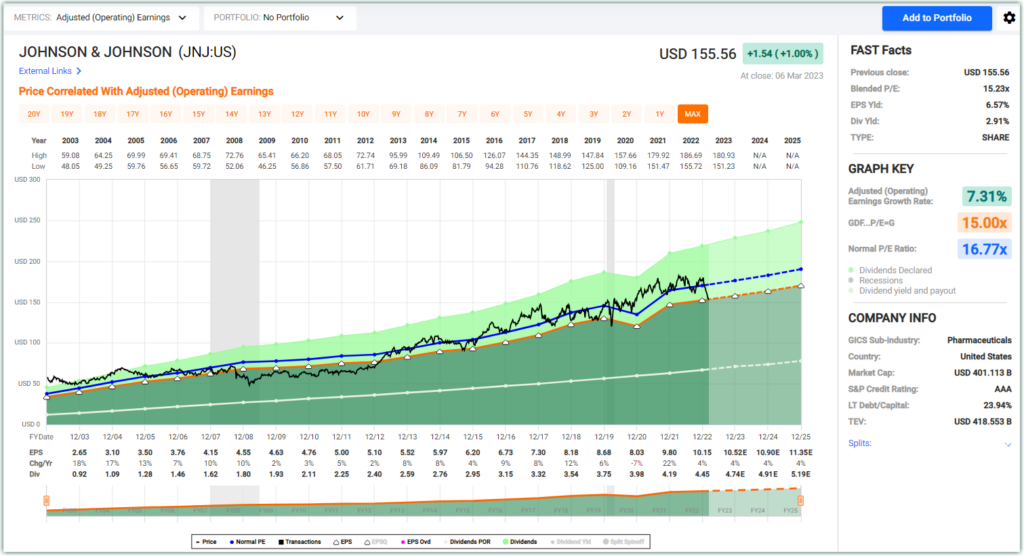

Johnson & Johnson’s (JNJ) stock price has fallen approximately 13% since the beginning of the year. However, operating earnings are expected to increase modestly while operating cash flow is expected to increase 45% or more after dropping 1% in 2020 and 9% in 2022.

Nevertheless, JNJ’s dividend is well covered and the company’s balance sheet contains enough cash and short-term investments to cover any contingent liabilities from several lawsuits on talcum powder and opioids.

From a valuation perspective, JNJ has fallen into fair value territory, but we do not consider it dramatically undervalued.

From a valuation perspective, JNJ has fallen into fair value territory, but we do not consider it dramatically undervalued.

Consequently, for those investors who are looking for high quality, and above-average dividend yield approaching 3%, JNJ may be just the ticket. The point is that the future return is expected to be positive but single digit. Considering the quality of this AAA rated behemoth with a strong balance sheet, it could be attractive to many types of investors.

We consider JNJ a solid hold and a reasonably valued buy at this time. In order to receive a true margin of safety, Johnson & Johnson would have to fall further from here which may or may not occur. Caveat emptor.

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

After researching income stocks for over 30 years, I've come up with a one of a kind dividend portfolio. With the right 20-30 stocks, you can collect a dividend check every single day the market is open. That's over 260 dividend checks per year. Click here for the names of these 20+ stocks.

Source: FAST Graphs