A few short weeks ago everything looked fine for Alibaba (NYSE:BABA). Earnings were approaching, as was China’s Singles’ Day event. Ant Group’s IPO was another catalyst, although that hasn’t panned out well for Alibaba stock.

Unfortunately, while things were looking good for the company, the catalysts haven’t panned out.

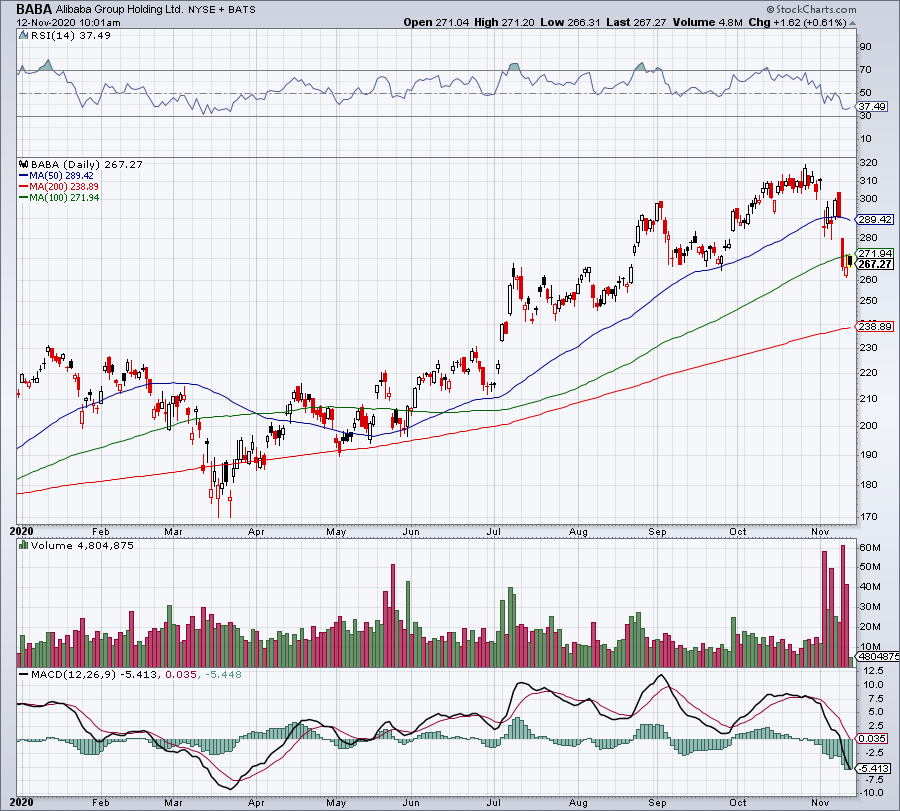

From there though, the stock began to wobble. The action remained controlled and bullish until Nov. 3.

However, it wasn’t the election sinking Alibaba, it was news that the Ant IPO was being pushed back. Due to Chinese regulatory issues, the highly anticipated event has been delayed.

That resulted in a one-day 10.5% drop for Alibaba stock. After a modest recovery, shares suffered a two-day decline of 11%. The move comes after earnings and Singles’ Day.

So why own the stock?

Catalysts Galore

When the Ant IPO was shelved, the bias turned negative for Alibaba stock. On Nov. 5, Alibaba reported earnings, beating fiscal Q2 estimates by 58 cents per share by earnings $2.65 a share. Revenue was in-line, but grew 30% year over year.

Singles’ Day set another record, with Gross merchandise value (GMV) hitting roughly $75.1 billion. That’s almost double what Alibaba did last year, at $38 billion.

Despite both of these amazing results, the stock is struggling to rally. Not rallying on good news is a bad sign for traders. However, I think it’s an opportunity for investors.

They are seeing Alibaba turn in strong results — the proof is right there! — yet the stock is not being rewarded for it. While shares are not exactly in a free-fall, it would be nice to see some leadership from Alibaba.

From Daniel Zhang, chairman and CEO of Alibaba:

Alibaba had another strong quarter. We continued to help businesses recover and find new opportunities for growth through digitalization in the post-pandemic landscape. The solid performance of our core commerce and robust growth of Alibaba Cloud are the direct results of our commitment to value creation for customers.

Alibaba Has Great Assets

Alibaba has formed a robust e-commerce environment in China. Remember by the way, China is huge. With roughly four times the population as the U.S. and a middle class that is booming (and roughly the size of the entire U.S. population), one can see how and why online sales have been so strong.

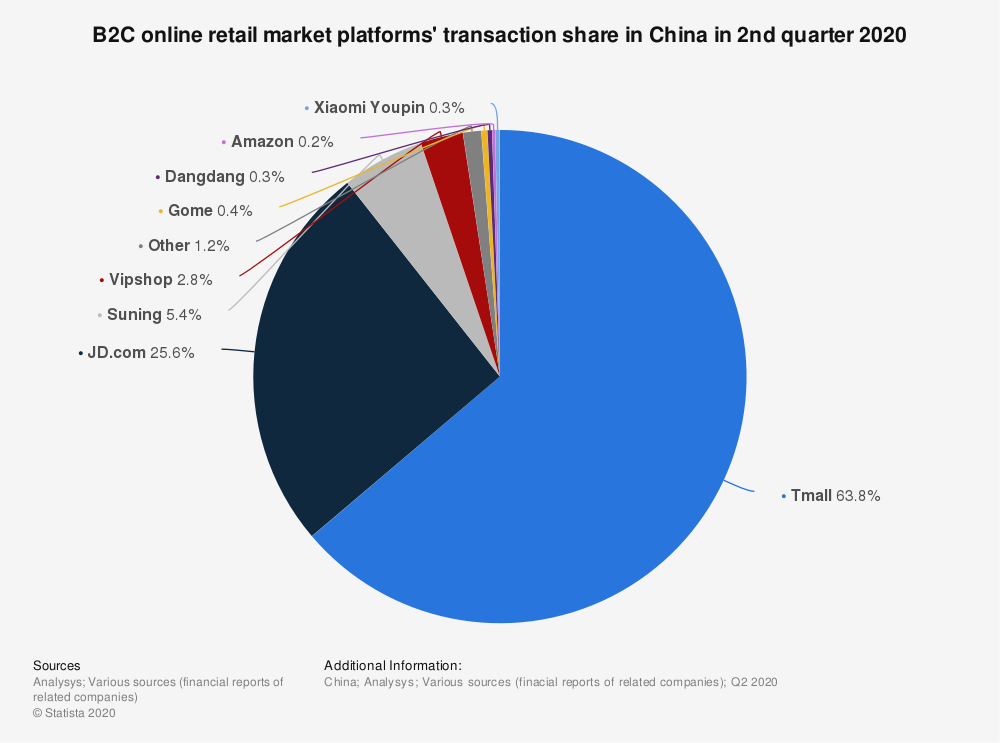

Alibaba not only has Alibaba.com, but it’s has T-Mall. The latter is the most popular e-commerce site in all of China. The graphic above highlights just how dominant this unit is in the retail sector. Adding other services to its business — like the cloud — is a natural progression for a company with Alibaba’s presence.

But then you throw in the Ant stake and there’s even more value. Alibaba owns one-third of Ant, so it was set to cash in when Ant went public in both Shanghai and Hong Kong.

So what went wrong here? Ant was supposed to be a record-breaking IPO, but was pulled at the last minute because “the company’s proposed offering might no longer meet the requirements for listing after Chinese regulators had summoned company executives … for a meeting on Monday.”

Neither the regulators nor Ant has said in detail what was discussed at the meeting. But the timing of the conversation, mere days before Ant’s shares were expected to begin trading concurrently in Shanghai and Hong Kong, suggested discord with the company or with Mr. Ma, who spun Ant out of Alibaba in 2011.

At this point, putting the brakes on the Ant IPO is confusing and frustrating. The plus side is that Ant is an incredibly valuable asset and Alibaba will keep that in its coffers for now.

Alibaba Stock Has Growth

Source: Chart courtesy of StockCharts.com

Source: Chart courtesy of StockCharts.com

For many investors, they have not been to China or interact with people who live in China. If they did, they would know just how big this company is.

Because Alibaba stock is listed in the U.S., we can compare it to other mega-cap tech stocks. Let’s just say, this name is undervalued given how large it is, the type of growth it has and the size of its addressable market.

At a time where most companies are struggling for growth, consensus estimates call for robust growth this year. Analysts expect 46% revenue growth and 36% earnings growth. Admittedly, estimates call for that growth to decelerate in the following year once the novel coronavirus cools down as a catalyst.

Still, forecasts for 20% earnings growth and 31% revenue growth is pretty impressive to me. For a company that generated $72.75 billion in sales in 2019 to one that is forecast to register sales of $138.8 billion in 2021, I’m floored.

For all that growth and its high-quality assets, Alibaba stock trades at a reasonable 26 times this year’s earnings estimates. Down over 18% from its September high to recent low and this name is one to start considering on the long side.

— Matt McCall and the InvestorPlace Research Staff

Silicon Valley venture capitalist Luke Lango says this little-known Apple project could be 10X bigger than the iPhone, MacBook, and iPad COMBINED! Investing in Apple today would be a smart move... but he’s discovered a bigger opportunity lying under Wall Street’s radar -one that could give early investors a shot at 40X gains! Click here for more details.

Source: Investor Place

Source: Chart courtesy of StockCharts.com

Source: Chart courtesy of StockCharts.com