There continues to be an abundance of opportunity among the Zacks Construction sector with this area of the economy thriving at the moment.

Specifically, homebuilders have had immense success in 2023 and further opportunity lies with their suppliers. To that point, the Zacks Building Products – Miscellaneous Industry is currently in the top 9% of over 250 Zacks industries.

Among the space Gibraltar Industries (ROCK) stock stands out with a Zacks Rank #1 (Strong Buy) and is the Bull of the Day.

Gibraltar’s Importance

Gibraltar has a leading presence and unique niche in the building products industry as a provider of a wide range of products from ventilation and expanded metal to mail storage and rain dispersion solutions.

Furthermore, Gibraltar’s reach extends to various markets including wholesalers, retail home centers, residential, commercial, and transportation contractors among others with Home Depot (HD) being a notable customer.

Gibraltar’s stock has now soared +53% this year correlating with the company’s importance to the building products industry and construction-related activities.

Emphasizing this stellar performance, Gibraltar’s stock has outperformed some of the top-performing homebuilders such as Lennar Corporation (LEN) and M.D.C. Holdings (MDC) while easily topping the broader indexes, the Zacks Building Products-Miscellaneous Market and Home Depot shares.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Plausibility of More Upside

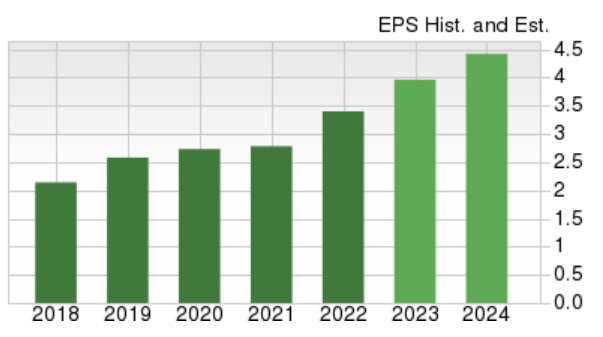

Gravitating to the trend of earnings estimate revisions and Gibraltar’s P/E valuation is a sound way to see if its market edge can continue.

Reassuringly, in the last 60 days fiscal 2023 and FY24 earnings estimates have risen 11% and 4% respectively.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Annual earnings are now forecasted to climb 17% this year and rise another 13% in FY24 to $4.51 per share. Fiscal 2024 EPS projections would represent 65% growth over the last five years with Gibraltar’s earnings at $2.73 a share in 2020.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

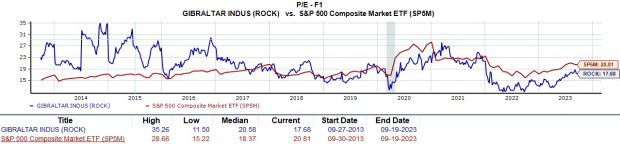

More importantly, Gibraltar’s stock trades at $70 and 17.6X forward earnings which is not a stretched premium to its industry average of 14.6X. Despite Gibraltar’s blazing stock performance shares of ROCK still trade at a 15% discount to the S&P 500’s 20.9X.

It’s also noteworthy that Gibraltar’s stock trades 50% below its decade-long high of 35.2X forward earnings and offers a 14% discount to the median of 20.5X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Investors looking for a company that is poised to have a defying edge in its industry have this opportunity with Gibraltar’s stock shaping up to be a very viable investment for 2023 and beyond. At this point, it’s not a surprise that Gibraltar Industries stock continues to rise and now looks like a good time to join in on the company’s success or add to positions.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks