Today’s episode of Full Court Finance at Zacks explores where the market stands after Wall Street ramped up its selling on the back of ‘higher for longer’ fears during what is already a historically rough month for stocks.

Even though the market is dealing with a pullback that has both the Nasdaq and the S&P 500 below their 50-day moving averages, the overall stock market backdrop appears to remain bullish for the fourth quarter and beyond. Therefore, investors with long-term horizons might want to consider buying proven large-cap stocks at potentially attractive levels.

Wall Street already knew interest rates were going to remain elevated, we need only look at U.S. Treasury yields, which began soaring again in April and May. Jay Powell was also never going to declare victory over inflation. The Fed is simply giving themselves breathing room, should they have to turn up the heat slightly.

Powell and the Fed are still likely almost done tightening, as the updated outlook from the CME Fed Watch tool highlights. Plus, the outlook for S&P 500 earnings growth in 2024 and 2025 is impressive.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Earnings and interest rates move the market over the long haul. On top of that, the S&P 500 is now approaching its most oversold RSI levels since the end of Q3 2022 (when the market bottomed) and March 2023 (when the current rally heated up again).

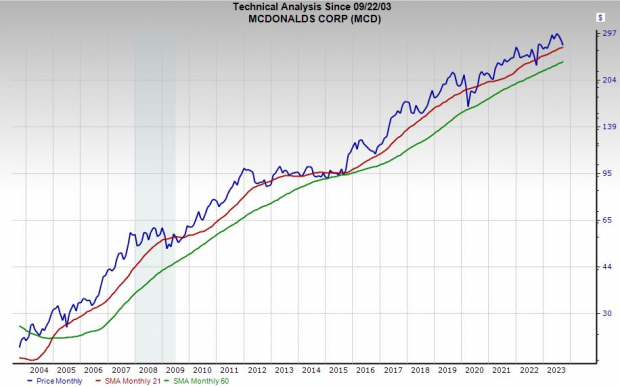

McDonald’s (MCD) was in the news Friday after the fast-food titan said it would raise royalty fees for new franchise restaurants in the U.S. and Canada for the first time in roughly 30 years—around 95% of McDonald’s are owned by franchisees.

Despite all the talk of a health food craze, McDonald’s posted 11% global comps growth in 2022 and 17% in 2021. And the McDonald’s app was downloaded 127 million times worldwide in 2022, blowing away Uber Eats’ 60 million, DoorDash’s 42 million, and Starbucks’ 34 million.

Zacks estimates call for MCD’s adjusted earnings to surge 14% in 2023 and another 8% in FY24, on 10% and 8%, respective revenue growth. On top of that, McDonald’s positive earnings revisions help it land a Zacks Rank #2 (Buy), and MCD is an S&P 500 Dividend Aristocrat, yielding 2.2%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

McDonald’s shares have nearly doubled the S&P 500 over the last 25 years, with MCD up 67% in the last five years. MCD is currently trading around 9% below its highs and 22% under its average Zacks price target.

On the valuation side of the coin, McDonald’s trades at a discount to its own 10-year median and 25% below its highs at 22.3X forward earnings. Plus, MCD is near oversold RSI levels. And it could find support at its 21-month moving average soon.

Halliburton (HAL) is an oil field services standout that helps clients with everything from exploration and well construction to abandonment activities. Energy stocks are on the comeback trail as oil prices rise and Wall Street realizes the renewable energy transition won’t happen overnight.

Oil prices have climbed rather steadily over the last three months, up from around $70 a barrel to $90 today. Haliburton topped our Q2 estimates in the summer, with Zacks estimates calling for its sales to climb 15% in 2023 and another 8% in FY24 to $25 billion.

Plus, its adjusted earnings are projected to soar by 41% this year and 14% in FY24. This projected growth comes on the back of 33% revenue expansion in 2022 and 99% adjusted earnings growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Halliburton, which currently lands a Zacks Rank #3 (Hold), is part of a space that ranks in the top 22% of over 250 Zacks industries, and it raised its dividend by 33% earlier this year. On top of that, 18 of the 20 brokerage recommendations Zacks has are “Strong Buys,” alongside two “Buys,” showing the vital role oil will likely play for decades to come.

Halliburton stock has soared 210% in the past three years to blow away the Zacks Oil and Energy sector’s 110%. At around $41 per share, it trades 16% below its average Zacks price target. On the valuation front, HAL trades at a 28% discount its 10-year median at 12.2X forward 12-month earnings and 11% below its industry.

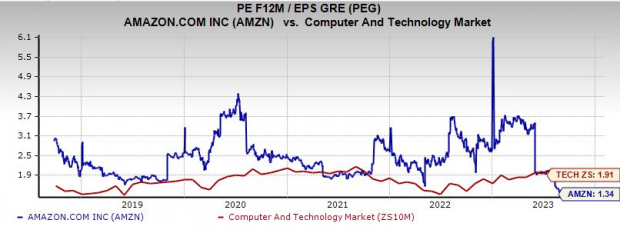

Amazon’s (AMZN) earnings outlook keeps getting better as the e-commerce and cloud computing titan focuses on profitable expansion for the first time. Amazon’s upbeat earnings outlook helps it land a Zacks Rank #1 (Strong Buy), with its most recent/most accurate estimate 16% higher than the current consensus for 2024.

Zacks estimates call for Amazon to post 214% earnings growth in 2023 and another 38% expansion next year. Meanwhile, Amazon’s revenue is projected to grow 11% this year and 13% higher next year to climb from $514 billion in 2022 to $644 billion in FY24.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Amazon stock has soared 730% in the last decade vs. the Nasdaq’s 250%. Despite that run, AMZN is down 15% over the last three years, even as the Nasdaq climbed 25%.

Amazon is still trading nearly 30% under its peaks and 65% below its highs when it comes to forward earnings. AMZN’s peg ratio, which factors in its earnings growth outlook, comes in at 1.3 (five-year lows) vs. the Zacks tech sector’s 1.9. And Wall Street remains very high on the company given its huge market share in vital segments of the economy.

— Benjamin Rains

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks