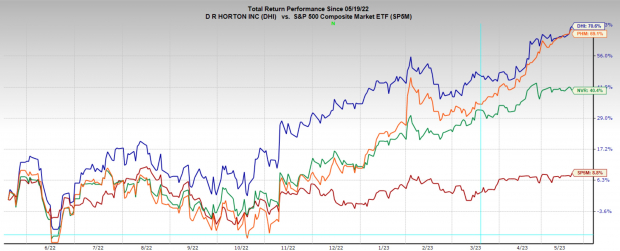

The home builder industry has firmly established itself as one of the leading sectors in the stock market, delivering a remarkable performance over the past year. Home builders currently sit in the top 2% of the Zacks Industry Rank, with 10 stocks scoring a Zacks Rank #1.

Fueled by a confluence of factors, including a persistent scarcity in housing supply and a decline in interest rates over the last year, the industry has enjoyed an upward trajectory with no signs of slowing down. This was a huge surprise for many on Wall Street, as most analysts projected a recession at the beginning of the year, which should have challenged the sector.

Furthermore, bolstered by improving earnings estimates and reasonable valuations, home builder stocks appear as compelling investments, with strong return potential for investors. Although there are a number of stocks in the sector with convincing fundamentals, I will focus on D.R. Horton (DHI) , PulteGroup (PHM) , and NVR (NVR) , which have all outperformed the market YTD and over the last decade.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

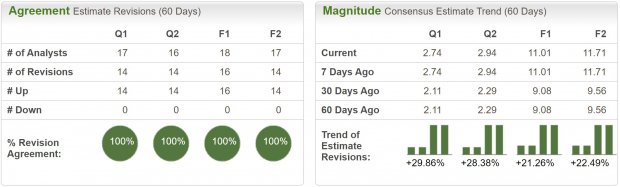

D.R. Horton

After experiencing some aggressive downgrades in the second half of 2022, DHI is back to being upgraded again. D.R. Horton boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions. Earnings estimates have been revised 20-30% higher across timeframes over the last two months.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

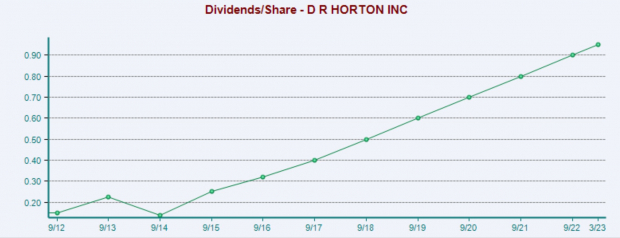

Not only is DHI a steady grower, and well positioned in the current housing environment, but management is also generous with returning cash to shareholders. DHI has a dividend yield of 1%, which has been increased by an average of 15% annually over the last five years. Additionally, over the last five years, the share count has been reduced by 10% thanks to stock buy-back programs.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

DHI is currently trading at a one-year forward earnings multiple of 10.2x, which is in line with the industry average, and below its 10-year median of 11.6x. Additionally, the industry itself is below its 10-year median of 11.1x.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

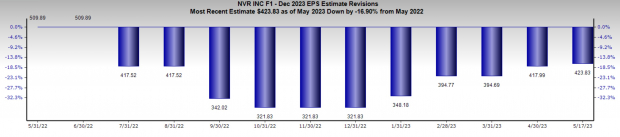

NVR

NVR is also a Zacks Rank #1 (Strong Buy) home builder stock, with upward trending earnings revisions. In the chart below we can see just how severe the revisions lower were going into the end of 2022, and how strongly they have rebounded this year. It should be noted that estimates are still below what they were a year ago.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Unlike other homebuilders, NVR’s sole business is selling and building quality homes by typically acquiring finished building lots, without the risk of owning and developing land in a cyclical industry.

NVR acquires finished lots at market prices from various third-party land developers under the Lot Purchase Agreements so that the legal obligation and economic loss is limited to the amount of the deposit, in case of failure.

The lot acquisition strategy helps the company to avoid financial requirements and risks associated with direct land ownership and land development. This strategy allows it to gain efficiency and a competitive edge over its peers.

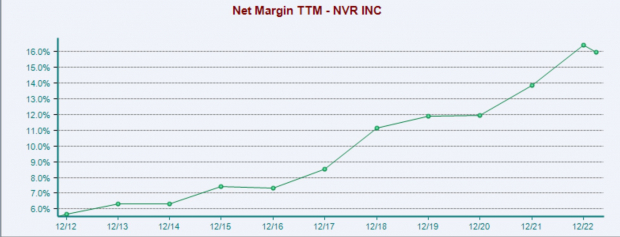

NVR has managed to expand Net Margins considerably over the last ten years, in part thanks to this strategy. Over that time margins have nearly tripled from 6% to 16%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

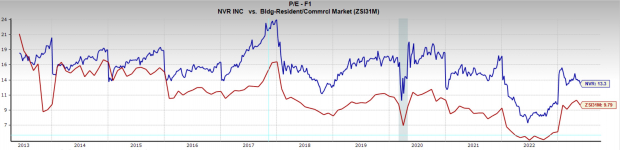

NVR is trading at a one-year forward earnings multiple of 13.3x, which is above the industry average 9.8x, but below its 10-year median of 16x. However, with its unique acquisition strategy, and high margins, NVR likely earns a premium valuation.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

PulteGroup

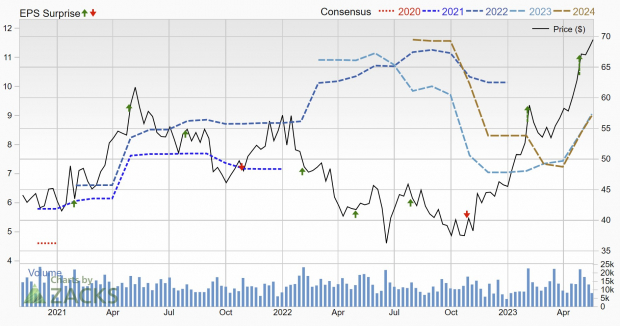

PulteGroup stock is blasting to new all-time highs as well. After being downgraded through the end of 2022, investors are now caught flat-footed as earnings estimates are revised higher and the stock charges higher. Pulte also enjoys a Zacks Rank #1 (Strong Buy), reflecting the strong trend in earnings estimates upgrades.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

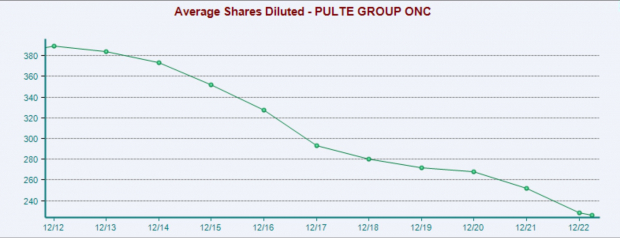

PHM is very generous with its investors as well, making huge efforts to return cash to shareholders. In addition to reducing its share count by 40% over the last ten years though buybacks, PHM also offers a dividend which is has raised every year since 2012. The dividend payment has been increased by an average of 12% annually over the last five years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

PHM is trading at a one-year forward earnings multiple of 7.7x, which is well below the industry average 10.3x, and below its 10-year median of 10.4x. This is an attractive valuation for a company with a long history of growing sales, returning cash to shareholders, and benefiting from secular tightness in its respective market.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Interest Rates

In the chart below of the Ten-Year Treasury yield, we can see that interest rates peaked back in November 2022 and have trended lower since. If you compare this chart with the home builder stocks, you will see that home builders began to rally exactly when rates peaked. This isn’t surprising as lower mortgage rates lead to more home buying.

Additionally, we can now be relatively confident that interest rates will continue to trend lower because of rhetoric from the Federal Reserve. After raising interest rates 5% since 2021, the Fed has now made it clear that they are close to, if not completely done raising interest rates. Lower rates mean cheaper mortgages, which should encourage further strength in home buying.

Image Source: TradingView

Image Source: TradingView

Housing Supply

Anyone that has tried buying a house in the last two years knows just how competitive the market has been. And anyone that hasn’t tried buying a home has read about it or spoken to someone that has. Besides several markets that were exceptionally hot during the post-Covid boom, most local real estate markets have remained extremely supply constrained.

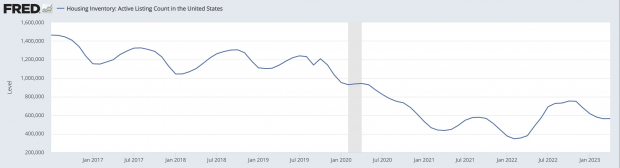

The housing boom and bust of 2008 had something of a traumatic effect on housing developers, because since then housing supply has collapsed. Even in more recent years we can see that the amount of active real estate listings has more than halved in the last five years. Because of this, home builders and their products are an extremely hot commodity.

Image Source: St Louis Fed

Image Source: St Louis Fed

Bottom Line

Even after the strong run up in the industry, home builder stocks are still compelling investments. High Zacks Ranks and technical chart patterns make them strong near-term investment candidates. While secular tailwinds, and low valuations make them very attractive long-term investments.

— Ethan Feller

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks