“You had me at VIP,” my buddy Nick texted back to me.

Our babysitter canceled due to a last-minute illness. My wife took one for the team and kindly sent me to the Sacramento Kings game solo—which meant I had a seat to fill on 35 minutes notice.

No problem for my man, a fellow dad and fan. (I’ll let you decide the order!) Nick flipped the game off at home, kissed his own wife and kids goodbye and beelined from his house to our seats.

He only missed a few minutes of gametime because, as I alluded to at the open, we got him in through the VIP entrance.

We contrarians make a living—and a retirement—finding the VIP entrance. Take ONEOK (OKE), a pipeline operator and our favorite “energy toll bridge.” OKE made its debut in these pages when we added it to our Contrarian Income Portfolio in April 2020.

As income investors we take comfort in “dividend cushions.” When we bought OKE its yield was 11.8%. Eleven-point-eight percent! Sounds nuts but remember, at the time, crude oil was trading for less than zero dollars a barrel. I wouldn’t believe it if I hadn’t seen it. Buying OKE was anything but comfortable.

Mainstream rags and pundits speculated that OKE would have to cut its dividend. Six months later, the stock had sold off further and the dividend yield was above 14%. Fourteen percent!

Surely, a dividend cut was on the way, according to the headlines. We freethinkers knew better, though. In the October edition of CIR, we reasoned:

OKE is a well-run energy pipeline firm with assets that have the potential to produce yearly earnings (defined by EBIDTA) of more than $3 billion, yet the company has a total market cap of just $13 billion!

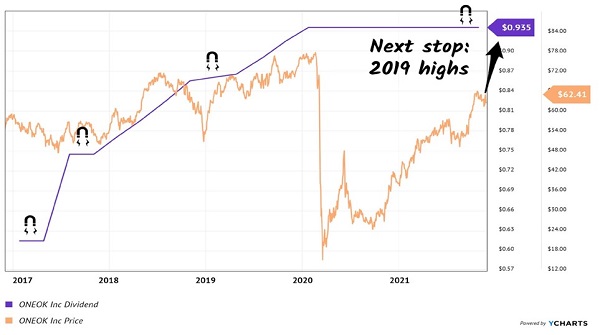

While you and I aren’t going to pool our money together and produce $13 billion, you can simply buy as many shares as you want for a yield that is still above 14%. Plus, we collect the $0.935 quarterly dividend, we get to sit on this underpriced asset and wait for it to bounce back to 2019 levels (which would represent a near-3X gain from here).

OKE should be a long-term holding for us. We’re riding the 2020 ups and downs in anticipation of a brighter 2021 and beyond for the energy sector, with OKE leading the way higher.

That’s exactly how it played out. Energy assets rallied like crazy. OKE kept paying that quarterly dividend.

Fast forward to early 2022, and we had “rich people” problems. We were up 149% on OKE and had to figure out what to do next!

And this is where investing experience really helps.

Any newbie investors who rode the OKE bandwagon with us would have sold too soon. Which is the opposite of what we want to do. We want to let our winners run.

Sure, eleven months ago, we were sitting on 149% gains from OKE. But Mr. and Ms. Market don’t care who has owned what when. Wall Street’s “power couple” do, however, respect the dividend magnet—which indicated that even higher highs were likely.

OKE’s Dividend Magnet at Work

And guess what? OKE is up even more since we said “hang on.” Our CIR gains have climbed to 188% since that VIP buy call back in April 2020.

And guess what? OKE is up even more since we said “hang on.” Our CIR gains have climbed to 188% since that VIP buy call back in April 2020.

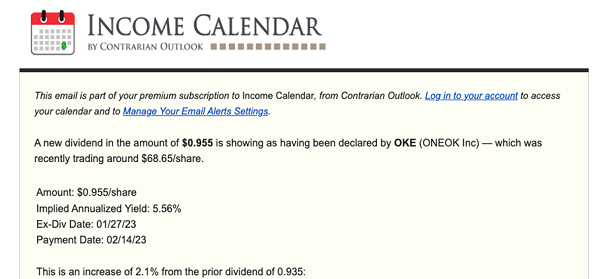

But wait, there’s more. OKE’s cash flows have boomed, and the stock has been due for a dividend raise! Which is exactly what we got a couple of weeks back.

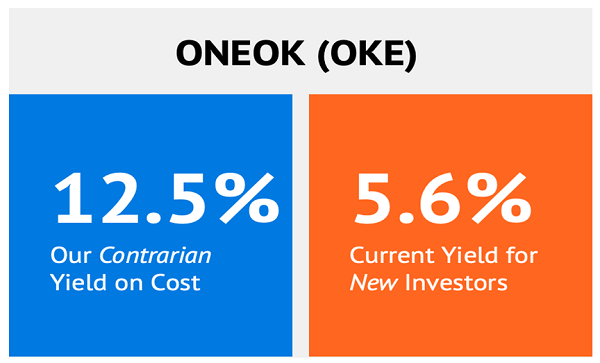

If you bought OKE when we mailed that now famous Flash Alert, congratulations! You’re enjoying a terrific 12.5% yield on your initial investment.

If you bought OKE when we mailed that now famous Flash Alert, congratulations! You’re enjoying a terrific 12.5% yield on your initial investment.

A $10,000 stake is now receiving $1,250 per year. While $100K in OKE is banking $12,500 in yearly dividends. Nice.

Now should we book profits? After all, we recently told Exxon Mobil (XOM) thanks and farewell for now.

Now should we book profits? After all, we recently told Exxon Mobil (XOM) thanks and farewell for now.

Nah. I still have OKE as a buy. Remember, “the Markets” don’t care that we’re up 188%. They see a 5.6% dividend that just got a bump. Good for the stock price!

Plus, China is finally reopening after a three-year economic hiatus. Bullish for oil demand.

Really, flat energy prices are fine for OKE shareholders. That means these toll bridges keep collecting. Which means the dividends keep coming.

Just remember, that’s a 5.6% yield on new money. The 12.5% VIP rate sold out years ago.

— Brett Owens

3 “Must-Own” Stocks That Could Let You Retire on Dividends Alone [sponsor]

7%+ payers with hidden value (like high insider buying and short interest) are the key to what I call the “retirement holy grail”: the ability to clock out on dividends alone, leaving your principal intact.

It’s the only way to ensure you have a safe retirement, because with dividends paying your monthly bills (and therefore no need to sell your investments to supplement your income), you can largely ignore the day-to-day gyrations in the stock market!

Deep down, most investors know this is how they should be investing for the future. But they don’t know what to buy.

That stops now. Because I’ve released 2 Special Reports detailing my complete “No-Withdrawal” retirement strategy and revealing 3 off-the-radar investments you need to buy to get it done. With rich yields up to 12%, these 3 buys are the key to financial freedom.

Click here and I’ll give you access to these 2 Special Reports so you can start profiting from my “No-Withdrawal” strategy and these 3 incredible investments (with yields up to 12%!) right away.

Source: Contrarian Outlook