Introduction FedEx (FDX)

Contrarian investing requires extra due diligence to identify traits that give investors confidence and conviction to invest in a company when everything and everyone is against it.

Not all companies that are in the doghouse are investable.

Quality always matters and identifying characteristics that set these companies apart from their peers is critical for the Contrarian Investor to zig when others zag.

In this article, we examine FedEx (FDX) as a classic Contrarian play.

Preamble

Any serious investor is always on the hunt for great companies to own. However, finding these great companies may not be easy. Even harder is to buy them at fair, or better still, at prices much lower than their intrinsic value, the classic “paying 50 cents for a dollar” investment. This is when the investment offers the margin of safety value investors always look for.

Intuitively, investors know that great companies will often trade at a premium. Conversely, less great companies trade at lower multiples to reflect the higher risks and lower quality associated with them.

Occasionally, there are times when great companies are sold on the cheap, and these times are usually associated with negativity. It could be some adverse news, like a class action lawsuit in the case of 3M (MMM). It could be how Amazon’s (AMZN) share price fell 8% after reporting weak earnings. Share prices could fall due to threats from the competition like Alphabet (GOOGL) reacting to Microsoft’s (MSFT) investment in Chat GPT.

Or it could be a combination of all these. If an investor were to own shares in any of the three companies mentioned above, what would that investor’s response be to the fall in their portfolio value when they see the stock prices of their holdings decline precipitously? Would the investor buy more shares, hold off more buying until the situation clarifies, or sell everything to cut losses? Investor psychology suggests that an investor will feel the pain of loss 2 ½ times greater than the pleasure of gain.

In this article, we shall examine FedEx Corporation (FDX), a great company that has fallen upon hard times. It was hammered in 2022 amidst a challenging economic environment. The company missed earnings estimates for three consecutive quarters from Q3 FY 2022 to Q1 FY 2023 and missed revenue forecasts for another three consecutive quarters from Q4 FY 2022 to Q2 FY 2023.

The stock price had already been declining since the start of 2022. Talking heads were circling like vultures, blaming the CEO and his team for poor execution. The final nail in the coffin came on 15 September 2022 when the company reported Q1 FY 2023 earnings that missed the consensus forecast by 41.9% year-on-year.

As a result, its stock price fell 21% that day as disappointed investors abandoned FDX in droves, bringing the total decline to 45% from January 2022 to September 2022, a decline that was almost twice that of S&P 500 and 18% more than Invesco QQQ ETF in the same period.

Had investors “zigged when everyone else zagged” and invested in September 2022 instead of dumping FDX’s shares, they would have benefited from, FDX’s stock price rebounded 44.6% from 30 September 2022 till 3 February 2023, a recovery three times the 15.4% bounce in SPY and almost four times the 12.05% rebound in the QQQ in the same period.

In this article, we shall attempt to identify traits that can help investors recognize the next FDX so they can do the right thing when the opportunity comes knocking, which does not come very often to great companies.

Also, we need to qualify our stance before we proceed. we are not advocating a buy-and-hold-no-matter-what strategy. Nor are we recommending a “let’s buy all the 52-week-low stocks because they will all rebound”. Instead, we are looking for high quality businesses that we have the confidence can and will recover, or as often stated “revert to the mean.”

Before any investor invests, sufficient due diligence must be done because fundamentals matter and they matter a lot. In fact, more due diligence is required of Contrarian Investors because they need more conviction to invest in apparently underperforming companies and stay invested through periods of falling knives.

In this article, we shall examine FDX fundamentals through the lens of:

Business value proposition.

Long-term business viability.

Balance sheet and cash flow.

All our readers no doubt know the importance of fundamentals but it does not hurt to remind ourselves about it.

Fundamentals matter because no investors want to be bag-holding for a decade and still lose money.

Fundamentals matter because no investors want to sell their investments at the wrong time. We almost sold our Exxon Mobil (XOM) shares in 2020 because we saw our stock value fall 66% from $90 per share to $30 per share; instead, we doubled down, and brought our cost basis down to $70 per share.

Before we dive into the article, keeping this quote from Charlie Munger of Berkshire Hathaway at the back of our minds will serve us well:

If you are not willing to react with equanimity to a market price decline of 50% 2 or 3 times a century, you’re not fit be a common shareholder and you deserve the mediocre result you’re going to get.

With that, let’s get to work.

What is FedEx’s Business Value Proposition?

In other words, does FDX have a moat?

In FedEx’s investor day presentation in June 2022, CEO Raj Subramaniam shared:

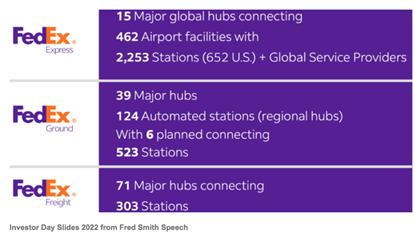

FedEx Express is the largest express transportation company in the world, with 15 hubs, our Express global network connects more than 99% of global GDP.

And connecting all of these hubs is an impressive fleet of 714 planes, 4700 long-haul tractors, and 77000 other vehicles. That scale in itself is a moat that is difficult to replicate. For instance, FDX has 2.5 times more planes than United Parcel Service (UPS) and 8 times more planes than Amazon Prime Air. More on this in a while.

Of course, this level of connectivity with the global economy is a double-edged sword, meaning FDX’s fortunes will rise and ebb with the global economy. As an FDX investor (or someone considering buying the shares), it is necessary to have this understanding when evaluating FDX’s growth targets for the future. This also helps to explain the cyclical or semi-cyclical operating history the company has achieved.

During June 2022 Investor Day, CEO Raj set some bold targets for 2025.

And since the day CEO made that projection in June 2022, he was ridiculed for getting a little ahead of himself. He was blamed for being too optimistic. With the second half of 2022 behind us in our recent memory, and with the knowledge that China had fully reopened in December 2022, we now have the most recent growth forecast for the global economy by the International Monetary Fund (IMF) which is +2.9% in 2023. That figure is only half of the high end of FDX’s projected revenue CAGR but it is nonetheless a positive sign to see some cautious optimism from economists.

And since the day CEO made that projection in June 2022, he was ridiculed for getting a little ahead of himself. He was blamed for being too optimistic. With the second half of 2022 behind us in our recent memory, and with the knowledge that China had fully reopened in December 2022, we now have the most recent growth forecast for the global economy by the International Monetary Fund (IMF) which is +2.9% in 2023. That figure is only half of the high end of FDX’s projected revenue CAGR but it is nonetheless a positive sign to see some cautious optimism from economists.

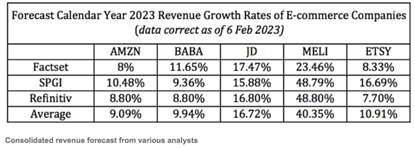

FDX’s CEO Raj was able to be optimistic because he knew the expected rate of growth for e-commerce is far greater than the expected rate of growth of the global economy, and that is the key that will power FDX’s growth for the next few years. Despite a return to normality after the initial pandemic fears, with the euphoria around “the new normal of e-commerce” having subsided and subdued somewhat in 2022 when compared to 2020 and 2021, the e-commerce landscape has inevitably ramped up to a new and higher baseline and is expected to grow at comfortable rates that outpace the growth of the global economy. When we examine analysts’ 2023 revenue forecasts for some of the leading e-commerce companies like Amazon (AMZN), Alibaba (BABA), JD (JD), MercadoLibre (MELI) and Etsy (ETSY), we can see a lot of positivity with these e-commerce companies expected to grow revenue at least more than three times the rate of the global economy.

CEO Raj believes 90% of FDX’s future revenue growth will come from e-commerce and hence FDX has been investing in its critical network infrastructure to position itself to benefit from the tailwind of a multi-year growth in e-commerce. In the June 2022 Investor Day presentation speech, FedEx founder Fred Smith shares that:

CEO Raj believes 90% of FDX’s future revenue growth will come from e-commerce and hence FDX has been investing in its critical network infrastructure to position itself to benefit from the tailwind of a multi-year growth in e-commerce. In the June 2022 Investor Day presentation speech, FedEx founder Fred Smith shares that:

Networks take time and are difficult to build. Expenses are front-loaded. A network does not exist until it reaches minimal scale. Scale matters in competitive networks. Just ask T-Mobile and Sprint before they merged how it was competing with AT&T and Verizon. Networks serving many distant addresses require hubs or switches to connect all points with all other points. Max scale FedEx core networks are nearly impossible to duplicate with significant earnings upside given 2016-2021 investments and acceleration of volumes and yields during the pandemic.

It is not difficult to see the scale of FDX’s network giving it a competitive moat, and how it is deserving of being known as the largest express transportation company in the world, capable of picking up a shipment in any one part of the world and getting it to any other part of the world in the next couple days.

Other than FedEx Express, the FedEx Ground division has been growing steadily too. Over the last several years, the Ground market has outpaced the Express market, growing at about 8.5% CAGR while the Express grew at about 0.5% CAGR. For comparison, the Ground market represented about 70% of the United States market 10 years ago. Today, it has about 90% of the market share.

Other than FedEx Express, the FedEx Ground division has been growing steadily too. Over the last several years, the Ground market has outpaced the Express market, growing at about 8.5% CAGR while the Express grew at about 0.5% CAGR. For comparison, the Ground market represented about 70% of the United States market 10 years ago. Today, it has about 90% of the market share.

What is FedEx’s long-term business viability?

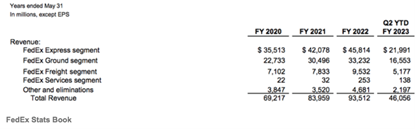

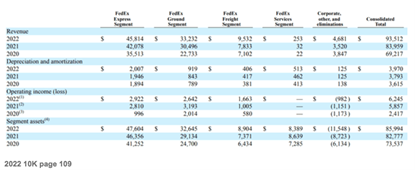

Despite a more muted 2.9% global growth projection from the IMF, FDX is still a healthy and viable business. Each of its 3 main business segments is still bringing in billions of dollars in revenues.

Below is a brief overview of what each business segment does:

Below is a brief overview of what each business segment does:

- FedEx Express provides rapid, reliable, time-definite delivery to more than 220 countries and territories, connecting markets that comprise more than 99 percent of the world’s gross domestic product, utilizing its air route authorities and transportation infrastructure, and information technologies.

- FedEx Ground provides low-cost, day-certain service to any business address in the U.S. and Canada, as well as residential delivery to 100% of U.S. residences through its FedEx Home Delivery® Service. FedEx Ground Economy, a FedEx Ground service, specializes in the consolidation and delivery of high volumes of low-weight, less time-sensitive business-to-consumer packages.

- FedEx Freight provides less-than-truckload (LTL) freight services across all lengths of haul to businesses and residences in North America. Within the U.S., the company offers 3 services: FedEx Freight Priority for speedy delivery, FedEx Freight Economy for cheaper delivery, and FedEx Freight Direct to meet the needs of the growing e-commerce market for delivery of heavy, bulky products to or through the door for residences and businesses.

A weak macro outlook in 2022 brought on by a rising interest rate environment, a war in Ukraine, and rising costs of everything had been weighing down investors’ sentiments. Naturally, investors were spooked when the CEO shared in the Q2 2023 earnings call in December 2022 that:

“Volumes declined across all segments, primarily at Express down low double digits. As such, revenue was down 3%, driven by a decline at FedEx Express, which was partially offset by growth at FedEx Freight and FedEx Ground.”

Remember that we said that FDX’s fortune is tied to the global economy? The economy moves in cycles and it will eventually and inevitably recover. Brie Carere, Executive Vice President and Chief Customer Officer, shared that silver lining in the same conference call projecting volume recovery by the back half of FY 2023:

…” we remain prudent in our expectations for volume and yield in the second half of the fiscal year. That being said, our service value proposition relative to our competition will remain strong. And in fact, our relative market position will improve in the back half of the year.”

Management is confident that with the better comps expected in Q4 that will be lapping the impact of the beginning of the war in Ukraine, FDX’s year-over-year volume comps will improve through the back half of the fiscal year 2023.

In addition, despite softer volumes, earnings should hold up through a combination of the measures taken to reduce costs (such as the recently announced 10% layoff of senior and director-level jobs), improve efficiencies, reduce CAPEX, and structural improvement in revenue through cost recovery fuel surcharges in April 2022 to offset the rising cost of fuel in 2022, and a 6.9% general rate increase in September 2022, plus peak surcharges in December 2022.

It is necessary to highlight that FDX’s business model allows it to:

(1) pass the costs of rising fuel to their customer,

(2) raise rates annually, and

(3) impose surcharges during peak periods.

The ability of FDX to keep rising rates even in the face of lower volume is an understated strength of its business model. That ability enables FDX to maintain or even grow earnings through periods of weaker demand. And when the global economic recovery is in full swing, these rate increases will supercharge earnings.

The most important reason regarding FDX’s long-term business viability lies in the way the company has embraced the mission-critical nature of its business through its investments in its network infrastructure to better serve a world where e-commerce is an integral part and one where consumers have gotten used to instant gratification and same-day or next-day delivery.

If you think FDX is just made up of delivery drivers, their vehicles, and their physical hubs, you will be sorely mistaken. FDX realizes it has a huge treasure trove of data that can be leveraged to improve operational efficiencies, reduce cost, improve margins, and provide greater visibility in terms of delivery dates for its customers. FDX’s very own AI model named “Dataworks” has made the accuracy of delivery times better by reducing changes by 40%.

The company’s goal is to get all FedEx Ground deliveries in the United States to a 4-hour window, to get Express to a 2-hour window, and then to rapidly improve by expanding this capability to 13 countries. By using the data it has, FDX is able to better integrate the strengths of its three separate divisions – Express, Ground, and Freight – to reduce redundancy and provide better service at lower costs.

Lance D. Moll, CEO of FedEx Freight explains:

“working with Dataworks and Ground, the engineering team over at Ground as well as the engineers at Freight, we’ve identified some complementary activities to reduce drayage cost between both operating companies. So, all of the intermodal activity… at Ground and… at Freight, previously was being looked at separately. Ground took care of their intermodal trailers, Freight took care of theirs. But the Dataworks team created a dashboard which gave the Freight team who really needs to manage the intermodal business for both companies, visibility to all the intermodal containers with Ground, Freight, and with Freight on them. So then, when our drivers were there, instead of driving back just a tractor, a bobtail mile, which is just a tractor by itself without a trailer attached to it, we had visibility to where, okay, instead of going back to Freight, the Freight hub with just a tractor, there’s a Ground trailer over there. We’ll pick it up and bring it back then to John’s (CEO FedEx Ground) station… the savings on reducing those empty bobtail miles… is roughly 8 million miles.”

Placing all the above in the wider backdrop of a very healthy and fast-growing e-commerce industry, it is easy to feel confident in the business viability of this company knowing that FDX has a moat that is not easily surpassed.

What is FedEx’s balance sheet and cash flow situation?

FDX is a BBB rated company, which according to the rating agency is still generally classed as being investment grade which means companies shouldn’t have too much trouble attracting investors or lenders.

Its operating cash flow has been strong, especially in FY 2021 and 2022.

Sales growth in these two years was great too, bolstered by the growth in e-commerce.

Sales growth in these two years was great too, bolstered by the growth in e-commerce.

2021 and 2022 were very positive years for FDX. Those were the e-commerce boom during the first 2 years of the pandemic, coupled with labor shortages and supply-chain issues reducing inventory levels and creating a demand crunch, all converging to drive growth.

2021 and 2022 were very positive years for FDX. Those were the e-commerce boom during the first 2 years of the pandemic, coupled with labor shortages and supply-chain issues reducing inventory levels and creating a demand crunch, all converging to drive growth.

FY 2023 reflects a vastly different situation with supply chain issues easing, and the world returning to normality, hence delivery volume fell and the tough comps versus the two great years were impossible to match up.

At the end of the day, it is worth noting that FDX is a business that in FY 2022 brought in a net operating cash flow of $9.8 billion, had $6.9 billion in cash and cash equivalents (Note: It has $4.6 billion of cash and cash equivalent as of 30 November 2022), and $20.4 billion in total assets.

Investors were concerned that FDX was spending too much on investments while revenues were on the decline so when the company announced various cost-cutting actions to boost the balance sheet, investors cheered. Recently, the announcement by FedEx to cut senior jobs as part of a larger staff reduction sparked a mini-rally in the stock price as investors expressed relief at this additional cost-cutting effort.

FDX has $19 billion in total debt (see page 92 of 2022 10K). If FDX has trouble paying off the debts, it can lead to a credit rating downgrade or even insolvency.

However, the scheduled principal payments due by each fiscal year on the long-term debt are very manageable at just $52 million a year for the next 5 years. For a company that generated $93 billion in revenues in FY 2022, I am quite sure FDX can pay off its debts easily.

However, the scheduled principal payments due by each fiscal year on the long-term debt are very manageable at just $52 million a year for the next 5 years. For a company that generated $93 billion in revenues in FY 2022, I am quite sure FDX can pay off its debts easily.

Also, most of these loans are fixed rates such as the U.S. dollar fixed-rate notes and the Euro fixed-rate notes so a rising interest rate environment does not have any material impact. The weighted-average interest rate on the long-term debt was 3.5% as of 31 May 2022.

Also, most of these loans are fixed rates such as the U.S. dollar fixed-rate notes and the Euro fixed-rate notes so a rising interest rate environment does not have any material impact. The weighted-average interest rate on the long-term debt was 3.5% as of 31 May 2022.

What should investors do with FDX when it gets hit by a nasty trifecta of bad news, poor earnings, and even poorer sentiments?

We have covered the fundamentals from the perspective of:

Business value proposition.

Long-term business viability.

Balance sheet and cash flow.

Now, let’s address the matter of decision-making in the face of a tremendous amount of negativity that was surrounding the company.

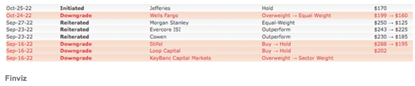

On 15 September 2022, FDX reported weak earnings of $3.44 for Q1 2023, missing estimates by $1.70. When bad press (see article below), poor earnings, and even poorer sentiments hit FedEx, as if on clockwork, the stock met with a flurry of analysts’ downgrades the day after, with Stifel downgrading FDX stock by a whopping 32% even before the earnings call which happened on 22 September 2022. And within days of the earnings call on 22 September, more analysts issued downgrades with Morgan Stanley taking the podium with a 50% cut in their price target.

(Note: The article “FedEx Shares Sink After Company Cites Weakening Global Demand” from 15 September 2022 summarized the circumstances surrounding the company.)

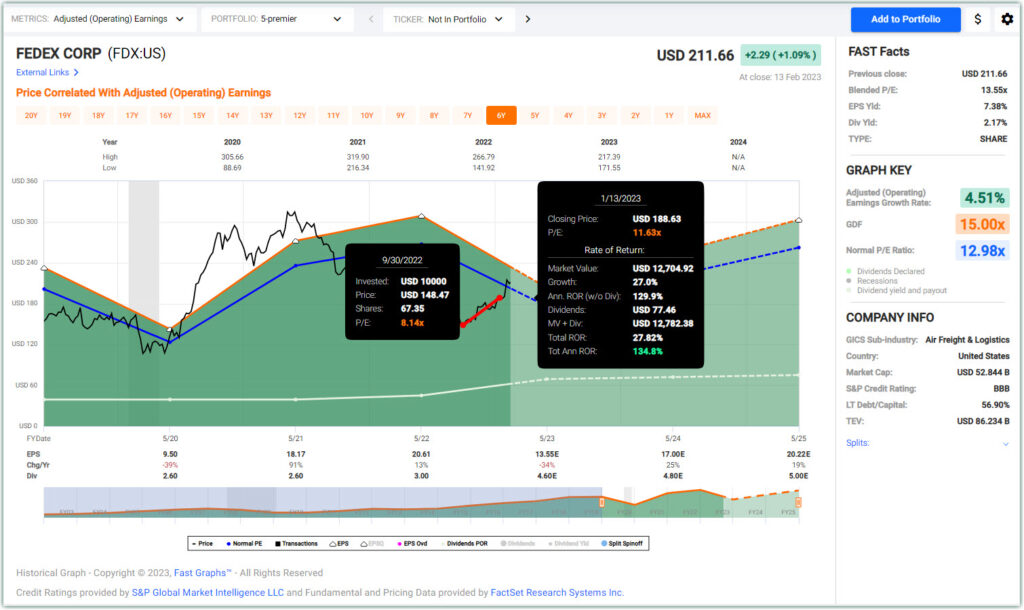

Let’s say that we take a worst-case scenario and assume zero earnings growth for the rest of FY 2023, $3.44 x 4 = $13.76, which is way lower than the $20 of earnings per share analysts like David Vernon with Bernstein were projecting prior to that terrible earnings report. At the 52-week low of $141.92, FDX’s shares were being priced at just 10x earnings. Using Morgan Stanley’s price target of $125 and Factset analysts’ revised consensus earnings estimate of $13.55 for FY 2023, FDX was just priced at 9.2x earnings.

Let’s say that we take a worst-case scenario and assume zero earnings growth for the rest of FY 2023, $3.44 x 4 = $13.76, which is way lower than the $20 of earnings per share analysts like David Vernon with Bernstein were projecting prior to that terrible earnings report. At the 52-week low of $141.92, FDX’s shares were being priced at just 10x earnings. Using Morgan Stanley’s price target of $125 and Factset analysts’ revised consensus earnings estimate of $13.55 for FY 2023, FDX was just priced at 9.2x earnings.

We get that analysts and investors were concerned. And CFO Mike Lenz was not helping to soothe their nerves at the earnings call when he said:

“For the remainder of the year, while we are not providing guidance, given current uncertainties, our plan is based on an expectation that the weak trends we saw in late Q1 will persist across our major geographies.”

Nobody likes it when a company misses earnings by a mile. Nobody likes it when a company stops providing guidance. Investors hate uncertainties. Yet, it is during periods of uncertainty that mispricing happens. And FDX priced at 13.36x blended earnings just does not sound right. And that is the time Contrarian Investors should take note and strike.

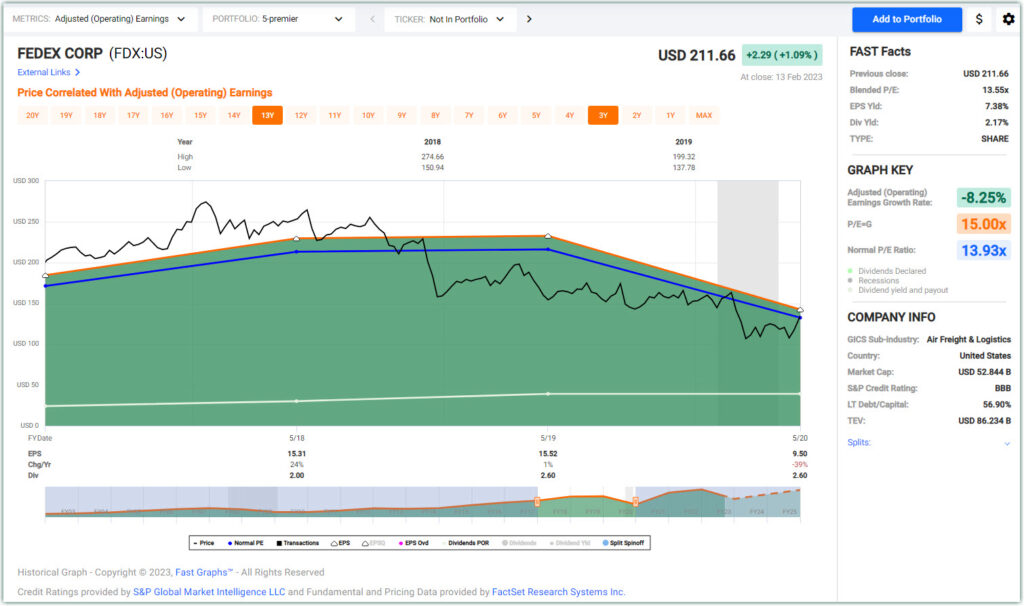

Consider the following: in the period from the start of the Great Financial Crisis (June 2007) to the early months of Covid (May 2020), FDX traded at a normal P/E of 16.42. Take a moment to let that sink in. Despite including these two market-shaking global events, one where livelihoods and financial security were shaken and millions lost their homes and savings, and the other where billions of people were living on tether hooks in an unprecedented global shutdown, FDX traded at a normal P/E of 16.42.

Let’s further narrow down the analysis period to between June 2017 and May 2020. FY 2019 was when FDX’s stock was hit by a deceleration in adjusted operating earnings. And 2020 included the crash in FDX’s earnings due to the global lockdown. Despite all of these, FDX was trading at a normal PE of 13.93 in that time frame.

Let’s further narrow down the analysis period to between June 2017 and May 2020. FY 2019 was when FDX’s stock was hit by a deceleration in adjusted operating earnings. And 2020 included the crash in FDX’s earnings due to the global lockdown. Despite all of these, FDX was trading at a normal PE of 13.93 in that time frame.

Yet in September 2022, the market was pricing FDX at a P/E of 9x to 10x earnings.

Yet in September 2022, the market was pricing FDX at a P/E of 9x to 10x earnings.

The views of the market and professional analysts back then in September were way too pessimistic, in our opinion.

Howard Marks of Oaktree Capital Management once said:

Everyone gets worried when prices decline, but the flipside of price deterioration is an increase in prospective returns.

We have often heard the phrase “all the bad news has been priced in“. That certainly applies to FDX’s stock price 4 months ago. The peak of the confluent of bad news that hit FDX happened in September 2022, driving the stock price down 20% in one day, and actually making an investment in FDX safer then. And that lower price offered investors an increase in prospective returns once the share price reverts to the mean.

And if the Contrarian Investor had purchased shares of FDX when others were dumping it, even excluding the mid-January 2023 runup in asset prices, an investment in FDX at its doldrums would have returned 27% in a little over 3 months, which clearly crushed SPY’s 11.6% and QQQ’s 5.1% in the same period.

Conclusion

Conclusion

FDX is an investment-grade company with strong fundamentals with a mission-critical business model. It has invested billions to create a physical network with an unparalleled scale that is hard to replicate. Its investments into its digital infrastructure are ready to bear fruit to allow it to improve margins and reduce costs by leveraging spare capacity across its different business divisions like FedEx Express and FedEx Ground. And with most of the investments already underway or over, the past average annual CAPEX of $2.4 billion is expected to be at or less than $1.5 billion from 2025.

Its future revenue growth is supported by enduring long-term tailwinds of a fast-growing e-commerce world. The reopening of the world, especially China, portends well for an improving global economy. As in all businesses, especially cyclical ones that are tied closely to the economy, there will be ups and downs, and when Mr. Market offers mispricing opportunities in world-class companies, it is up to Contrarian Investors to take advantage.

Contrarian investing can be very lucrative. Identify great companies, wait for opportunities, and when they stumble and the market misprices them, invest and wait for the stock to recover. Contrarians zig when others zag.

Readers, we are not downplaying the economic realities of a challenging business environment or one where many economists are expecting a recession in a few months. We are realists who accepts that even the best company in the business, especially those intricately tied to the global economy, will encounter bad times. When it is a (temporary) fall from grace, it is more reflective of external circumstances rather than a defective business model or poor management, then it is time to buy more if you can, but not a time to sell.

In a July 2022 interview with Fortune soon after Raj became the new CEO of FedEx, he shared his strategy for the company:

“We have build a very strong foundation over the last 50 years. Building networks is not easy at all and it takes a lot of time and patience to build these networks. Now we are at a pivotal point where we can build off that foundation our networks and create value for all of our stakeholders. The second part of the story is that we have such a strong physical network but it also got a strong underpinning of the digital network and going forward we are going to create value not only from the physical aspect but also from the digital aspect of our network. We are here to create the legacy of the next 25 years.”

We believe that FDX is here to stay for the next 25 years, and the Contrarian Investor in us will always keep a lookout for times when it stumbles to add more shares.

— James Long and Chuck Carnevale

Marc Lichtenfeld - Author of the best-selling book Get Rich With Dividends – is giving away his Ultimate Dividend Package... Free of charge! Click Here to Get His #1 Dividend Stock... The Safest 8% Dividend in the World... Top Three "Extreme Dividend" Stocks, And Much, Much More.

Source: FAST Graphs