The Building Products-Home Builders Industry is in the top 7% of over 250 Zacks industries and Lennar Corporation (LEN) is standing out amongst the space with a Zacks Rank #1 (Strong Buy).

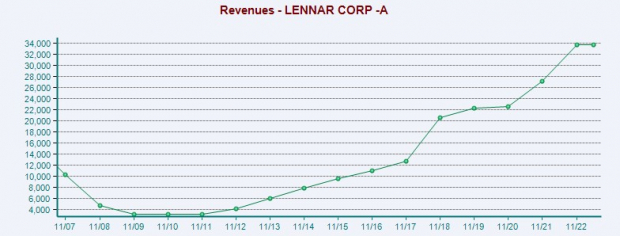

Stronger housing data has correlated with Lennar’s rising earnings estimates with the company coming off a record year for revenue at $33.67 billion and earnings at $17.55 per share.

Lingering demand for new homes following the pandemic and stabilizing mortgage rates continue to make Lennar stock very compelling as one of the largest homebuilders in the U.S.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Outpacing EPS Expectations

Earnings estimates are intriguingly higher and indicative of more upside in Lennar stock in correlation with strong housing data and the company’s very impressive fiscal second quarter report on June 14.

Notably, Lennar blasted Q2 earnings expectations by 27% at $2.94 per share compared to EPS estimates of $2.32. Lennar beat quarterly top-line estimates by 10% with Q2 sales coming in at $8.04 billion.

This was very impressive as Lennar’s top and bottom lines were expected to decline by a much larger magnitude following a very tough-to-compete-against prior year quarter that saw earnings at $4.69 per share and sales at $8.35 billion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

More impressive, Lennar has now beaten the Zacks EPS Consensus for 17 consecutive quarters dating back to June of 2019.

Lennar is having another strong year as earnings estimate revisions have soared since the company’s Q2 report. Fiscal 2023 earnings estimates have skyrocketed 29% over the last 30 days to $12.65 per share compared to $9.76 a share a month ago.

Plus, FY24 EPS estimates are soaring as well and are now up 20% to $13.08 per share compared to estimates of $10.85 a share 30 days ago.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Attractive P/E Valuation

With earnings estimates on the rise and Lennar’s bottom line remaining robust, shares of LEN look attractive trading at $125 and just 9.9X forward earnings. This is slightly beneath the industry average of 10.4X and attractively below the S&P 500’s 20.8X.

Furthermore, Lennar stock trades 49% below its decade-long high of 19.5X while still offering a 10% discount to the median of 11X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Lennar stock is up +38% year to date and there should be even more upside with earnings estimates climbing since the company’s second quarter report. Now appears to be a good time to buy as demand for new homes remains higher and mortgage rates stabilize.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks