“Past performance is no guarantee of future results.”

It’s one of the most-used sentences in the entire investment world.

It’s definitely correct – the past cannot be used to guarantee the future.

However, since the future is unknown, the past is all we have to go on.

It begs a question: If a company has been successful for 100+ years, does not that portend a successful tomorrow?

I’d argue that a company that’s done well for a very long time is at least positioned to continue doing well for a long time to come.

There’s a certain inertia in place.

This line of reasoning is present in the dividend growth investing strategy.

This strategy espouses investing in world-class businesses that pay reliable, rising dividends.

These reliable, rising dividends are, of course, funded by reliable, rising profits.

The Dividend Champions, Contenders, and Challengers list contains pertinent information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

Again, there’s an inertia in place here.

Again, there’s an inertia in place here.

A proven ability to continually grow profit and the dividend for years on end already engenders a lot of confidence (but not guarantees) about the future.

I’ve followed the dividend growth investing strategy for years.

It’s guided me as I’ve gone about building the FIRE Fund.

That’s my real-money portfolio.

It produces enough five-figure passive dividend income for me to live off of.

Dividends have been covering my bills for years now.

I actually retired in my early 30s.

If you’re wondering how I was able to do that, my Early Retirement Blueprint spills the beans on it.

Suffice it to say, the dividend growth investing strategy has been critical to my success.

But it goes beyond strategy and investing in the right businesses.

But it goes beyond strategy and investing in the right businesses.

There’s also valuation at the time of investment, which is very important

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Investing in high-quality businesses with successful pasts, as partially evidenced by lengthy track records of growing dividends, and doing that investing when undervaluation is present, is a good way to to position oneself for a successful future.

This all makes sense, right?

But how do we figure out what a business might be worth?

Well, it’s not that hard.

My colleague Dave Van Knapp released Lesson 11: Valuation in order to make that process a lot easier.

It’s part of an overarching series of “lessons” on all matters relating to the dividend growth investing strategy, and it lays out a valuation system that can be applied toward almost any dividend growth stock you’ll run across.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Toronto-Dominion Bank (TD)

Toronto-Dominion Bank (TD)

Toronto-Dominion Bank (TD) is a Canada-based multinational banking and financial services corporation.

Founded in 1855, Toronto-Dominion, commonly known as TD, is now a $110 billion financial gargantuan that employs 100,000 people.

TD reports results across five business segments: Canadian Personal and Commercial Banking, 34% of FY 2022 revenue; U.S. Retail, 25%; Wealth Management and Insurance, 22%; Wholesale Banking, 10%; and Corporate, 9%.

One of the two largest Canadian banks, TD has branched out into the US in a major way and now has the most US branches out of all Canadian banks.

The banking business model is as enduring as it is powerful.

It’s a business model that dates back into antiquity.

It’s been around since our species gathered into societies.

Since the flow of money, goods, and services all depend on banking, modern-day capitalism has served to catapult banking into the next echelon.

As impressive as the endurance is, the power of the business model might be even more impressive.

That power stems from the “float” – the low-cost and low-risk source of capital that accrues to a bank through sticky deposits.

The float allows a bank to fund loans and other ventures in order to earn a return.

It’s essentially earning money from other people’s money, which is the best possible way to earn money.

If all of that weren’t good enough already, TD takes all of this and supercharges it by way of a home market advantage.

That’s because TD is based in Canada.

Canada has a very concentrated banking industry that is dominated by five very large banks.

TD is part of the “Big Five”.

Running a bank can be quite lucrative.

Running a bank within a country-wide oligopoly can be especially lucrative.

This has all added up to TD being able to routinely grow its revenue, profit, and dividend.

Dividend Growth, Growth Rate, Payout Ratio and Yield

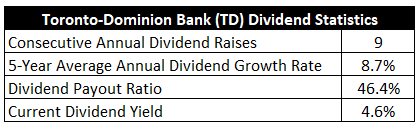

Indeed, TD has increased its dividend for nine consecutive years.

However, this short track record belies the bank’s rich dividend history.

TD, as it exists today, has been formed through a series of mergers, which clouds things, but we can trace a steady dividend payment back to more than 160 years ago.

That’s phenomenal.

That’s phenomenal.

The five-year dividend growth rate of 8.7% is solid in and of itself.

But it’s the stock’s market-beating yield of 4.6% that makes this a compelling yield-and-growth package.

This is a rare situation where you get both a high yield and a high dividend growth rate.

That yield, by the way, is 70 basis points higher than its own five-year average.

Making matters better, the 46.4% payout ratio provides plenty of headroom for more sizable dividend raises in the years ahead.

I really don’t see anything to dislike here when it comes to the dividend.

Revenue and Earnings Growth

As likable as the dividend metrics may be, they’re mostly looking backward.

However, investors must look forward and acknowledge that today’s capital is being risked for tomorrow’s rewards.

Therefore, I’ll now build out a forward-looking growth trajectory for the business, which will assist greatly when it comes time to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then uncover a professional prognostication for near-term profit growth.

Amalgamating the proven past with a future forecast in this manner should give us what we need to roughly gauge where the business might be going from here.

TD increased its revenue from CAD $27.3 billion in FY 2013 to CAD $49 billion in FY 2022.

That’s a compound annual growth rate 6.7%.

Really good top-line growth here.

Meantime, earnings per share grew from CAD $3.46 to CAD $9.47, which is CAGR of 11.8%.

Terrific.

And what’s perhaps even more terrific is the way in which the growth was consistently sustained.

The last decade was just a steady march higher for TD’s revenue and EPS.

A general improvement in profitability across the board helped to drive a lot of excess bottom-line growth.

Now, a lot of banks have been challenged around growth over the last decade.

That’s not surprising.

From low interest rates to a global pandemic, it’s been a really tough period for banks.

But TD has put up some of the best numbers I’ve yet seen compared to other banks I’ve reviewed.

Looking forward, CFRA is projecting that TD will compound its EPS at an annual rate of 6% over the next three years.

CFRA sees “…elevated interest rates leading to improved net interest income.”

Of course.

It’s a bonanza right now compared to what banks have been dealing with over most of the last 10 years.

However, CFRA balances this favorable rate environment against “weakness in underwriting and advisory fees given a soft economy.”

There are a few other things that TD has to juggle.

First, acquisitions.

TD recently acquired US-based advisory firm Cowen Inc. for $1.3 billion.

Cowen should accentuate TD Securities, TD’s investment bank arm.

There’s also the still-pending acquisition of First Horizon Corp. (FHN) for $13.4 billion, which is an acquisition that has faced significant regulatory scrutiny and may also be due for a markdown on pricing.

In addition, TD owns approximately 12% of Charles Schwab Corporation (SCHW) – a stake worth about $11.5 billion by itself.

One of the biggest question marks regarding TD might be the Canadian housing market, which has looked overinflated for quite a while now.

CFRA notes the “potential severe downturn in the Canadian housing market…” as a key risk facing TD.

Seeing as how Canadian banking is only about 1/3 of the business, though, I’m less leery about this issue compared to some of TD’s peers.

I’m willing to take CFRA’s forecast as the base case.

That would easily set up TD for similar, or better, dividend growth over the foreseeable future.

And you’re already starting off with a 4.6% yield.

I’m having trouble locating anything problematic about that.

Financial Position

Moving over to the balance sheet, the financial position is sound.

Total assets of CAD $1.9 trillion line up well against CAD $1.8 trillion in total liabilities.

The company’s senior debt has the following credit ratings: A1, Moody’s; A, S&P; AA-, Fitch.

These ratings are well into investment-grade territory.

Profitability for the bank is quite robust.

Over the last five years, the firm has averaged annual net margin of 29.9% and annual return on equity of 15%. Net interest margin came in at 1.7% last year.

This is a very solid financial institution right across the board.

And with economies of scale, “sticky” deposits, switching costs, established relationships, and an entrenched float, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Competition, regulation, and litigation are omnipresent risks in every industry.

Recent idiosyncratic bank failures in the US may present additional regulatory hurdles in the near future for TD.

On the other hand, bank failures, and possible consolidation across the industry, reduces some of the competitive pressure.

As we’ve recently been reminded of, any bank is susceptible to a sudden bank run.

If a recession transpires, this can negatively affect a bank twice over – reduced deposits and loan demand harm the income statement, while higher credit losses harm balance sheet.

Interest rates have been persistently low over the last decade, which has constrained banks, but rates are finally on the rise.

The Canadian housing market may be in a bubble, and any deflating of this market would impact TD.

TD has been acquisitive, which adds integration and execution risks, and the costs of these acquisitions will have to be justified through future results.

I see most of these risks as fairly standard for a large bank, and TD’s well-managed history assuages most of my concerns.

Furthermore, the stock’s recent 20% drop has created what appears to be a very favorable valuation…

Stock Price Valuation

The stock is trading hands for a P/E ratio of 10.1.

That’s very low in both absolute and relative terms.

For perspective, the stock’s five-year average P/E ratio is 11.6.

Another way to look at it is through the P/B lens.

Most large banks command P/B ratios of between 1 and 2, depending on the bank’s quality.

TD has averaged a P/B ratio of 1.7 over the last five years, but it’s currently sitting at 1.5.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 6.5%.

This dividend growth rate is at the low end of the range I’m usually allowing for.

On the other hand, I tend not to get super aggressive when valuing a bank.

There are just so many moving parts, and the economic sensitivity is very high.

I always like to err on the side of caution, but that’s doubly so with a bank.

However, TD has blown the doors off of this number when looking at proven EPS and dividend growth over the last decade.

Also, CFRA’s near-term EPS growth projection is right in this neighborhood.

It’s quite possible that TD exceeds my expectation here, but I also believe I’m being judicious and rightfully cautious.

The DDM analysis gives me a fair value of $86.72.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I don’t see how my valuation was audacious, yet the stock comes out looking very cheap.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates TD as a 4-star stock, with a fair value estimate of $72.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates TD as a 3-star “HOLD”, with a 12-month target price of $67.00.

I came out on the high end this time around, in spite of what I feel was actually a conservative valuation. Averaging the three numbers out gives us a final valuation of $75.24, which would indicate the stock is possibly 17% undervalued.

Bottom line: Toronto-Dominion Bank (TD) is a high-quality, diversified financial institution that is protected by an entrenched oligopoly in its home market. With a market-smashing yield, a high-single-digit dividend growth rate, a low payout ratio, nearly 10 consecutive years of dividend increases, and the potential that shares are 17% undervalued, long-term dividend growth investors looking to take advantage of the recent fears around banks could have a fantastic opportunity on their hands here.

Bottom line: Toronto-Dominion Bank (TD) is a high-quality, diversified financial institution that is protected by an entrenched oligopoly in its home market. With a market-smashing yield, a high-single-digit dividend growth rate, a low payout ratio, nearly 10 consecutive years of dividend increases, and the potential that shares are 17% undervalued, long-term dividend growth investors looking to take advantage of the recent fears around banks could have a fantastic opportunity on their hands here.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is TD’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 80. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, TD’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income