One underrated aspect of investing that I absolutely love?

The fact that it’s an even playing field.

Anyone can start from scratch, receive no formal training, and actually perform better than the industry’s highly-paid professionals.

There is almost no other professional occupation where this can happen – doctor, pilot, etc.

Investing is wide open.

How can one come out of the gate competitive?

By investing in the best businesses.

It’s simple logic: If one wants to be a great investor, they should be invested in great businesses.

Following that logic for myself led me straight to dividend growth investing.

This is a strategy whereby one buys and holds shares in world-class businesses that pay reliable, rising dividends.

Those reliable, rising dividends are funded by reliable, rising profits.

Those reliable, rising dividends are funded by reliable, rising profits.

And reliable, rising profits are produced when a business is great.

It’s circular.

You can find hundreds of stocks that fit this strategy by perusing the Dividend Champions, Contenders, and Challengers list.

It contains invaluable information on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

I’ve been plowing my hard-earned savings into these stocks for years, building my FIRE Fund in the process.

This is my real-money portfolio.

It generates enough five-figure passive dividend income for me to live off of.

I do actually live off of dividends.

I do actually live off of dividends.

In fact, I’ve been doing that for years.

I retired in my early 30s.

How?

My Early Retirement Blueprint answers that question.

It’s simple: Investing in great businesses should produce a great investor.

But that’s not all.

Valuation at the time of investment is important.

Price only tells you what you pay, but it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

The investing playing field is even, but you can tip it in your favor by buying high-quality dividend growth stocks when they’re undervalued.

By the way, valuation isn’t something that only the professionals on Wall Street can understand.

My colleague Dave Van Knapp put together Lesson 11: Valuation in order to make sure of that.

Part of an overarching series of “lessons” on dividend growth investing, it lays out a valuation system that can be easily applied to just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

BlackRock, Inc. (BLK)

BlackRock, Inc. (BLK)

BlackRock, Inc. (BLK) is a multinational investment management corporation.

Founded in 1988, BlackRock is now a $100 billion (by market cap) investment management monster that employs more than 19,000 people.

With approximately $9.1 trillion in assets under management, BlackRock is the largest asset manager in the world.

Equity products account for 52% of the company’s long-term assets under management; fixed income products, 29%; multi-asset class products, 8%; and alternative investment products, 3%. Cash management accounted for the remaining 8%.

The asset management business model is extraordinary.

Put simply, BlackRock charges fees to manage global assets.

Simple enough.

But this simplicity doesn’t detract from how effective the business model is at making money.

The effectiveness is a result of the fee base exponentially increasing.

See, BlackRock has massive exposure to global equities.

The swelling of the world’s population and collective economic output helps to fuel compounding growth across the spectrum of global businesses.

What that means is, BlackRock’s fee base is compounding over time.

On top of that, BlackRock’s huge scale supercharges the process – putting distance between them and the competition.

BlackRock is in a rising tide (global capital markets) that’s lifting all boats (participants in said capital markets).

However, since BlackRock is the largest boat in that rising tide, the company stands to disproportionately gain from this.

BlackRock’s unrivaled ability to benefit from scaled compounding sets the company up to continue growing its revenue, profit, and dividend for many years into the future.

Dividend Growth, Growth Rate, Payout Ratio and Yield

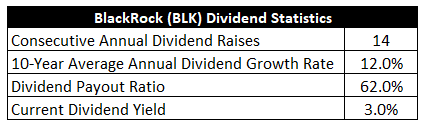

Indeed, BlackRock has increased its dividend for 14 consecutive years.

The 10-year dividend growth rate is 12.5%.

And, up until recently, due to extreme market volatility, consistent double-digit dividend growth has been a hallmark.

Pairing that kind of dividend growth with the stock’s market-beating 3% yield is a compelling combination.

By the way, this yield is 50 basis points higher than its own five-year average.

By the way, this yield is 50 basis points higher than its own five-year average.

The 62% payout ratio is healthy, but this is kind of a trough ratio, and I believe it’ll become healthier as markets and results recover.

I like dividend growth stocks in what I refer to as the “sweet spot” – a yield of between 2.5% and 3.5%, paired with high-single-digit (or higher) dividend growth.

The yield is dead center, and the dividend growth rate is quite a bit higher than I’d usually look for.

Extra sweet dividend metrics here.

Revenue and Earnings Growth

As sweet as the metrics might be, many of them are using information from the past.

However, investors are risking present capital for the rewards of the future.

As such, I’ll now build out a forward-looking growth trajectory for the business, which will be of great help when it comes time to approximate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Fusing the proven past with a future forecast like this should allow us to determine what the growth path of the business could look like from here.

BlackRock enlarged its revenue from $10.2 billion in FY 2013 to $17.9 billion in FY 2022.

That’s a compound annual growth rate of 6.5%.

Very solid top-line growth.

I tend to look for a mid-single-digit top-line growth rate from a large, mature business such as this.

BlackRock more than delivered.

Meanwhile, EPS grew from $16.87 to $33.97 over this 10-year period, which is a CAGR of 8.1%.

The top line looks very good.

The bottom line looks even better.

Share buybacks helped to drive much of this excess bottom-line growth.

For perspective on this, the outstanding share count has been reduced by approximately 13% over the last decade.

Notably, the growth of the dividend has outpaced EPS growth, but that’s largely due to how shaky the last 12-24 months have been.

Many prior 10-year periods show a 10%+ EPS CAGR, which I believe BlackRock is good for over the long run.

Looking forward, CFRA is forecasting a 13% CAGR for BlackRock’s EPS over the next three years.

Well, how about that?

We’re clearly on the same page here.

Recent turbulence is hiding just how powerful BlackRock’s platform is.

To that point, CFRA states: “A decline in asset values is masking relatively decent long-term asset inflow trends, like the $393 billion recorded in 2022 (equal to 4% organic assets under management [AUM] growth).”

I’d argue the inflow trends reveal two important points.

First, we can see that BlackRock is capable of pulling in capital during rough periods for markets, which bodes extremely well for better times ahead.

Second, in an industry where many major firms are plagued by outflows, BlackRock’s diversified mix, particularly around passive offerings, is proving its worth at bucking the trend and rising above the competition.

CFRA notes: “…[BlackRock] generates above-peer organic AUM growth, reflecting [BlackRock’s] best-in-class product mix, technology platforms, and capabilities.”

In my opinion, it’s the passive offerings that really set BlackRock apart.

Unlike many of its peers, BlackRock is actually mostly a passive investment firm.

BlackRock owns iShares, the largest provider of exchange-traded-funds (ETFs) in the world.

Passive strategies account for roughly two-thirds of BlackRock’s AUM.

This differentiation is crucial, as capital has been flowing into passive investments for years, much to the chagrin of asset managers that focus on active strategies.

CFRA’s projection for EPS growth over the next few years would set up BlackRock for similar dividend growth, although the elevated payout ratio will also have to come down a bit.

Thus, balancing things out, assuming CFRA isn’t totally wrong, I’d expect BlackRock to deliver at least high-single-digit dividend growth over the next few years or so.

And I think that’s a pretty good expectation for the long run, too.

Bolting that kind of dividend growth on top of the 3% starting yield is a pretty nice way to build serious wealth and passive income over time.

Financial Position

Moving over to the balance sheet, BlackRock has a fantastic financial position.

The long-term debt/equity ratio is 0.3, while the interest coverage ratio is nearly 30.

Profitability is extremely robust.

Over the last five years, the firm has averaged annual net margin of 31.2% and annual return on equity of 14.8%.

It’s clear to me that this is a best-in-class business with high returns on capital and a stellar balance sheet.

And with massive scale, a “sticky” asset base, a diversified product mix, and global brand recognition, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

The very business model introduces exposure to global capital markets and the associated volatility.

BlackRock has exposure to economic cycles, and a recession would likely reduce asset valuations – along with AUM, fees, and profits.

The shift from active to passive strategies moves capital away from certain higher-fee products, but BlackRock’s leadership in ETFs mitigates this risk.

The law of large numbers is a key risk, and BlackRock’s huge AUM base makes it challenging to grow at a high rate in percentage terms.

BlackRock is a global entity with geopolitical risks.

I see most of these risks as being pretty standard for a very large asset manager, but BlackRock is anything but standard.

And with the stock down more than 30% from its all-time high, the valuation is now anything but standard…

Stock Price Valuation

The stock is trading hands for a P/E ratio of 20.3.

That’s roughly in line with its own five-year average.

However, most other multiples are more favorable.

Take the cash flow multiple, for instance.

At 20.2, it’s well off of its own five-year average of 26.8.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 7.5%.

This dividend growth rate is on the high end for me, but it’s not as high as I can go.

But I think it’s warranted here.

It’s much lower than the demonstrated dividend growth over the last decade.

It’s also below the proven EPS growth over the last 10 years.

Based on where the near-term EPS growth forecast is at, this kind of dividend growth could easily be supported – even while the payout ratio simultaneously compresses.

I don’t see anything unrealistic about this.

If anything, it’s mildly conservative.

The DDM analysis gives me a fair value of $860.00.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

After a sensible valuation model, the stock looks cheaply priced.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates BLK as a 4-star stock, with a fair value estimate of $810.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates BLK as a 5-star “STRONG BUY”, with a 12-month target price of $805.00.

We have a tight consensus this time around. Averaging the three numbers out gives us a final valuation of $825.00, which would indicate the stock is possibly 21% undervalued.

Bottom line: BlackRock, Inc. (BLK) is a best-in-class business that disproportionately benefits from a rising tide lifting all boats. With a market-beating yield, double-digit dividend growth, a reasonable payout ratio, nearly 15 consecutive years of dividend increases, and the potential that shares are 21% undervalued, long-term dividend growth investors would be wise to take a close look at this name right now.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is BLK’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 98. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, BLK’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income