Picking a winning trade on a consistent basis is not simply a stroke of luck. It’s the result of calculated screening, planning, and deliberation.

With this in mind, we have started a new weekly series on our top 10 stocks to watch this week — stocks that look poised for a possible breakout in the coming days. Traders should add these stocks to their watchlist now.

The Top 10 Stocks to Watch This Week for Possible Breakouts

| Sl # | Name of the Stock | Stock Ticker | Last Close | Buy Level(s) | Reason |

| 1 | Nevro Corp | NYSE: NVRO | $18.82 | $19.30 | Falling Wedge Pattern Breakout |

| 2 | M.D.C. Holdings, Inc. | NTSE: MDC | $46.20 | $46.30 | Symmetrical Triangle Pattern Breakout |

| 3 | SoFi Technologies Inc. | NASDAQ: SOFI | $7.83 | $8.20 | Falling Wedge Pattern Breakout |

| 4 | Warner Music Group Corp | NASDAQ: WMG | $34.59 | $35.10 | Breakout From Consolidation Area |

| 5 | General Motors Company | NYSE: GM | $32.36 | $32.70 | Falling Wedge Pattern Breakout |

| 6 | CNH Industrial NV | NYSE: CNHI | $11.18 | $12.00 | Downtrend Channel Breakout |

| 7 | Schneider National Inc. | NYSE: SNDR | $24.02 | $25.10 | Falling Wedge Pattern |

| 8 | DTE Energy Co. | NYSE: DTE | $108.17 | $109.00 | Symmetrical Triangle Pattern Breakout |

| 9 | Marriott Vacations Worldwide Corp | NYSE: VAC | $77.53 | $80.80 | Falling Wedge Pattern |

| 10 |

1-800 Flowers.com Inc. |

NASDAQ: FLWS | $9.25 | $10.00 | Symmetrical Triangle Pattern Breakout |

Important: Typically, these trades offer a risk: reward ratio of 1:2 or 1:3 in the next 6 months, which implies 2x to 3x rewards when compared to risks. So, be sure to set your stop-loss levels and target prices accordingly to manage your risk. In addition, these trade ideas are triggered using daily closing prices, not intra-day pricing. So, if you participate in these trades, make sure that you only buy the stock once its daily close is above the recommended price level.

That said, here are the top 10 stocks to watch for a breakout, in no particular order.

#1 Nevro Corp (NYSE: NVRO)

Sector: Healthcare • Medical Devices

Reason: Falling Wedge Pattern Breakout

A falling wedge pattern is formed by joining two downward-sloping, converging trendlines having a contracting range. The pattern appears to be wide at the top and continues to contract as prices fall. A breakout from a falling wedge pattern can indicate either reversal or continuation depending on where the pattern appeared in the trend.

A stock that has broken out of a falling wedge pattern would have gained momentum and would have the potential to move higher.

Buy Level(s): The stock has currently broken out of a falling wedge pattern. However, the ideal buy level for NVRO is above the nearest resistance level of $19.30. This is marked in the chart below as a green color dotted line.

Daily chart – NVRO

#2 M.D.C. Holdings, Inc. (NTSE: MDC)

Sector: Consumer Cyclical • Residential Construction

Reason: Symmetrical Triangle Pattern Breakout

A symmetrical triangle is a chart pattern formed by two converging trend lines connecting a series of sequential peaks and troughs. These two lines result in the formation of a triangle that appears to be symmetrical.

A symmetrical triangle pattern is usually formed when there is indecision in the price movements and there is uncertainty among the buyers and sellers. This chart pattern represents a period of consolidation before the price breaks out or breaks down. In case a breakout occurs from the upper trend line, it is a strong bullish indication as it signifies the start of a new bullish trend.

Buy Level(s): The stock has currently broken out of a symmetrical triangle pattern. However, the ideal buy level for MDC is if the stock closes above the immediate resistance level of $46.30. This is marked in the chart below as a green color dotted line.

Daily chart – MDC

#3 SoFi Technologies Inc. (NASDAQ: SOFI)

Sector: Financial • Credit Services

Reason: Falling Wedge Pattern Breakout

A falling wedge pattern is formed by joining two downward-sloping, converging trendlines having a contracting range. The pattern appears to be wide at the top and continues to contract as prices fall. A breakout from a falling wedge pattern can indicate either reversal or continuation depending on where the pattern appeared in the trend.

A stock that has broken out of a falling wedge pattern would have gained momentum and would have the potential to move higher.

Buy Level(s): The stock has currently broken out of a falling wedge pattern. However, the ideal buy level for SOFI is above the nearest resistance level of $8.20. This is marked in the chart below as a green color dotted line.

Daily chart – SOFI

#4 Warner Music Group Corp (NASDAQ: WMG)

Sector: Communication Services • Entertainment

Reason: Breakout From a Consolidation Area in the Daily Chart

A Consolidation Area is a price action contained between two parallel lines. It is formed by a lower line that connects the lows, and an upper line that joins the highs. A stock usually trades between the two lines of the consolidation area before finally breaking out from the upper rail.

Buy Level(s): Although the stock has currently broken out of a consolidation area, the ideal buy level for WMG is above the near-term resistance area, which translates to a price of around $35.10. This is marked in the chart below as a green color dotted line.

Daily chart – WMG

#5 General Motors Company (NYSE: GM)

Sector: Consumer Cyclical • Auto Manufacturers

Reason: Falling Wedge Pattern Breakout

A falling wedge pattern is formed by joining two downward-sloping, converging trendlines having a contracting range. The pattern appears to be wide at the top and continues to contract as prices fall. A breakout from a falling wedge pattern can indicate either reversal or continuation depending on where the pattern appeared in the trend.

A stock that has broken out of a falling wedge pattern would have gained momentum and would have the potential to move higher.

Buy Level(s): The stock has currently broken out of a falling wedge pattern. However, the ideal buy level for GM is above the nearest resistance level of $32.70. This is marked in the chart below as a green color dotted line.

Daily chart – GM

#6 CNH Industrial NV (NYSE: CNHI)

Sector: Industrials • Farm & Heavy Construction Machinery

Reason: Downtrend Channel Breakout

A downtrend or descending channel is the price action contained between downward sloping parallel lines. It is formed by two lines that are drawn by connecting the lower highs and lower lows of a stock’s price. Even though this is typically a bearish pattern, a breakout from the upper rail of this pattern is considered a good bullish indication.

Buy Level(s): The daily chart shows that the stock has currently broken out of a downtrend channel. However, there is a near-term resistance level for the stock. Hence, the ideal buy level for CNHI is if the stock has a daily close above $12.00. This is marked in the chart below as a green color dotted line.

Daily chart – CNHI

#7 Schneider National Inc. (NYSE: SNDR)

Sector: Industrials • Trucking

Reason: Formation of a Falling Wedge Pattern

A falling wedge pattern is formed by joining two downward-sloping, converging trendlines having a contracting range. The pattern appears to be wide at the top and continues to contract as prices fall. A breakout from a falling wedge pattern can indicate either reversal or continuation depending on where the pattern appeared in the trend.

A stock that has broken out of a falling wedge pattern would have gained momentum and would have the potential to move higher.

Buy Level(s): The ideal buy level for SNDR is if the stock breaks out of the falling wedge pattern, at a price of around $25.10. This is marked in the chart below as a green color dotted line.

Daily chart – SNDR

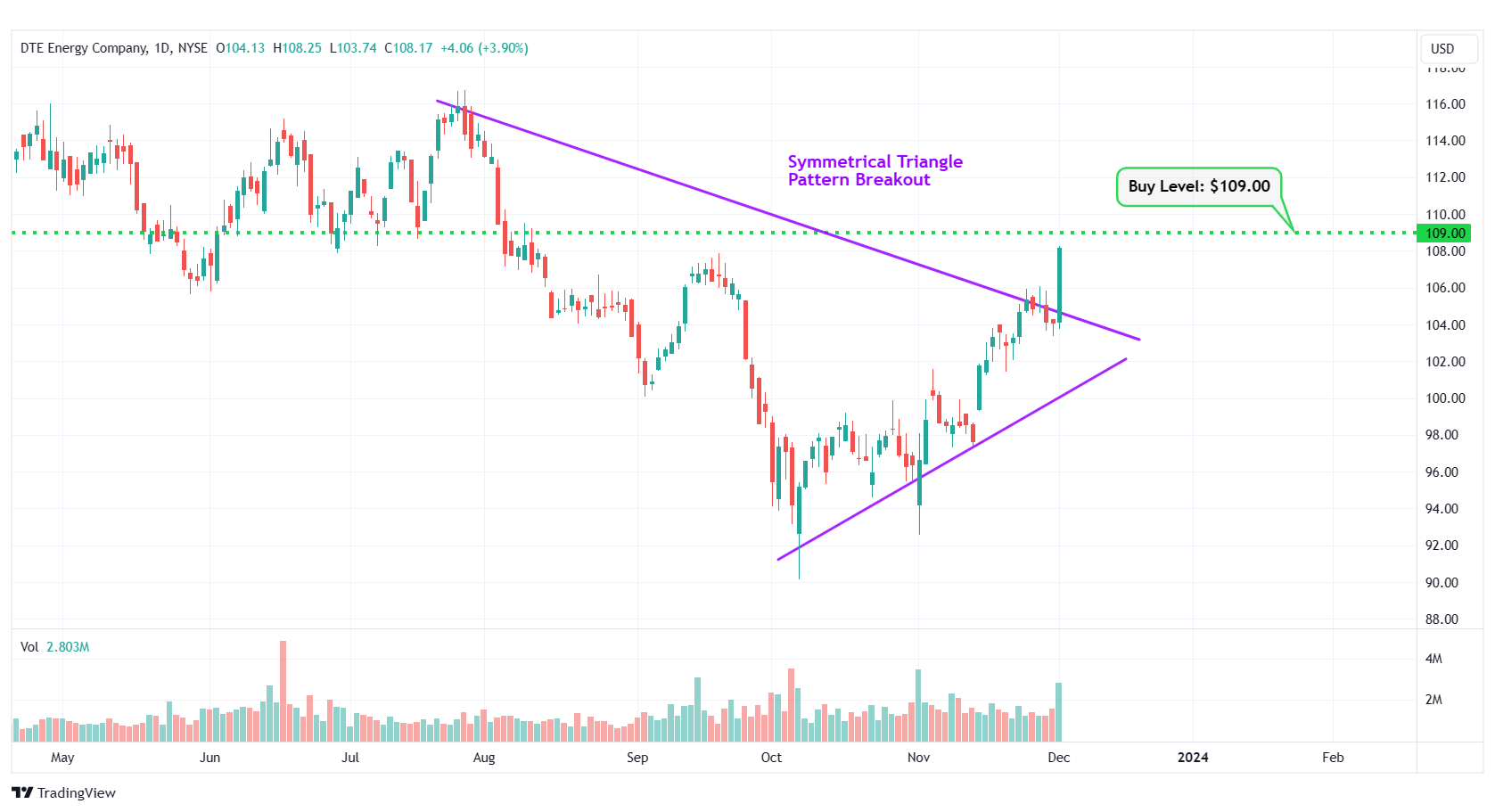

#8 DTE Energy Co. (NYSE: DTE)

Sector: Utilities • Utilities – Regulated Electric

Reason: Symmetrical Triangle Pattern Breakout

A symmetrical triangle is a chart pattern formed by two converging trend lines connecting a series of sequential peaks and troughs. These two lines result in the formation of a triangle that appears to be symmetrical.

A symmetrical triangle pattern is usually formed when there is indecision in the price movements and there is uncertainty among the buyers and sellers. This chart pattern represents a period of consolidation before the price breaks out or breaks down. In case a breakout occurs from the upper trend line, it is a strong bullish indication as it signifies the start of a new bullish trend.

Buy Level(s): The stock has currently broken out of a symmetrical triangle pattern. However, the ideal buy level for DTE is if the stock closes above the immediate resistance level of $109.00. This is marked in the chart below as a green color dotted line.

Daily chart – DTE

#9 Marriott Vacations Worldwide Corp (NYSE: VAC)

Sector: Consumer Cyclical • Resorts & Casinos

Reason: Formation of a Falling Wedge Pattern

A falling wedge pattern is formed by joining two downward-sloping, converging trendlines having a contracting range. The pattern appears to be wide at the top and continues to contract as prices fall. A breakout from a falling wedge pattern can indicate either reversal or continuation depending on where the pattern appeared in the trend.

A stock that has broken out of a falling wedge pattern would have gained momentum and would have the potential to move higher.

Buy Level(s): The ideal buy level for VAC is if the stock breaks out of the falling wedge pattern, at a price of around $80.80. This is marked in the chart below as a green color dotted line.

Daily chart – VAC

#10 1-800 Flowers.com Inc. (NASDAQ: FLWS)

Sector: Consumer Cyclical • Specialty Retail

Reason: Symmetrical Triangle Pattern Breakout

A symmetrical triangle is a chart pattern formed by two converging trend lines connecting a series of sequential peaks and troughs. These two lines result in the formation of a triangle that appears to be symmetrical.

A symmetrical triangle pattern is usually formed when there is indecision in the price movements and there is uncertainty among the buyers and sellers. This chart pattern represents a period of consolidation before the price breaks out or breaks down. In case a breakout occurs from the upper trend line, it is a strong bullish indication as it signifies the start of a new bullish trend.

Buy Level(s): The stock has currently broken out of a symmetrical triangle pattern. However, the ideal buy level for FLWS is if the stock closes above the immediate resistance level of $10.00. This is marked in the chart below as a green color dotted line.

Daily chart – FLWS

Happy Trading!

Trades of The Day Research Team

The analyst who was ranked as America's #1 Stock Picker in 2020 by TipRanks details the 40X opportunity behind Apple's "Project Titan." Click Here To Learn More.

Source: Trades of the Day