The asset classes have no teacher and no grading system, but they are the subject of an important lesson for investors. When you know how to combine asset classes within your investment portfolio, you can tailor your risk and growth potential to suit your needs.

What is an asset class?

What is an asset class?

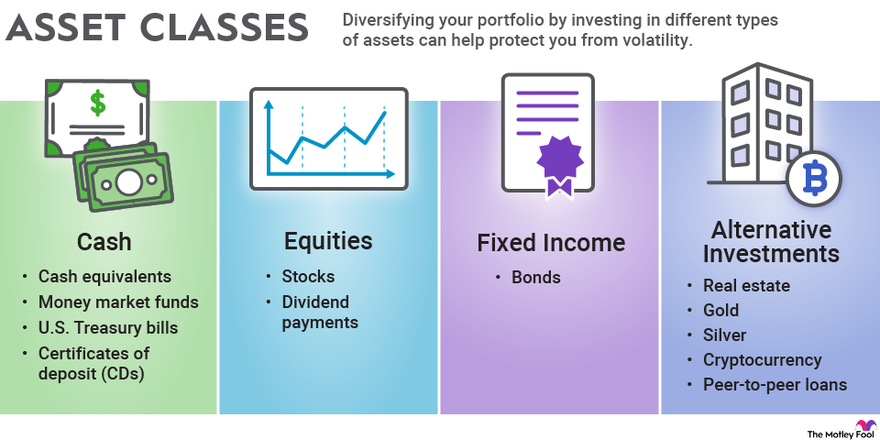

An asset class is a grouping of investments based on shared behaviors, characteristics, and regulations. Equities and cash are two of the asset classes, for example. Equities have their own risk, return, and liquidity profile, which is different from the risk, return, and liquidity profile of cash.

Types of asset classes

Here are the four primary asset classes:

- Cash and cash equivalents. You know what cash is — the legal tender we use to buy goods and pay debts. Cash equivalents are investments that can easily be converted into cash. Examples include money market funds and U.S. Treasury bills and certificates of deposit (CDs) that mature within three months.

- Equities. Equities are shares of ownership in a company, also known as stock. The value of equities can rise or fall based on the company’s performance, investor demand, and other factors. Ideally, stocks increase in value over time, creating returns for investors. Some stocks also result in dividend payments.

- Fixed income. Fixed-income securities, or bonds, are loans that are split up into units and sold to investors. Investors provide the principal up front and then receive interest payments until the security matures. At maturity, investors are repaid the principal. The principal does not increase in value over time the way a stock would, but fixed-income securities should provide predictable income.

- Alternative investments. Alternative investments is a catchall asset class for anything that’s not cash, equities, or fixed income. Real estate, precious metals, cryptocurrency, and peer-to-peer loans are alternative investments.

Understanding asset classes

Understanding how asset classes behave relative to each other helps you manage risk in your portfolio. As shown in the table below, each of the conventional asset classes offers its own level of risk and reward.

Table by author.

Table by author.

Equities have the most growth potential, but what goes up can also go down. There is no free lunch, so to speak — if you want growth, you must accept volatility.

If it weren’t for that volatility, investors might put all their wealth into the stock market where they can generate the largest returns. But it’s possible for a stock portfolio to temporarily lose 20% or 30% of its value very quickly.

You can protect yourself from that volatility by diversifying your portfolio — or holding different asset classes alongside your equities. Cash, fixed income, and alternative assets aren’t directly affected by all the same factors that influence the stock market.

In investor-speak, those other asset classes have a low or negative correlation to equities. In practical terms, if the stock market crashes, your cash balance won’t change, nor will the interest payments you receive from your fixed-income securities.

The importance of diversification

You can test how diversification protects you from major market fluctuations with some simple calculations. The table below shows how four portfolios would respond to a 30% decline in the S&P 500, which is a major stock market index. For simplicity, these portfolios hold cash and S&P 500 index funds only.

Table data source: Author calculations.

Table data source: Author calculations.

As you can see, the all-equity portfolio mimics the 30% market decline. The portfolios with cash and equities aren’t impacted as dramatically.

Of course, any buffer against market volatility always works both ways. If your diversification into cash or fixed-income protects you from market crashes, it also limits your access to market growth. In short, your asset mix heavily influences your portfolio’s risk level and its growth potential.

Diversification within asset classes

You can also manage risk by diversifying within the asset classes. This involves holding multiple equities and multiple fixed-income securities. You can and should be precise about this diversification for two reasons:

- Diversifying into stocks that share risk factors doesn’t help you much. Spread out your exposure across companies of different sizes that operate in separate industries.

- You can diversify too much — to the point that each additional security reduces your growth more than it limits your risk. This is known as over-diversification. You can get over-diversified by holding too many individual stocks or by investing in funds with overlapping portfolios.

How does diversification work?

As you think about how to diversify your portfolio, consider the various levels of risk you face. For example:

- A single company can falter. The possibility that a single company can falter or fail is what investors call unsystematic risk. Problems specific to one company usually arise from issues that are within management’s control such as production, product quality, or strategic direction. If the company shows poor financial results, the stock price may decline. In extreme cases, the company could default on its debts and go into bankruptcy. You’d protect yourself against unsystematic risk by owning around 20 individual stocks or bonds. Alternatively, you could invest in index funds or mutual funds that hold many stocks or bonds.

- An industry can falter. Entire industries can falter, too. Changing consumer behaviors, regulatory factors, and other broad trends can put pressure on all companies in one industry. As an example, movie rental retail chains no longer exist, in part because customers prefer streaming to physical rentals. You’d protect yourself against industry-specific risk by — you guessed it — investing in various industries.

- The entire stock market can falter. Macroeconomic trends such as recession or a global pandemic can limit business performance across industries and even geographies. These broader trends can lead to bear markets, stock market corrections, and the dreaded stock market crash. This is what’s called systematic risk. Systematic risk is unpredictable and unavoidable. You can lessen your exposure to systematic risk — but not eliminate it — by diversifying into non-equity asset classes.

The bottom line on asset classes and investment diversification

To wrap this up, here’s some homework for you. Review what you know about these five investment vocabulary words: asset class, correlation, diversification, unsystematic risk, and systematic risk. Then think about how to apply these concepts to your own investment portfolio. You’ll know you’ve passed with flying colors when you’re comfortable with your portfolio’s risk and excited about its growth potential.

— Catherine Brock

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: The Motley Fool