Graphic Package Holding Company (GPK) is a prominent and dynamic multinational corporation that specializes in providing innovative packaging solutions to various industries. With a strong global presence and a history dating back several decades, GPK has established itself as a leader in the packaging industry.

With a Zacks Rank #1 (Strong Buy), a historically cheap valuation, strong earnings growth and expanding operations, Graphic Packaging Holding Company is a worthy consideration for any investment portfolio.

Industry Leading Products

The company’s comprehensive portfolio encompasses a wide range of packaging products, including corrugated containers, folding cartons, displays, and labels. GPK has been capitalizing on the newest trends in consumer packaging and is producing some of the highest quality renewable and recyclable, fiber-based packaging in the industry.

At its most recent quarterly earnings meeting, management announced that Chick-Fil-A, the most profitable fast-food chain in the US, would be launching GPK’s new, highly insulated, double-wall fiber-based cups as a potential long-term solution for their beverage program.

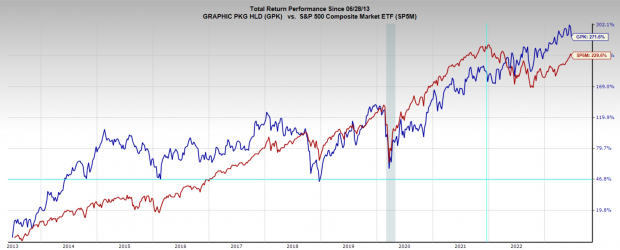

Steady Stock Performance

Graphic Package Holding Company has been an extremely steady and impressive performing stock. Over the last decade GPK has compounded at 14% annually, beating both the broad market and industry. Additionally, GPK offers a tidy 1.6% dividend yield, which it has increased 10% annually over the last three years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

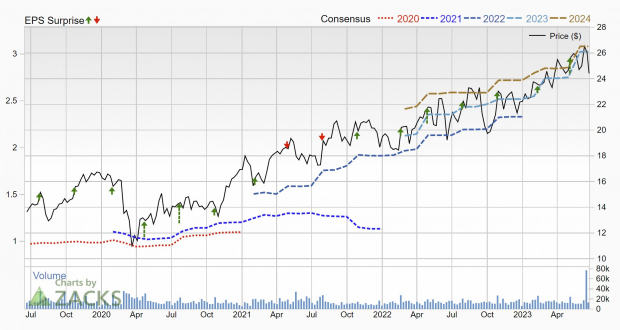

Earnings Trend

GPK has experienced consistent revisions higher in its earnings estimates since 2021, following the steady pace of returns in the stock. The last two months have seen especially strong earnings revisions giving it a Zacks Rank #1 (Strong Buy).

Current quarter earnings estimates have been upgraded by 7% over the last two months and are projected to grow 28% YoY. Additionally, FY23 earnings have been upgraded by 10.2% and are expected to climb 30% YoY.

Considering sales are expected to grow 6% YoY in the current quarter and FY23, and earnings are expected to grow multiples of that, GPK is clearly improving business efficiency. The company’s CEO Michael Doss recently noted that “during the (most recent) quarter our newest coated recycled paperboard machine in Kalamazoo exceeded quality, yield and financial expectations,” indicating those upgraded efficiencies.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Reasonable Valuation

Graphic Packaging Holding Company is currently trading at a 10-year low in terms of earnings multiples. Its one-year forward earnings multiple is just 8x, which is well below the market average of 20x, below the industry average of 13x, and its 10-year median of 16.5x.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

While packaging materials may not be quite as sexy as AI or Crypto, Graphic Package Holding Company is making its investors considerable wealth, nonetheless. GPK has an impressive performance history and strong projections for earnings growth. With robust earnings estimate revisions and a cheap valuation GPK stock has the wind at its back.

— Ethan Feller

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks