Charlie Munger is one of the greatest investors of all time.

He’s built up a multibillion-dollar fortune for himself through amazing investing acumen.

Munger has also been Warren Buffett’s business partner and sidekick for decades.

One of Munger’s best quips?

“The first rule of compounding: Never interrupt it unnecessarily.”

That’s it.

Whatever you do, you can’t get knocked out of the game.

You have to keep the compounding process going for as long as you possibly can.

Anything multiplied by zero is zero, and it doesn’t matter how well you did before the zero.

This is why I’m such a fan of dividend growth investing.

This strategy is all about buying and holding shares in world-class enterprises that pay reliable, rising dividends to their shareholders.

You can find hundreds of such enterprises by perusing the Dividend Champions, Contenders, and Challengers list, which has compiled invaluable information on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

The dividend growth investing strategy has guard rails built right in.

The dividend growth investing strategy has guard rails built right in.

By diversifying oneself across great businesses, it’s extremely difficult – almost impossible – to interrupt the process of compounding and knock oneself out of the game.

I’ve been using this strategy myself for more than a decade now, using it to guide me as I’ve gone about building the FIRE Fund.

That’s my real-life, real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

This portfolio – and the dividend income it produces – allowed me to retire in my early 30s.

My Early Retirement Blueprint explains how I was able to achieve this.

A major pillar of my success has been investing in the right businesses.

A major pillar of my success has been investing in the right businesses.

But investing when valuations were right has also been key.

Price is only what you pay, but it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Buying high-quality dividend growth stocks when they’re undervalued is a great way to accumulate wealth, build passive income, and help guard against ever getting knocked out of the investing game.

Now, being able to spot undervaluation would first require one to be able to estimate the value of businesses.

But it’s not as difficult as you might think it is.

My colleague Dave Van Knapp put together Lesson 11: Valuation in order to help with that.

Part and parcel of a series of “lessons” designed to teach the dividend growth investing strategy, it provides a valuation template that can be used to estimate the fair value of just about any dividend growth stock you’ll run into.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Microchip Technology Inc. (MCHP)

Microchip Technology Inc. (MCHP)

Microchip Technology Inc. (MCHP) develops and manufactures microcontrollers, analog semiconductors, and other semiconductor products.

Founded in 1989, Microchip Technology is now a $42 billion (by market cap) technology titan that employs more than 22,000 people.

Microchip Technology makes most of its money by selling microcontroller units, or MCUs.

FY 2023 sales can be broken down by product line: Mixed-signal MCUs, 56%; Analog, 28%; and Other, 16%.

This business model is highly appealing for long-term investors for three key reasons.

First, MCUs act as the “brains” for many everyday electronic devices, such as washing machines, game controllers, and garage door openers.

There’s nearly an endless variety of applications and end markets for this company to take advantage of.

Second, which relates to that point, there’s a natural lack of customer concentration here.

Because of the wide net that gets cast from dealing with MCUs, Microchip Technology sells its products to thousands of customers.

The company is not overly dependent on any one customer or end market, which makes it incredibly resilient.

Third, MCUs and analog chips are not reliant on leading-edge chip design, which reduces CapEx needs and obsolescence risks.

And since many of the products that require MCUs and analog chips are everyday electronic devices that have high value and low cost (to the OEM), there’s a bit less cyclicality there relative to a business that might cater to high-end, expensive technology.

This company seemingly offers a lot of the upside that investing in technology offers, all while simultaneously limiting a lot of the downside that usually comes with that.

This has led to remarkable consistency in Microchip Technology’s revenue and profit growth profile, which has also led to a consistently growing dividend.

Dividend Growth, Growth Rate, Payout Ratio and Yield

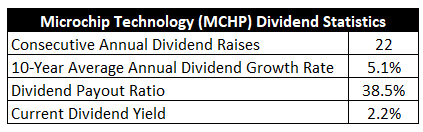

The company has increased its dividend for 22 consecutive years.

That’s a fantastic track record for consistent dividend growth, and it puts the company on track for Dividend Aristocrat status within three years.

The 10-year dividend growth rate is 5.1%, which is somewhat meager.

The 10-year dividend growth rate is 5.1%, which is somewhat meager.

However, there’s been a serious acceleration in dividend growth over the last several years.

The five-year dividend growth rate is 9.9%, and the three-year dividend growth rate is 16.5%.

If you think that’s great, the company has increased its dividend four times in 2023 – and the current dividend is 33.8% higher YOY.

So the dividend raises have been really ramping up.

And you get to pair this dividend growth with the stock’s market-beating 2.2% yield.

This yield, by the way, is 70 basis points higher than its own five-year average.

And the dividend is protected by a payout ratio of 38.5%.

If you prefer growth over yield, Microchip Technology’s dividend package is very alluring.

Revenue and Earnings Growth

As alluring as that package may be, these dividend metrics are mostly looking backward.

However, investors must always look forward, as today’s capital gets risked for the rewards of tomorrow.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be highly useful when the time comes later to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Amalgamating the proven past with a future forecast in this manner should give us the information we need to make an educated decision on what the business’s future growth path could look like.

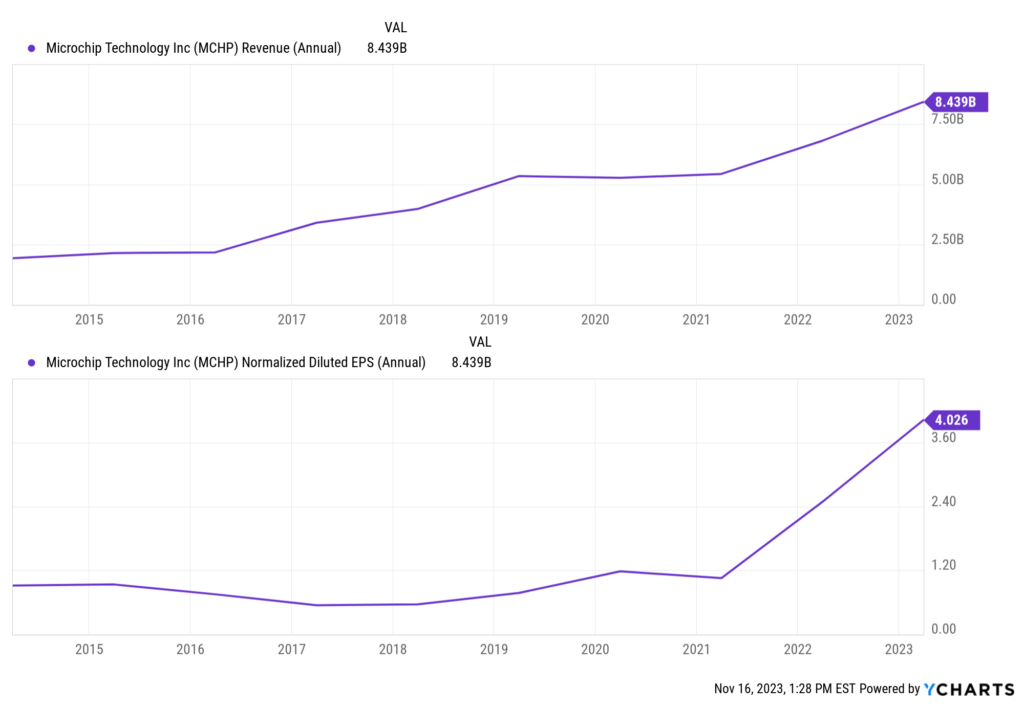

Microchip Technology advanced its revenue from $1.9 billion in FY 2014 to $8.4 billion in FY 2023.

That’s a compound annual growth rate of 18%.

Truly incredible.

It’s rare to see a top-line growth rate like that, especially from a sales base that was decently large to start with.

Meanwhile, earnings per share grew from $0.91 to $4.02 over this period, which is a CAGR of 18%.

Boy, it is so interesting to see these two growth rates line up so well.

Boy, it is so interesting to see these two growth rates line up so well.

I’d like to point out a few things.

First, a lot of this bottom-line growth has been back-loaded.

The last two fiscal years have accounted for much of the growth, as EPS was mostly flat from FY 2014 through FY 2021.

Second, seeing as how the company has issued a lot of shares and diluted shareholders over the last decade, it’s remarkable that EPS growth has kept up so perfectly with revenue growth.

Indeed, the outstanding share count has ballooned by approximately 28%, which is not something I like to see.

However, there’s been a prolific margin expansion at the same time, which I’ll touch on later, and that’s counteracted the dilution.

Looking forward, CFRA believes that Microchip Technology’s EPS will have a CAGR of -3% over the next three years.

There’s a bit of a yin and yang playing out here.

On one hand, CFRA believes that Microchip Technology is in the throes of a cyclical downturn: “Sales are likely to decline 2.4% in FY 24 (Mar.) and fall another 6.4% in FY 25 (+24% in FY 23). Sales in Sep-Q fell 1.5% from Jun-Q (still +8.7% Y/Y) but guidance looks for another 17.5% sequential decline, as customers are pushing out/canceling backlog as they start to normalize inventories amid weaker business conditions.”

CFRA adds that they see: “…near-term China weakness while automotive/industrial softness is likely to persist through 1H of CY 24.”

That’s the yin.

The yang is a long-term growth story: “Long term, we see [Microchip Technology] benefiting from content gains and greater momentum in the automotive, industrial, home appliance, and medical devices markets.”

With all of that out of the way, I don’t take issue with CFRA’s short-term call.

The last two years have been abnormal for Microchip Technology, and some near-term softness in order to normalize inventories and demand would be a reasonable outcome.

Microchip Technology is certainly not the only business that’s going through a normalization process.

But if we’re talking about the long term – and that’s all I’m ever talking about – Microchip Technology is positioned well.

The company’s MCUs are necessary but low-cost components for a large range of devices, and this company’s scale and expertise allows it to entrench itself into OEM’s manufacturing processes, leading to switching costs.

Once the business moves through this air pocket over the next year or two, things could start to pick up nicely once again.

And that bodes well for shareholders who play the long game.

A moderation in dividend growth for 2024 and 2025 seems likely, but I don’t see why Microchip Technology can’t make good on a high-single-digit (or better) dividend growth rate when looking out past the next 24 months.

In the interim, a starting 2%+ yield (well in excess of what it usually is from this stock) means shareholders are paid to wait.

I think investors could do a lot worse than that.

Financial Position

Moving over to the balance sheet, Microchip Technology has a rock-solid financial position.

The long-term debt/equity ratio is 0.8, while the interest coverage ratio is over 18.

I’ll also note that long-term debt has been nearly cut in half after peaking in FY 2019.

While Microchip Technology doesn’t have the best balance sheet I’ve seen among the tech companies that I follow, the company is in a very good financial spot.

The firm’s profitability is robust.

Net margin has averaged 14.6% over the last five years, while return on equity has averaged 17.7%.

Again, not the most spectacular results I’ve seen in all of tech.

Nonetheless, Microchip Technology is very profitable and putting up strong numbers.

And with economies of scale, technological expertise, R&D, IP, and switching costs, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

Being a global enterprise, the company is exposed to global economic trends and currency exchange rates.

Ongoing shareholder dilution is a key issue to remain aware of.

The balance sheet is leveraged and isn’t as strong as it could be.

The very business model is a risk, as technology could change in ways that the company cannot foresee and/or adapt to.

Heightened tensions between the US and China weigh on all tech companies caught in the crossfire.

The company is acquisitive, which introduces questions around execution and integration.

These are valid risks to be concerned about, but one must also keep in mind the quality and growth of the business.

Also worth keeping in mind is the valuation, which looks appealing right now…

Stock Price Valuation

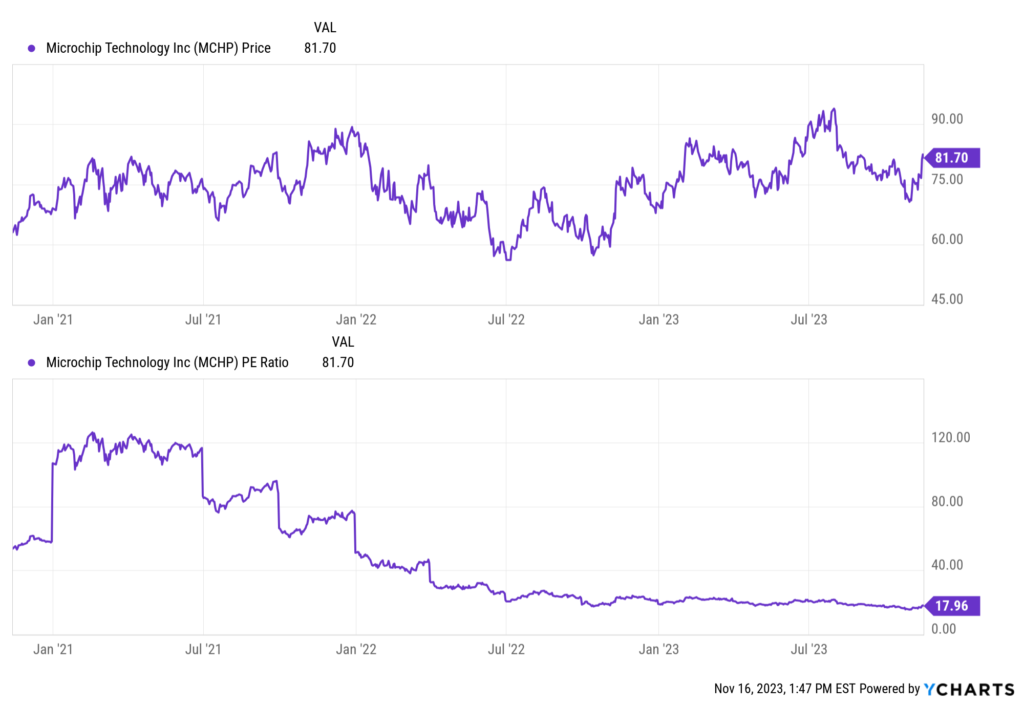

The stock is trading hands for a P/E ratio of 18.1.

That’s a very reasonable earnings multiple, which would put the PEG ratio at almost exactly 1.

We can see a P/S ratio of 5.1, which is below its own five-year average of 5.5.

The P/CF ratio of 12.7 is well off of its own five-year average of 15.5.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 8%.

That DGR is as high as I’ll go, and Microchip Technology seems to deserve the designation.

Top-line and bottom-line growth have both been in the high teens over the last decade.

And dividend growth for several years has been at a similar level.

Against that type of backdrop, an 8% growth rate looks conservative.

However, we have to be aware of a possible near-term slowdown in earnings, which will limit the company’s ability to drive dividend growth.

Overall, averaging things out, I think a high-single-digit dividend growth rate is a reasonable expectation from this business over the long haul, even if the next year or two is modest.

The DDM analysis gives me a fair value of $95.04.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

Even after what I believe was a reasonable valuation model, the stock comes out looking cheap.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates MCHP as a 4-star stock, with a fair value estimate of $90.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates MCHP as a 3-star “HOLD”, with a 12-month target price of $80.00.

I came out pretty close to where Morningstar landed. Averaging the three numbers out gives us a final valuation of $88.35, which would indicate the stock is possibly 7% undervalued.

Bottom line: Microchip Technology Inc. (MCHP) is a great business that captures a lot of the upside of tech without suffering too much of the downside. It’s carved itself out a nice niche that has broad applications. With a market-beating yield, a low payout ratio, recent double-digit dividend growth, more than 20 consecutive years of dividend increases, and the potential that shares are 7% undervalued, long-term dividend growth investors aiming for more tech exposure should definitely look at this business right now.

Bottom line: Microchip Technology Inc. (MCHP) is a great business that captures a lot of the upside of tech without suffering too much of the downside. It’s carved itself out a nice niche that has broad applications. With a market-beating yield, a low payout ratio, recent double-digit dividend growth, more than 20 consecutive years of dividend increases, and the potential that shares are 7% undervalued, long-term dividend growth investors aiming for more tech exposure should definitely look at this business right now.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is MCHP’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 60. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, MCHP’s dividend appears Borderline Safe with a moderate risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income