What’s up with floating-rate funds? Why haven’t they all, well, floated higher in price as interest rates have risen over the past couple of years?

Is there any hope that they’ll finally float?

Today we’ll discuss five such funds—underperforming yet now cheap because of it—yielding up to 11.7%. Can they live up to their billing? We contrarians want to know because they are trading at large discounts to their net asset values (NAVs).

First, a primer on floaters. Floating-rate securities such as bank loans have variable coupons (interest payments) that are recalculated regularly—often quarterly, sometimes monthly—to reflect changes in short-term interest rates. Typically, rates will start with a reference rate (say, the Fed funds rate) and have a defined payout percentage tacked on. If that reference rate heads higher, so too does the coupon’s payout.

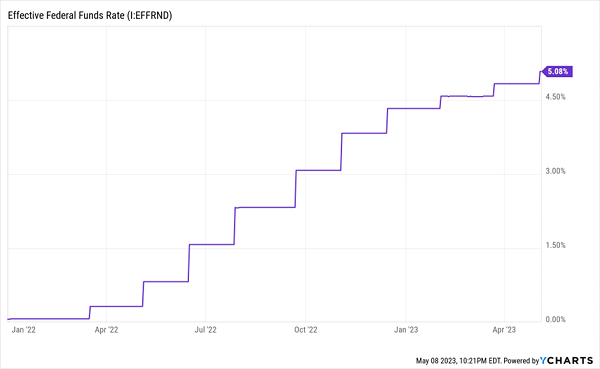

In theory, then, the Fed’s nonstop hikes over the past year-plus should’ve been quite the catalyst for floaters. But, for whatever reason, that hasn’t happened:

Fed Rate Up…

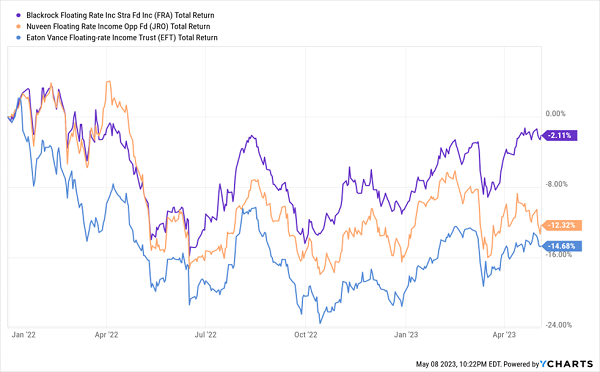

… Floaters Down

… Floaters Down

Yes, variable-rate bank loans have a natural leg up on fixed-rate debt. Which is exactly why they haven’t cratered nearly as hard as Treasuries and other traditional bonds. But they still have credit risk—and it’s that credit risk that has made them less than steady in this economic environment.

Yes, variable-rate bank loans have a natural leg up on fixed-rate debt. Which is exactly why they haven’t cratered nearly as hard as Treasuries and other traditional bonds. But they still have credit risk—and it’s that credit risk that has made them less than steady in this economic environment.

So, when might bank loans have their day? Research from AllianceBernstein points at what you should be looking for:

“In fact, history suggests that the best time to buy bank loans isn’t when rates are rising but after growth has slowed, the Fed has reduced interest rates and companies have started to clean up their balance sheets and repair their credit metrics.”

That day might not be today, but it’s nearing. The Fed has already signaled that its rate hikes might be at an end. And growth is indeed slowing—U.S. GDP was up just 1.1% in Q1, and economists expect a tepid 0.3% number come Q2.

The time to buy might be soon—and better still, several floating-rate strategies not only are offering 10.9% to 11.7% yields at deep nominal discounts to their net asset values (NAV), but they’re even trading more cheaply than their long-term averages.

We’ll start with a pair of Nuveen funds: Nuveen Floating Rate Income Opportunity (JRO, 11.4% distribution rate) and Nuveen Senior Income Fund (NSL, 11.4% distribution rate).

Floating Rate Opportunity must invest at least 65% of its portfolio in adjustable-rate senior secured loans—effectively, the highest priority in any company’s capital structure. The rest of the portfolio can be made up of unsecured senior loans, as well as secured and unsecured subordinated loans. Nuveen Senior Income has a slightly stricter mandate, insisting on at least 80% investment in senior secured loans.

But despite differing ground rules, they’re being managed very similarly, with both sitting on 82%-83% in senior loans, another 15% in corporate bonds and the rest scattered among common stocks, warrants and other assets. Their debt leverage usage is similar, too, at a sky-high 39% apiece.

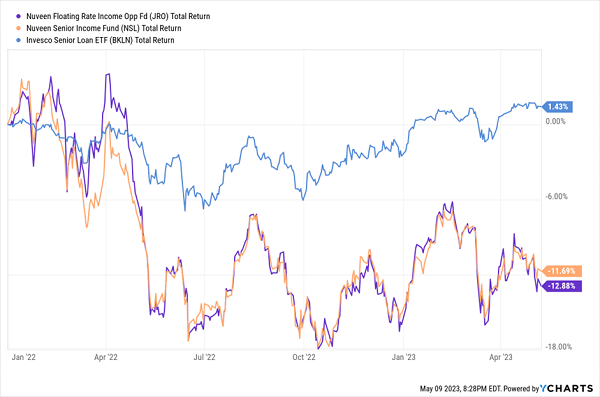

They’re Managed Alike, And They Act Alike

Unsurprisingly, there’s little difference in how the pair have performed since the start of 2022, when rate-hike fears really started in earnest—followed by the actual ramp-up in the Fed funds rate. Both were crushed compared to the plain-Jane Invesco Senior Loan ETF (BKLN), largely thanks to that high leverage amplifying losses.

Unsurprisingly, there’s little difference in how the pair have performed since the start of 2022, when rate-hike fears really started in earnest—followed by the actual ramp-up in the Fed funds rate. Both were crushed compared to the plain-Jane Invesco Senior Loan ETF (BKLN), largely thanks to that high leverage amplifying losses.

However, both now trade at considerable discounts of roughly 13% to NAV, both of which are deeper deals compared to their longer-term averages of about 10%.

One of the deepest discounts among floating-rate funds is the Apollo Senior Floating Rate Fund (AFT, 10.9% distribution rate), which typically trades at an 11% discount to NAV, but currently is trading at 15%—that’s just 85 cents on the dollar!

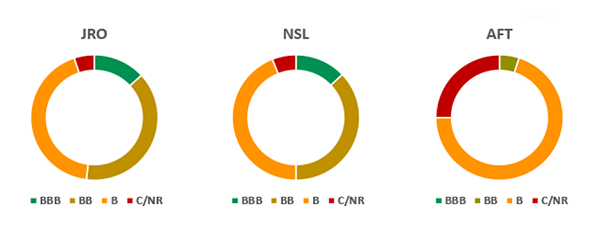

AFT is committed to investing at least 80% in senior secured loans; in reality, it has much more than that, at 93% versus just 7% in bonds. But what stands out most is the CEF’s credit profile:

AFT Deals in Much Riskier Loans

Interestingly, that loan profile hasn’t made much of a difference during the broader downturn, even despite a hefty 36% in debt leverage. But it has given AFT a long-term performance edge against the two Nuveen funds.

Interestingly, that loan profile hasn’t made much of a difference during the broader downturn, even despite a hefty 36% in debt leverage. But it has given AFT a long-term performance edge against the two Nuveen funds.

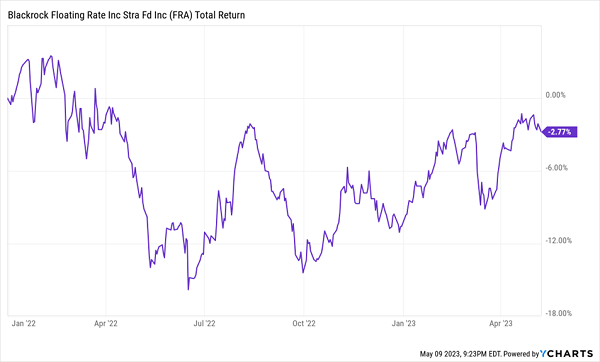

BlackRock Floating Rate Income Strategies Fund (FRA, 11.3% distribution rate) sits between JRO/NSL and AFT from a credit-quality standpoint. And it’s even more strictly invested in bank loans, which make up 97% of the portfolio.

FRA sticks out for its (relatively) low usage of debt leverage—about 25% compared to the mid to high 30s of the other CEFs on this list. That’s not as helpful on the way up, but it has helped BlackRock’s fund lose less on the way down.

3% Losses Aren’t Great, But They’re Better Than the Alternatives

The flip side? FRA isn’t cheap. Yes, it’s trading at a roughly 9% discount to NAV, but that figure is par for the course over the past five years.

The flip side? FRA isn’t cheap. Yes, it’s trading at a roughly 9% discount to NAV, but that figure is par for the course over the past five years.

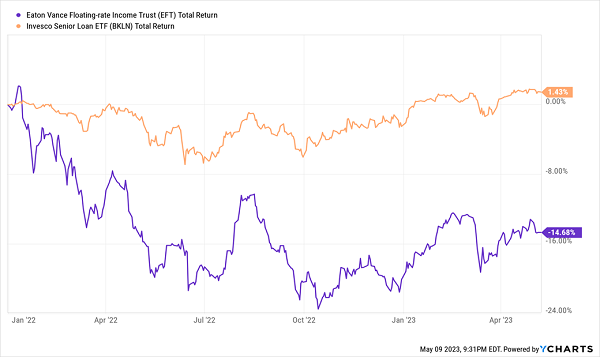

Then we have our old friend Eaton Vance Floating-Rate Income Trust (EFT, 11.7% distribution rate). Manager Ralph Hinckley and his predecessor, Scott Page, have historically done well in rising-rate environments because their loans, on average, reset every 45 days. EFT isn’t stranded when rates rise—Ralph and Scott usually cycle into higher-paying investments.

Ralph and his predecessor, Scott Page, have done well in rising rate environments because their loans, on average, reset every 45 days. EFT isn’t stranded when rates rise—Ralph and Scott usually cycle into higher-paying investments. But this latest interest-rate cycle has proven too quick for most bank loan managers, Ralph included.

Ralph Had a Rough Go This Time Around

The good news? EFT should be in prime position once the cycle becomes more favorable to bank loans. For now, you can capture a deeper-than-usual 11% discount to NAV on the CEF’s shares.

The good news? EFT should be in prime position once the cycle becomes more favorable to bank loans. For now, you can capture a deeper-than-usual 11% discount to NAV on the CEF’s shares.

— Brett Owens

Give Me 4 Minutes, I’ll 4X Your Retirement Income [sponsor]

Of course, I get a little twitchy whenever I think about potential retirement holdings whose success relies on the whims of Jerome Powell.

Yes—most stocks and funds will at least feel some effect from the Fed’s comings and goings. But when it comes to securing a sturdy retirement, we need to rely on high-yielding holdings that can show resilience no matter the market or monetary environment.

We need to plan out our income with laser precision to guarantee ourselves a cozy, comfortable retirement without bleeding our nest eggs dry. Fortunately, there are plenty of safe harbors in our “Perfect Income” portfolio—and you can enjoy their security and sky-high dividends, too.

The perfect dividend retirement stocks have several things in common:

- They pay you consistently, predictably and reliably.

- They’re built to survive—even thrive—in market crashes.

- They deliver double-digit returns, with safe, secure investments.

- They take just a few minutes every month to “manage.”

- They DON’T involve day trading, buying on margin or any other risky strategy.

- They DON’T involve gambling on penny stocks, Bitcoin or buying puts and calls.

Getting each and every one of these things from any single holding might sound impossible. But it’s par for the course for every position in my “Perfect Income” portfolio.

Let me show you the stocks and funds you need to stabilize your retirement. But more importantly, let me teach you more about this incredible strategy itself and make you a better investor in the process!

Take control of your financial legacy today. Click here for my newly updated briefing on the Perfect Income Portfolio!

Source: Contrarian Outlook