Comcast Introduction

What comes to mind when most people think about Comcast (CMCSA)?

Could it be Comcast’s products and services delight their customers? The following statement from the President of Comcast Corporation Michael Cavanagh at the Q1 2023 earnings call certainly got me fired up.

… our position as a scaled leader in very large and profitable markets with tens of millions of customers paying us over a $100 per month…

“People must love the Comcast experience to pay so much for it,” was our first thought.

FAST Graphs Analyze Out Loud Video on Comcast

Let’s Dig A Little Deeper – The Bad

Now, if customers have no real alternatives of getting their broadband other than through Comcast or a few other broadband and cable TV providers because these companies operate in an oligopoly, then the “$100 per month” fees that these “tens of millions of customers” are paying Comcast are out of a lack of choice rather than a case of them liking Comcast over other competitors.

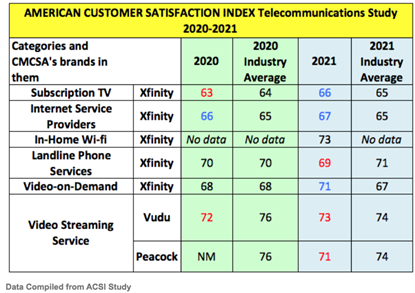

Other than the high costs of its services, the quality of service is also in question too. The American Customer Satisfaction Index Telecommunications Study (ACSI), a trusted “national indicator of the quality of economic output for goods and services as experienced by consumers of that output”, conducted a study of the different telecommunications companies in the United States for the years 2020 and 2021. CMCSA did not exactly impress.

The Ugly

The Ugly

CMCSA has the dubious honor of having received the highest share of negative response to their customer service. A check on Trustpilot reveals CMCSA’s dismal score.

Could those be the reasons why what comes to mind could be the term “cord cutters”? Many may think that CMCSA is a dying cable business because millennials are not interested in Cable TV anymore; the high prices and poor service certainly did not help retain customers. As of April 2023, the number of customers in the United States willing to pay for cable TV fell below 50% of its residential customers.

Could those be the reasons why what comes to mind could be the term “cord cutters”? Many may think that CMCSA is a dying cable business because millennials are not interested in Cable TV anymore; the high prices and poor service certainly did not help retain customers. As of April 2023, the number of customers in the United States willing to pay for cable TV fell below 50% of its residential customers.

CMCSA has also been embroiled in multiple lawsuits. Now, I get it that big companies get sued all the time. However, when a huge number of these cases got to do with allegations of fraud or misrepresentation of facts, the very integrity of the company becomes undermined. And when a company’s business practices is being doubted, it can make trusting certain information that the company presents a tough one to swallow.

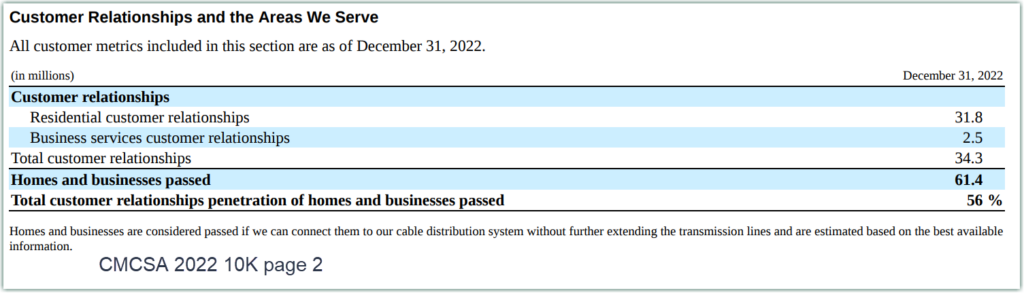

Take for example the following information that is presented on page 2 of the 2022 annual report, informing readers of the areas that CMCSA serves.

If that information can be trusted, it will mean that the “total customer relationships penetration of homes and businesses passed” of 56% in 2022 is a better result than that of 10 years ago at 53.8%. But when CMCSA admits to giving the wrong broadband map to the (Federal Communications Commission) FCC, with implications on getting federal grants for expanding broadband connectivity, to blocking rivals from getting the same grant, this is serious on many levels.

If that information can be trusted, it will mean that the “total customer relationships penetration of homes and businesses passed” of 56% in 2022 is a better result than that of 10 years ago at 53.8%. But when CMCSA admits to giving the wrong broadband map to the (Federal Communications Commission) FCC, with implications on getting federal grants for expanding broadband connectivity, to blocking rivals from getting the same grant, this is serious on many levels.

With the above as our backdrop, let’s study the business.

The Good

The Business

According to the 2022 Annual Report, Comcast (CMCSA) describes itself as

… a global media and technology company with three primary businesses: Comcast Cable, NBCUniversal and Sky. We were incorporated under the laws of Pennsylvania in December 2001. Through our predecessors, we have developed, managed and operated cable systems since 1963. Through transactions in 2011 and 2013, we acquired NBCUniversal, and in 2018, we acquired Sky. We present our operations in five reportable business segments:

(1) Comcast Cable in one reportable business segment, referred to as Cable Communications;

(2) NBCUniversal in three reportable business segments: Media, Studios and Theme Parks (collectively, the “NBCUniversal segments”); and

(3) Sky in one reportable business segment.

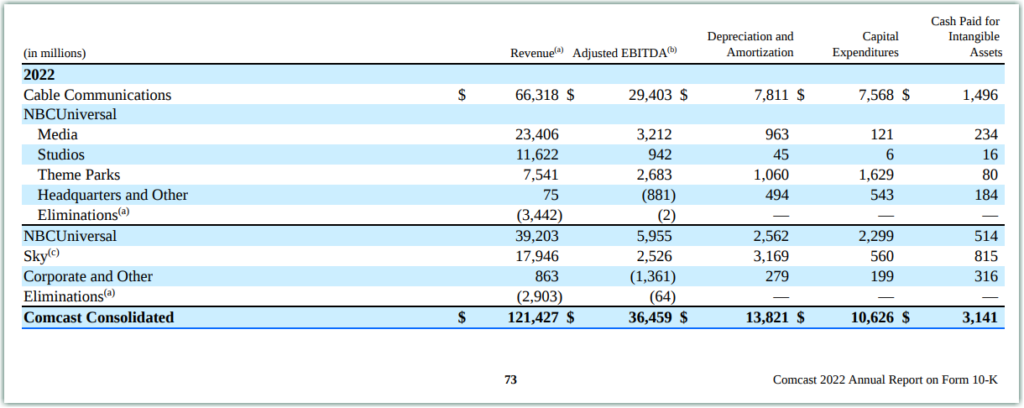

The results for 2022 are presented below. The largest segment is the Cable Communications Segment, at 52% of the full-year consolidated revenue.

A Company In Transition And Transformation

A Company In Transition And Transformation

Investors new to Comcast may not know but back in 2010, this segment was responsible for 95% of CMCSA’s revenue. Out of the full-year 2010 revenue of $37.9 billion, the Cable Segment was responsible for $35.8 billion of that. Since then, management has been diversifying the revenue stream to bring that figure down. By 2013, 64.6% of the full-year revenue ($41.8 billion out of $64.7 billion) came from the Cable Communications Segment. And by 2022, just 52% of the revenue is generated by the Cable Communications Segment.

How Did Comcast Get Here

How Did Comcast Get Here

To more fully understand where Comcast Corporation (CMCSA) is headed requires an appreciation that this is a company that has undergone multiple transformations in the past 15 years to get here.

In the 2008 annual report, CMCSA described itself as

… the nation’s leading provider of cable services, offering a variety of entertainment, information and communications services to residential and commercial customers. As of December 31, 2008, our cable systems served approximately 24.2 million video customers, 14.9 million high-speed Internet customers and 6.5 million phone customers and passed over 50.6 million homes in 39 states and the District of Columbia. We report the results of these operations as our Cable segment, which generates approximately 95% of our consolidated revenue… Our other reportable segment, Programming, consists primarily of our national programming networks, including E!, Golf Channel, VERSUS, G4 and Style.

CMCSA’s main competitors back in 2008 were other direct broadcast satellite (“DBS”) operators and phone companies. The operating margins for the Cable segment were 40.6%. The competitors then were mainly AT&T (T) and Verizon (VZ).

The Great Financial Crisis

The Great Financial Crisis provided an opportunity for CMCSA to diversify its revenue stream into the entertainment industry by buying out NBCUniversal from General Electric (GE). This naturally means CMCSA now competes with entertainment giants like Disney (DIS) and its Marvel and Star Wars franchise, Warner Bros Discovery (WBD) and its DC Universe with even more superhero-genre, Netflix (NFLX) with its original content expertise, Apple (AAPL) with its billions invested in Apple TV+; and more recently we have Amazon (AMZN) throwing itself into the fray with its MGM acquisition in 2022.

CMCSA is no slouch. Its multi-year evolution in the media and entertainment business only started with the NBCU acquisition which came with it not just content but also the world-renowned theme park Universal Studios (Disney is the only other company above that has something like that) and film production capabilities with Universal Pictures.

That was followed by DreamWorks Animation in 2016, Sky in 2018 to offer streaming services to Europe, before launching the Peacock streaming service in the United States in 2020. The $0 tier that Peacock offered (discontinued in 2023) definitely helped to boost its subscription numbers. Even so, at $5 a month for the full Peacock library, it remains one of the most affordable streaming services out there, a key consideration when many are tightening their purse strings.

In 2015, Alan Wurtzel, NBCUniversal’s audience research chief, spoke to New York Post in an interview about the change in millennials’ content consumption behavior, expressing his shock at the double-digit increase in usage of streaming and smartphones, so I doubt management underwent the transformation they did because they had the foresight a decade ago to address the issue of cord-cutting. However, when CMCSA decided to shift to streaming, which is apparently the right move, they moved fast.

In 2015, Alan Wurtzel, NBCUniversal’s audience research chief, spoke to New York Post in an interview about the change in millennials’ content consumption behavior, expressing his shock at the double-digit increase in usage of streaming and smartphones, so I doubt management underwent the transformation they did because they had the foresight a decade ago to address the issue of cord-cutting. However, when CMCSA decided to shift to streaming, which is apparently the right move, they moved fast.

Thesis For Growth

Peacock Will Lead The Way

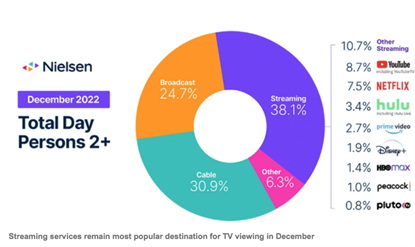

According to this August 2022 research from Nielsen,

Amid the slowdown of new content on traditional television and reduced sports programming, streaming claimed the largest share of U.S. TV viewing in July—a first after four consecutive months of hitting new viewership highs. Streaming viewership in a given month has exceeded broadcast viewing before, but this is the first time it has also surpassed cable viewing.

Even the start of the football season in October 2022 which boosted television viewership by 12.4% from the low in August 2022 was insufficient to shake streaming’s leadership. And Peacock, despite its late start in the streaming business when compared to established peers, managed to capture 1% of the total streaming viewership in December 2022, it, according to data by Nielson.

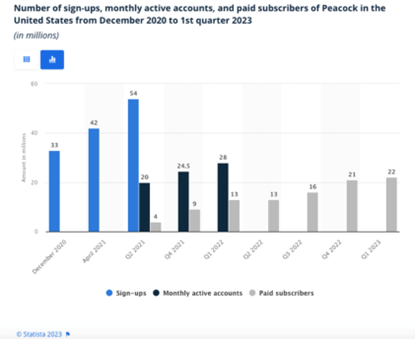

The growth is not just in the number of sign-ups, which many did when the service was first launched with a free tier option. The important metric is the number of paid subscribers, which increased more than 5-fold in 7-quarters from 4 million in Q2 2021 to 22 million in Q1 2023.

The growth is not just in the number of sign-ups, which many did when the service was first launched with a free tier option. The important metric is the number of paid subscribers, which increased more than 5-fold in 7-quarters from 4 million in Q2 2021 to 22 million in Q1 2023.

Paid subscribers of Peacock in the United States from December 2020 to 1st quarter 2023

Paid subscribers of Peacock in the United States from December 2020 to 1st quarter 2023

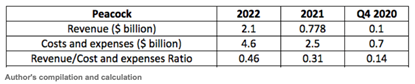

The ratio of revenue to costs and expenses in Q4 2020 was a very low 0.14 but by the end of 2022, that ratio has improved to 0.46 meaning the cost of acquiring each paid subscriber has come down. Once the ratio exceeds 1, the segment will be profitable.

Comcast President Mike Cavanagh shared his views about Peacock at the Q1 2023 earnings call,

Comcast President Mike Cavanagh shared his views about Peacock at the Q1 2023 earnings call,

Premium content with a dual revenue stream, both advertising and subscription fees, and we’re encouraged by our results so far, growing paid subscribers and engagement levels to roughly 20 hours per subscriber per month fuelling strong growth in advertising revenues. We’re investing, but the results we are seeing give us confidence that we are on the right path for Peacock to break even and grow from there.

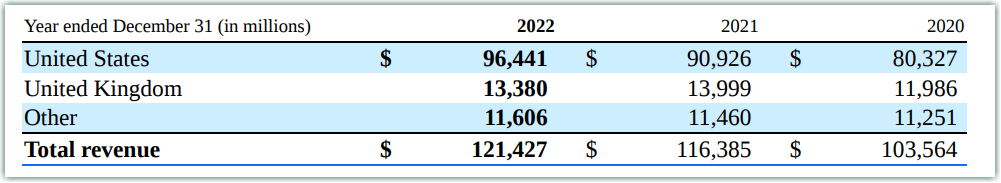

Before anyone gets too excited about the demonstrated growth of the streaming business, let’s put the $2.1 billion of revenue from Peacock into context.

CMCSA generates more than $100 billion in revenue every year from 2020 to 2022. $2.1 billion is just 1.73% of CMCSA’s total revenue for 2022. To be sure, since Peacock’s share of the total revenue in 2021 was even smaller at 0.67%, bulls can say that the revenue at Peacock had increased 2.5 times in just one year, which is remarkable but in the bigger scheme of things, Peacock by itself is not going to move the needle much. But that is not the point of Peacock, at least not yet. To think about Peacock just from a paid-subscriber point of view will be mistaken. Comcast President explains the strategy for Peacock,

CMCSA generates more than $100 billion in revenue every year from 2020 to 2022. $2.1 billion is just 1.73% of CMCSA’s total revenue for 2022. To be sure, since Peacock’s share of the total revenue in 2021 was even smaller at 0.67%, bulls can say that the revenue at Peacock had increased 2.5 times in just one year, which is remarkable but in the bigger scheme of things, Peacock by itself is not going to move the needle much. But that is not the point of Peacock, at least not yet. To think about Peacock just from a paid-subscriber point of view will be mistaken. Comcast President explains the strategy for Peacock,

Premium content with a dual revenue stream, both advertising and subscription fees, and we’re encouraged by our results so far, growing paid subscribers and engagement levels to roughly 20 hours per subscriber per month fuelling strong growth in advertising revenues.

With so much at stake and the billions spent on Peacock, eyes will be on the profitability and growth of this segment as its success is not a done deal. This is not segment that has a moat. Despite Peacock’s impressive library of content and it having unique shows, it is pit against content giants like Disney (DIS), Warner Bros Discovery (WBD), Netflix (NFLX), Apple (AAPL), and Amazon (AMZN). There will come a point when subscribers have to give up something.

CMCSA is definitely not depending on Peacock alone.

Other Growth Areas

Four growth areas were outlined at the conference call.

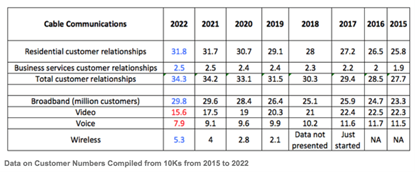

The first is in the Cable Communications segment. The increase in the number of customers for both the residential and business side have been increasing over the years.

In the hyper connected world today, people are consuming more content, at home, work, and even when they are on the go. That story is supported by the growth in the numbers of broadband and wireless customer. Growth in these areas are able to mitigate the decline in video and voice customers.

In the hyper connected world today, people are consuming more content, at home, work, and even when they are on the go. That story is supported by the growth in the numbers of broadband and wireless customer. Growth in these areas are able to mitigate the decline in video and voice customers.

The second area of growth comes from high-margin (almost 60%) Business Services. CMCSA’s 2.5 million domestic business customers is more than any of its competitor, giving it a head start in this segment. Its advanced network infrastructure is more suitable for serving commercial and government locations compared to the competitors offering legacy wire line and fixed wireless services.

The third area of growth maximizing CMCSA’s own slate of intellectual property – including special IP that is licensed like Harry Potter or Nintendo’s characters like Mario – to create experiences that can delight customers in its theme parks. There are 4 more theme parks to come – Donkey Kong, Epic, a themed park, and one for younger children – are coming online in the next two years and providing even more revenue streams to cover a wider range of audiences.

The fourth area of growth is content and streaming (Peacock). CMCSA has well-loved brands/characters like Jurassic, Minions, Halloween, Puss in Boots, Megan and now Super Mario Bros. Scoring movie hits is not a given but the beauty of having such a breadth of content is CMCSA does not have to depend on hits to bring in new customers and retain existing ones. Having a roster of famous characters that can be refreshed in sequels (think of all the good the never ending Marvel and Star Wars movies have benefited Disney) will do the trick.

Risks and Concerns

Intense competition has been raised in this article so we shall not repeat that again.

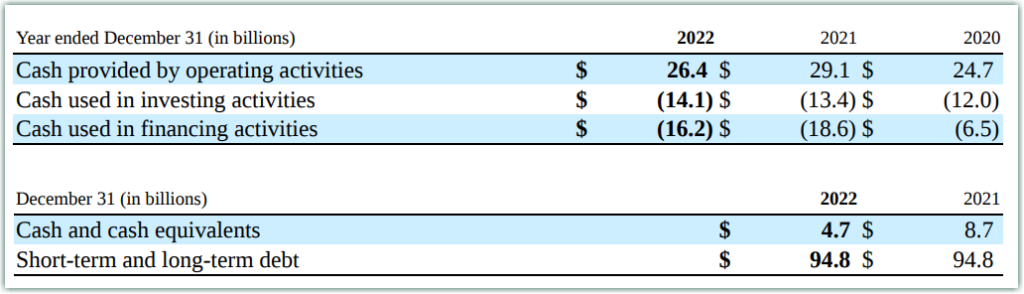

Investors should keep an eye on the debt situation. CMCSA is (at the point of writing) a $173 billion market cap company with $94.8 billion in debt.

At the same time, CMCSA businesses generates a lot of cash flows from operating activities. In 2022, CMCSA managed $26.4 billion in operating cash flow which is 27% of the total debt. So long as CMCSA can continue to growth that cash flow – and the four growth drivers outline above seem plausible – the company should be able to continue to handle all the current and long-term debt.

At the same time, CMCSA businesses generates a lot of cash flows from operating activities. In 2022, CMCSA managed $26.4 billion in operating cash flow which is 27% of the total debt. So long as CMCSA can continue to growth that cash flow – and the four growth drivers outline above seem plausible – the company should be able to continue to handle all the current and long-term debt.

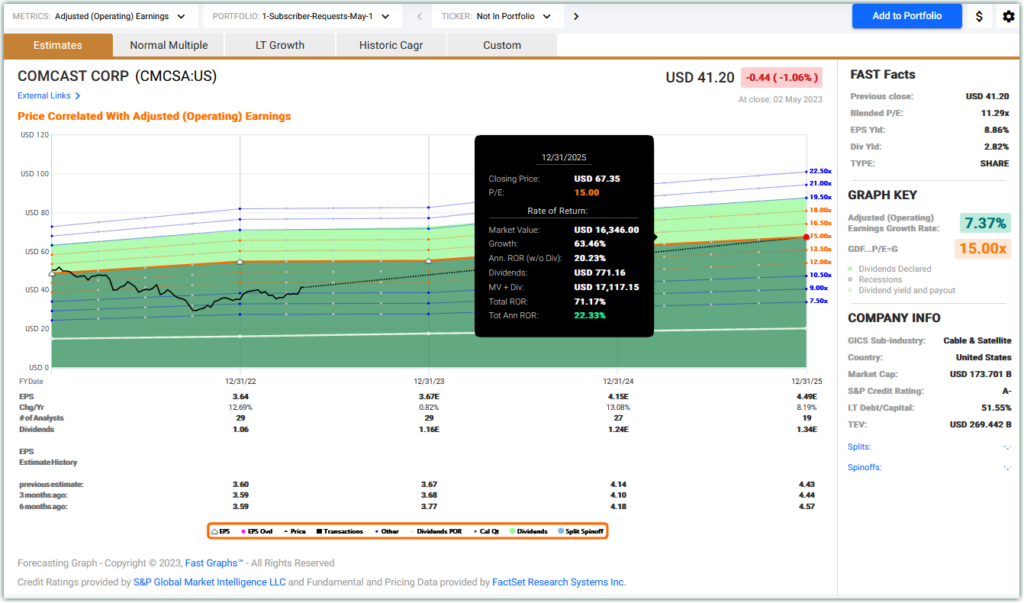

Valuation

Although the forecasts for earnings and sales have been lowered slightly over the past 6 months for FY 2023, 2024, and 2025, earnings are still expected to grow at an average rate of 7.37% through 2025. This reasonable growth expectation would imply a fair value P/E ratio of 15. Therefore, through the combination of 7.37% growth, P/E ratio expansion from 11.29 to a fair value P/E of 15, plus dividend income growth, would suggest a total annualized rate of return of 22.33% and a future fair value of $67.35 by 2025.

Morningstar is more bullish valuing CMCSA at $60, which indicates the company is significantly undervalued.

Conclusion

Conclusion

Comcast Corp operates in the cable and satellite sub industry sector; and is a company that has been quietly reinventing itself. Despite low customer satisfaction scores as reported in this paper, the company has been able to string together a persistent track record of earnings growth and dividend growth supported by strong generation of operating and free cash flow. Consequently, the fast-growing dividend appears well covered and safe.

Comcast has an S&P credit rating of A- with a moderate debt to ratio of 51.55%. The company has been out of favour, which has created a high value proposition currently. You can buy it today at a blended P/E ratio of 11.2 offering an earnings yield of 8.93%, which indicates a strong margin of safety. Historically, the company has traded at a premium price earnings ratio, which further supports attractive valuation. An investment in Comcast today offers the opportunity to more capital appreciate with a margin of safety, a dividend yield approaching 3%, and is growing rapidly.

— James Long and Chuck Carnevale

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: FAST Graphs