Interest rates are topping out—and it’s finally time for us contrarians to get greedy. We’ll start with a group of funds throwing off double-digit yields and trading at big discounts.

In fact, I’ll hand you a ticker that’s throwing off a 10% dividend—paid monthly—shortly. We’re buying bonds again today because interest rates are topping. And when rates fall, bond prices rise. It really is that simple.

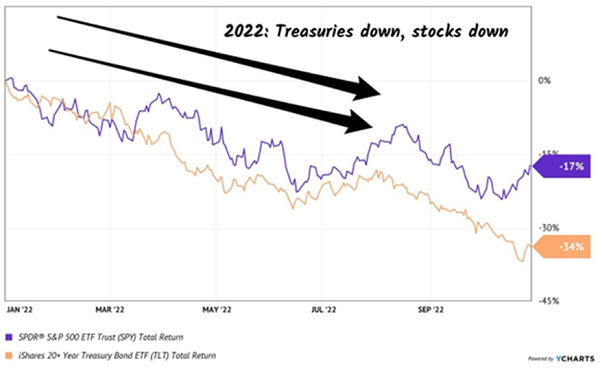

To see what I’m getting at, think back to last fall. Stocks and bonds were both hammered, putting a big dent in the idea that the vaunted 60/40 portfolio—a long-touted retirement mix of 60% stocks and 40% bonds—was safe.

T-Bonds Crashed and Burned in ’22

That plunge in bond prices sent yields soaring—until they smacked into the 4% level last October. That was our buy signal, because every time bond prices zoomed higher over the preceding 15 years, the “4% lid” held strong. It did the same last year, sending bond yields lower (and prices higher).

That plunge in bond prices sent yields soaring—until they smacked into the 4% level last October. That was our buy signal, because every time bond prices zoomed higher over the preceding 15 years, the “4% lid” held strong. It did the same last year, sending bond yields lower (and prices higher).

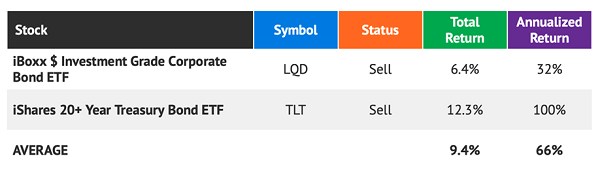

We played that bond bounce in my Contrarian Income Report advisory through two ETFs: the iBoxx $ Investment Grade Corporate Bond ETF (LQD), which we picked up in the October issue, and the iShares 20+ Year Treasury Bond ETF (TLT), our November buy.

Boy, did these moves pay off:

Fast-forward to today and the yield on the 10-year is around 3.4%. That’s still below 4%, but no matter—rates are topping yet again. Sure, the Fed is still making noises about another possible hike, but c’mon, man. There’s a banking crisis going on, with PacWest Bancorp (PACW), the latest to be put on life support. Plus inflation is in retreat and, yes, we’re looking at a recession, likely in just a few months.

Fast-forward to today and the yield on the 10-year is around 3.4%. That’s still below 4%, but no matter—rates are topping yet again. Sure, the Fed is still making noises about another possible hike, but c’mon, man. There’s a banking crisis going on, with PacWest Bancorp (PACW), the latest to be put on life support. Plus inflation is in retreat and, yes, we’re looking at a recession, likely in just a few months.

That means bond yields have further to fall. And our price upside is just getting going.

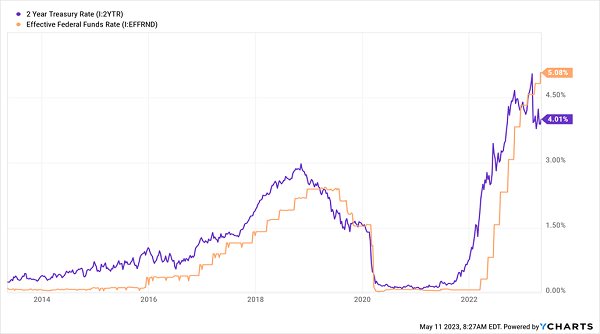

The yield on the 2-year Treasury, which has a long record of predicting where the Fed will head next, agrees: it’s called the top on this rate-hike cycle and sees rates heading lower by a full percentage point.

The 2-Year Knows the Fed’s Next Move Long Before Powell Does

Lower rates = higher bond prices. Which is what’s driving our “second shot” at locking in high bond yields at a bargain. But what are we going to buy?

Lower rates = higher bond prices. Which is what’s driving our “second shot” at locking in high bond yields at a bargain. But what are we going to buy?

TLT, our ETF play from back then, still looks good. And for once it actually pays: its posted yield is just 2.8%, but its 30-day SEC yield—a truer measure—comes in at 3.7%.

But that’s below the 4.1% SEC yield we got in the fall. Which is one reason why I recommend passing on bond ETFs and going with CEFs. Another? The bargains in CEF-land are simply too big to ignore.

Consider the DoubleLine Income Solutions Fund (DLY), which yields a gaudy 10% now and sports a 7% discount to NAV. Given that this fund traded at a 4% discount in mid-January 2022, as this rate-hike cycle was about to kick off, I expect the current markdown to be chopped in half (or more) as rates top out and roll over.

Closing CEF “discount windows” are one of our favorite ways to profit at Contrarian Income Report because they give us a coupon on top of a coupon. We get to buy a fund whose holdings are oversold and we get the CEF itself at a discount, too.

The other thing we need to talk about is the edge that human managers have in the bond world. Here, hardworking pros with deep connections make a big difference because they get tipped off when hot new bond issues hit the market.

Algorithm-driven ETFs just can’t compete. And DLY’s manager, none other than the “Bond God” himself, Jeffrey Gundlach, is as connected as they come. Plus, DLY converts its portfolio returns into dividend cash it hands us in the form of that fat 10% monthly payout. (That’s another nice benefit of corporate-bond CEFs, as 34 of the 36 or so out there pay every month.)

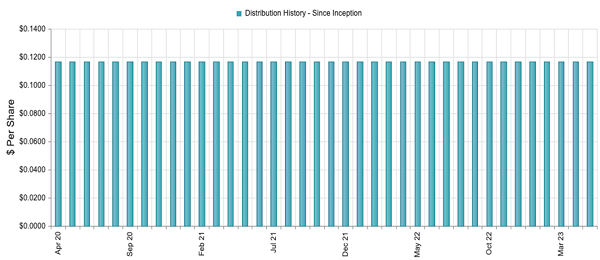

And DLY’s 10% payout is as steady as they come. Check out the steady beat of monthly dividends we’ve seen since the fund launched in February 2020. DLY’s stormy start in the early days of the virus let Gundlach pick up high-yield credit quality than would otherwise be available with 7%+ yields:

Gundlach Converts His Bond Wins Into a Monthly 10% Payout

Source: CEF Connect

Source: CEF Connect

Put it all together and the opportunity we have in front of us is clear. As is the fact that when it comes to corporate bonds, it pays—in both dividends and upside—to go with CEFs.

— Brett Owens

4 Incredible Income Plays Dropping 9%+ Dividends (With 20%+ GAINS Ahead, Too) [sponsor]

These 3 investments are a great start if you’re dipping a toe into the high-yield world. But my 4 favorite dividend payers are a better play—they’re a special group of funds that yield 9% on average and send their payouts your way every single month.

In fact, these 4 diversified income buys are so cheap I’m calling for 20%+ price upside from them in the next 12 months, to go along with their huge 9%+ payouts.

Click here to get the full story on these 4 incredible 9%+ monthly payers, along with a unique opportunity to download a FREE Special Report revealing their names, tickers, current yields and more.

Source: Contrarian Outlook