It’s hard to lose money in the stock market over the long run.

But we’re not here to just “not lose money”, right?

We’re here to make money.

Well, the good news is that this is not an extremely difficult task.

And taking advantage of the right strategy makes it even easier.

I’d argue the right strategy is dividend growth investing.

This strategy involves buying and holding shares in world-class enterprises that pay safe, growing dividends to their shareholders.

It takes a special kind of business to produce the reliable, rising profit necessary to sustain reliable, rising dividends.

And special businesses tend to be excellent wealth builders over the long run.

You can see many examples of these businesses by checking out the Dividend Champions, Contenders, and Challengers list.

This list contains invaluable information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

I’ve followed this strategy myself for more than 10 years.

I’ve followed this strategy myself for more than 10 years.

In the process, I’ve assembled the FIRE Fund.

That’s my real-money stock portfolio, and it generates enough five-figure passive dividend income for me to live off of.

Actually, I’ve been living off of dividends for years.

In fact, I was able to retire in my early 30s.

How?

My Early Retirement Blueprint explains.

Suffice to say, the dividend growth investing strategy has been instrumental to my success.

However, the strategy does involve more than just buying particular stocks.

However, the strategy does involve more than just buying particular stocks.

It also involves buying these stocks at attractive valuations.

Price only tells you what you pay, but it’s value that tells you what you get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

You can’t lose money if you’re making money, and buying high-quality dividend growth stocks at attractive valuations is one of the best ways to make money in the stock market over the long run.

Of course, finding attractive valuations requires one to understand valuation in the first place.

This is yet another task that isn’t all that difficult.

Dave Van Knapp, my colleague, made this task easier than you might think.

His Lesson 11: Valuation, which is part of an overarching series of “lessons” on dividend growth investing, spells out an easy-to-follow valuation process that can be applied toward almost any dividend growth stock.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Truist Financial Corp. (TFC)

Truist Financial Corp. (TFC)

Truist Financial Corp. (TFC) is an American bank holding company.

Founded in 1872, Truist is now a $64 billion (by market cap) financial monster that employs more than 50,000 people.

Operating as the seventh-largest US commercial bank by deposits, Truist has approximately 2,500 branches that are primarily located in the Southeastern portion of the United States.

The bank reports results across the following four segments: Consumer Banking and Wealth, 54% of FY 2021 revenue; Corporate and Commercial Banking, 35%; Insurance Holdings, 12%; and Other, Treasury, and Corporate, -2%.

The 2019 merger of equals between BB&T Corporation and SunTrust Banks, Inc. formed what is now known as Truist.

Florida is the bank’s largest market by deposit base (22%).

The banking business model has long been, and continues to be, one of my favorite business models.

After all, banks are literally in the business of money.

If you want to make a lot of money, money itself is a pretty good place for that.

But that’s not all.

It gets better.

Banks make money from other people’s money.

That occurs by way of the “float”, which is the business model’s powerful “secret sauce”.

A bank is given access to large sums of low-cost and low-risk capital, via deposits.

This deposit base – the float – provides a bank the ability to fund loans and other ventures that generate attractive returns.

And since the deposit base tends to be “sticky”, it’s usually a reliable source of funds.

Banks date back to ancient history.

We’re talking thousands of years.

The everlasting nature of the business model largely comes down to the fact that our society is dependent on the proper flow and utilization of capital.

Without this, our modern-day economies fail.

And without our modern-day economies, modern-day society fails.

That’s part of why I have little doubt that this bank will continue to flourish for many years to come.

As a result, Truist should continue to grow its revenue, profit, and dividend.

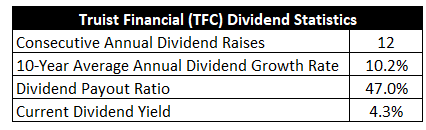

Dividend Growth, Growth Rate, Payout Ratio and Yield

Already, the bank has increased its dividend for 12 consecutive years.

The 10-year dividend growth rate of 10.2% is strong.

Plus, the stock yields a market-smashing 4.3%.

Plus, the stock yields a market-smashing 4.3%.

It’s not often that you find a 4%+ yield paired with a 10%+ dividend growth rate.

That’s an extremely appealing combination.

This yield, by the way, is 90 basis points higher than its own five-year average.

And with a payout ratio of 47%, this appears to be a healthy, well-covered dividend.

I love these dividend metrics.

Revenue and Earnings Growth

As much as I love these numbers, many of them are looking backward.

However, investors must face the reality that they’re risking today’s capital for tomorrow’s rewards.

Thus, I’ll now build out a forward-looking growth trajectory for the business.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then uncover a professional prognostication for near-term profit growth.

Fusing the proven past with a future forecast in this way should allow us to judge what the future growth path of the business might look like.

Truist moved its revenue from $10.3 billion in FY 2013 to $25.4 billion in FY 2022.

That’s a compound annual growth rate of 10.6%.

On the face of it, that’s outstanding top-line growth for a fairly large bank, especially during an extremely challenging period for banks.

But much of this was not organic in nature.

The aforementioned 2019 merger of equals created a much larger absolute revenue base, which skews things.

Looking at profit growth on a relative, per-share basis will give us a better idea of the bank’s true growth profile.

Truist grew its EPS from $2.19 to $4.43 over this period, which is a CAGR of 8.1%.

I see that latter number as a more accurate representation of what the business is capable of doing.

Considering how challenging the last decade was for banks, that’s a pretty impressive result.

Looking forward, CFRA believes that Truist will compound its EPS at an annual rate of 3% over the next three years.

On one hand, CFRA notes elevated net interest margin and continued growth in loan balances as being beneficial for Truist.

On the other hand, CFRA points to a difficult operating environment, evidenced by credit deterioration and a reduction in mortgage demand.

Regarding credit, CFRA states the following: “Credit quality deteriorated in the quarter with net charge-offs (NCOs) jumping 7 bps Q/Q to 0.34%. Additionally, provisions for credit losses doubled to $467 million as management noted a decline in its economic forecast.”

The last few years have been bumpy and unpredictable, to say the least.

And since the merger closed just before the pandemic hit, it’s difficult to get a feel for just how successful it’s going to be.

But I’d argue that CFRA is underestimating the bank’s potential, particularly as it relates to the geographic footprint.

Truist is heavily exposed to Florida, which is one of the fastest-growing states in the US.

That bodes well for Truist.

Furthermore, the US interest rate framework is more favorable than it’s been in a long time.

In addition, the bank has a differentiating factor in its insurance brokerage business, which could offer a smoother path toward growth.

The next year or two could be tough, but I think Truist is positioned well for the next decade and beyond.

If Truist can deliver just mid-single-digit bottom-line growth for the next year or two, the moderate payout ratio gives the bank the ability to grow the dividend at a similar rate.

From there, we could be looking at a nice acceleration back into the high-single-digit range.

When you’re starting off with a 4%+ yield, it’s really tough to find fault with that kind of setup.

Financial Position

Moving over to the balance sheet, the bank appears to have a rock-solid financial position.

Total assets of $555 billion lines up against $487 billion in total liabilities.

The bank’s senior unsecured debt has the following investment-grade credit ratings: A-, Standard & Poor’s; A3, Moody’s; A, Fitch.

Profitability is robust, although it’s difficult to read too much into this because of the newness of the combined enterprise.

Over the last five years, the firm has averaged annual net margin of 23.7% and annual return on equity of 9.3%. Net interest margin came in at 3% last year.

In my view, Truist is a well-run bank that has geographic favorability.

And with large economies of scale, switching costs, unique financial expertise, and built-up relationships, the bank is protected by durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

All three of these risks are arguably elevated for a bank like this.

Banks are highly exposed to economic cycles.

A recession can hurt the bank’s income statement (through reduced loan demand) and balance sheet (via higher loan losses).

Truist has gained absolute size through the merger of equals, and size can be an advantage, but this bigger size also limits the relative growth that can be produced.

This merger of equals, which was poorly timed in some ways, also means that Truist has unique integration risk.

Ongoing changes in financial technology may make it easier for upstarts to take market share.

I see most of these risks as pretty standard for a bank.

But I also see these risks as being more than priced in at this point, as the stock’s 25% drop from its 52-week high has created an appealing valuation…

Stock Price Valuation

The stock is trading hands for a P/E ratio of 11.

That’s quite low by any measure, even for a bank.

It’s nearly half of where the broader market is at.

While we have to take recent averages with a grain of salt in this case, consider the stock’s five-year average P/E ratio of 13.6.

Most banks command P/B ratios of between 1 and 1.5.

The stock’s P/B ratio of 1.2, which is in line with its own five-year average, is on the lower end of that spectrum.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 7%.

This dividend growth rate is slightly on the conservative side compared to where I normally land for banks.

I’m erring on the side of caution here, due to the fact that Truist has very little operating history in its current form.

If we look at the legacy long-term EPS and dividend growth, this is an easily attainable target for the bank to hit over the coming years.

While the next year or two could be closer to what CFRA is expecting, I think the bank’s geographic footprint, differentiation, and overall platform positions the institution very well for the long run.

The DDM analysis gives me a fair value of $55.64.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I believe my valuation model is prudent, yet the stock still looks cheap.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates TFC as a 4-star stock, with a fair value estimate of $57.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates TFC as a 3-star “HOLD”, with a 12-month target price of $46.00.

I came out closer to where Morningstar landed on this one. Averaging the three numbers out gives us a final valuation of $52.88, which would indicate the stock is possibly 8% undervalued.

Bottom line: Truist Financial Corp. (TFC) is a differentiated bank with a favorable geographic footprint. It produced impressive growth during a challenging period for banks, but rising rates and its recently completed merger of equals sets up the bank for even better performance over the next decade. With a market-smashing yield, a double-digit long-term dividend growth rate, a moderate payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 8% undervalued, this idea offers something to like for just about any dividend growth investor.

Bottom line: Truist Financial Corp. (TFC) is a differentiated bank with a favorable geographic footprint. It produced impressive growth during a challenging period for banks, but rising rates and its recently completed merger of equals sets up the bank for even better performance over the next decade. With a market-smashing yield, a double-digit long-term dividend growth rate, a moderate payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 8% undervalued, this idea offers something to like for just about any dividend growth investor.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is TFC’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 55. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, TFC’s dividend appears Borderline Safe with a moderate risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income