U.S. stock markets are flying high in November after three months of downtrend. The impressive rally that Wall Street witnessed in the first seven months of 2023, has resumed this month. Month to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have rallied 7.1%, 8.2% and 10.9%.

Most of the market participants are confident that the Fed is through with its current rate hike cycle buoyed by a steadily declining inflation rate, cooling down of several key economic data and a slowdown in the resilient labor market.

The U.S. economy is likely to flourish in 2024 as the Fed is set to initiate a rate cut at least in the second half of the year. Meanwhile, several stocks are currently trading at their 52-week high prices with more upside left for 2024. Investment in these stocks with a favorable Zacks Rank should be prudent at this stage.

Our Top Picks

We have narrowed our search to five large-cap stocks with more upside for 2024. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

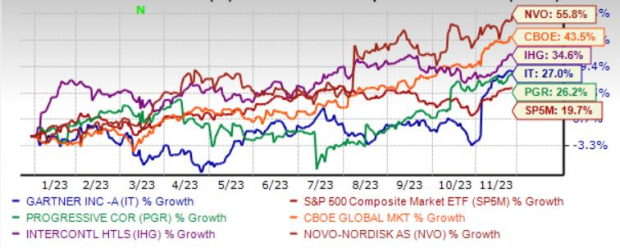

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Gartner Inc. (IT) is reportedly the world’s leading information technology research and advisory firm. IT offers rich domain expertise and technology-related insight necessary for an informed decision-making process. Over the years, IT’s comprehensive services portfolio has enabled customers across the spectrum to research, analyze and interpret the business with greater precision, efficiency and discipline.

Gartner has an expected revenue and earnings growth rate of 7.7% and 9.3%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 0.9% over the last seven days. The stock price of IT has appreciated 27% year to date.

The Progressive Corp. (PGR) continues to gain on higher premiums, given its compelling product portfolio, leadership position and strength in both Vehicle and Property businesses. Focus on becoming a one-stop insurance destination, catering to customers opting for a combination of home and auto insurance, augurs well for PGR’s growth.

Policies in force and retention ratio should remain healthy for PGR. Competitive pricing to retain current customers and address customer needs with new offerings should continue to drive policy life expectancy.

The Progressive has an expected revenue and earnings growth rate of 13.2% and 49%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 0.6% over the last seven days. The stock price of PGR has advanced 26.2% year to date.

InterContinental Hotels Group plc (IHG) owns, manages, franchises, and leases hotels in the Americas, Europe, Asia, the Middle East, Africa, and Greater China. IHG also provides the IHG Rewards loyalty program.

IHG operates hotels under the Six Senses, Regent, InterContinental Hotels & Resorts, Vignette Collection, Kimpton Hotels & Restaurants, Hotel Indigo, EVEN Hotels, HUALUXE, Holiday Inn, Holiday Inn Express, Holiday Inn Club Vacations, avid, Staybridge Suites, Atwell Suites, Candlewood Suites, voco, and Crowne Plaza.

InterContinental Hotels Group has an expected revenue and earnings growth rate of 3.7% and 15%, respectively, for next year. The Zacks Consensus Estimate next-year earnings has improved 1.2% over the last 30 days. The stock price of IHG has surged 34.6% year to date.

Cboe Global Markets Inc. (CBOE) is one of the largest stock exchange operators by volume in the United States and a leading market globally for ETP trading. CBOE offers trading across a diverse range of products in multiple asset classes. CBOE operates through six segments: Options, North American Equities, Europe and Asia Pacific, Futures, Global FX, and Digital. The Options segment trades in listed market indices.

Cboe Global Markets has an expected revenue and earnings growth rate of 4.9% and 5.4%, respectively, for next year. The Zacks Consensus Estimate next-year earnings has improved 0.5% over the last seven days. The stock price of CBOE has climbed 43.5% year to date.

Novo Nordisk A/S (NVO) is a global healthcare company and a leader in the worldwide diabetes market with a full portfolio of GLP-1 receptor agonists, modern insulins and human insulins. NVO is also a key player in hemophilia care, growth hormone therapy, hormone replacement therapy and obesity. NVO operates through two segments: Diabetes and obesity care and Rare diseases.

Novo Nordisk has an expected revenue and earnings growth rate of 18.2% and 17.2%, respectively, for next year. The Zacks Consensus Estimate next-year earnings has improved 2.7% over the last 30 days. The stock price of NVO has climbed 55.8% year to date.

— Nalak Das

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks