in your 60s, no worries. We recently published videos for investors in their 20s. 30s, 40s, and 50s. Make sure to take a look at the whole series so that you can keep some ideas in mind as you age.

I think all three of these stocks could be appropriate for investors of all ages. But their yield-heavy tilt makes them particularly suitable for investors in their 60s. These stocks won’t grow like crazy. Instead, they’re healthy income generators that can make a retirement much easier. These are mature golden geese laying big, fat golden eggs. And they even have enough growth left in the tank to more than keep up with inflation so that you don’t lose ground to the rising costs of life. If you want large, safe, growing dividends, these three high-quality dividend growth stocks should be near the top of your shopping list.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

This stock checks all the boxes. Pays a high dividend (8%), has a record of increasing that yield (an average of 37.5% throughout company history), and is set up perfectly to profit from continued Fed rate hikes. Click here for the name and ticker of the most perfect dividend stock on the market right now.

DGI Stock for Your 60’s #2: Altria Group (MO)

DGI Stock for Your 60’s #2: Altria Group (MO) DGI Stock for Your 60’s #3: AT&T (T)

DGI Stock for Your 60’s #3: AT&T (T)