World Acceptance Corporation (WRLD), a Zacks Rank #1 (Strong Buy), has staged a remarkable turnaround this year amid improving lending prospects. The stock is breaking out to the upside after bottoming out late last year. A surge near 52-week highs reflects the underlying momentum that appears set to continue in the months ahead. Shares are displaying relative strength as buying pressure accumulates in this highly-ranked company.

WRLD stock sports the second-highest overall Zacks VGM Style Score of ‘B’, indicating further upside is likely based on promising value, growth and momentum metrics. The company is part of the Zacks Financial – Consumer Loans industry group, which ranks in the top 12% out of more than 250 Zacks Ranked Industries. Note the favorable valuation characteristics for this industry below:

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

World Acceptance is engaged in the consumer finance business in the United States. The lender offers short-term small installment loans, medium-term larger installment loans, related credit insurance, and ancillary products and services to individuals.

The company also provides income tax return preparation and filing services, as well as automobile club memberships. It serves individuals with limited access to other sources of consumer credit such as banks, credit unions, and credit card lenders. World Acceptance was founded in 1962 and is headquartered in Greenville, SC.

Earnings Trends and Future Estimates

WRLD has built up an impressive earnings history, surpassing earnings estimates in three of the last four quarters. Back in May, the company reported fiscal fourth-quarter earnings of $1.97/share, a 32.21% surprise over the $1.49/share consensus estimate. Consistently beating earnings estimates is a recipe for outperformance.

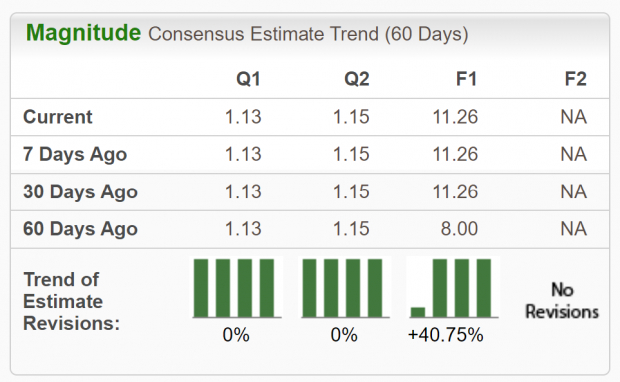

Analysts have grown increasingly bullish in terms of earnings estimates. Full-year estimates have been raised by 40.75% in the past 60 days. The Zacks Consensus EPS Estimate for the current fiscal year now stands at $11.26/share, reflecting potential growth of 212.78% relative to the previous year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Let’s Get Technical

WRLD shares have advanced over 115% this year alone. The stock has been making a series of higher highs on increasing volume and is now approaching the coveted 52-week high mark. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been widely outperforming the major indexes. With both strong fundamentals and technicals, WRLD is poised to continue its bullish run.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, World Acceptance has recently witnessed positive revisions. As long as this trend remains intact (and WRLD continues to deliver earnings beats), the stock will likely continue its surge this year. Despite the impressive performance, WRLD currently trades at just a 12.47 forward P/E.

Bottom Line

Improved lending prospects should continue to provide a tailwind for the stock price. WRLD is ranked favorably by our Zacks Style Score Categories, with a ‘B’ for Value and an overall ‘B’ VGM score. Increasing volume at recent breakout levels is another bullish sign.

Robust fundamentals combined with a strong technical trend certainly justify adding shares to the mix. Backed by a leading industry group and impressive history of earnings beats, it’s not difficult to see why this company is a compelling investment. Investors would be wise to consider WRLD as a portfolio candidate.

— Bryan Hayes

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks