This report will cover two things:

- My monthly dividend reinvestment.

- The status of and outlook for my overall Dividend Growth Portfolio.

Dividend Reinvestment for June: VICI Properties (VICI)

My dividend reinvestment this month is a little unusual for me, because I am following a hunch almost as much as applying my usual data-driven approach.

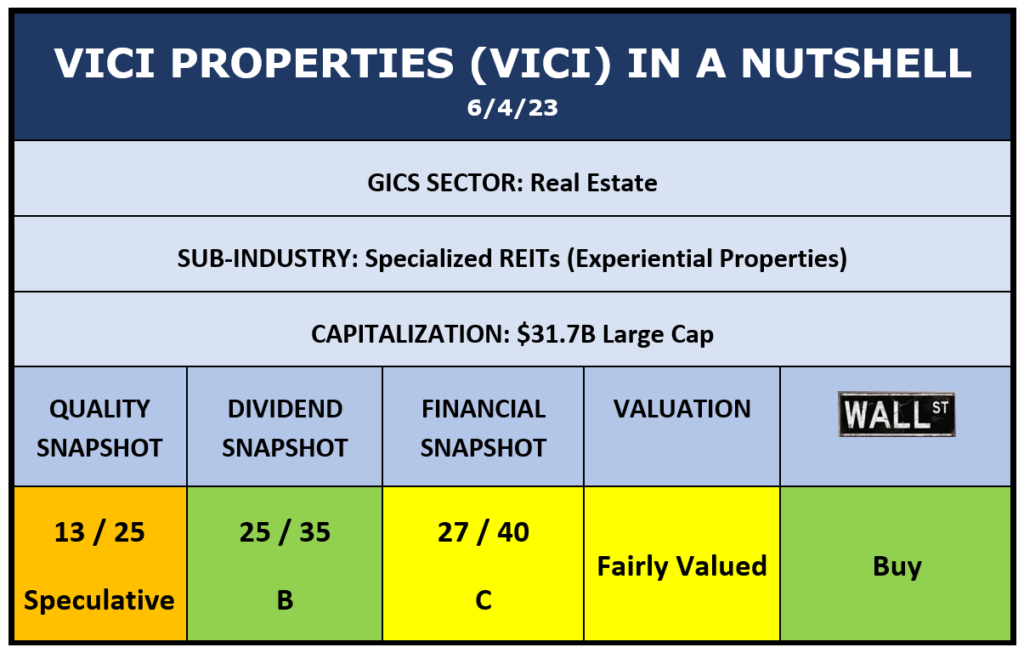

My reinvestment this month opens a new position in VICI Properties (VICI). VICI is a real-estate investment trust (REIT) that invests in gaming and “experiential” properties. It has a giant presence in Las Vegas, while being headquartered in New York City.

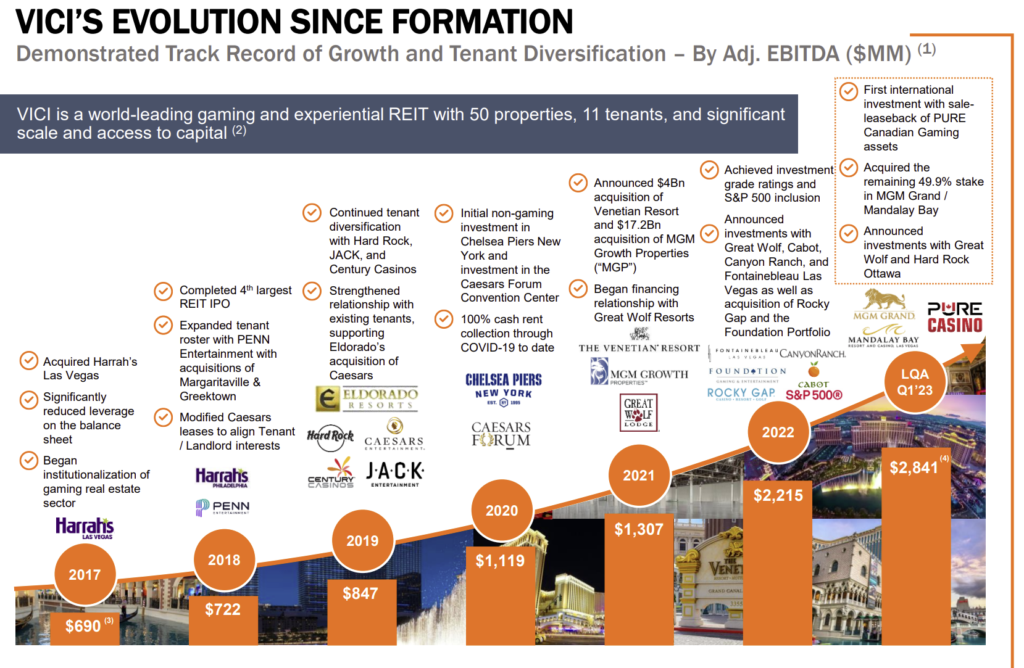

VICI Properties was created in 2017 as one outcome of the bankruptcy reorganization of Ceasars Entertainment. Its IPO (initial public offering) came in 2018, and in the short time since then, VICI has grown significantly and been added to the S&P 500.

VICI owns one of the largest portfolios of gaming, hospitality, and entertainment destinations, including Caesars Palace, MGM Grand, Mandalay Bay, and Venetian, which are four iconic entertainment facilities on the Las Vegas Strip.

VICI’s overall portfolio includes 50 properties across the United States and Canada. They comprise about 124 million square feet, 60,100 hotel rooms, vast gaming areas, and more than 450 restaurants, bars, nightclubs, and sportsbooks.

VICI also owns or has interests in a growing array of non-gaming experiential properties, including Great Wolf Resorts, Cabot, Canyon Ranch and Chelsea Piers; four championship golf courses; and 34 acres of undeveloped and underdeveloped land along or near the Las Vegas Strip.

VICI, like most REITs, grows largely through acquisitions. In its recent Q1 2023 report, it reported that it had acquired four gaming properties in Alberta, Canada for C$271.9 million, representing its first international investment, and also that it has completed full acquisition of MGM Growth Properties. That gives VICI full ownership of MGM Grand and Mandalay Bay, two more iconic Las Vegas Strip properties.

As to the Canadian acquisition, VICI’s president stated that the international expansion opens up a new frontier of opportunities, as VICI aims to expand globally.

This display shows VICI’s evolution since it was created.

Source: Investor presentation

Source: Investor presentation

VICI is what is known as a triple net lease REIT. Under this business model, VICI acts solely as a landlord to its operators/tenants. VICI owns the properties and collects rent as the landlord, while its tenants are responsible for operating their businesses, and for paying property maintenance expenses, taxes, and insurance – hence the “triple-net” label.

Source: Investor presentation

Source: Investor presentation

Note the reference in the lower right to investment-grade balance sheet. VICI’s credit rating from S&P is BBB-, which is S&P’s lowest investment-grade rating. It achieved that rating in 2022.

VICI’s tenants rent primarily under master lease agreements, which generally bind all of a casino operator’s properties under a single payment and renewal schedule. In addition, the contracts tend to have very long-term (40+ years) durations and contain rent escalators, although the escalators tend to be slow (around 2% per year). Thus, major growth comes from continual expansion.

Even accounting for its presence in numerous locations, VICI is largely a play on Las Vegas itself. It is noteworthy that VICI collected 100% of its rent expectations throughout the Covid downturn. Ultimately, an investment in VICI requires a belief in the economic outlook of the Las Vegas Strip and the ability of VICI’s tenants, who almost all maintain speculative credit ratings, to weather future downturns successfully.

I said that this month’s reinvestment is based as much on my judgement as on data. Here’s what I mean:

Source: Author

Source: Author

I would normally not purchase a stock that rates as speculative on my Quality Snapshot system. However, I would note that the quality rating would be a C (Investment Grade) were it not for Morningstar’s Moat rating of “None.” Morningstar gives very few positive moat ratings to REITs. In explaining that, Morningstar states that many REITs have no barriers to entry.

For VICI, that seems like an inapplicable standard, because its properties in Las Vegas are unique in the world, and no one can duplicate their holdings. Unfortunately, Morningstar does not have a human analyst assigned to VICI, so there is no full report on the company that might shed light on the no-moat rating.

Wall Street analysts have a consensus “Buy” rating on VICI. One analyst argues, “[VICI] should be one of the best positioned REITs for a potential uncertain macro environment” given its transparent tenant base, potential upside from announced and already structured investments, locked in capital, and a positive correlation to inflation. Per the Analyst Research feature on E-Trade, where my portfolio resides, “In the last 3 months, 11 ranked analysts set 12-month price targets for VICI. The average price target among the analysts is $37.17 [which is an 18% upside].”

The intrinsic valuation provider Alpha Spread suggests that VICI is 23% undervalued.

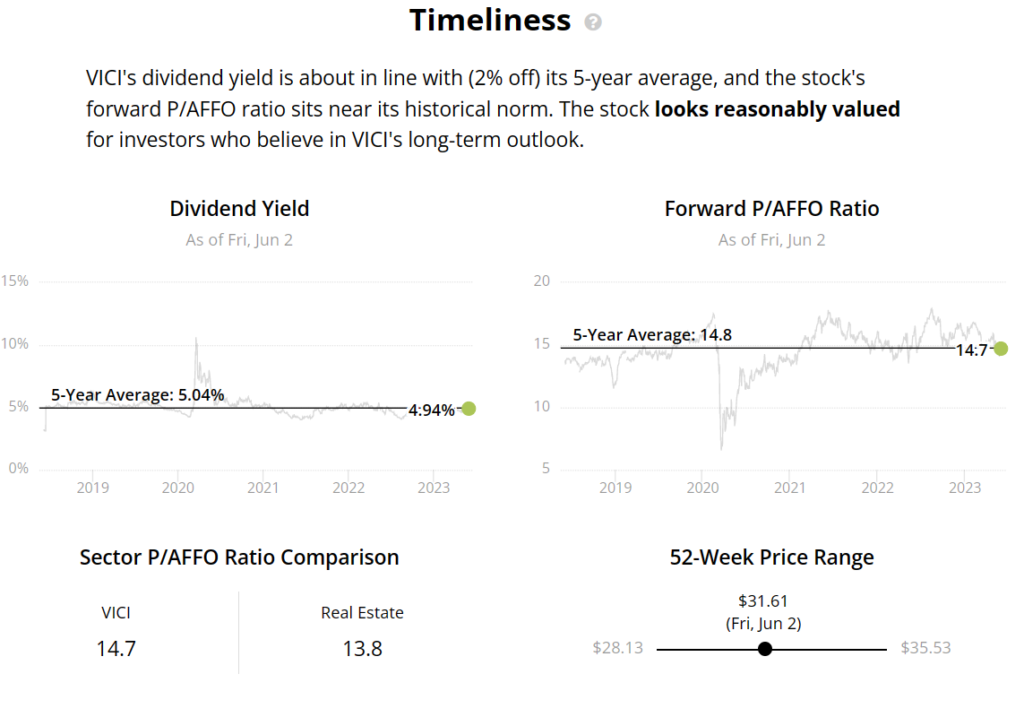

The reason I ranked VICI’s valuation as Fairly Valued in the table above is that, using multiple valuation methods as described in DGI Lesson 11: Valuation | Daily Trade Alert, I calculated a current valuation ratio of 0.96 for VICI, which would be 4% undervalued. Further, look at how close VICI is to the “middle” of various valuation metrics in this display:

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Looking at the four metrics in turn:

- Current yield is just 2% off its 5-year average.

- Forward Price/AFFO ratio is practically identical to its 5-year average.

- Price/AFFO (14.7) is 7% over the sector average (13.8).

- VICI’s price is just 1% from being exactly in the middle of its 52-week range.

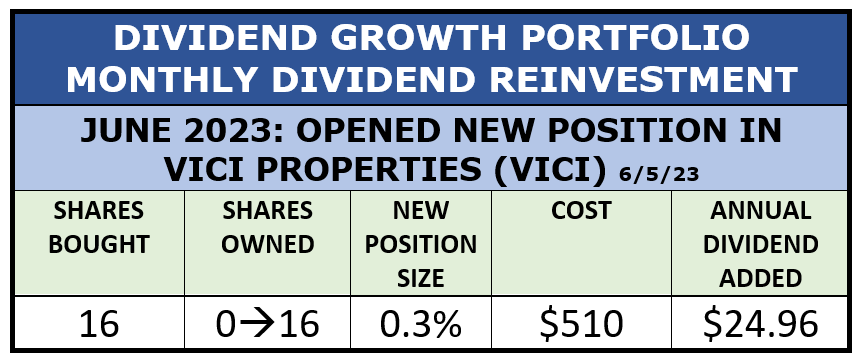

So, taking all of the data about VICI into account, and adding my positive hunch about Las Vegas into the mix, I decided to start a position in VICI Properties (VICI) with this month’s reinvestment.

Source: Author

Source: Author

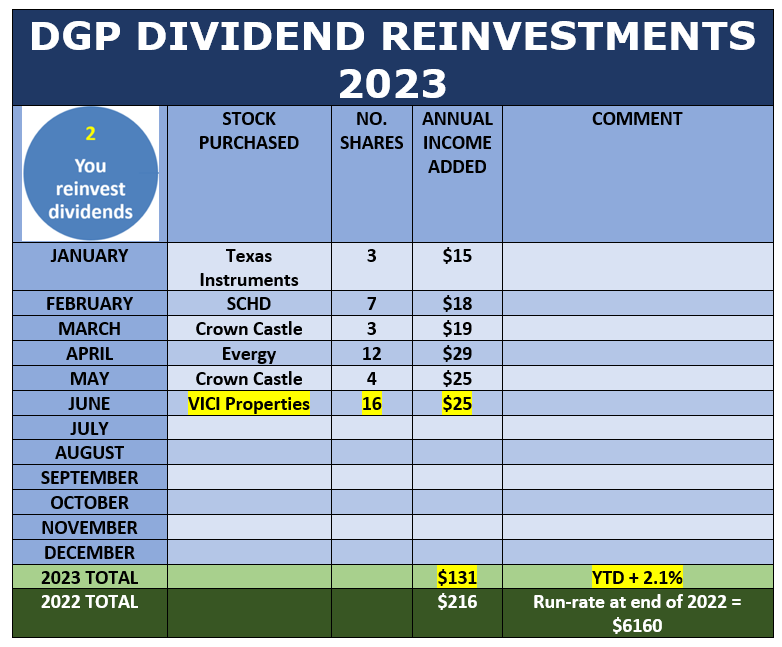

The net effect of opening the new position in VICI:

- Creates a new, very small position, which I intend to build over time, assuming that the investment thesis remains intact.

- Adds $25 to the portfolio’s annual dividend run-rate.

- Leaves $7 in the kitty to start building back up for next month’s reinvestment.

Update of Full Portfolio

VICI becomes the 30th position in my public Dividend Growth Portfolio (DGP).

I started the DGP in 2008 to demonstrate dividend-growth investing. The portfolio is real, the holdings are actual, and all decisions about managing the portfolio have been made in real time. This is not a back-test.

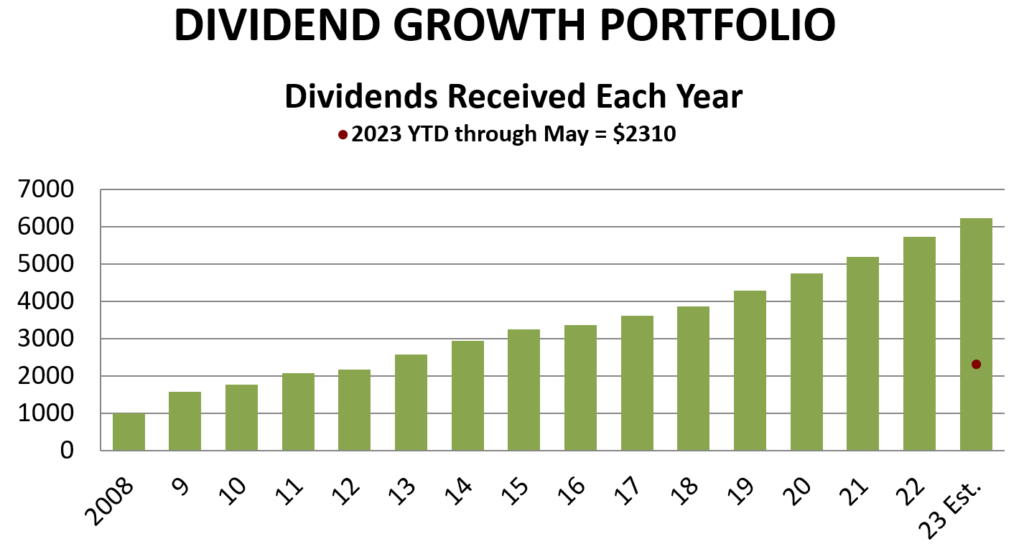

The main financial goal of the portfolio is to generate a reliable, ever-increasing stream of dividends in meaningful amounts, which it has done:

Source: Author

Source: Author

While the estimate for this year’s dividends changes a little each month as new information becomes available, the dividends collected so far in 2023 are about 10% more than the dividends collected last year through May.

Therefore, annual growth in dividends seems assured again in 2023, for the 15th year in a row. Right now, I project that 2023’s dividends will surpass $6000 for the first time in the portfolio’s history. That growth in income has come without a dime of new money ever being added to the portfolio since its inception.

I will wait a couple of months to make my first estimate for 2024’s dividends.

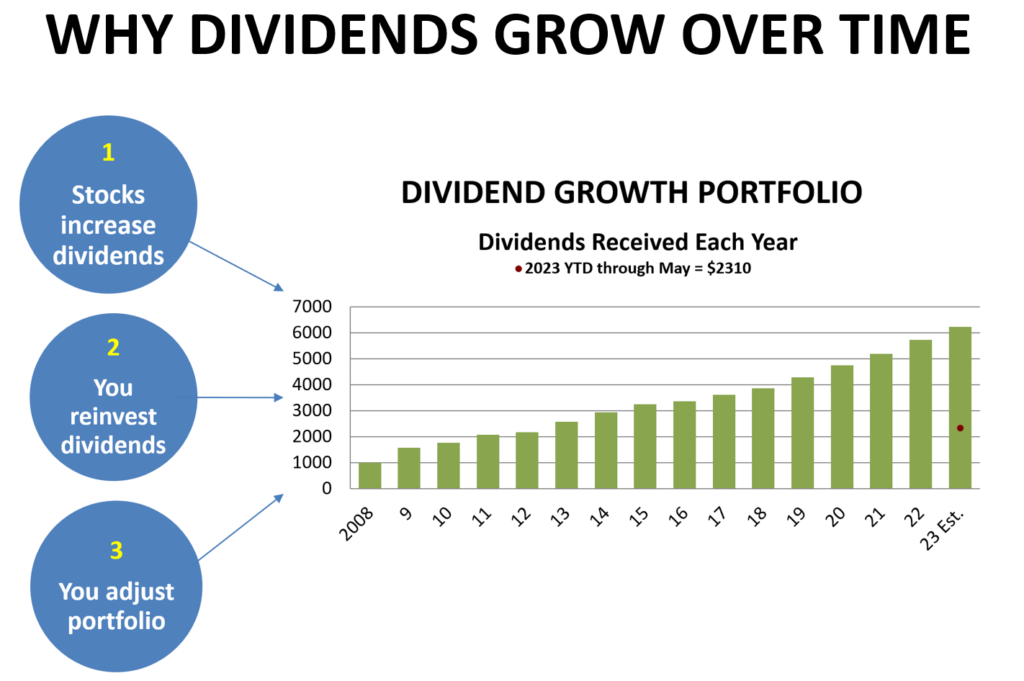

There are three reasons that dividends go up in a DG portfolio:

Source: Author

Source: Author

Two of the three reasons were illustrated in May.

Reason #1. Stocks increase their dividends

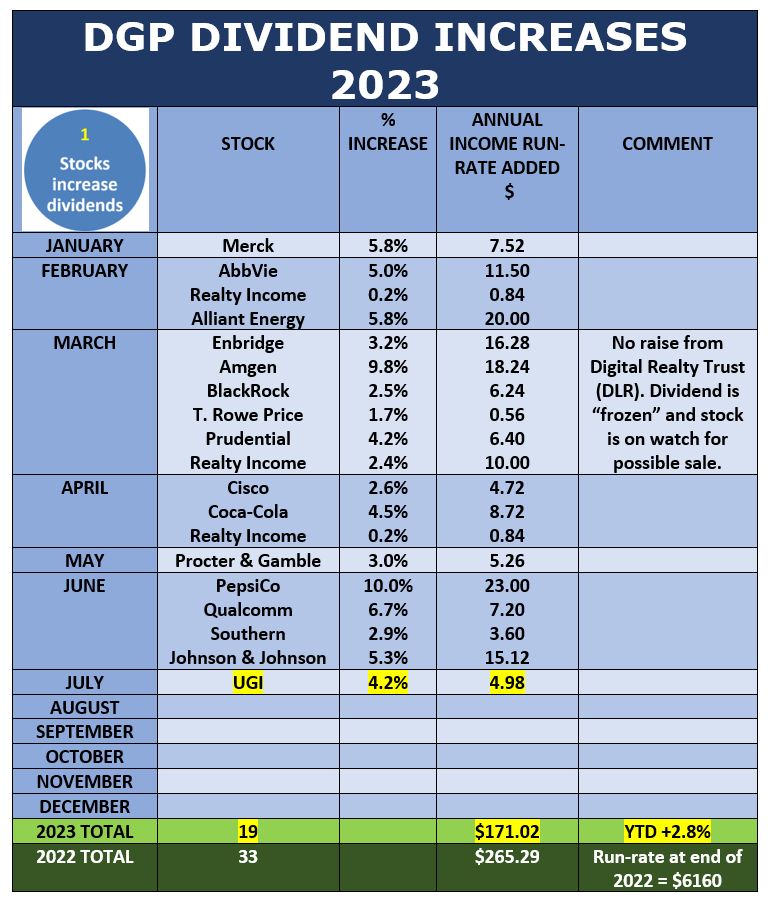

The following table shows the DGP’s dividend-increase record so far in 2023. Just one company announced an increase since last time, and that is highlighted in yellow, along with the new totals at the bottom.

Overall, dividend increases are on pace to add about 5% to the portfolio’s annual dividend run-rate this year. They have already added 2.7%. I expect around 15 more increases to be announced by the end of the year.

Source: Author, from company announcements

Source: Author, from company announcements

Reason #2. Dividend reinvestments

The second reason the portfolio’s overall dividends go up is that I reinvest them. Since dividends are paid per share, each additional share purchased causes the portfolio’s income to increase.

This outcome of reinvesting dividends is illustrated this month by my purchase of VICI. My process is to collect dividends as they come in, then reinvest them once/month into a hand-selected company.

The table below shows how my dividend reinvestment program is going so far in 2023.

Source: Author

Source: Author

At the YTD pace, it looks like the reinvestments will add upwards of 3.5% to the portfolio’s annual dividend run-rate by the end of 2023.

Reason #3. Portfolio adjustments

This category refers to standard portfolio management activities, such as trimming or selling a stock, deciding how to replace it, and executing those decisions.

I am not planning any such changes in June.

Over the years, I haven’t churned the DGP very much. Every stock or fund I buy is one that I expect to hold “forever.” Not everything works out that way, but my porfolio turnover rate rarely exceeds 10% per year, and some years it is zero.

So far in 2023, I have turned over just $1697, or about 1% of the portfolio’s value at the beginning of the year.

And that wraps up this month’s DGP review. If you want to see the positions in the portfolio at any time, its status as of the end of the previous month is always available here. That link also has an archive with links to to all the articles and videos that I have published about the portfolio.

Thanks for reading!

-–Dave Van Knapp

And you could make more money in 2023 than you would by trading, chasing the latest "hot" stock, or doing anything your broker tells you. Get the details here - including the name of my #1 stock.

Source: Dividends & Income