The Fed decision to leave rates unchanged Wednesday still led to a late selloff and a sea of red in [Thursday’s] trading session with the S&P 500 and Nasdaq down over -1% respectively.

The current target range for the federal funds rate remains at 5.25%-5.50% but Fed Chair Jerome Powell’s belief that a soft landing is not the expectation left investors assuming that more rate hikes are ahead causing markets to fall.

Certainly, investors may keep getting their watch list together for stocks that serve as buy-the-dip candidates or have the potential to propel past temporary headwinds.

This points us to highly ranked Zacks stocks that have an “A” Zacks Style Scores grade for Momentum and should remain attractive.

Image Source: St Louis FED

Image Source: St Louis FED

Technology Stocks with Strong Momentum

The trend of earnings estimate revisions has largely improved for the broader technology sector this year and with the Nasdaq still up over +20% YTD many investors will be looking for buy the dip prospects among tech stocks.

Big tech conglomerates may come to the forefront of investors’ minds but Asure Software (ASUR) and Axcelis Technologies (ACLS) shouldn’t be overlooked with both sporting a Zacks Rank #1 (Strong Buy).

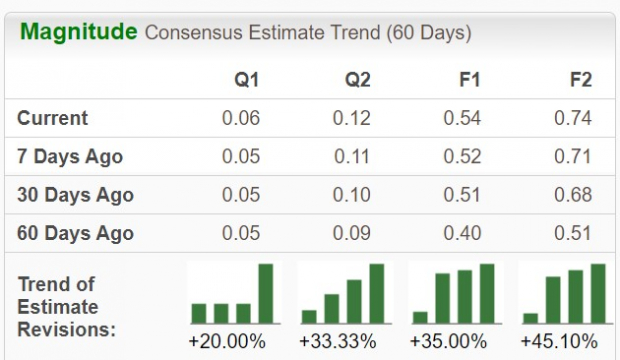

Asure Software also belongs to the top-rated Zacks Internet-Delivery Services Industry which is currently in the top 2% of over 250 Zacks industries. Providing web-based workforce management solutions, in the last 60 days Asure Software’s fiscal 2023 and FY24 earnings estimates have soared 35% and 45% respectively. Plus, Asure Software’s stock trades at $8 a share and at a reasonable forward earnings multiple amid intriguing bottom line expansion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Similarly, Axcelis Technologies is benefitting from a strong business environment with its Zacks Electronics-Manufacturing Machinery Industry in the top 35 percentile. Providing ion implantation equipment in the fabrication of semiconductors, Axcelis Technologies FY23 earnings estimates are up 7% over the last two months and FY24 EPS estimates have jumped 9%.

More impressive is that Axcelis Technologies’ earnings are now expected to climb 28% this year and leap another 16% in FY24 to $8.13 per share making ACLS an attractive buy-the-dip candidate.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Energy Stocks with Strong Momentum

With the potential for crude oil prices hitting $100 a barrel still a possibility, Vermilion Energy’s (VET) stock is compelling in terms of momentum and sports a Zacks Rank #1 (Strong Buy). Furthermore, the resurgence of inflationary fears potentially alludes to the possibility of higher commodity prices outside of oil. This could start to make alternative energy player REX American Resources (REX) attractive with a Zacks Rank #3 (Hold) at the moment.

Starting with Vermilion Energy it’s noteworthy that the Zacks Oil and Gas-Exploration and Production-International Industry is in the top 27% of all Zacks industries. Vermilion Energy looks poised to benefit as a Canadian-based energy producer focused on the exploitation of light oil and natural gas.

Trading at $14 a share and just 4.5X forward earnings, Vermilion Energy’s FY23 and FY24 earnings estimates have climbed 11% and 18% in the last 60 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Pivoting to Rex American Resources the company produces ethanol and distillers’ grains in the United States with its Zacks Biofuels Industry in the top 18%. High double-digit percentage growth is expected on the company’s bottom line this year making REX shares enticing at 12.8X forward earnings.

It is noteworthy that Rex American Resources Momentum score has gone to a “C” from an “A” since the update of this article as FY25 earnings estimates have slightly dipped but its current FY24 EPS estimates remain much higher. Plus, Rex American Resources has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Rising earnings estimates are an indication that these stocks could outperform the broader market in the near future, especially when interest rate fears subside. Keeping this scenario in mind, investors may want to start monitoring the earnings picture for stocks as inflationary concerns still linger making these companies attractive as beneficiaries of vibrant industries at the moment.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks