We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: 23andMe Holding Co. (NASDAQ: ME)

Today’s penny stock pick is the consumer genetics testing company, 23andMe Holding Co. (NASDAQ: ME).

23andMe Holding Co. operates in two segments, Consumer & Research Services and Therapeutics. The Consumer & Research Services segment provides a suite of genetic reports, including information on customers’ genetic ancestral origins, personal genetic health risks, and chances of passing on certain rare carrier conditions to their children, as well as reports on how genetics can impact responses to medications; and Lemonaid telehealth platform, patients can access affiliated licensed healthcare professionals for medical consultation and treatment for several common conditions, as well as research services.

The Therapeutics segment focuses on the drug development; and discovery and development of novel therapies to improve patient lives across various therapeutic areas, including oncology, respiratory, and cardiovascular diseases, as well as offers out-licensing of intellectual property associated with identified drug targets related to drug candidates under clinical development. It has a collaboration agreement with GlaxoSmithKline plc to leverage genetic insights to validate, develop, and commercialize drugs.

Website: https://www.23andme.com

Latest 10-k report: https://investors.23andme.com/sec-filings/sec-filing/10-k/0000950170-23-024232

Analyst Consensus: As per TipRanks Analytics, based on 4 Wall Street analysts offering 12-month price targets for ME in the last 3 months, the stock has an average price target of $4.88, which is nearly 160% upside from current levels.

Potential Catalysts / Reasons for the Hype:

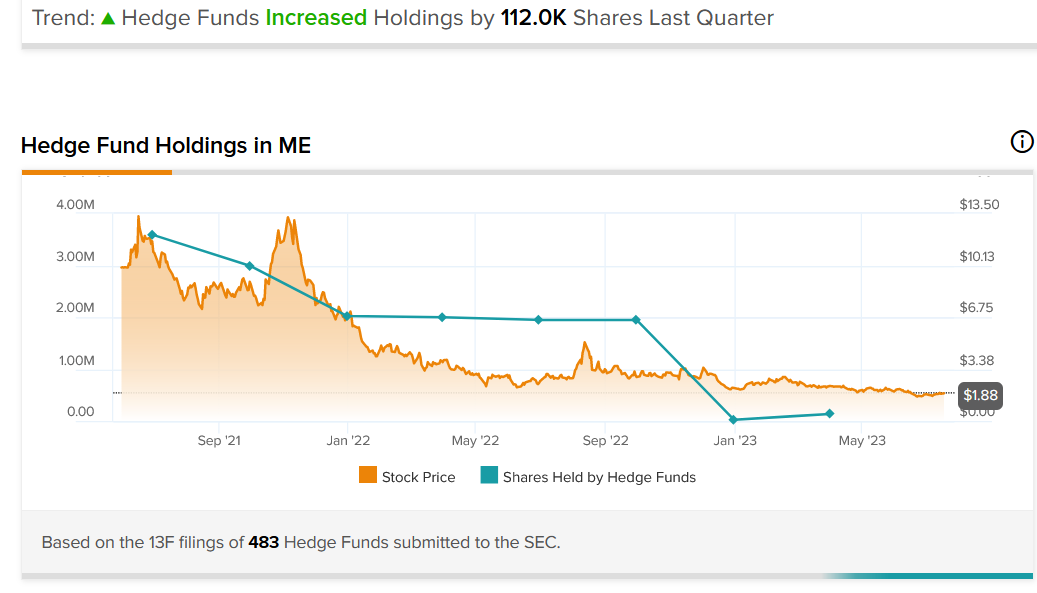

- Hedge Funds Increased Holdings by 112.0K Shares Last Quarter.

- Rumors that a high-value pharma partnership would be announced once the company’s five-year exclusive partnership with GSK ends on July 25th, 2023.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

#7 Bullish RSI: In the weekly chart, the RSI is currently moving higher from oversold levels. This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for ME is above the price of $1.93.

Target Prices: Our first target is $2.30. If it closes above that level, the second target price is $2.70.

Stop Loss: To limit risk, place a stop loss at $1.70. Note that the stop loss is on a closing basis.

Our target potential upside is 19% to 40%.

For a risk of $0.23, our first target reward is $0.37, and the second target reward is $0.77. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

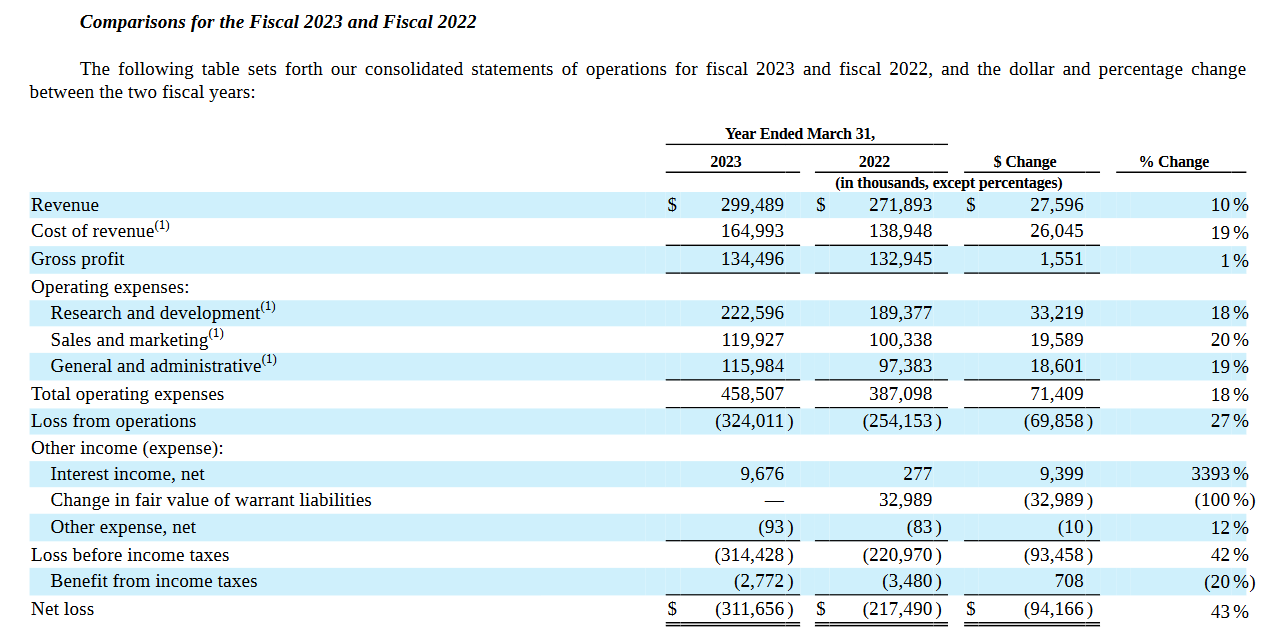

- The company has a history of net losses. For the fiscal years ended March 31, 2023, 2022, and 2021, the company incurred net losses of $311.7 million, $217.5 million, and $183.6 million, respectively. As of March 31, 2023, ME had an accumulated deficit of $1.5 billion.

- On December 10, 2019, Celmatix Inc. filed a lawsuit in the Supreme Court of the State of New York against ME (Index No. 657329/2019) asserting claims against the company for breach of contract and the implied covenant of good faith and fair dealing and tortious interference with contract and prospective economic advantage, alleging damages that, according to the complaint, plaintiff “believed to be in excess of $100 million.” On March 30, 2022, both parties agreed to a settlement, pursuant to which the company had to make a payment of $10.0 million net.

- Despite being a loss-making company, the executives are being paid millions as compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

The best way to earn monthly income is NOT a stock, bond or option... Rather, it's this little-known alternative investment. CLICK HERE TO FIND OUT MORE.

Source: Trades of the Day