Amazon (AMZN) is one of the most widely-recognized e-commerce giants, with the company also enjoying a dominant space in cloud computing thanks to AWS (Amazon Web Services).

It’s one of several stocks that have helped lead the market’s surge in 2023, being classified as one of the ‘Magnificent Seven.’

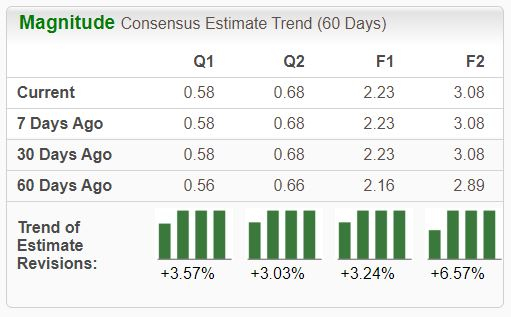

Analysts have taken their earnings expectations higher across the board, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company resides within the Zacks Internet – Commerce industry, which is currently ranked in the top 26% of all Zacks industries. Roughly half of a stock’s movement can be attributed to its group, helping to clarify the importance of targeting industries with favorable current standings.

Aside from the favorable earnings outlook, let’s take a closer look at a few other characteristics of Amazon.

Current Standing

As mentioned previously, Amazon shares have been big-time performers in 2023, up more than 50% and widely outperforming the S&P 500’s impressive 14% YTD gain on the back of an improved operating environment and a strong consumer.

The company’s success in 2023 has been reflected by its quarterly performance, with Amazon exceeding Zacks Consensus EPS and revenue estimates in three consecutive quarters. In its latest print, the market titan delivered an 85% EPS beat and posted revenue 2% ahead of expectations.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The heavyweight is scheduled to reveal its next set of quarterly results near late October. Currently, the Zacks Consensus EPS Estimate of $0.58 suggests a 190% improvement from the year-ago quarter, with our $141.9 billion quarterly revenue estimate implying growth of 11.6% year-over-year.

The revisions trend has been notably bullish for the quarter-to-be-reported, with the $0.58 per share consensus estimate up nearly 50% since July.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In addition, it was recently revealed that Amazon will invest up to $4 billion in Anthropic, an AI safety and research company based in San Francisco and a rival of OpenAI. We’re all aware that AI is Wall Street’s shiny new toy in 2023, constantly dominating headlines.

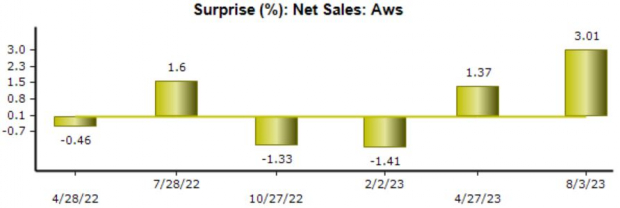

The deal reflects a partnership to develop reliable and high-performing foundation models, with AWS now becoming Anthropic’s primary cloud provider for critical workloads. Regarding AWS expectations for the upcoming print, the Zacks Consensus Estimate for AWS Net Sales stands at $23.2 billion, 13% higher than the year-ago figure.

As shown below, the company has recently exceeded consensus expectations for AWS Net Sales in back-to-back releases.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Amazon (AMZN) would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

— Derek Lewis

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks