Based on seasonality studies, the stock market is entering the weakest period of the year. The second half of September through the first week of October has historically been a particularly challenging period to own stocks.

If you are an investor who is looking to position yourself in more defensive stocks over this period, then continue reading.

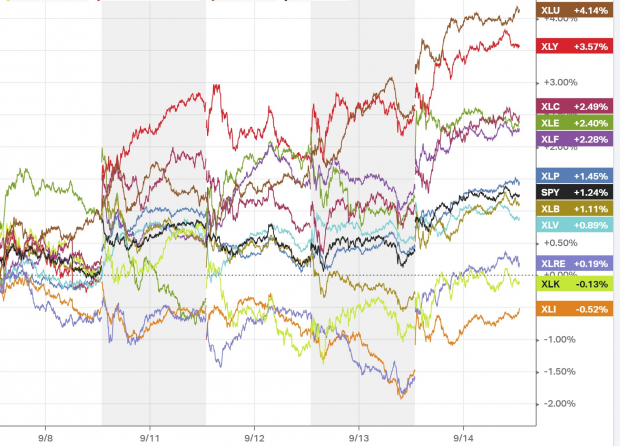

Relative Strength

I have noticed over the last week that utilities stocks are being bought up rather aggressively. Over the last five days, the utilities sector ETF (XLU) has far outperformed all the others.

I think it is quite clear that large institutions are positioning themselves for the coming volatility.

Consolidated Water (CWCO), FirstEnergy (FE), and Vistra (VST) are top ranked utility stocks that investors should consider if they are focused on reducing high risk exposure during the coming few weeks.

Image Source: Koyfin

Image Source: Koyfin

Consolidated Water

Consolidated Water is a company that specializes in developing and operating seawater desalination plants and water distribution systems in areas of the world where naturally occurring supplies of potable water are scarce or unavailable. Founded in the Cayman Islands in 1973, CWCO uses reverse osmosis technology to convert seawater into fresh water. This fresh water is then supplied to industrial, commercial, and residential customers. Their operations primarily span across the Caribbean region and other locations.

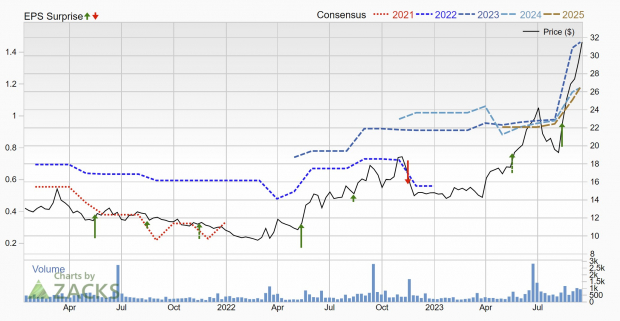

Complementing its already strong YTD performance Consolidate Water also boasts a Zacks Rank #1 (Strong Buy) rating. In the chart below we can see that earnings estimates have rocketed higher over the last month.

Current quarter earnings estimates have been increased by 65% and are projected to climb 660% YoY to $0.38 per share. FY23 earnings estimates have been upgraded by 50.5% and are forecast to grow 170% YoY to $1.46 per share.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

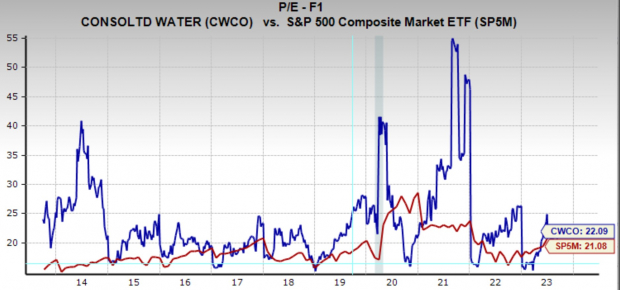

CWCO is currently trading at a one year forward earnings multiple of 22.1x, which is just above the broad market average of 21.1x, and just above its 10-year median of 21.4x. Additionally, the stock yields a dividend of 1.2%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

FirstEnergy

FirstEnergy is a diversified energy company headquartered in Akron, Ohio. Primarily operating through its regulated distribution subsidiaries in the Midwest and Mid-Atlantic regions, it serves millions of customers across multiple U.S. states. FirstEnergy is involved in the generation, transmission, and distribution of electricity and also focuses on energy management and other related services. Over the years, the company has undergone various transformations, emphasizing its commitment to cleaner energy and grid modernization.

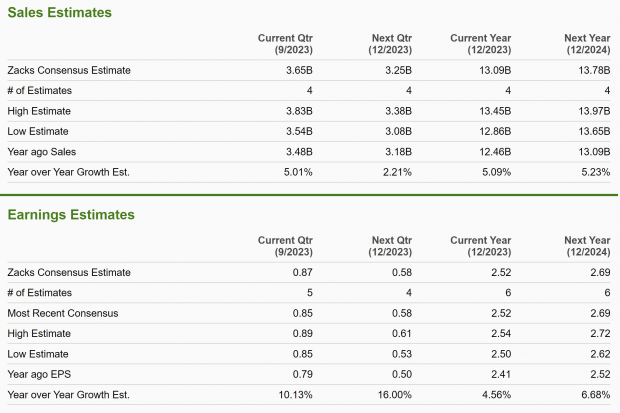

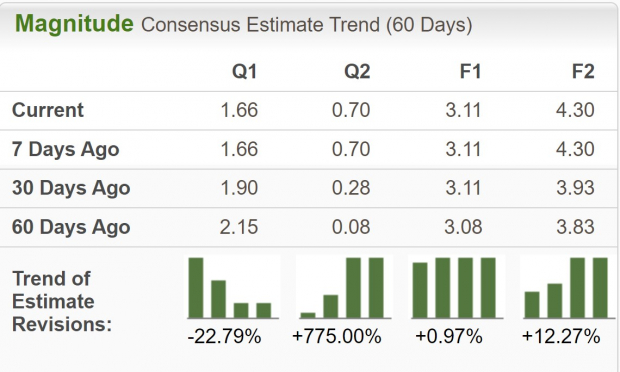

FirstEnergy is expected to grow sales and earnings at a steady pace, as is typical of utilities and illustrates why they make for good additions to investment portfolios. Additionally, FE has a Zacks Rank #2 (Buy) rating, indicating upward trending earnings revisions.

EPS are forecast to grow 6.45% annually over the next 3-5 years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

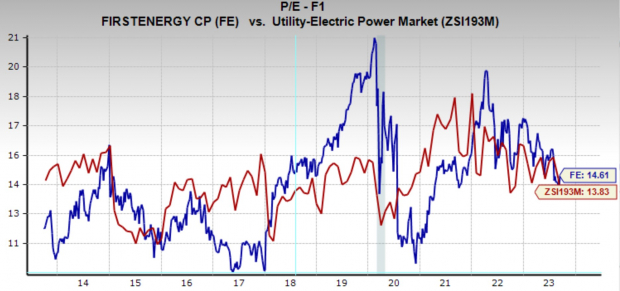

FirstEnergy is trading at a one year forward earnings multiple of 14.6x, which is above the industry average of 13.8x, and just above its 10-year median of 14x. The stock also offers a hefty dividend yield of 4.2%, further sweetening the deal.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Vistra

Vistra is an integrated retail electricity and power generation company based in the United States. Primarily involved in the production and sale of electricity, Vistra combines a large-scale, diversified generation fleet with a retail platform, serving residential, commercial, and industrial customers. Their generation portfolio comprises natural gas, nuclear, coal, and battery storage facilities. Over time, Vistra has also emphasized its transition towards cleaner energy sources and reducing carbon emissions.

Although current quarter earnings estimates have been lowered over the last month, next quarter, FY23, and FY24 have all been revised considerably higher. These aggregate raises in earnings estimates give VST a Zacks Rank #1 (Strong Buy) rating.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

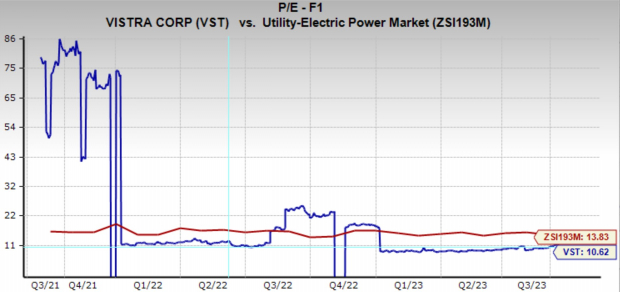

VST is trading at a one year forward earnings multiple of 10.6x, which is below the industry average of 13.8x, and below its six-year median of 13.1x. Vistra pays a dividend yield of 2.5%, and has raised the payment by an average of 13.2% annually over the last five years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

This seasonally weak period in the markets may take some investors by surprise, but those who enter this period with defensive stocks, or an increased cash position will come out of this situation in an advantageous position. Furthermore, even if volatility doesn’t increase significantly, utility stocks will always be a welcome addition to a stock portfolio.

–Ethan Feller

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks