When I was a kid, I thought everyone on TV was rich. I know better now, of course, but it still strikes me when I hear stories of celebrities going broke, struggling to earn a living or taking on projects just because they desperately need to pay off some kind of debt.

It just goes to show that being famous isn’t enough to have true financial freedom.

That’s why I was intrigued by a recent interview with That ’70s Show star Ashton Kutcher, who has built a name for himself in the VC world by investing in tech startups. Kutcher’s string of successes is impressive: he was an early investor in Uber, Airbnb and Spotify, for example.

In a recent interview, he said that those investments mean he can just worry about playing roles he wants to play without taking those he doesn’t want. And beyond that, Kutcher’s got enough clout that he could force his upcoming romantic comedy, Your Place or Mine, to move production from Georgia to California (despite the higher cost incurred) because he wanted to stay close to his wife and children. Few actors can make demands like that.

What really gives Kutcher that kind of clout is those pocketed millions from his venture-capital investing. And that’s really the true power—and value—of wealth: it brings financial freedom. But how much do you need to be truly free?

Financial Freedom Vs. Retirement

Above all, let’s be clear: retiring and being financially free aren’t exactly the same thing.

Something that many wealthy investors know is that a large amount of money is not there to stop you from working forever. It’s there to give you the financial freedom to choose what you want to do. If that endeavor makes money, great. If not, that’s fine, too. That’s the kind of freedom that Ashton Kutcher says investing gave him.

When you think about investing this way, many of the conventional “rules” go out the window. We don’t need to build up a huge pile of money to live off the meager 2% (or less) dividend payments we get from the average S&P 500 stock. All we need are cash flows to keep us afloat while we quit our jobs and decide to do whatever we want to do. But how can we get that?

How to Get $60,000 in Yearly Dividends on $670K in Savings

The most basic rule of finances is that you’ll never run out of money if more money is coming in than is going out. So the first step is to determine how much money you spend every month, or every year, and find an income stream greater than that.

How much you spend will vary, but let’s stick with the example of a single American who works full-time and spends $60,000 a year. Without the cost of commuting, lunch at the office and the other expenses that come with regular office jobs, maybe this hypothetical person can live on less. But we’ll ignore this for the moment and stick with our $60,000 estimate.

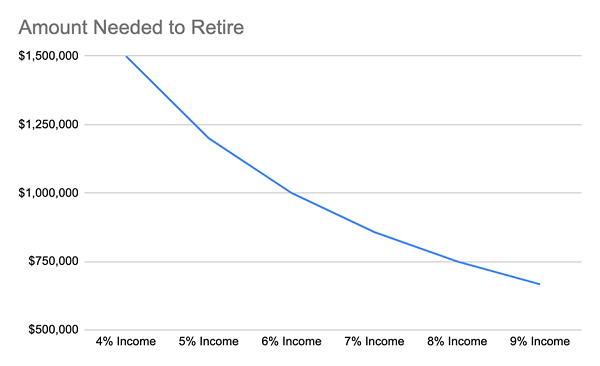

Source: CEF Insider

Source: CEF Insider

Instead of needing the $1.5 million that conventional wisdom tells us we need, we can see how going with higher-yielding investments like, say, closed-end funds (CEFs), where yields of 9%+ are commonplace, can cut down on how much we truly need.

And with a 9% income stream, that $60,000 of annual income is easy to get with just under $670k in the bank.

2 Clicks to Secure a 9.3%+ Income From Household-Name Stocks

Take for instance, the Liberty All-Star Equity Fund (USA), a 9.3%-yielding CEF that holds well-known names like Visa (V), Microsoft (MSFT), Google (GOOGL) and Dollar General (DG).

USA generates that income stream by first collecting dividends on its holdings. Second, it sells its stocks at a profit over time and uses those gains to supplement the dividends its portfolio generates. And USA’s profits have been so strong that it’s boosted payouts significantly over the last decade.

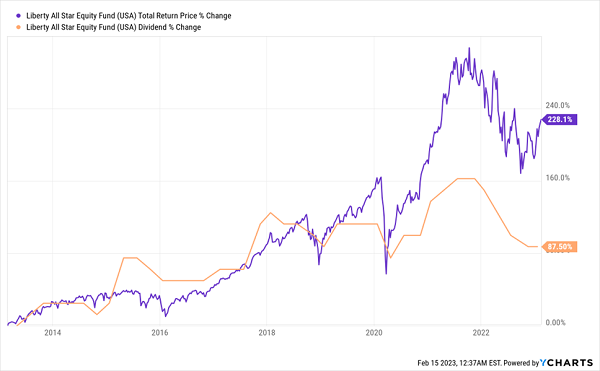

USA’s Long-Term Profits

And with a return averaging over 8% per year for over a decade, this fund has proven that it delivers profits and a reliable income stream. The only small snag—if you can call it that—is that USA trades at a slight premium to net asset value (NAV, or the value of the stocks in its portfolio). This isn’t a major knock against the fund, but it could limit its upside.

And with a return averaging over 8% per year for over a decade, this fund has proven that it delivers profits and a reliable income stream. The only small snag—if you can call it that—is that USA trades at a slight premium to net asset value (NAV, or the value of the stocks in its portfolio). This isn’t a major knock against the fund, but it could limit its upside.

If you’d like a CEF with steadier income and a discount, I’ve got you covered: the Nuveen Real Estate Income Fund (JRS) yields 9.8% today and actually raised its payout recently—a 10% increase starting with the April 2022 payment.

The fund holds publicly traded real-estate investment trusts (REITs), whose payouts tend to be higher than those on regular stocks. Warehouse REIT Prologis (PLD), data-center REIT Equinix (EQIX) and self-storage landlord CubeSmart (CUBE) are top holdings. To top it off, JRS trades at a 7.2% discount, setting the fund up for gains as that discount is bid back to premium levels.

While many investors use funds like these to build their wealth, they can also be used to gain a high cash flow from profiting on appreciating assets with little effort. Tools like these are what make Ashton Kutcher’s financial freedom possible for everyone.

— Michael Foster

4 CEFs Kutcher Wishes He’d Bought (9.5% Dividends and 20% Gain Potential) [sponsor]

As we just discussed, CEFs could give you financial freedom on much less than most advisors say you need. Better still, these funds hold the investments you know well, including high-yield corporate bonds, real estate and blue-chip stocks. So you don’t have to be a VC player like Kutcher, hoping to hit on the next big trend—like EVs, AI or crypto—before the rest of the crowd does.

With CEFs, you simply buy a selection of funds and collect your regular dividends. Meantime, these funds’ discounts give us further upside, as other investors spot the bargains and high yields on offer and drive the price up further.

To give you the best opportunity for strong gains and healthy, stable CEF dividends, I’ve compiled an exclusive report called “4 Great CEFs to Buy Now: 9.5% Dividends and 20% Upside Ahead.” It gives you 4 of my top picks in CEFs today, which, as the name says yield an outsized 9.5% now.

Plus these CEFs’ overdone discounts mean we could be looking at an easy 20%+ price gain in the next 12 months (or less!)

Click here and I’ll share my full CEF investing strategy and show you how to download this exclusive FREE report to start profiting from these 4 ridiculously undervalued 9.5% payers today.

Source: Contrarian Outlook