Along with the Fed deciding to hold the target funds rate at 5.25%-5.5% on Wednesday, several stocks stood out after these companies impressively surpassed their quarterly earnings expectations.

Here are a few of these top-rated stocks that look poised to rise as broader markets gained steam in today’s trading session.

E.l.f. Beauty (ELF): Daunting a Zacks Rank #1 (Strong Buy), cosmetic leader E.l.f. Beauty posted another quarter of stellar results leading to the company raising its full-year guidance again.

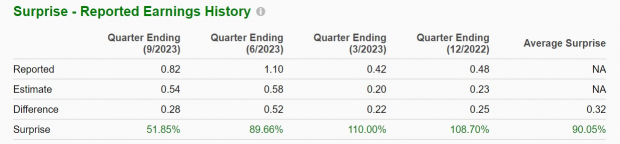

E.l.f. has beaten earnings expectations for 11 consecutive quarters with its fiscal second quarter EPS of $0.82 per share coming in 52% above the Zacks Consensus of $0.54 a share. Sales of $215.51 million topped Q2 estimates by 9%.

Earnings soared 128% from EPS of $0.36 per share in the prior year quarter with sales climbing 76% from $122.35 million a year ago. With its most recent quarter driven by higher digital and international sales, E.l.f. has posted an outstanding average earnings surprise of 90% in its last four quarterly reports contributing to ELF shares skyrocketing +76% year to date.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Sunoco (SUN): Sporting a Zacks Rank #2 (Buy), Master Limited Partnership (MLP) Sunoco crushed its third-quarter earnings expectations on Wednesday and comfortably surpassed sales estimates while increasing its full-year 2023 EBITDA guidance.

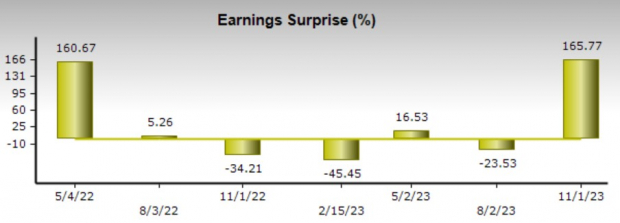

Earnings of $2.95 per share blasted Q3 estimates of $1.11 a share by 166% with sales of $6.32 billion coming in 10% above expectations. Year over year, earnings skyrocketed 293% despite sales dipping -4% from Q3 2022.

COO Karl Fails stated the strong quarter was supported by continued strength in margins, volume growth, expense discipline, efficient operations, and assertive acquisitions. Sunoco’s stock is up +22% YTD with it being notable that SUN offers a very generous 6.58% annual dividend yield as well.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Sunrun (RUN): Also landing a Zacks Rank #2 (Buy), solar energy provider Sunrun optimistically exceeded its Q3 top and bottom line expectations.

Sunrun posted a surprise earnings profit of $0.40 per share compared to estimates that called for an adjusted loss of -$0.05 a share. Down from $0.96 per share in the prior year quarter the earnings beat was still well received as the broader solar industry has dealt with slowing demand amid a tougher macroeconomic environment.

Furthermore, Q3 sales of $563.18 million slightly topped expectations of $559.72 million despite falling from $631.91 million a year ago. The much better-than-expected quarter is starting to make the case that Sunrun’s stock may be vastly oversold popping +10% in today’s trading session but down -55% for the year which is near the Zacks Solar Markets’ performance.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

After very impressive quarterly results the trend of earnings estimate revisions should be favorable for E.l.f. Beauty, Sunoco, and Sunrun. Their stocks could continue to drift higher in the coming weeks after massive earnings beats and a strengthening outlook.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks