Of course, by now you’ve probably read a dozen stories about the collapse of Silicon Valley Bank, or SVB for short.

This is what you need to keep in mind: the financial sector is not out of the woods yet. Yes, even though the U.S. Government (Treasury Department, Federal Reserve and the Federal Deposit Insurance Corporation) came to the rescue of depositors at SVB. And yes, even though the Federal Reserve is creating a new Bank Term Funding Program aimed at safeguarding deposits.

But that’s not stopping investors from thinking the recent trouble with banks will cause the Fed to pause raising rates. Goldman Sachs said it no longer expects the Federal Reserve to hike rates at its meeting next week and Evercore ISI’s Ed Hyman said it may be a good idea for the Fed to pause at this point.

I have no idea whether the Fed will actually pause its rate hike policy. But what I do know is that U.S. Government and the Federal Reserve aren’t going to let the current banks’ balance sheet problems torpedo the financial sector.

Case in point, the Fed’s recently announced Bank Term Funding Program will offer loans of up to one year to banks, saving associations, credit unions and other institutions. As collateral for the loans, the Fed is prepared to take underwater Treasuries off of banks’ balance sheets at full value, thus shoring up balance sheets and making the banks look good again, at least on paper.

Bottom line, I think the recent trouble in financial sector will pass – or at least the perception of the problem in the financial sector will pass – and that gives us an opportunity to “flip the chart” and potentially make a triple-digit profit.

Here’s what I’m seeing.

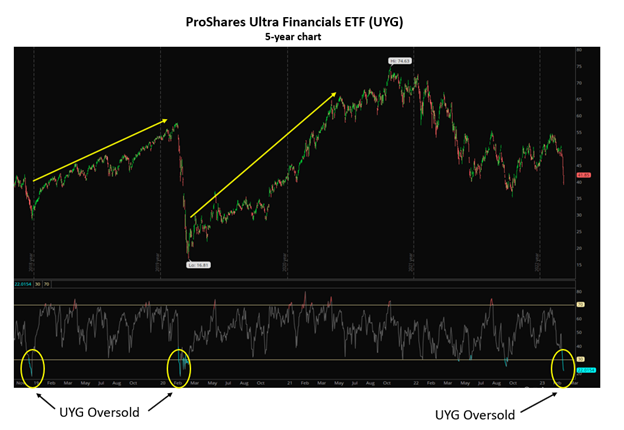

The chart below demonstrates just how oversold the ProShares UltraFinancials ETF (UYG) is currently, along with the last two times UYG has been this oversold. This ETF, which tracks the Dow Jones U.S. Financials Index, experienced two huge rallies after becoming as oversold as it has at this point.

When the current panic fades, investors will come back to bank stocks, and we can get in before the correction happens.

When the current panic fades, investors will come back to bank stocks, and we can get in before the correction happens.

I like buying a ProShares UltraFinancials ETF (UYG) June 16, 2023, $44/$45 Call Spread for $0.45 or less. Plan on exiting the position for a 100% profit.

— Shah Gilani

According to one of the world's top AI scientists, there's a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead... but whatever you do, don't go all in on big tech before you have all the details. Click here.

Source: Total Wealth