Every process that leads to a successful outcome in life is easier said than done.

What’s necessary to lose weight is a great example – limit calories, exercise more, etc.

Easy to say, hard to do.

Long-term investing is another example of this.

It’s easy to talk about buying and holding shares in great businesses, but it’s hard to actually do this in practice.

That’s because reality gets in the way.

Economic cycles, media noise, market volatility, and the surprises of life can all conspire against you.

This is why I’m such a fan of dividend growth investing.

This investment strategy can make it easier to turn saying into doing.

That’s because the strategy is all about investing in world-class businesses that pay reliable, rising cash dividends to their shareholders.

When the inevitable bumps in the road pop up, growing cash dividend payouts that are steadily coming in can smooth things out, keep one invested, and prevent poor financial choices.

Whereas market volatility is like a bucking bull trying to throw you off, a growing stream of cash is a calm in the storm.

Take a look at the Dividend Champions, Contenders, and Challengers list.

This list contains invaluable information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

Through thick and thin, these businesses are paying out ever-larger dividends to shareholders, and that kind of behavior is only sustainable when revenues and profits are also rising.

I’ve been using this strategy for myself for more than 10 years now.

I’ve been using this strategy for myself for more than 10 years now.

It’s helped me to build the FIRE Fund.

That’s my real-life, real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

Indeed, I’m able to currently offset all of my bills with dividend income, and this situation allowed me to retire in my early 30s.

And that’s even though I grew up poor, don’t have a college degree, and didn’t make a six-figure income.

How did this happen?

My Early Retirement Blueprint explains.

Now, as helpful as the dividend growth investing strategy can be, it’s more than just selecting the right businesses.

It’s also about investing at the right valuations.

It’s also about investing at the right valuations.

See, price only tells you what you pay, but value tells you what you get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Building serious wealth and passive income might be easier said than done, but buying undervalued high-quality dividend growth stocks can help to convert saying into doing.

Of course, recognizing undervaluation means that one already has an understanding of valuation.

Fear not.

Fellow contributor Dave Van Knapp’s Lesson 11: Valuation, which is part of an overarching series of “lessons” that are designed to teach dividend growth investing, is a great (and free!) primer to valuation and can guide one to go about valuing just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Cummins Inc. (CMI)

Cummins Inc. (CMI)

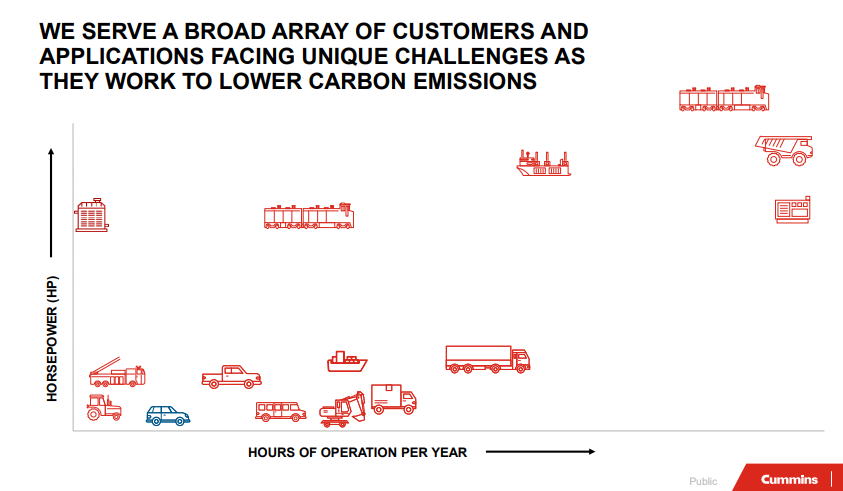

Cummins Inc. (CMI) is a multinational company that designs, manufactures, and distributes engines, filtration, and power generation products.

Founded in 1919, Cummins is now a $32 billion (by market cap) mobility monster that employs more than 73,000 people.

The company reports results across five business segments: Distribution, 32% of FY 2022 sales; Engine, 29%; Components, 28%; Power Systems, 11%; New Power, less than 1%.

Cummins makes money by manufacturing, distributing, and supplying a range of diesel and natural gas engines and related components.

Many types of vehicles use these engines.

Think heavy-duty trucks, medium-duty trucks, buses, recreational vehicles, construction machinery, agricultural machinery, and watercraft.

That’s a good start.

That’s a good start.

And if that’s all there were, this would be a pretty interesting investment case.

But there’s more to it than that.

Cummins is positioning itself for the future of mobility by investing in fully electric and hybrid powertrain systems, as well as hydrogen fuel cell technology.

The uninitiated might assume that Cummins is just an engine company, and I wouldn’t blame anyone for making this assumption.

However, this simplistic view is missing the big picture.

Cummins is providing a full suite of products to cater to present and future mobility and power generation.

The distinction is important.

Everyday goods are often produced and moved around using the power generation products that Cummins manufactures and distributes.

It’s true today.

And Cummins is doing its best to make sure that it remains true for the many tomorrows yet to come.

Cummins has been a vital element of the industrial backbone of the American economy.

This is why Cummins has been wildly successful for more than a century.

And with prescient preparations for the next era in mobility and power generation, Cummins may see even more success over the next century.

That bodes incredibly well for the company’s ability to drive its revenue, profit, and dividend higher over the coming years.

Dividend Growth, Growth Rate, Payout Ratio and Yield

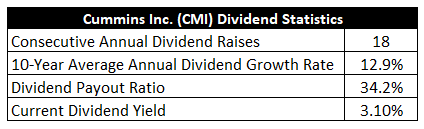

To date, Cummins has increased its dividend for 18 consecutive years.

The 10-year dividend growth rate is 12.9%, which is very strong.

However, more recent dividend raises have been in the 8% area.

However, more recent dividend raises have been in the 8% area.

Still, I think that’s more than enough growth to go along with the stock’s yield of 3.1%.

This yield, by the way, is 40 basis points higher than its own five-year average.

This larger-than-average dividend is protected by a low payout ratio of 34.2%.

Boy, there’s a lot to like here – yield, growth, and safety are all there.

Revenue and Earnings Growth

As much as there is to like, though, many of these metrics are looking into the past.

However, investors must always be looking forward, as today’s capital is being risked for the rewards of the future.

This is why I’ll now build out a forward-looking growth trajectory for the business, which will be instructional when the time comes later to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past with a future forecast in this way should allow us to develop an idea of what the business’s future growth path may look like.

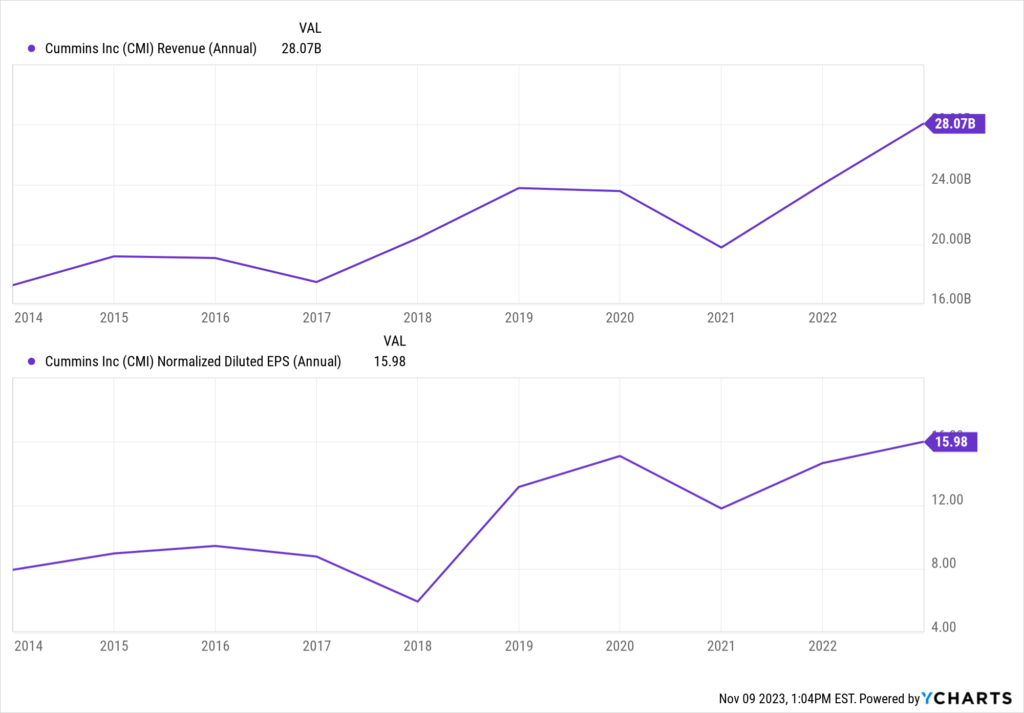

Cummins increased its revenue from $17.3 billion in FY 2013 to $28.1 billion in FY 2022.

That’s a compound annual growth rate of 5.5%.

I’m usually looking for a mid-single-digit top-line growth rate from a fairly mature business like Cummins, and it’s right there.

Meanwhile, earnings per share grew from $7.91 to $15.12 over this period, which is a CAGR of7.5%.

That’s really good.

That’s really good.

Not amazing, but I think this is a very satisfactory level of bottom-line growth from this kind of business.

It also explains why we’ve been seeing the dividend grow at somewhere around 8% annually over the last several years.

The two growth rates match up.

Excess bottom-line growth was mostly fueled by consistent buybacks.

For perspective on that, the outstanding share count has been reduced by approximately 24% over the last 10 years.

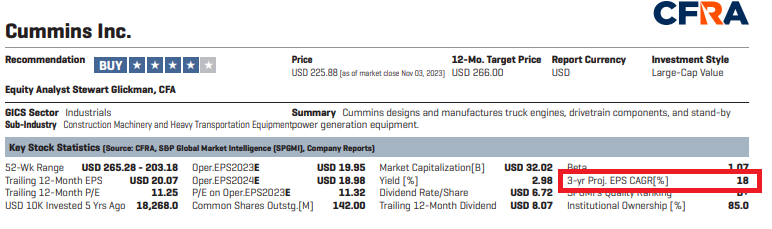

Looking forward, CFRA is projecting that Cummins will compound its EPS at an annual rate of 18% over the next three years.

In my view, that’s an aggressive number.

In my view, that’s an aggressive number.

It’s more than twice as high as what Cummins has historically produced over a longer period of time, although a very short period of time could certainly go many different ways.

I think it’s worth highlighting this passage from CFRA, which would back up a sanguine view on the near-term prospects for Cummins: “[Cummins] should benefit from a strong truck replacement cycle after several years of overworked trucks due to the pandemic boom. We also think that relatively high fuel costs should spur demand for newer trucks, which tend to be more fuel-efficient than the units being replaced.”

A bit of a coiled-spring effect that’s been created here in terms of existing truck inventory, which bodes well for Cummins.

So there’s a demand boost on one hand.

Also, there could be a boost from lack of supply, as CFRA points out that “lingering supply chain issues (for the industry as a whole) will prevent the industry from boosting production sufficiently to meet end-market demand, and therefore should help on pricing.”

This means supply troubles are showing up just as demand could be picking up.

That’s an effective one-two punch for Cummins and its ability to control pricing.

In addition, and simultaneous to all of this, there’s also the background tailwind of a secular move toward cleaner emissions.

On this point, CFRA states: “We think increasing anti-carbon regulation could be a driver for [Cummins]’s nascent New Power segment. In March, [Cummins] launched Accelera by Cummins, a new brand in this segment, which brings more zero-emission vehicles to the market.”

Cummins has long been a go-to diesel engine brand, but it’s slowly turning into a go-to all-encompassing brand for mobility and power generation.

If you want great propulsion today, you go to Cummins.

If you want great propulsion tomorrow, you may very well be going to Cummins.

With all of this in the mix, I can see a case for being enthusiastic about what’s possible for Cummins over the next few years.

Still, I’d be leery about being too far out on a limb compared to what the business has demonstrated over a longer period of time.

I think it’s quite possible – even likely – that Cummins will grow faster than usual over the next few years, but I’d be cautious around pinning my hopes on a high-teens growth rate.

That said, Cummins doesn’t really need to grow that fast in order to be an appealing long-term investment right now.

Even something closer to a low-double-digit growth rate, which would be more in line with norms, would offer the company the ability to grow the dividend at a high-single-digit (or better) rate over the next few years.

Nothing wrong with that at all.

If you can get a 3%+ starting yield and a high-single-digit dividend growth rate, you’re setting yourself up for a double-digit annualized total return, assuming a static valuation.

If you can get a 3%+ starting yield and a high-single-digit dividend growth rate, you’re setting yourself up for a double-digit annualized total return, assuming a static valuation.

And compounding money at a low-double-digit rate adds up in a hurry.

Financial Position

Moving over to the balance sheet, Cummins has a rock-solid financial position.

The long-term debt/equity ratio is 0.5, while the interest coverage ratio is just over 15.

Cummins is running a capital-intensive business model, and I think these numbers are very good when viewed within that context.

Profitability is robust.

Net margin has averaged 8.9% over the last five years, while return on equity has averaged 27.1%.

Cummins is putting up some pretty high returns on capital, which is encouraging.

This is a great business, and there are reasons to believe that it’ll be even greater in 10 years.

And the company does benefit from durable competitive advantages that includes economies of scale, switching costs, barriers to entry, IP, R&D, technological know-how, and brand power.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

Cummins has a unique competitive landscape, as the company is often competing against some of its most important customers (such as truck manufacturers).

Cummins has a high degree of exposure to economic cycles.

Customer concentration is a key risk, with the top four customers accounting for approximately 30% of annual sales.

Since propulsion technology could change faster than Cummins can adapt to, or in a way that’s unforeseen, there’s technological risk present.

Any broad changes across trucking and/or commercial transportation, in general, would impact Cummins.

These risks should be carefully thought over, but so should the quality and growth of the business.

Also, after the stock’s near-20% decline in price from its 52-week high, the valuation should be carefully thought over…

Stock Price Valuation

The P/E ratio for the stock is sitting at 11.1.

This is undemanding and well below the broader market’s earnings multiple.

It’s also well off of the stock’s own five-year average P/E ratio of 15.1.

The sales multiple of 0.9 is also quite a bit lower than its own five-year average of 1.3.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 7.5%.

This is well below the demonstrated dividend growth rate from the business over the last decade.

The payout ratio is low, and the near-term forecast for EPS growth is in the high-teens.

So it does look like I’m being overly cautious against that backdrop.

However, the last few dividend raises from Cummins have been in this 7.5% area.

Moreover, this is a cyclic business model with a lot of questions around execution on future mobility plans.

And I wouldn’t forget about the customer concentration risk.

In the end, I’d rather err on the side of caution and leave room to be pleasantly surprised.

The DDM analysis gives me a fair value of $288.96.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

Even with a conservative valuation model, the stock still comes out looking very cheap.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates CMI as a 4-star stock, with a fair value estimate of $255.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates CMI as a 4-star “BUY”, with a 12-month target price of $266.00.

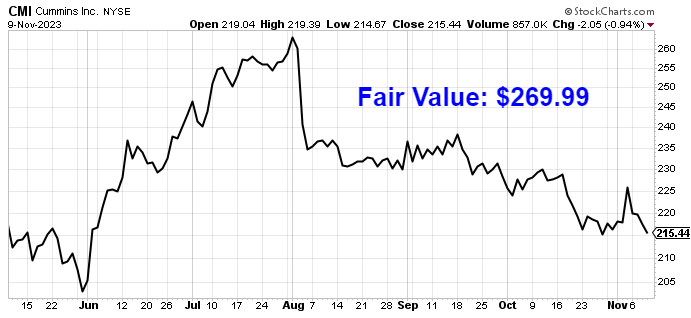

I came out a bit high this time around. Averaging the three numbers out gives us a final valuation of $269.99, which would indicate the stock is possibly 19% undervalued.

Bottom line: Cummins Inc. (CMI) is a high-quality company that is performing incredibly well as it balances current mobility offerings against future mobility solutions. Fundamentally speaking, there’s really nothing to strongly dislike. And with a market-beating yield, a low payout ratio, double-digit long-term dividend growth, nearly 20 consecutive years of dividend increases, and the potential that shares are 19% undervalued, long-term dividend growth investors looking for a solid, well-rounded business to invest in ought to be aware of this name right now.

Bottom line: Cummins Inc. (CMI) is a high-quality company that is performing incredibly well as it balances current mobility offerings against future mobility solutions. Fundamentally speaking, there’s really nothing to strongly dislike. And with a market-beating yield, a low payout ratio, double-digit long-term dividend growth, nearly 20 consecutive years of dividend increases, and the potential that shares are 19% undervalued, long-term dividend growth investors looking for a solid, well-rounded business to invest in ought to be aware of this name right now.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is CMI’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 98. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, CMI’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income