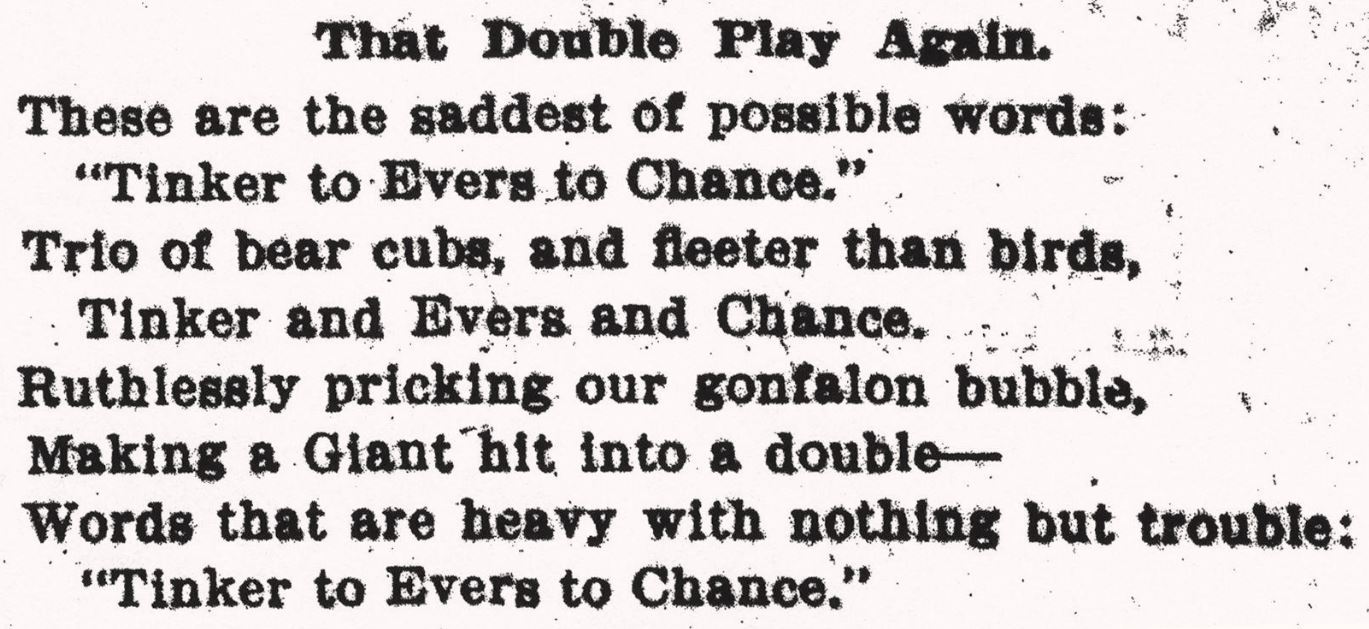

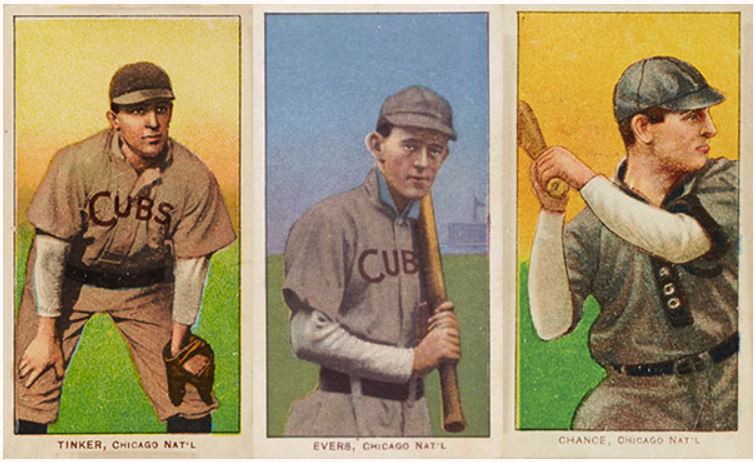

On July 11, 1910, the Chicago Cubs beat the New York Giants, snuffing out a late rally thanks to a double play turned by shortstop Joe Tinker, second baseman Johnny Evers and first baseman Frank Chance. The next day, newspaper columnist Franklin P. Adams, writing from the perspective of Giants fans, penned one of the most famous sports-related poems ever.

National Baseball Hall of Fame

The poem is known by three titles: “That Double Play Again” (as in the above image from the New York Evening Mail); “Baseball’s Sad Lexicon”; and, simply, “Tinker to Evers to Chance.”

In particular, I’ve always liked Adams’ use of “pricking our gonfalon bubble,” a reference to the damage done to the Giants’ hopes of winning the National League pennant. (Indeed, the Cubs did beat out the second-place Giants for the pennant before losing to the Philadelphia A’s in the World Series.)

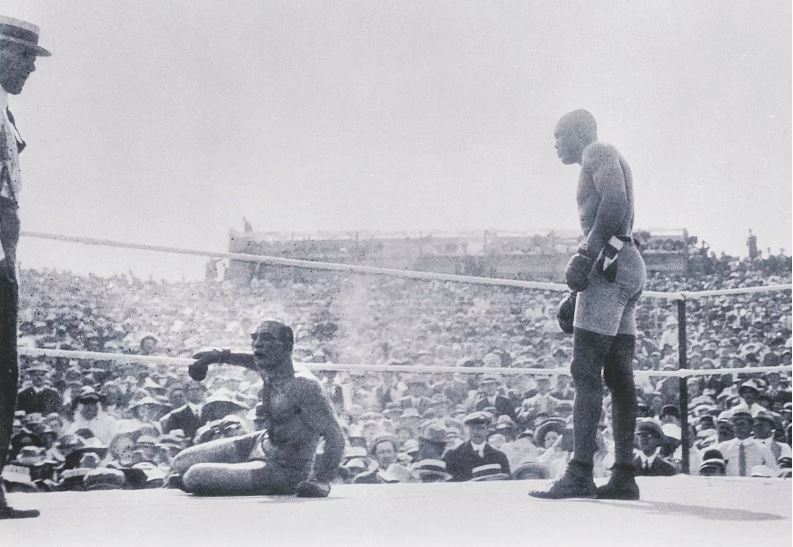

Adams’ poem wasn’t even the most famous sports-related event that month, however. The previous week, Jack Johnson — the first Black man ever to fight for boxing’s world heavyweight championship — knocked out James Jeffries for the crown.

Nevada Historical Society

The fight turned out to be one of the many racial touchstones in U.S. history, as cities and even entire states (especially in the South) banned showing footage of the fight, and Johnson faced numerous death threats.

The two grainy images in this article testify to how long ago July 1910 was. Events that now seem forever ago — World War I, Prohibition, women’s right to vote and the Great Depression — were all still years away.

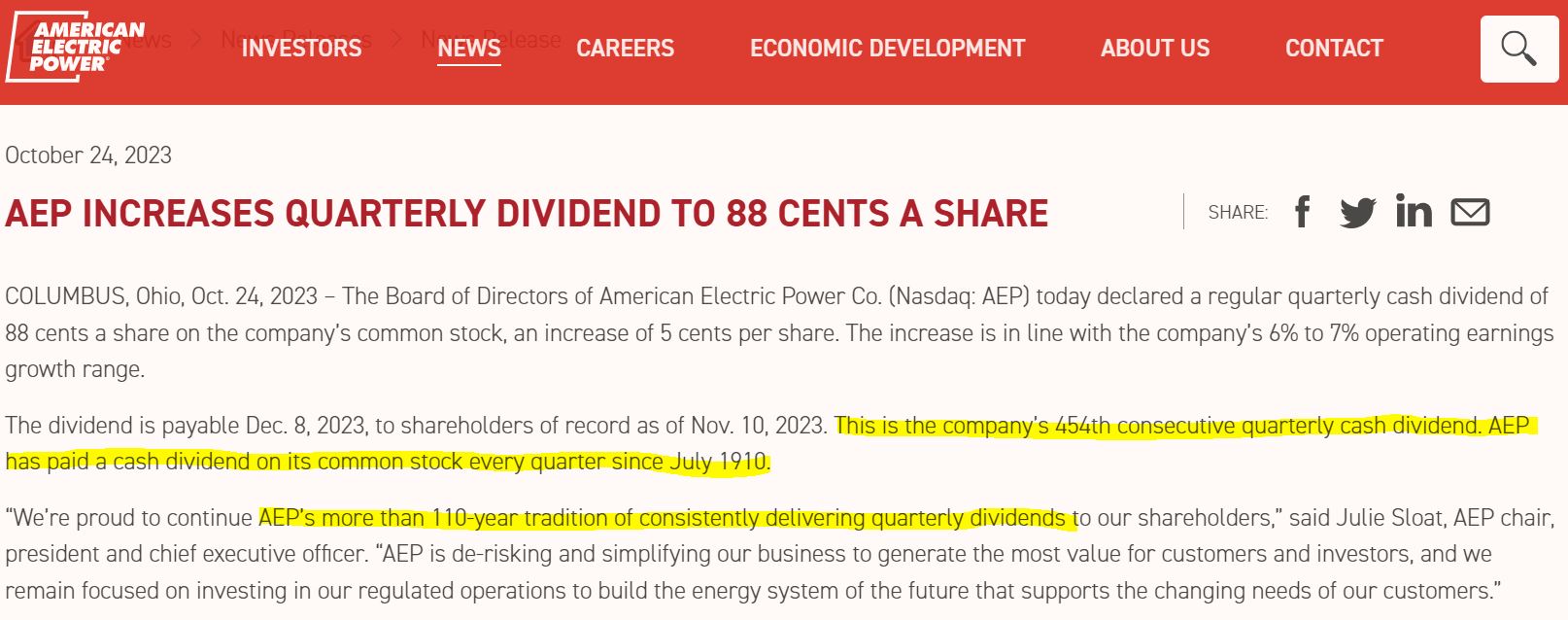

Something much less famous, and not sports-related at all, also happened in July 1910: A public utility called American Gas and Electric declared its first dividend.

Today, that company has grown to become one of the nation’s largest regulated electric utilities. It changed its name in 1958 to American Electric Power (AEP). And next month it will have paid a dividend to its shareholders for 454 consecutive quarters.

aep.com

As you can see, AEP also just raised its dividend by 6% — a move lifting the yield to a very attractive 4.5%.

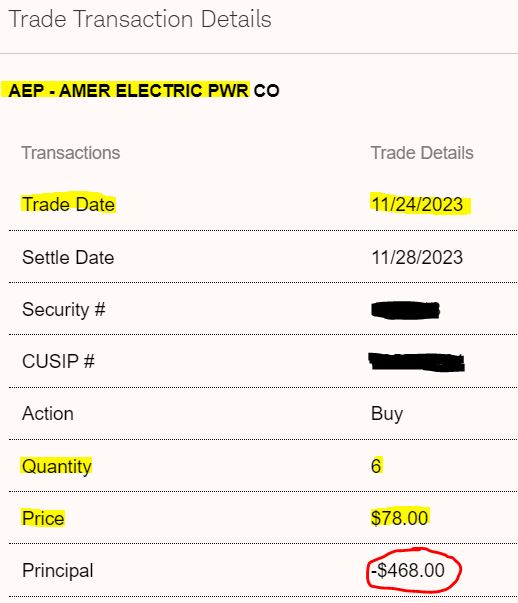

Dividend consistency and growth are among the many reasons I decided to add to the AEP stake in our Income Builder Portfolio. On Friday, Nov. 24, I executed a purchase order for 6 shares on behalf of this site’s co-founder (and IBP money man), Greg Patrick.

This was the fifth time we’ve bought shares of American Electric for the IBP. We initiated the position back in 2018, the year the portfolio was launched, and also made two buys in 2020 and another in 2022.

What’s Up With AEP?

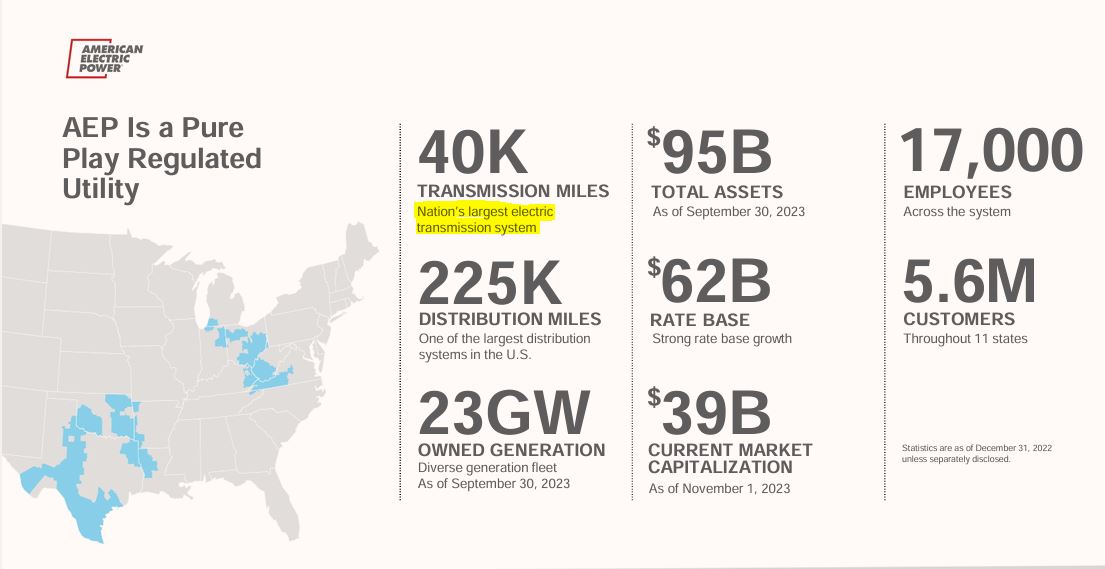

With some 40,000 “transmission miles,” AEP operates the nation’s largest electric transmission system. It serves 5.6 million customers in 11 states.

aep.com

CEO Julia Sloat says the company continues “to make progress in our efforts to simplify and de-risk our portfolio” by selling off its less-profitable unregulated businesses. Additionally, several of the states the utility serves have approved adequate rate increases for customers.

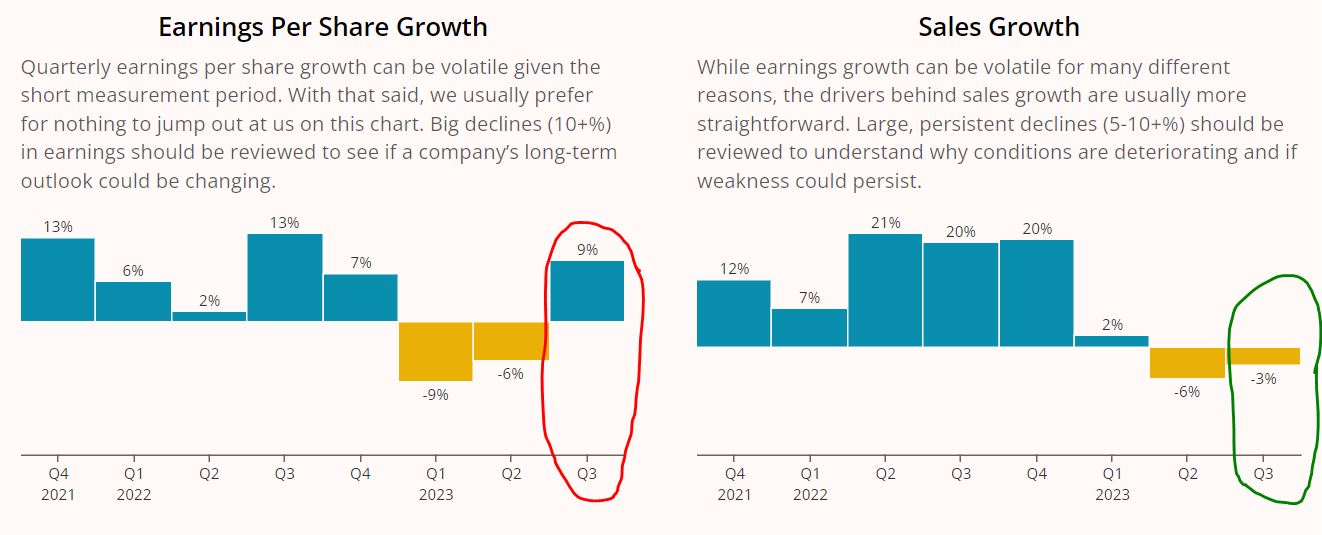

AEP issued its quarterly financial report on Nov. 2, beating earnings estimates while missing slightly on revenue. Still, earnings grew 9% in the quarter after having dropped the previous two periods, while the revenue loss was halved from the previous quarter.

SimplySafeDividends.com

While those statistics might not sound particularly impressive, I like to take a little more of a big-picture view: AEP’s earnings per share and total sales in Q3 2023 were among the highest of any quarter in company history.

SimplySafeDividends.com

Furthermore, the company maintained the midpoint of its projected full-year EPS range at $5.29 (a little higher than the $5.27 analyst consensus), and reaffirmed its expectations of 6%-7% long-term annual growth.

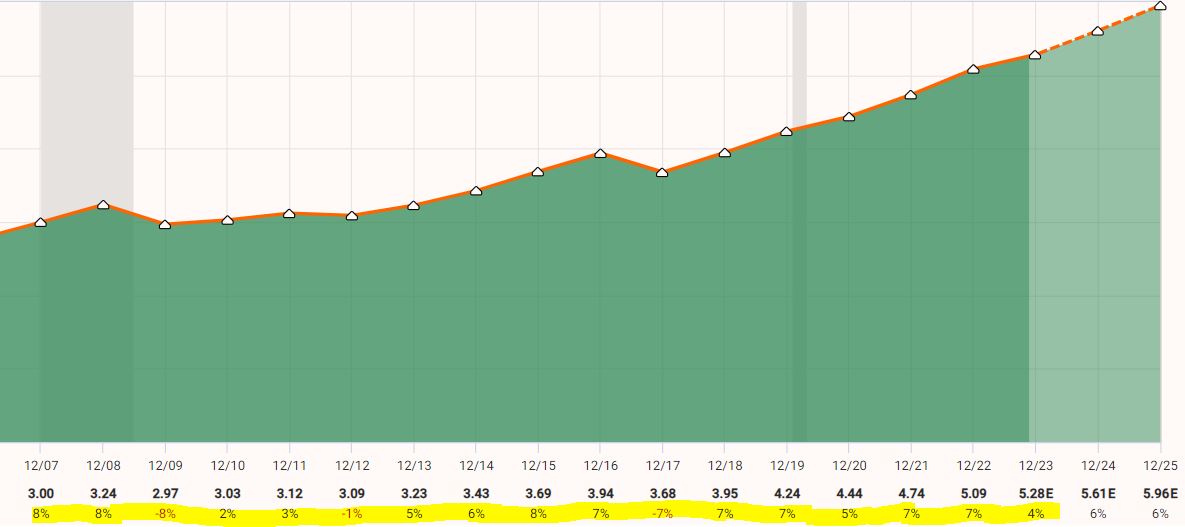

Given AEP’s history of steady earnings growth — with most years between 5% and 8% — those expectations seem realistic.

fastgraphs.com

Combine 6% annual earnings growth with a 4.5% yield, and AEP might be an interesting investment candidate for those who want exposure to the utility sector in their portfolios.

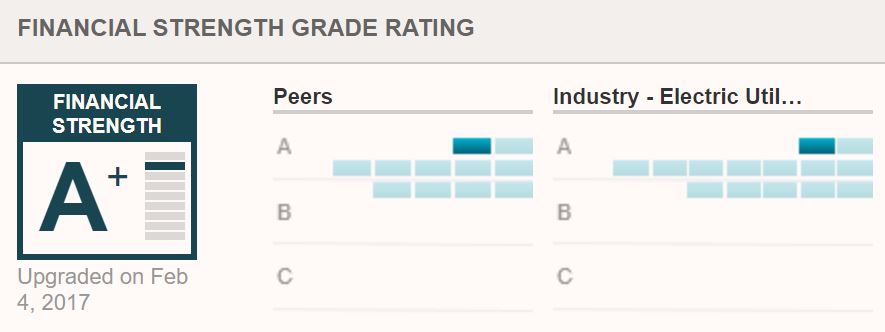

American Electric scores well in the quality department, too. In addition to giving AEP its top grade for relative safety, Value Line rates the company tops among its peers in financial strength.

valueline.com

Also, AEP gets an A- credit rating from Standard & Poor’s, a “narrow” moat grade from Morningstar, and a “very safe” score of 81 from Simply Safe Dividends.

About That Dividend

With the Federal Reserve in a raising-rates cycle, capital-intensive businesses such as utilities have felt a pinch. For example, the price we just paid to add to our AEP stake ($78) is 22% lower than the stock’s high of $100 about a year ago.

The combination of that price fall and the company’s dividend hike has led to AEP trading near its highest yield mark since the Great Recession. Anytime I can get a high-quality utility — or any fundamentally sound company, for that matter — with a 4.5% yield, it makes me take notice.

The AEP position is projected to contribute about $155 to the IBP income stream over the next year, making it the portfolio’s 6th-largest income producer.

Because we made this most recent buy after the Nov. 9 ex-dividend date, only the 38.0149 shares we held before that date will receive the 88 cents/share December payout. That $33.45 will be reinvested right back into AEP stock — the same “dripping” method we use with each of the portfolio’s 51 stock positions.

Valuation Station

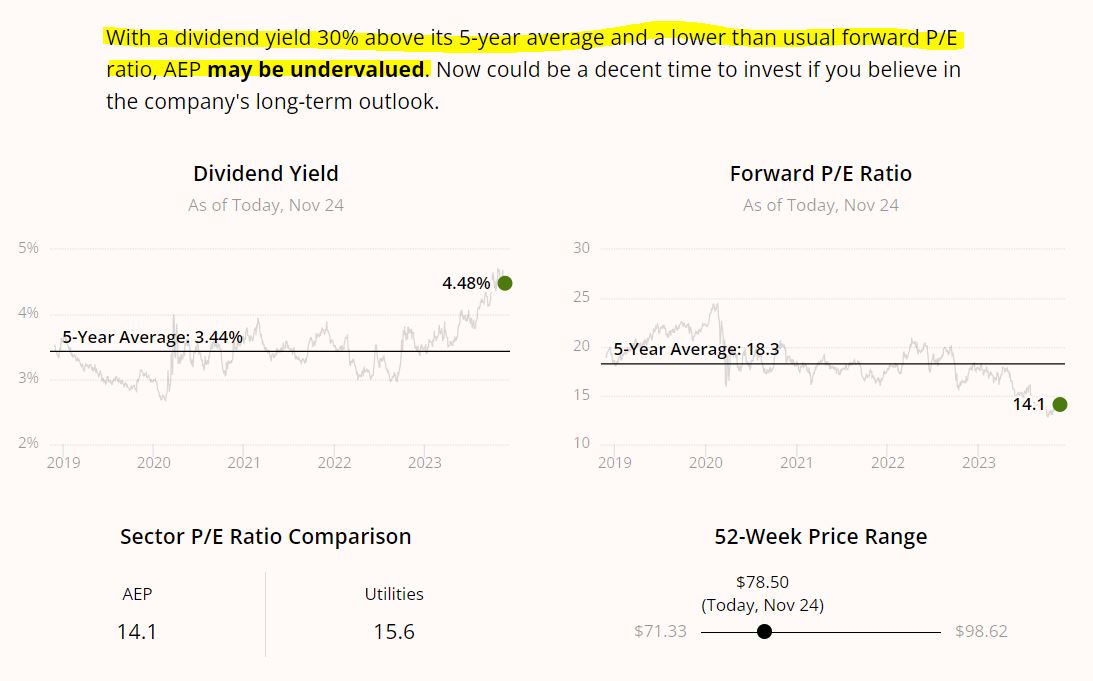

Not only did the Fed-caused price swoons increase yields for most utility stocks, they also sent price/earnings ratios lower. As Simply Safe Dividends notes, that has made investments like AEP more appealing.

SimplySafeDividends.com

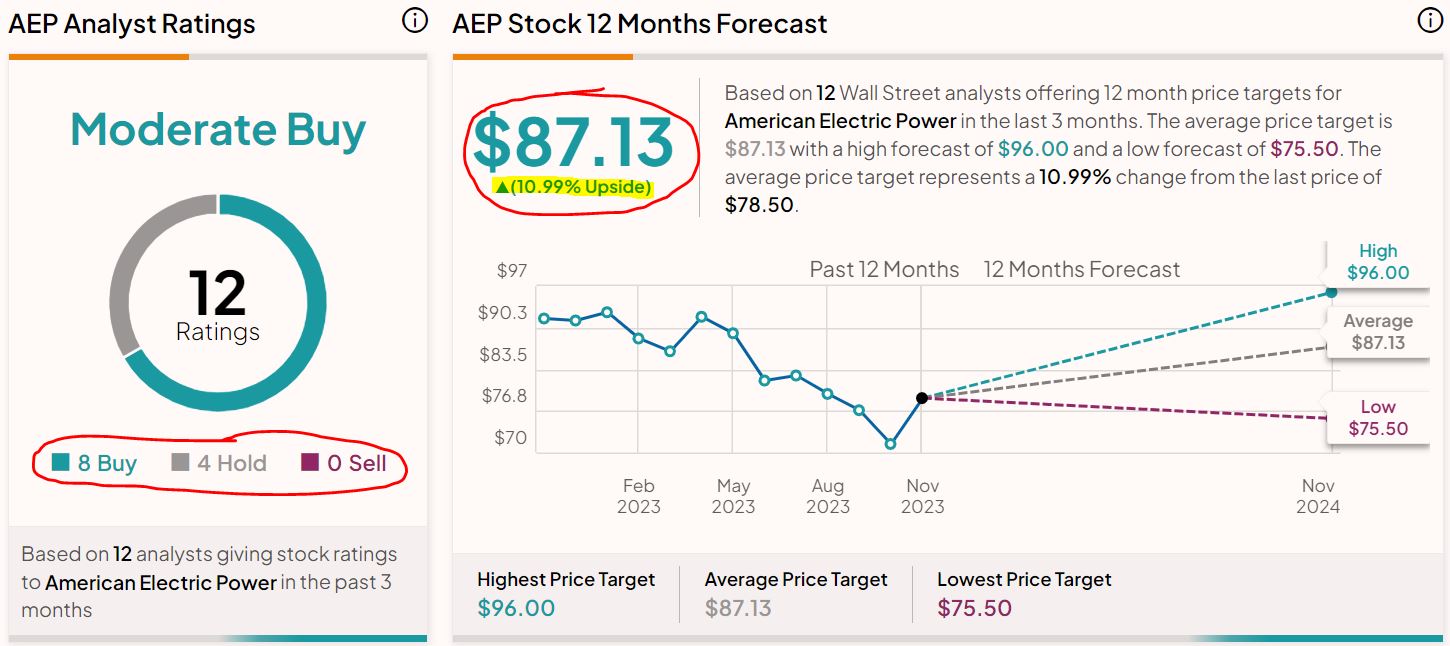

As the following graphic illustrates, analysts generally consider AEP to be a “buy.” The average 12-month price forecast by the dozen analysts monitored by TipRanks suggests an 11% upside.

tipranks.com

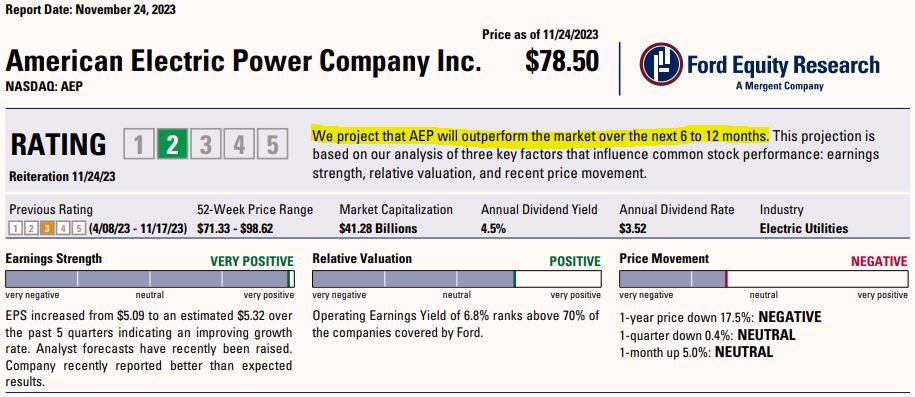

Earlier this month, Ford Equity Research upgraded AEP to “outperform,” thanks in part to positive earnings strength and relative valuation.

Ford Equity Research, via fidelity.com

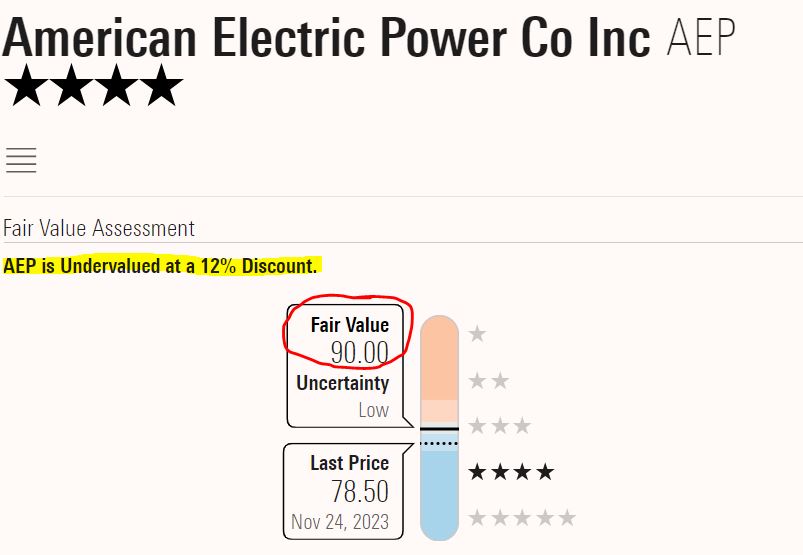

Morningstar recently revised its fair value assessment down from $97 to $90 because it is forecasting only 5.5% annual earnings growth through 2027 — a little lower than management’s 6% to 7% projection.

Nevertheless, even at the lower fair value, Morningstar considers AEP to be 12% undervalued.

morningstar.com

CFRA has $90 as a target, saying: “Our recommendation is Buy, with AEP’s valuation offering enough near-term upside for shares to outperform.”

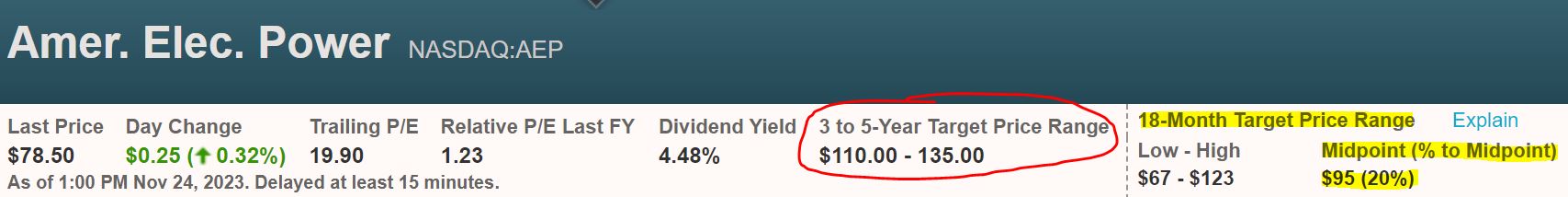

The midpoint of Value Line’s 18-month target price range (yellow highlight below) suggests a 20% upside, while the longer-term target (red-circled area) allows for as much as 70% price appreciation.

valueline.com

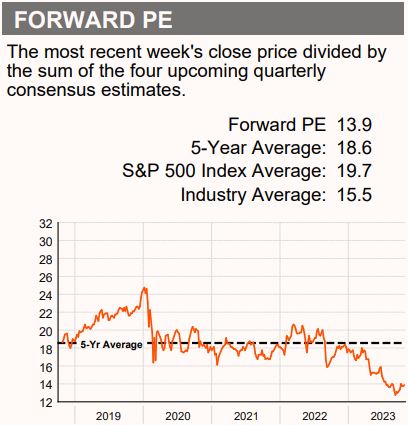

According to Refinitiv’s analytical report, “AEP’s forward P/E of 13.9 represents a 25% discount to its 5-year average of 18.6. If the forward P/E moved to its historical form, the stock would trade at $104.89.”

Refinitiv, via fidelity.com

FAST Graphs shows that only rarely in the last many years has American Electric Power traded below a 15 P/E ratio, as represented by the orange line. AEP’s normal P/E ratio during that stretch was 18.5.

fastgraphs.com

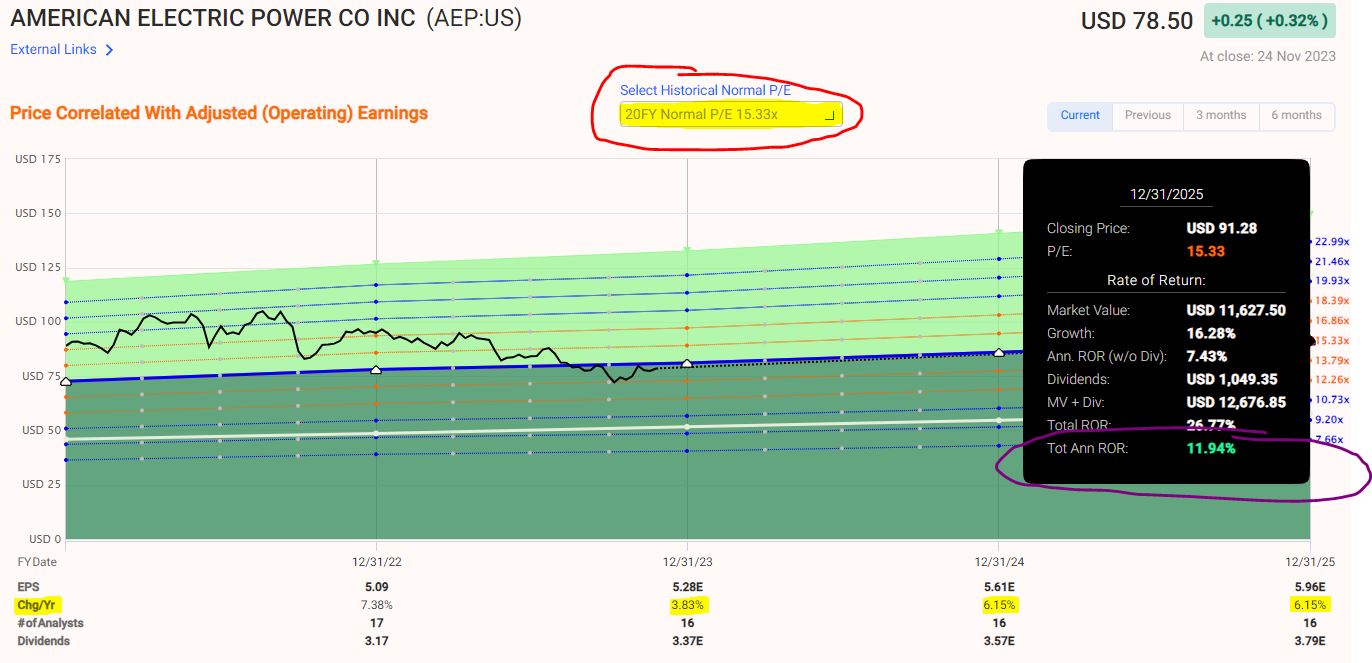

Because it’s important for investors to have a future gaze, I like to look at FAST Graphs’ forecasting calculator.

For the following image, I used AEP’s 20-year historical P/E ratio of 15.33 (red-circled area), which was the lowest available, so as to make a conservative estimate.

If AEP grows earnings at the 6.15% annual rate that analysts are forecasting for 2024 and 2025, and if the P/E ratio is indeed 15.33, then the annual rate of return with dividends reinvested will be 11.94% (green number, circled by purple).

fastgraphs.com

I’d be very happy with a nearly 12% rate of return from a utility, and a whole lot of other stocks in the Income Builder Portfolio.

Wrapping Things Up

American Electric is a financially strong company. And its 4.5% yield and 14-ish forward P/E ratio forms a double play that income investors — not to mention baseball (and poetry) aficionados — might appreciate.

beckett.com

If the Fed has reached the end of this rate-hike cycle and might actually start lowering interest rates in 2024 — as many economists expect — it could serve as a strong tailwind for solid utilities like AEP.

The Income Builder Portfolio home page includes a wealth of information about all of our positions, as well as links to every IBP-related article I’ve written. Check it out HERE.

— Mike Nadel

After researching income stocks for over 30 years, I've come up with a one of a kind dividend portfolio. With the right 20-30 stocks, you can collect a dividend check every single day the market is open. That's over 260 dividend checks per year. Click here for the names of these 20+ stocks.

Source: Dividends & Income