Tech has taken a punch in the face this past few weeks—prompting many readers to wonder if it’s time to sell after booking some big gains in the sector this year.

No way. We’re dividend investors first and contrarians second, so we’re going to take the other side of that bet and buy this tech “mini-dip.” We’ll do it with closed-end funds (CEFs) yielding 7% (and more) that also give us a unique “double discount” to hedge any downside we might see in the coming months (this is 2020, after all) and a good shot at outperforming tech and the broader market, too.

Yes, COVID-19 cases are rising in Europe and America, and that’s led some places to bring back lockdowns, raising worries that growth will be stifled yet again, and stocks will fall accordingly.

But remember that we can’t expect history to repeat itself exactly—markets never really do.

To see what I mean, think back to the depths of the March 2020 crash: back then, most pundits were predicting it would take years for stocks to recoup their gains. Yet if we look at where stocks are now, we see that the S&P 500’s total return is actually positive on the year:

Stocks Bounce While the Pundits Lose the Plot

This is a classic case of the “generals fighting the last war”: the pundits were focused on the long climb out of the 2008/’09 crisis and dismissed the possibility of the quick crash and rally we’ve seen in 2020.

That’s why, when you hear those same pundits say that tech is on its way to big losses now, you need to take it with a big grain of salt: financial history tends to rhyme, and markets learn from the mistakes of the past.

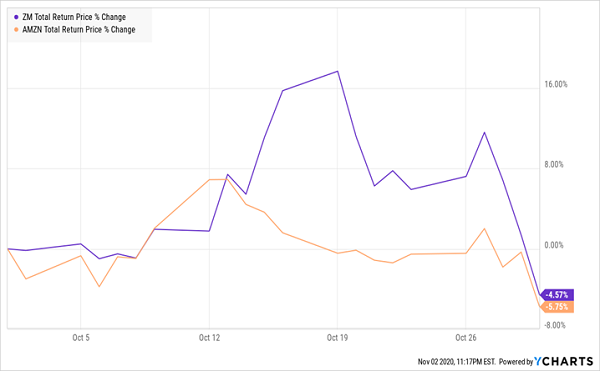

And that’s why the bigger fall in tech stocks, as seen with the 4.5% decline in the tech benchmark Invesco QQQ Trust (QQQ) in October, is particularly interesting. Large parts of tech were obvious big winners of the lockdown, as anyone who’s used Zoom Video Communications (ZM) and Amazon.com (AMZN) for the first time in 2020 can attest to. Yet both stocks fell in October and underperformed the rest of the tech sector.

Quarantine’s Winners Suddenly Losers?

But I think you’ll agree that a month is a pretty short time period over which to judge anything in the stock market. So let’s “zoom” (sorry, I couldn’t resist) out to a more meaningful time period.

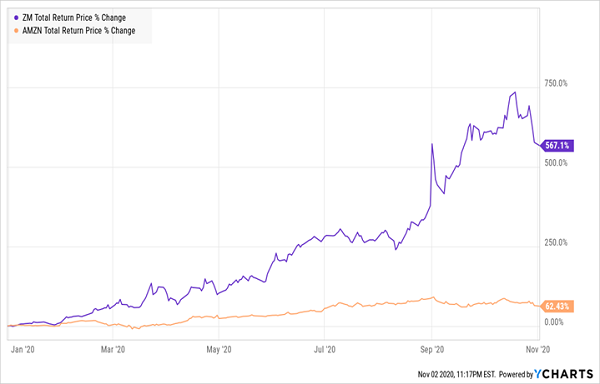

Little Sign of a Big Correction Here

As we can see, these stocks aren’t entirely correcting. If they were, they would be down a lot more, if suddenly the market felt these companies will disappoint investors in the coming months. Simply put: a stock that’s still up over 560% in a year doesn’t drop 5% in a month because the market has changed its attitude on the name.

This kind of small dip in tech stocks indicates a broader trend divorced from fundamentals: a lot of people have been selling just about everything at about the same rate, which makes little sense, as any new lockdowns would affect different companies differently.

This “baby with the bathwater” reaction is the first hint that we’ve got a buying opportunity in front of us. The second is that it’s out of step with the economic numbers we’re seeing.

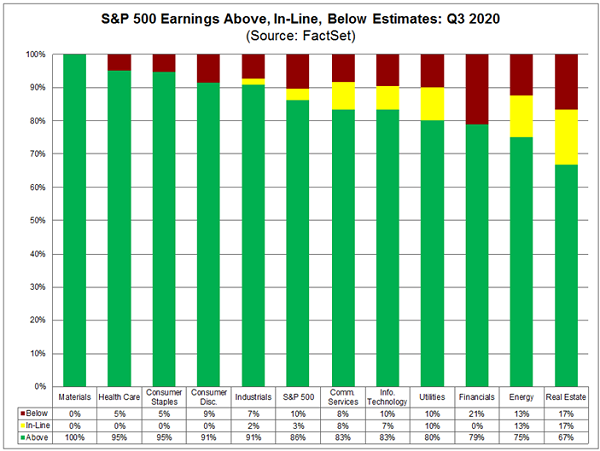

Stocks Down, Earnings Up

Turning to earnings, we see a clear and consistent picture take form. Spoiler: it’s good news.

So far, we’ve seen the vast majority of companies outperform earnings expectations, some of them by a huge margin. In total, 86% of companies have reported above-expected earnings per share, which is a historical record.

The truth is, despite the virus and all the other uncertainty we’re experiencing, we’ve seen many US companies swiftly adjust, and we’ve also seen expectations for companies fall too far too fast. With GDP growth swinging from 31.4% decline in the second quarter to a 33.1% gain in the third quarter, the American economy has quickly come closer to its pre-pandemic level—again defying those backward-looking pundits.

Tech Stocks Can Offer Less Risk in a Worrying Time

Still, if you want to be careful but you still want to invest in this market, where should you put your money?

The answer: tech. With tech stocks falling further than other sectors, and with tech still better positioned in case things take a turn for the worse again, it makes more sense than ever to jump into the sector. One way (but not the best way!) to do that is to simply buy QQQ.

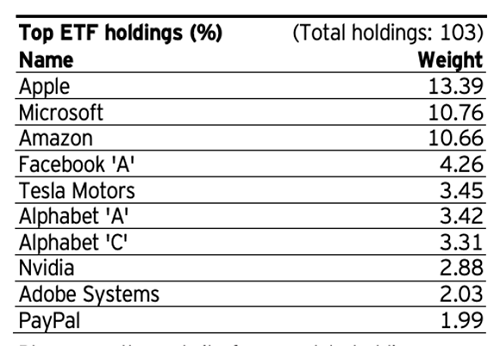

But before you do that, you might want to know what’s exactly in those three Q’s. So let me show you.

Source: Invesco

Source: Invesco

Because QQQ tracks the NASDAQ 100 index, you can see that it holds household-name blue chips (and work-from-home beneficiaries) like Apple (AAPL) and Microsoft (MSFT), as well as e-commerce giant Amazon.com (AMZN). Meantime, QQQ holdings Facebook (FB) and Google (GOOG, GOOGL) are more important than ever in helping us stay in touch with the world from the confines of home, while Paypal (PYPL) is, of course, an important tool in making online transactions happen.

And that’s why the tech selloff makes no sense if it’s based on fears of a coronavirus resurgence: these are the companies that won big after last March/April, and the market is giving us another opportunity to buy them for cheap—but this time, the window to buy is probably going to be a lot smaller.

Add an “X” to QQQ—and Get a 7% Dividend

QQQ is a solid bet right now. And to be honest, this is the fund that most people will gravitate to. But if you’re like me, you want more of your return in dividends, so I’d be more inclined to look at something like the Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX).

This CEF holds the same stocks as QQQ and yields 7% today, nearly 12 times more than QQQ’s meager 0.6% payout! That big, stable income stream adds a measure of safety: you can use it to pay your bills or reinvest, either back in QQQX or elsewhere.

— Michael Foster

BUY Now: My 5 Best CEFs for a Volatile Market (and 8% Dividends!) [sponsor]

CEFs’ potential to hand you a lifetime of safe, steady profits (and high dividends!) is a matter of record.

Here’s what my latest research is telling me: of the 326 CEFs that are a decade old (or older), only 16 have lost money in the last 10 years! That’s a 95% “profit rate.”

This is shocking enough on its own, but there’s more.

Of the 16 CEFs that did lose money, all but 5 were in the energy sector. Dump those 11 laggards and these CEFs’ win rate jumps to an incredible 98.4%! I think that proves just how critical it is to hold these cash-rich funds in a whipsawing market like this one.

Case closed.

And that’s not all, because I’ve just released my 8 favorite CEFs for these uncertain times. These funds are ALL cheap now, and yield just over 8%.

A $500K investment returns $41,000 in yearly dividends! I think you’ll agree that this puts the outdated 4% rule to shame.

But these are small funds, and their prices can jump quickly, so you need to act now. Click here to get all the details on these 5 powerhouse funds—names, tickers, dividend history and everything else you need to know before you buy.

Source: Contrarian Outlook