Another quarter of stellar results from Nvidia (NVDA) currently has the chipmaker and AI pioneer sporting a Zacks Rank #1 (Strong Buy).

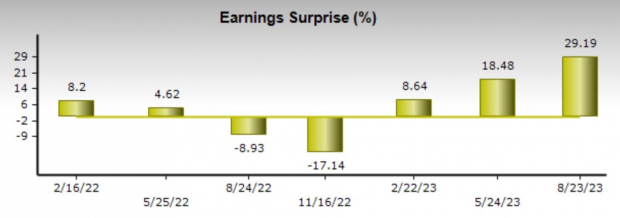

With Nvidia’s Q2 earnings of $2.70 per share skyrocketing 429% year over year and topping expectations by 29% it’s no question that earnings estimates will most likely soar in the upcoming weeks.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Still, Nvidia’s stock carries a hefty price tag that correlates with its success and investors may be looking for other companies that were also able to produce strong quarterly results.

Here are three candidates who have a strengthening earnings outlook and may be more affordable options to invest in at the moment.

Abercrombie & Fitch (ANF) : Clothing apparel retailer Abercrombie & Fitch made headlines along with Nvidia yesterday after beating its Q2 top and bottom line expectations as well.

Abercrombie’s stock popped more than 20% with Q2 earnings coming in at $1.10 per share compared to estimates of $0.13 a share. More importantly, this soared from an adjusted loss of -$0.30 a share in the prior-year quarter.

The very impressive results were attributed to the acceleration of the company’s brand on a global scale with inventory levels down -30% YoY. Abercrombie’s stock boasts a Zacks Rank #1 (Strong Buy) as earnings estimates are largely up over the last quarter.

For its current fiscal 2024, Abercrombie’s earnings are now projected to rebound and skyrocket 736% to $2.09 per share compared to EPS of $0.25 a share in FY23. Plus, FY25 earnings are expected to jump another 18%. This stellar recovery has many analysts boosting their price targets following a strong Q2 report.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zoom Video Communications (ZM) : Considering where Zoom Video Communications stock traded during the pandemic (high of $568.34 a share in October 2020) investors may have to take a double take at its current price of around $67 a share.

Of course, Zoom was naturally going to lose its pandemic mojo with businesses less reliant on remote work now. However, Zoom still has intriguing earnings potential and appears to be overlooked with Q2 EPS of $1.34 a share topping estimates of $1.05 per share by 27% on Monday.

More impressive, Zoom has now surpassed bottom-line expectations for 17 consecutive quarters. Zoom’s stock currently sports a Zacks Rank #1 (Strong Buy) with annual earnings estimates slightly up in the last week.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Canadian Solar (CSIQ) : With a Zacks Rank #2 (Buy) Canadian Solar’s stock is enticing after blasting Q2 EPS estimates by 57% on Tuesday. Earnings came in at $2.39 per share compared to estimates of $1.52 a share. This also soared 123% from Q2 earnings of $1.07 per share a year ago.

Despite the impressive earnings beat Canadian Solar’s stock dropped more than -10% after missing top-line estimates by -5% and giving weaker-than-expected sales guidance. Sales of $2.36 billion were still up 2% from Q2 2022 and shares of CSIQ make the case for bargain territory with sentiment toward many solar stocks being unjustafiably low this year.

Canadian Solar’s stock trades around $26 and near 52-week lows. More intriguing, CSIQ trades at just 4.6X forward earnings which is a steep discount to the Zacks Solar Industry’s 23.5X and the S&P 500’s 20.7X.

Annual earnings estimates are up in the last week supporting the case that CSIQ shares are cheap. Furthermore, Canadian Solar’s earnings are now expected to climb 70% in fiscal 2023 to $5.85 per share compared to $3.44 a share in 2022.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Simply put, Abercrombie & Fitch, Zoom Video Communications, and Canadian Solar have been overlooked in 2023. Now appears to be an ideal time to buy their stocks after impressive Q2 earnings and these companies join Nvidia as standouts this week.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks