Comfort Systems USA (FIX) provides comprehensive heating, ventilation, and air conditioning installation, maintenance, repair, and replacement services.

The company performs most of its services within manufacturing plants, office buildings, retail centers, apartment complexes, and healthcare, education, and government facilities.

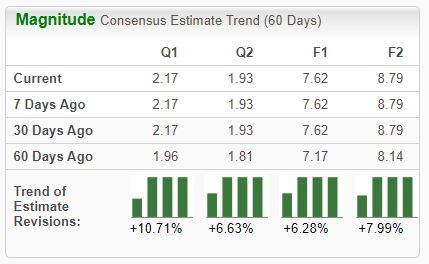

Analysts have taken a bullish stance on the company’s earnings outlook, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company resides within the Zacks Building Products – Air Conditioner and Heating industry, currently ranked in the top 2% of all Zacks industries due to positive earnings estimate revisions.

As many know, roughly half of a stock’s movement can be attributed to its group, helping to clarify the importance of targeting industries seeing bright outlooks.

Aside from the improved earnings outlook and favorable industry standing, let’s take a closer look at a few other traits of Comfort Systems USA.

Comfort Systems USA

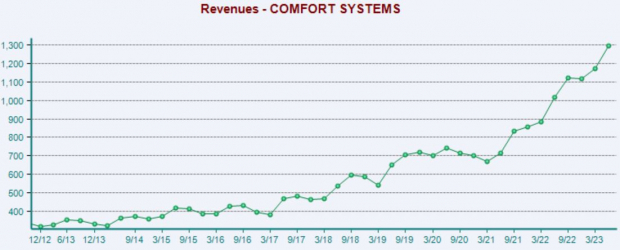

The company sports a solid growth profile, with Zacks Consensus Estimates suggesting 44% EPS growth on 21% higher revenues in its current year. And peeking ahead to FY24, expectations allude to a further 15% improvement in earnings paired with a 15% revenue bump. FIX carries a Style Score of “B” for Growth.

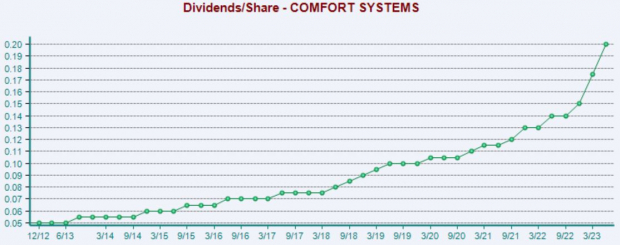

Income-focused investors could be attracted to FIX also, with shares currently yielding a respectable 0.5% annually. While the yield may be on the lower end, the company’s 15% five-year annualized dividend growth rate helps bridge the gap.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In addition, the company has been a stellar earnings performer, exceeding the Zacks Consensus EPS Estimate by an average of more than 20% across its last four releases. Just in its latest release, Comfort Systems USA posted an 18% EPS beat and reported revenue 7% above expectations.

As we can see below, the company’s top line growth has remained steady and accelerated in recent quarters.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Perhaps to the surprise of some, shares have long-time outperformed the general market in a big way, annualizing a sizable 29% return over the last decade vs. the S&P 500’s 12.8%. FIX shares have seen bullish activity following each of its previous three quarterly releases.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Comfort Systems USA (FIX) would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).

— Derek Lewis

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks