Investing in great businesses can totally transform one’s finances.

I’m talking about a life-changing transformation.

It comes down to compounding.

It’s hard for the average person to fully understand compounding, because the math is not naturally intuitive.

But if you can compound your money at a high rate for a very long time, you almost can’t help but to become incredibly wealthy.

So how do you find these great businesses that are compounding away?

The first place I start is always the Dividend Champions, Contenders, and Challengers list.

This list contains invaluable information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

These are dividend growth stocks.

Great businesses can compound revenue and profit at a high rate over time, right?

Well, what better proof of that than a compounding dividend?

Well, what better proof of that than a compounding dividend?

A growing dividend is tangible proof of growing profit, as the former cannot be sustained for a long time without the latter.

I’ve been loading up on these stocks for years, building my FIRE Fund in the process.

That’s my real-money portfolio, and it produces enough five-figure passive dividend income to live off of.

I’ve actually been living off of dividends for quite a while now.

I retired in my early 30s.

And I share in my Early Retirement Blueprint exactly how I was able to accomplish that.

And I share in my Early Retirement Blueprint exactly how I was able to accomplish that.

Suffice it to say, putting great businesses on my side and having them compound for me has been a huge part of my success.

But another huge part of it has been valuation at the time of investment.

Whereas price tells you what you pay, value tells you what you actually get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Investing in great businesses that are compounding at a high rate, and doing that investing when undervaluation is present, then holding for a long time, is a simple-but-proven method for building incredible amounts of wealth and passive income over the long run.

Now, valuation isn’t printed anywhere.

One has to discover it on their own.

Fortunately, this isn’t as difficult as you might think it is.

My colleague Dave Van Knapp has made it much easier via Lesson 11: Valuation.

One of his “lessons” on dividend growth investing, it shares a valuation process that can be applied toward just about any dividend growth stock.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Broadridge Financial Solutions, Inc. (BR)

Broadridge Financial Solutions, Inc. (BR)

Broadridge Financial Solutions, Inc. (BR) is a global fintech company that provides technology-driven infrastructure behind corporate and investing communications.

Founded in 1962, Broadridge is now a $17 billion (by market cap) communications pioneer that employs approximately 14,000 people.

Broadridge was spun out from former parent company Automatic Data Processing Inc. (ADP) in 2007.

The company reports results across two segments: Investor Communication Solutions, 75% of FY 2022 revenue; and Global Technology and Operations, 25%.

The company’s largest segment largely includes the processing and distribution of proxy materials to investors that hold positions in equity securities and mutual funds, which is a service that Broadridge dominates.

Since most securities in the US are held in the “street name” of brokerages rather than directly under the name of the actual investor, communication and proxy voting must be coordinated with the broker/dealer, the issuer, and the beneficial owner.

This is where Broadridge steps in.

The vast majority of broker/dealers enlist Broadridge as a third-party agent to handle these communications.

To put the dominance of Broadridge into perspective, the company recently processed more than 80% of domestic shares outstanding through its ProxyEdge platform (Broadridge’s crown jewel).

There are two terrific aspects of this business model.

First, these communications, and the revenue associated with them, are recurring.

Second, because the fees involved with handling these communications are relatively immaterial for an issuer, it seems unlikely that Broadridge will face any near-term pressure on its revenue.

So what we appear to have here is a capital-light, high-margin software/service business that dominates a niche with recurring revenue.

This kind of advantageous setup tends to lead to impressive compounding and total return for shareholders.

It also tends to lead to impressive dividend growth, which is exactly what we’ve seen transpire.

Dividend Growth, Growth Rate, Payout Ratio and Yield

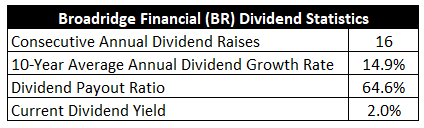

The company has increased its dividend for 16 consecutive years, dating back to the initial spin-off.

What a start Broadridge is off to here.

The 10-year dividend growth rate of 14.9% provides further evidence of just how committed the company is to the dividend and the growth of it.

Better yet, there’s been no big slowdown here.

Better yet, there’s been no big slowdown here.

The most recent dividend raise came in at 13.3%.

Now, you do give up some yield in order to access that double-digit dividend growth.

The stock’s yield is 2%.

Still, that beats the market.

Moreover, it’s 40 basis points higher than its own five-year average.

The payout ratio of 64.6% is elevated, but it’s certainly not worrisome.

I really like the commitment and high dividend growth rate here.

Revenue and Earnings Growth

As likable as these dividend metrics may be, they’re largely looking backward.

But investors must be always looking forward, as today’s capital is risked for the rewards of tomorrow.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be of great help when it later comes time to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past against a future forecast in this way should give us the ability to approximately judge where the business may be going from here.

Broadridge advanced its revenue from $2.4 billion in FY 2013 to $5.7 billion in FY 2022.

That’s a compound annual growth rate of 10.1%.

Strong top-line growth here.

However, it hasn’t all been organic.

Some of it was propelled by Broadridge’s 2021 acquisition of front office trading technology firm Itiviti for $2.5 billion in cash.

Meanwhile, earnings per share grew from $1.69 to $4.55 over this period, which is a CAGR of 11.6%.

Even better than the top-line growth, which is great.

Minor share buybacks, as well as slight margin expansion, juiced some of the extra EPS growth.

I’ll note that dividend growth has exceeded EPS growth over the last decade, which helps to explain the elevated payout ratio.

I’d look to see Broadridge start to reconcile the different growth rates over the coming years, which would mean a dividend that grows in tandem with EPS.

Looking forward, CFRA is forecasting that Broadridge will compound its EPS at an annual rate of 12% over the next three years.

It’s an assumption of the status quo continuing.

I think that’s pretty reasonable.

I simply do not see anything that would cause one to budge very much one way or another.

CFRA sums up the appeal of the business model, noting Broadridge’s: “…large cut of multi-year contracts that are recurring (90%+ ex. distribution) and unique market positioning that allow for strong closed sales and share gains.”

CFRA then adds: “The sluggish macro picture has fueled demand for [Broadridge], as clients span to tech-focused solutions across its three franchises (Governance, Capital Market, and Wealth), especially with the addition of Itiviti, which offers a comprehensive suite of trading solutions. We expect [Broadridge’s] balanced growth and capital allocation strategy leads to incremental long-term value creation, expressed through a mid-teens (or better) ROIC.”

I think a low-double-digit EPS and dividend growth outlook over the foreseeable future is rooted in reality.

And when you’re starting off with a 2% yield, you’re looking at a compelling total return package.

Indeed, since the 2007 spin-off, the stock is up by almost 600%.

That’s good for a CAGR of nearly 16% on the stock.

Not Buffett-level compounding, but it’s pretty close.

Financial Position

Moving over to the balance sheet, the company has a good financial position.

The long-term debt/equity ratio is 2, while the interest coverage ratio is nearly 9.

Broadridge historically maintained an excellent balance sheet for most of the time since the spin-off.

But the large size of the Itiviti acquisition is now weighing on Broadridge.

I’d like to see a reduction in the debt load over the coming years.

Profitability is robust.

Over the last five years, the firm has averaged annual net margin of 10.2% and annual return on equity of 36.5%.

Broadridge has been, and should remain, an incredible compounding machine.

And the company is protected by durable competitive advantages that include switching costs, scale, and heavily entrenched relationships.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

I see regulation as something that Broadridge constantly has to navigate properly.

On the flip side, its crown jewel has almost no competition.

The company is dependent on the overall pool of securities and security ownership to drive revenue.

While I’m not aware of any completely recession-proof business, Broadridge would likely see minimal impact from a recession.

The balance sheet has taken a big hit recently, which reduces financial flexibility and future M&A opportunities.

The Itiviti acquisition introduces execution and integration risks, and Broadridge will have to rationalize what they paid.

Any future pressure on the fees that Broadridge charges could have an adverse impact on the company.

Overall, I think these are acceptable risks in light of the compounding power.

And with the stock down 20% from its 52-week high, the valuation makes this an even more appealing investment candidate…

Stock Price Valuation

The stock’s P/E ratio is 32.4.

That’s quite a bit higher than the broader market’s earnings multiple.

However, this better-than-average business deserves, and usually commands, a higher multiple.

To that point, its own five-year average P/E ratio is 33.2.

We are lower than that right now.

Keep in mind, despite the stock almost always having a rather high earnings multiple, it’s still compounded at a very high rate anyway.

Also, the yield, as noted earlier, is higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 8%.

This dividend growth rate is as high as I’ll go with the model.

But I really do believe that Broadridge is precisely the type of firm that deserves the distinction.

It’s growing revenue, EPS, and the dividend at double-digit rates, respectively.

The returns on capital are outstanding.

Plus, there’s a dominant share of market that has no end in sight.

If not for the weakened balance sheet, Broadridge would be one of the very best businesses on the planet.

And even with the hit to the balance sheet, Broadridge is still a wonderful business.

The next few years or so may produce larger dividend raises than I’m expecting, but I would expect that to flatten out over the longer run.

The DDM analysis gives me a fair value of $156.60.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

The stock doesn’t look expensive to me, even after a sensible valuation model.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates BR as a 5-star stock, with a fair value estimate of $185.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates BR as a 4-star “BUY”, with a 12-month target price of $182.00.

I was the outlier and came out low. Averaging the three numbers out gives us a final valuation of $174.53, which would indicate the stock is possibly 17% undervalued.

Bottom line: Broadridge Financial Solutions, Inc. (BR) is a high-quality company that absolutely dominates its niche. It’s nearly flawless, outside of the weakened balance sheet. With a market-beating yield, a double-digit dividend growth rate, a reasonable payout ratio, more than 15 consecutive years of dividend increases, and the potential that shares are 17% undervalued, long-term dividend growth investors looking for an incredible compounding machine ought to be looking at this name.

Bottom line: Broadridge Financial Solutions, Inc. (BR) is a high-quality company that absolutely dominates its niche. It’s nearly flawless, outside of the weakened balance sheet. With a market-beating yield, a double-digit dividend growth rate, a reasonable payout ratio, more than 15 consecutive years of dividend increases, and the potential that shares are 17% undervalued, long-term dividend growth investors looking for an incredible compounding machine ought to be looking at this name.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is BR’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 75. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, BR’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income