Standing out in terms of value and steady growth is Covenant Logistics Group (CVLG) which lands a Zacks Rank #1 (Strong Buy) and is the Bull of the Day.

After a record year with freight revenue topping $1 billion in 2022, Covenant has expanded its portfolio of transportation and logistics services with the recent acquisition of Lew Thompson & Son Trucking Inc. The acquired company is a dedicated contract carrier specializing in poultry feed and live haul transportation in Northwest Arkansas and surrounding areas.

This should keep Covenant ahead of a slowdown in the broader freight market which the company can capitalize on as transportation costs remain lower. To that point, it’s noteworthy that Covenant’s total truckload operating cost per total mile decreased by 4 cents last quarter, or 1.5%.

Lew Thompson Acquisition

Last quarter, Covenant stated they purchased 100% of the outstanding stock of Lew Thompson in exchange for a closing enterprise value of approximately $100 million plus an earnout of up to $30 million depending on the results achieved by the business over the three following calendar years.

The acquisition seems very lucrative considering Lew Thompson generated $64 million in revenue in 2022. This should give Covenant’s top and bottom lines a nice boost in the future and continue its steady growth. Notably, Covenant’s sales of $1.2 billion last year represented 37% growth over the last five years with 2018 sales at $885 million.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Earnings Estimates

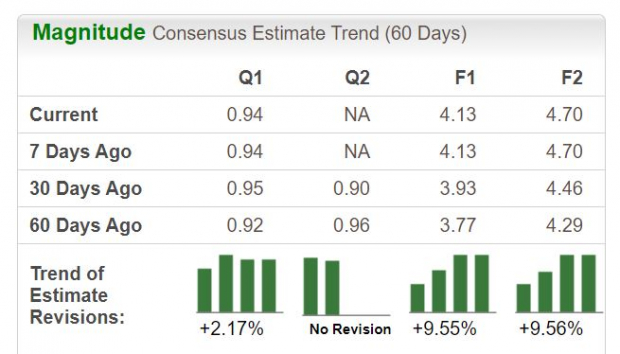

Despite the recent completion of the Lew Thompson acquisition, Covenant’s earnings estimates have trended higher over the last 60 days.

The upward trend in earnings estimates is one of the most powerful forces impacting stock prices and this is another reason to believe that acquiring Lew Thompson could certainly pay off. The acquisition is not having a dismal impact on Covenant’s bottom line in the short term and should increase its earnings potential in the long term.

Impressively, annual earnings estimates for the current year and fiscal 2024 have risen 9% in the last two months. This is a great sign with Covenant coming off a record year for annual earnings per share with EPS at $5.84 in 2022.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Strong Value

What is most compelling about Covenant stock at the moment is its valuation. Covenant checks many boxes in terms of value with the company’s price to earnings, price to sales, and price to cash flow all standing out.

Trading at $39 a share, Covenant stock has a 9.5X forward earnings multiple which is a 47% discount to its industry average of 18.1X and well below the S&P 500’s 20.3X.

More intriguing, investors are only paying $0.47 for every $1 the company makes. Covenant’s price-to-sales ratio of 0.47X is also a distinct discount to the industry’s 1.05X average and the benchmark’s 3.71X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Covenant’s price to cash flow indicates the company is in good financial health with a P/CF ratio of 4.31. This is attractively below the optimum level of less than 20, the industry average of 11.27, and the S&P 500’s 17.31 average.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

In addition to its Zacks Rank #1 (Strong Buy), Covenant stock has an overall “A” VGM Style Scores grade for the combination of Value, Growth, and Momentum. Covenant Logistics Group is starting to look like a very sound long-term investment following the acquisition of Lew Thompson & Son Trucking and now appears to be a great time to buy.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks