Amid the tragic events happening in the middle east, a number of stocks continue to hold up well, even with tensions continuing to rise. And while many traders are hedging their portfolios or lowering their exposure to equities, it may be a short-sighted strategy.

Surprisingly, markets often move past geopolitical escalations quicker than most expect, as their influence on financial markets is priced in rather quickly, and many participants overestimate the effects. Take for instance the Russia-Ukraine conflict which continues today. Markets experienced volatility right up until the actual start of the war, but the beginning of the conflict marked the end of pricing in the effects, and markets have been strong since.

In addition to these events likely being priced into the market already, the final quarter of the year is often the strongest in terms of stock market performance. I think investors should use this uncertain period to begin buying stock in some of the leading names in the market.

Here I will share three stocks with strong upward momentum and top Zacks Ranks to consider investing in.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Vertiv

Vertiv (VRT) is a global company specializing in designing, building, and servicing critical infrastructure that enables vital applications for data centers, communication networks, and commercial and industrial facilities. With its solutions ranging from thermal management and power backup to IT infrastructure, Vertiv aims to optimize customers’ data center and IT operations. The company’s expertise lies in ensuring the continuous operations of these facilities.

Following the explosion in Artificial Intelligence this year, Vertiv started to see its earnings estimates climb higher, giving it a Zacks Rank #2 (Buy) rating. Because the tremendous computing power necessary for Generative AI as well as data center requirements, Vertiv has found itself in a perfect position to service the burgeoning industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

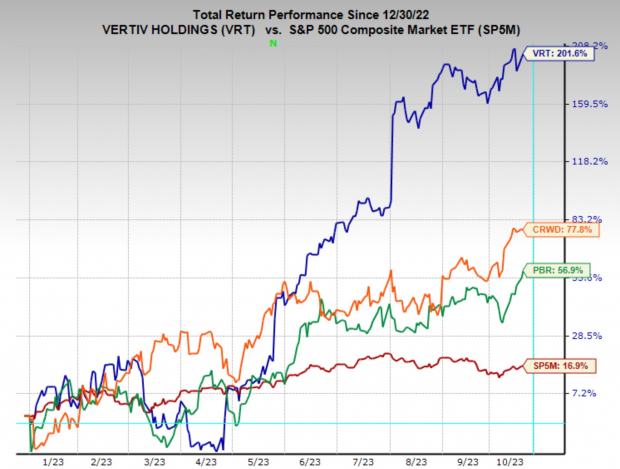

The technical setup in Vertiv is extremely compelling. In the chart you can see that VRT has been consolidating and breaking out all year and has led to 200% returns this year. Vertiv price action has been carving out another bull flag from which it looks ready to break out.

If the stock can break out above the $41 level, it should rally again. Alternatively, if it trades below the level of support at $39.40, investors may want to wait for another opportunity.

Image Source: TradingView

Image Source: TradingView

Petroleo Brasileiro

Petroleo Brasileiro, commonly known as Petrobras (PBR), is a state-controlled Brazilian multinational corporation in the petroleum industry. Founded in 1953, Petrobras specializes in the exploration, production, refining, and distribution of oil and natural gas, both in Brazil and internationally. As one of the largest oil companies in the world, Petrobras plays a significant role in Brazil’s economy and energy sector.

Because of the escalation in the Middle East, it is no surprise that the price of oil and oil stocks have been big. Petroleo Brasileiro, one of the leading oil companies worldwide, has been drawing in investors. On Wednesday, PBR made new three-year highs.

Image Source: TradingView

Image Source: TradingView

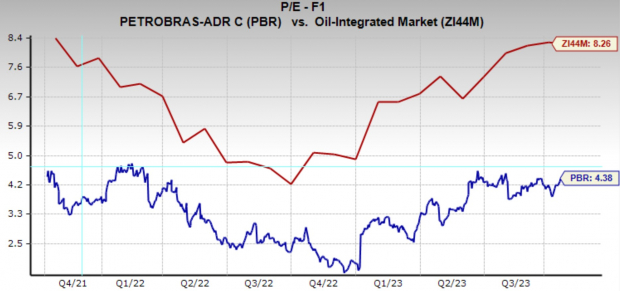

In addition to a Zacks Rank #1 (Strong Buy) rating, Petroleo Brasileiro also enjoys a very reasonable valuation, which has made it very popular with conservative investors. Today, it is trading at a one year forward earnings multiple of 4.4x, which is below the industry average, and below its 10-year median of 8.8x. It is also worth noting that PBR also pays a dividend yield of 2%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

CrowdStrike

CrowdStrike (CRWD) is an American cybersecurity company founded in 2011. Specializing in endpoint security, threat intelligence, and incident response, CrowdStrike offers a cloud-native platform called the Falcon platform to help businesses protect their systems against cyberattacks.

The company gained significant attention for its role in investigating high-profile cyber breaches, including the 2016 hack of the Democratic National Committee. CrowdStrike’s approach prioritizes proactive threat hunting and uses artificial intelligence to analyze vast amounts of data for real-time threat detection and protection.

There is no denying that the digital world creeps deeper and deeper into our everyday lives as time goes on, and understandably, people and businesses want better cyber security options. CrowdStrike is one of the leading cloud based cyber security companies in the world and analysts are recognizing its incredible platform.

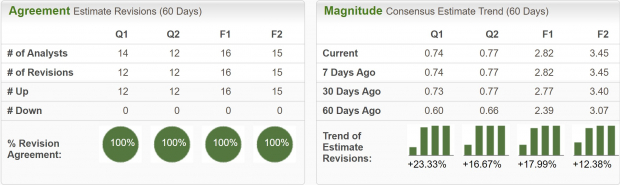

Over the last two months, CRWD has seen its earnings estimates move significantly higher. Analysts have unanimously upgraded expectations, with the current quarter earnings estimates getting boosted by 23.3% and FY23 estimates by 18%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

CrowdStrike is a company that is growing at an incredible pace, with sales expected to grow at 30% annually this and next year. Because of this expansion, CRWD stock also likes to move higher in rapid momentum powered spurts.

After staging a powerful breakout earlier this month, CrowdStrike stock is forming another tight bull flag extension setup. If the price can move above the $188.70 level, it would signal a breakout. But, if the price loses the $184.70 level of support, it may be worth waiting for another trading opportunity.

Image Source: TradingView

Image Source: TradingView

— Ethan Feller

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks