Realty Income (O) has underperformed several notable retail REITs in recent months in part from concerns over the firm’s continued foray into the gambling industry with a roughly $1 billion investment in the Bellagio, one of Las Vegas’ crown jewels, to assume a 22% stake in the casino.

Source: Realty Income Investor Presentation, August 2023

Source: Realty Income Investor Presentation, August 2023

The REIT first dipped its toes in the gambling universe last year when it sealed a $1.7 billion lease buyback with Wynn Resorts for the Encore Boston Harbor casino and luxury hotel.

Given Realty Income’s historically conservative portfolio that has resulted in annual payout growth since its public debut in 1994, these investments mark a stark departure from the REIT’s traditionally less flashy tenant base.

Source: Realty Income Investor Presentation, August 2023

Casinos tend to ride high when times are good, but are among the first casualties during economic downturns, raising some concern amongst investors with calls for an impending recession around every corner.

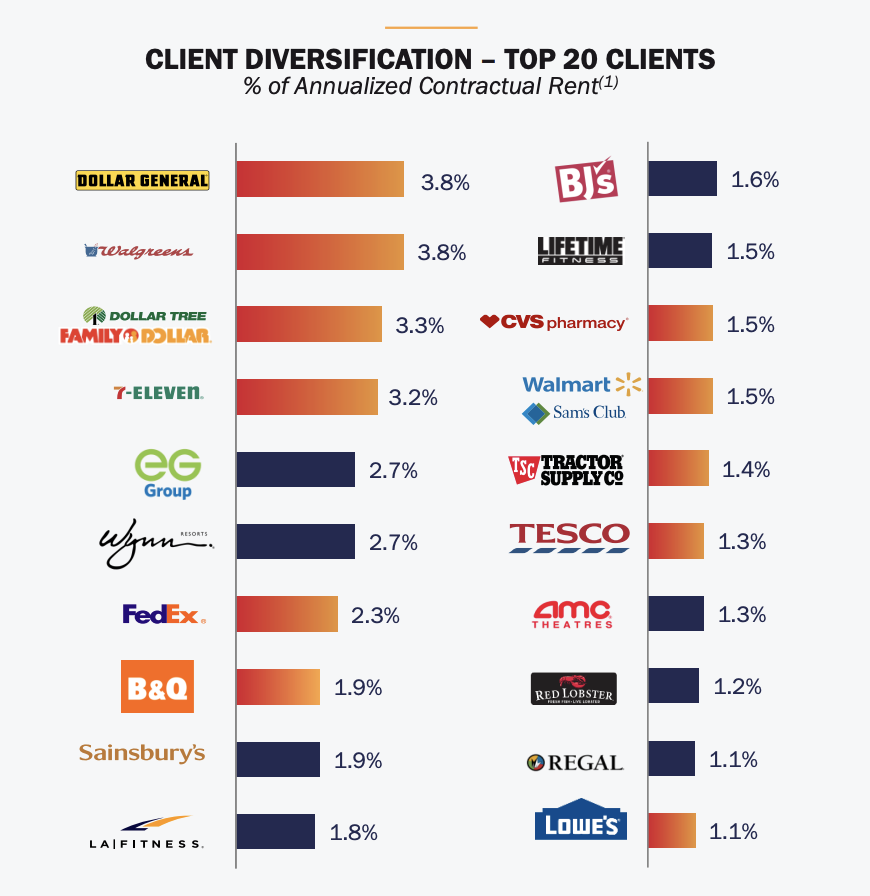

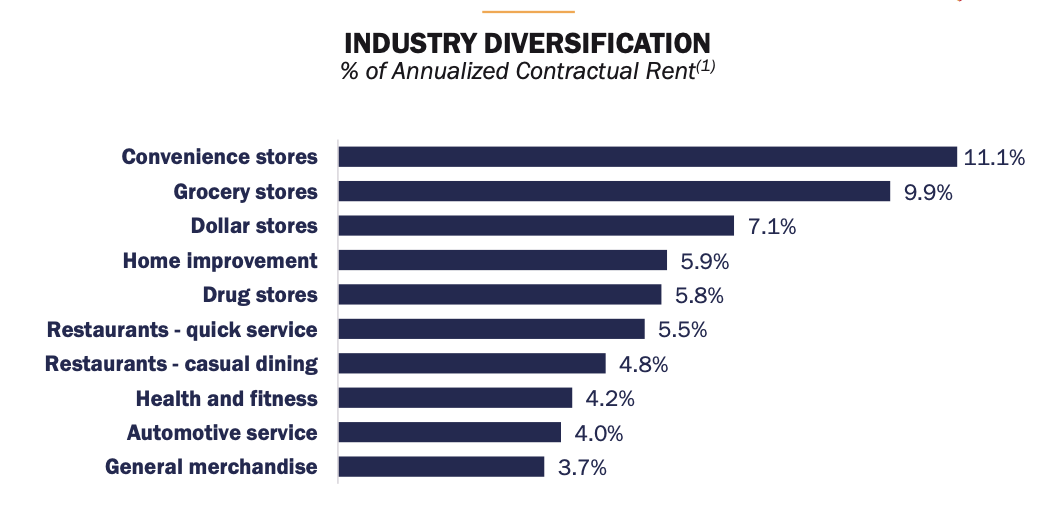

Even so, Realty Income remains well diversified by industry with heavy exposure to markets that tend to hold steady in economic slumps. And gaming will likely make up no more than 5% of rent after the Bellagio deal closes.

Source: Realty Income Investor Presentation, August 2023

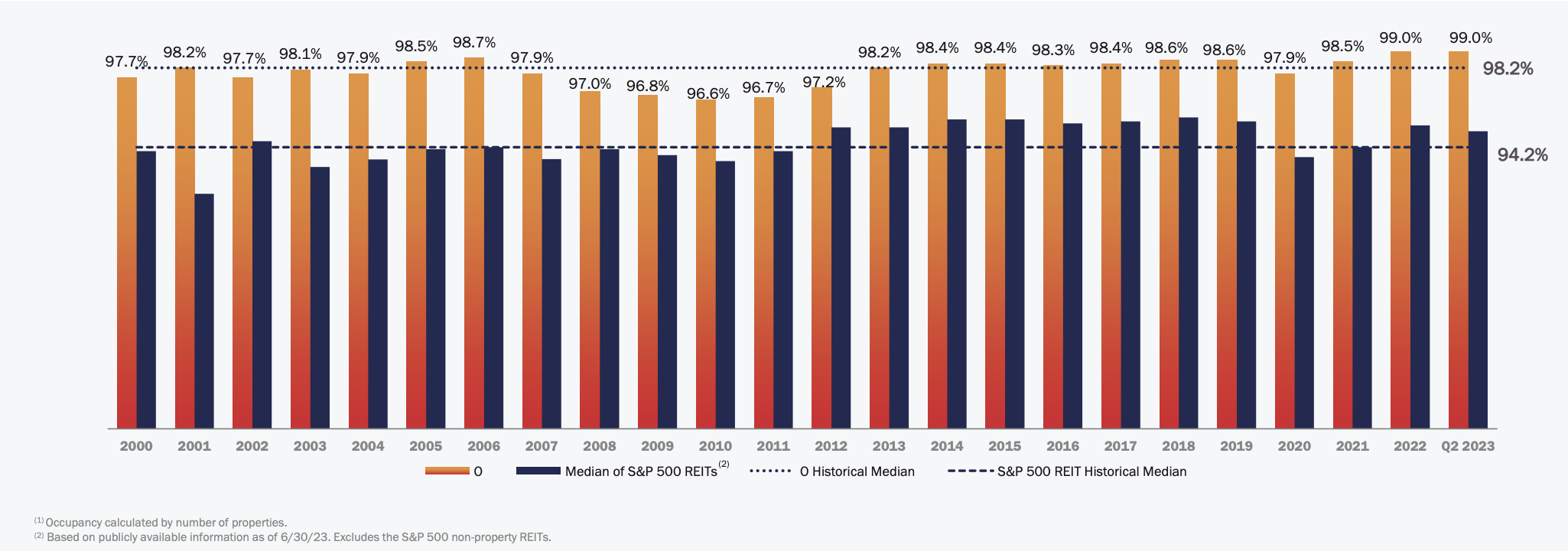

Plus, the firm’s strategy to invest in clients with “a non-discretionary, low price point, and / or service-oriented component to their business” has proven a buffer during past recessions when the REIT’s occupancy never dipped below 96%, as shown below.

Source: Realty Income Investor Presentation, August 2023

Source: Realty Income Investor Presentation, August 2023

Because most of the A- rated property owners’ tenants have recession-resistant qualities and are better suited to combat the rise of internet retailers, worries over Realty Income’s casino investments may be overblown.

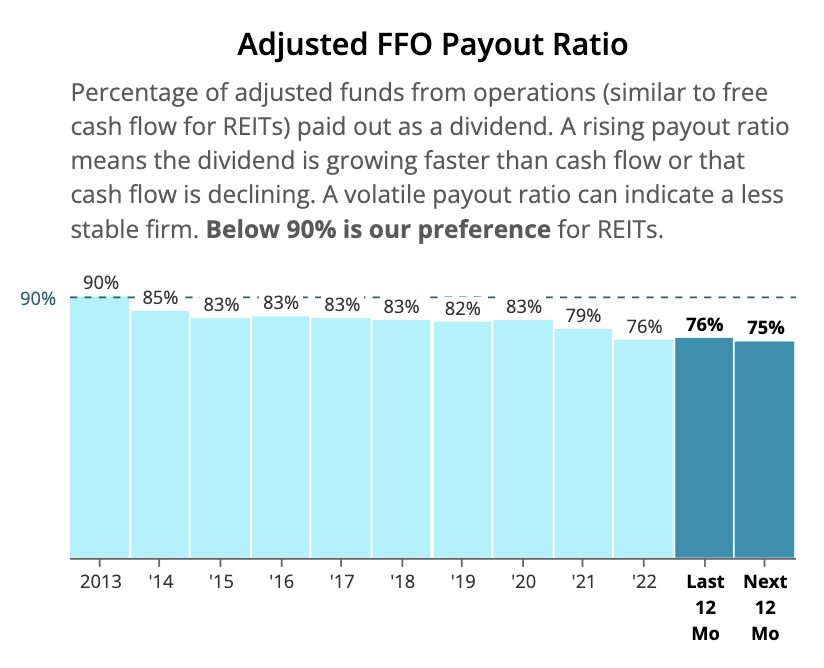

Realty Income’s diversified and stable strategy has helped the REIT generate steady cash flow growth, leading to a decade-low payout ratio that suggests the firm’s stellar dividend track record will continue.

Source: Simply Safe Dividends

Considering the firm’s sustained high occupancy, diversified portfolio, and history of financial conservatism, including a consistently healthy payout ratio, we are reaffirming Realty Income’s Safe Dividend Safety Score.

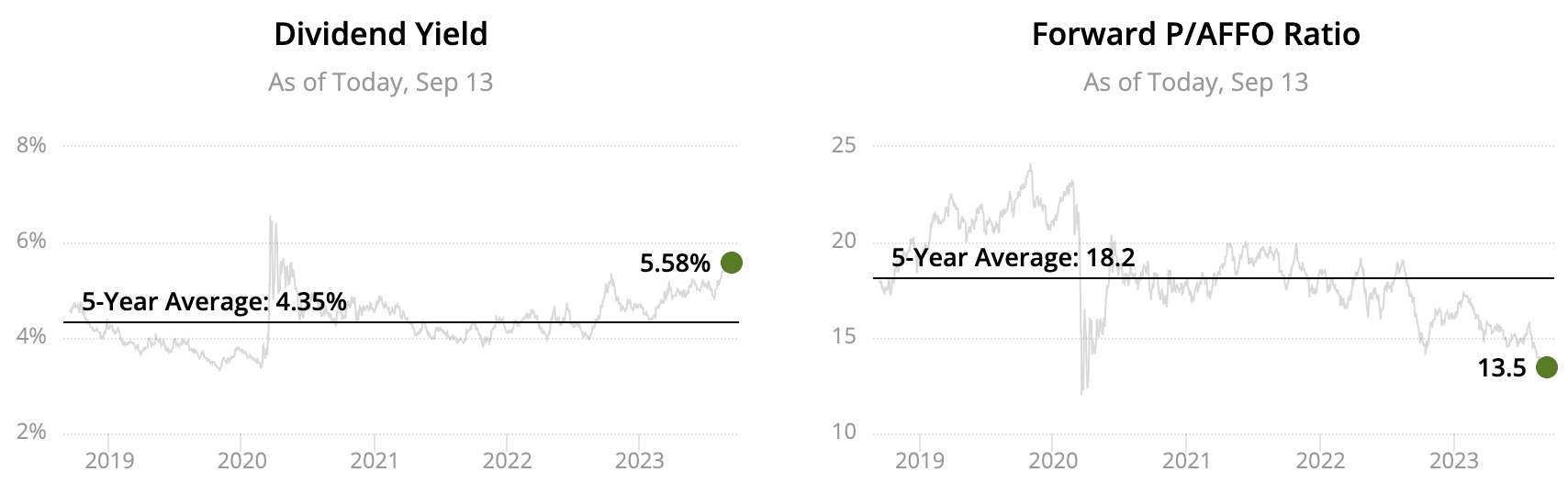

That said, it’s also worth noting REITs, in general, have become less attractive investments to some income investors as bond yields have climbed higher.

Considered a bond-like stock due to its high yield and slow growth, Realty Income’s dividend yield competes with risk-free yields for investors’ dollars.

The jump in interest rates over the last 18 months has put downward pressure on O’s stock price (bond prices fall as rates rise), pushing its dividend yield up to more competitive levels.

Realty Income’s valuation looks attractive compared to its trading range over the last five years, which were largely characterized by rock-bottom rates. If interest rates have peaked and begin to decline soon, Realty Income could represent a timely income idea to consider.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

That said, your guess is as good as ours regarding the future direction of long-term interest rates. It’s hard to believe bond yields will shoot significantly higher from here given America’s heavy debt load and moderating inflation trends. But if they do, Realty Income’s stock could re-rate even lower.

For example, in early 2000 when the 10-year Treasury yield exceeded 6.5% (versus 4.3% today), Realty Income’s dividend yield topped 10% (versus 5.6% today). This sensitivity is worth keeping in mind as you consider the stock and real estate sector in general.

Besides impacting REIT valuations, higher interest rates increase debt costs and can squeeze the profitability of new real estate investments, slowing growth.

Fortunately, Realty Income’s debt (92% fixed rate) has a favorable maturity schedule with no major repayment or refinancing needs until 2026, providing time for the REIT to adjust to (or wait out) the environment of higher interest rates.

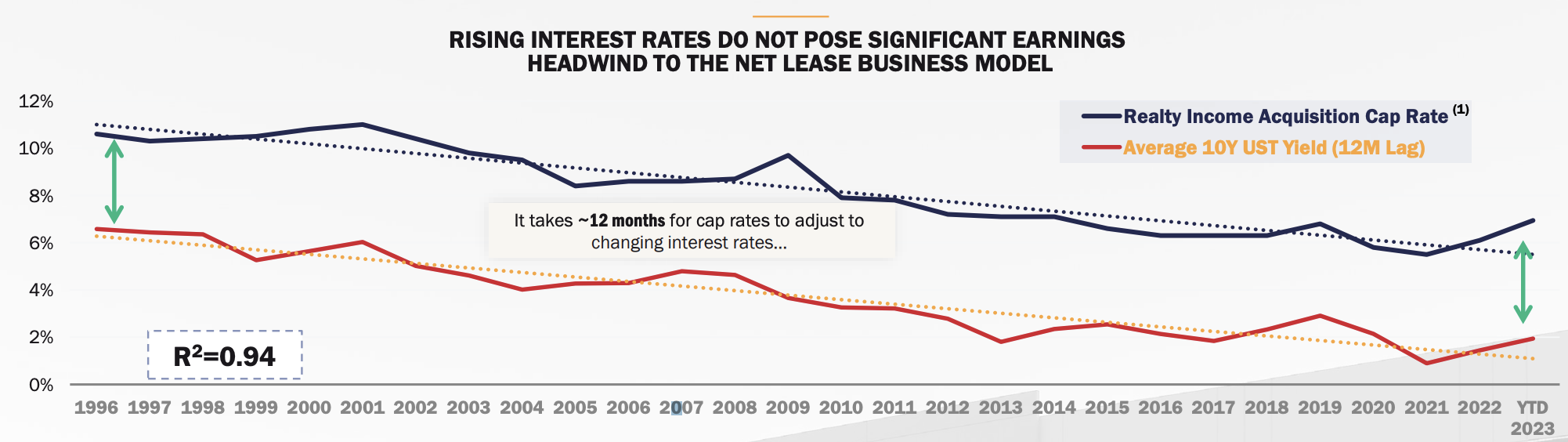

Investors can also take some comfort in Realty Income’s historical ability to maintain a positive investment spread, or the cap rate (property operating income / property acquisition price) minus financing costs (mostly debt and equity). This protects profitability and makes it possible to continue making accretive investments.

Source: Realty Income Investor Presentation, August 2023

While growth could slow if cap rates don’t adjust higher as quickly as interest rates have (O’s cap rate has sat near 6% to 7% in recent years), we don’t expect this environment to persist forever.

An equilibrium in real estate and financing markets will eventually be reached, and Realty Income’s scale (and the relatively low cost of capital that provides) creates more flexibility to pursue profitable acquisitions in the large and fragmented retail net lease market.

Overall, the REIT looks well-positioned to endure worsening economic conditions while continuing its low single-digit dividend growth trend. We’ll continue to monitor how higher interest rates affect Realty Income, providing updates as needed.

— Simply Safe Dividends

If you’re looking for tools and research to help you oversee your dividend portfolio, you might like to try our online product, which lets you track your portfolio’s income, dividend safety, and much more.

You can learn more about our suite of portfolio tools and research for dividend investors by clicking here.

Source: Simply Safe Dividends