We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Hycroft Mining Holding Corporation (NASDAQ: HYMC)

Today’s penny stock pick is the gold and silver development company, Hycroft Mining Holding Corporation (NASDAQ: HYMC).

Hycroft Mining Holding Corporation operates as a gold and silver development company in the United States. The company holds interests in the Hycroft mine which covers an area of approximately 70,671 acres located in the state of Nevada. As of December 31, 2021, its Hycroft mine had measured and indicated mineral resources of 9.6 million ounces of gold, and 446.0 million ounces of silver.

Website: https://www.hycroftmining.com

Latest 10-k report: https://www.sec.gov/ix?doc=/Archives/edgar/data/1718405/000171840522000016/hymc-20211231.htm

Analyst Consensus: Not Covered By Wall Street Analysts.

Potential Catalysts / Reasons for the Hype:

- The Silicon Valley Bank and Signature Bank crises resulted in investors moving to precious metals and crypto instead.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern: As you can see from the daily chart, the stock has been forming a falling wedge pattern during the past few months. This is marked in the daily chart in purple color. Currently, the stock is moving higher from the lower rail of the pattern with high volume. Once the stock breaks out from a falling wedge pattern, it has the potential to move further up.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Bullish RSI: The RSI is currently near 50 and moving higher, indicating possible bullishness.

#4 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for HYMC is above the price of $0.42.

Target Prices: Our first target is $0.70. If it closes above that level, the second target price is $0.90.

Stop Loss: To limit risk, place a stop loss at $0.28. Note that the stop loss is on a closing basis.

Our target potential upside is 67% to 114%.

For a risk of $0.14, our first target reward is $0.28, and the second target reward is $0.48. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

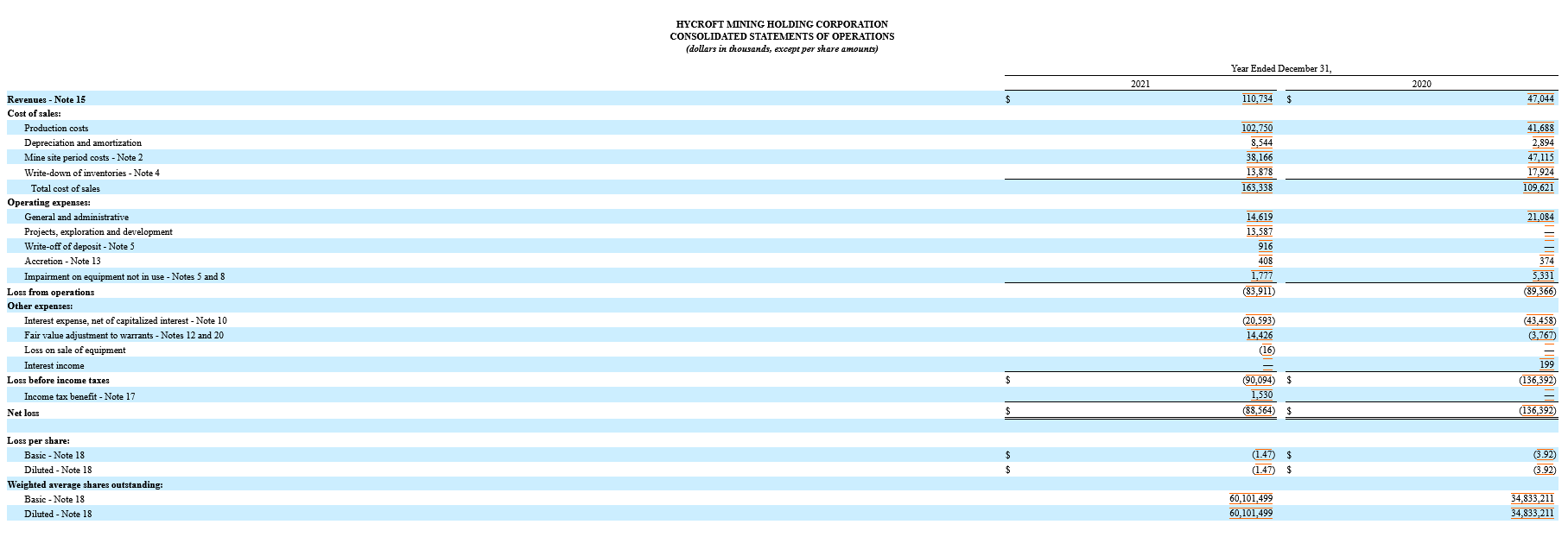

- The company has a history of net losses. HYMC reported a net loss of $88.6 million for the year ended December 31, 2021, and a net loss of $136.4 million for the year ended December 31, 2020.

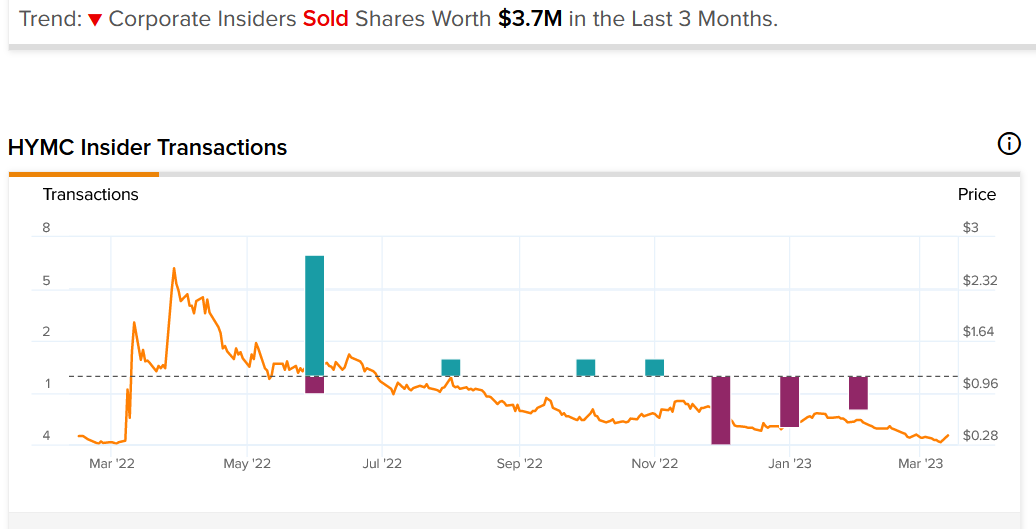

- Corporate Insiders Sold Shares Worth $3.7M in the Last 3 Months.

- On December 29, 2021, HYMC received a written notice from the Listing Qualifications department of The Nasdaq Stock Market indicating that it was not in compliance with the $1.00 minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Listing Rule) for continued listing on the Nasdaq Capital Market.

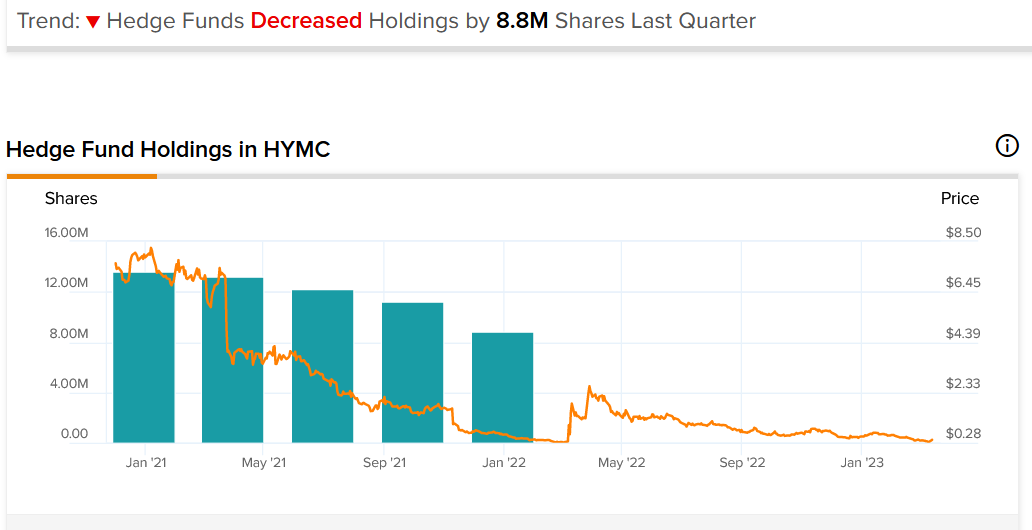

- Hedge Funds Decreased Holdings by 8.8M Shares Last Quarter.

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

The best way to earn monthly income is NOT a stock, bond or option... Rather, it's this little-known alternative investment. CLICK HERE TO FIND OUT MORE.

Source: Trades of the Day